Inflation in Turkey: investor returns keep falling and are turning negative

Photo: ING

Turkey’s real estate market often grabs headlines thanks to eye-catching price growth. Reports of annual increases in Turkish lira (TRY) prices of 50%, 80%, or even 100% create the impression of a high-yield investment environment. However, for a foreign investor operating in euros or dollars, the reality can be very different. It’s possible that while the nominal price of your property is rising, you are in fact losing money. This paradox is driven by two key economic factors: high inflation and the lira’s depreciation.

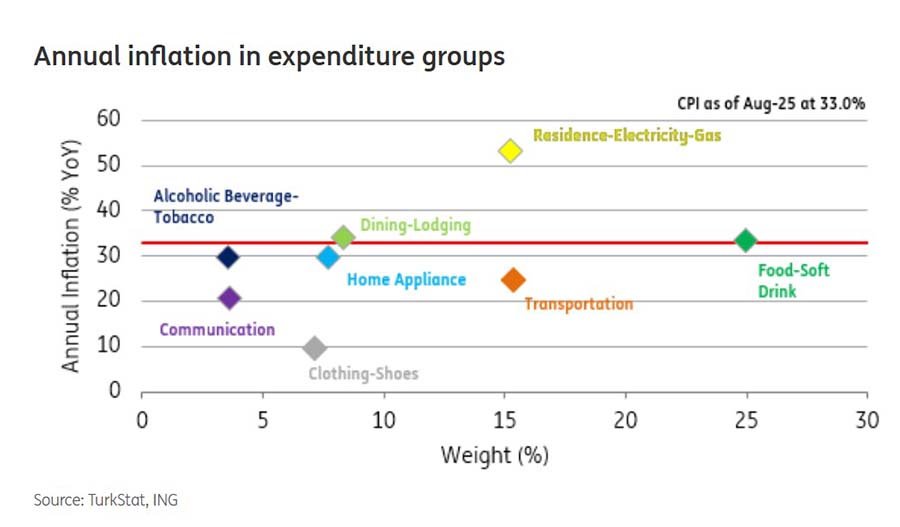

Inflation in Turkey has slowed compared to last year, but price pressures remain acute. Rents and food costs are rising the fastest, while higher production expenses are laying the groundwork for further increases. As a result, the statistical slowdown does not translate into real relief for the economy or households.

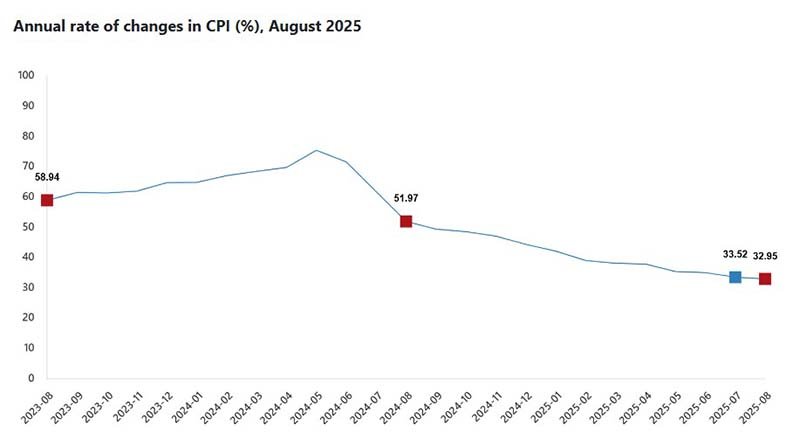

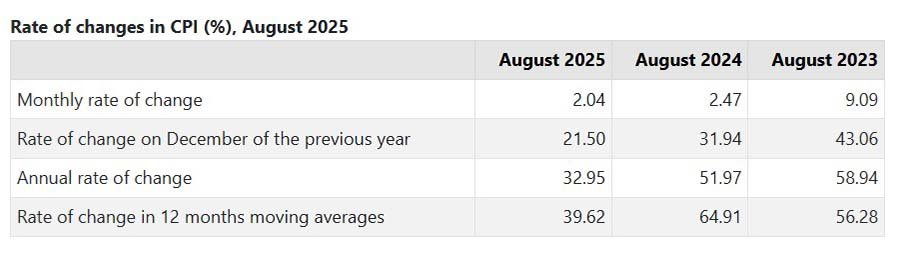

From 2023 to 2025, Turkey’s inflation showed gradual deceleration. According to the Turkish Statistical Institute, in August 2023 monthly inflation stood at 9.09%, in 2024 at 2.47%, and in 2025 at 2.04%. ING analysts earlier forecasted a level closer to 1.5%, while market consensus was 1.8%.

Year-on-year inflation fell from 58.94% in 2023 to 51.97% in 2024 and 32.95% in 2025. Other measures showed similar trends: cumulative growth since December dropped from 43.06% (2023) to 21.50% (2025), while 12-month averages declined to 39.62%. This confirms that inflationary momentum is cooling, though levels remain above the Central Bank’s target of 25–29% by year-end.

Inflation erodes returns. In August 2025, Turkey’s annual inflation stood at 32.95%.

Inflation is the rate at which the overall price level for goods and services rises and, as a result, the purchasing power of a currency falls. In Turkey, inflation is a significant and persistent factor. According to official data from the Turkish Statistical Institute (TurkStat), the annual inflation rate stood at 75.45% as of May 2024, and while forecasts suggest a decline, they still point to high double-digit figures for 2025.

Prices for real estate are rising in lira but falling in dollars, which poses a serious challenge for foreign investors. Combined with high household outlays and structural inflation problems, this amplifies red flags for Turkey’s economy as a whole. For example, in November 2024 the regulator recorded nominal prices up 29–30% y/y, but real prices down 12% y/y. Istanbul: −14% in dollar terms. The average price fell from $1,879/m² (peak, Q2’23) to $1,613/m² (Q4’24) — a 14.1% drop. Turkey overall: −9.6% in dollar terms, from $1,157/m² (Q2’23) to $1,046/m² (Q4’24) — down 9.6%. At the start of 2024, the CBRT noted that the decline in dollar-denominated prices had continued for a fourth consecutive month. Persistent USD declines translate into capitalization losses for foreign investors. According to expert forecasts, the devaluation will continue, and capitalization losses—already as high as 50%—are set to increase further.

Housing remains the main driver: rents rose 53.27% y/y, adding 8.12 percentage points to the index, while monthly growth added 0.46 p.p. Food prices climbed 33.28% y/y and 3.02% m/m, contributing 7.97 p.p. and 0.72 p.p. respectively.

Developers index their price lists in lira in step with rising costs of construction materials, labor, and land. In TRY, this looks like “growth.”

— FX factor. The lira’s depreciation against USD/EUR makes the same lira price cheaper in hard currency. Even +20–30% in TRY can easily turn into a “minus” in dollars.

— Liquidity-driven discounts. Because credit is expensive and hard-currency demand is weak, some developers offer substantial discounts for quick cash payment (peşin) and installments—further cutting the deal price in USD/EUR.

— Valuation in the investor’s base currency. The asset is marked in USD/EUR—that’s where returns and LTV are calculated. A nominally “rising” lira price in reports becomes a decline in equity in hard currency.

— Yield. Rents are indexed in TRY (often to CPI), but operating costs, taxes, insurance, and repairs rise even faster. In USD/EUR, the “net” yield can compress even if nominal lira cash flow grows.

— Exit. Selling in hard currency is harder: foreign demand has shrunk, local buyers think in lira, and developer stock competes via discounts. Liquidity is lower; the discount to “anchor” list prices is higher.

— High share of essential household spending (food, utilities and housing services, transport) erodes real incomes and caps effective housing demand.

— Expensive money and tight mortgage conditions raise entry barriers for buyers and lengthen time on market.

— Structural inflation (cost pass-through, import content, expectations) keeps lira list prices rising but doesn’t solve the decline of asset values in hard currency.

— Wealth effect: falling USD values of real estate weaken household and investor balance sheets, weighing on consumption and investment.

— Construction sector: with lower hard-currency prices and slower deal flow, developer cash gaps widen, discounts deepen, and pressure on banks increases.

— Dollarization of expectations: businesses and investors anchor to hard currency, increasing the economy’s sensitivity to FX swings and external financing.

Transportation also rose sharply: +24.86% y/y and +1.55% m/m, fueled by tariff hikes. Processed goods (including bread), alcohol, tobacco, and catering services contributed additional upward pressure.

Producer price inflation (PPI) increased 2.5% m/m and 25.2% y/y in August, driven largely by food and utilities. Despite upward momentum since April, the Central Bank’s currency interventions helped moderate cost growth.

Out of 143 tracked products, prices rose in 119 cases, fell in 20, and stayed unchanged in just 4 — a sign that inflation remains broad-based across nearly all household consumption categories.

Core inflation indicators show similarly high levels: Index A (excluding seasonal items) stood at 33.8%, Index B (excluding raw food, energy, alcohol, tobacco, gold) at 32.7%, and Index C (excluding food and energy) at 33%. Other modified indices (D, E, F) also remained in the 32–34% range. This indicates that structural problems, not temporary shocks, are fueling persistent inflation.

ING analysts expect inflation to end the year closer to 30%, unless unexpected shocks occur. Key risks include currency volatility, wage adjustments, price regulations, and global commodity market swings.

Political tensions may further complicate the Central Bank’s task, limiting flexibility in setting rates. As ING notes, monetary policy is likely to remain cautious, with decisions made step by step, which could slow disinflation and heighten risks to overall stability.

Growth in lira alongside a decline in dollars isn’t an anomaly—it’s the new normal. Without an FX and real (inflation-adjusted) lens, it’s easy to overstate returns and understate risks. For Turkey overall, the signal is clear: the construction engine in TRY is propped up by inflation and the exchange rate, but in hard-currency terms assets are shrinking—so the resilience of demand and financing remains in question.

Moreover, the Central Bank of Turkey terminated the Foreign Exchange-Protected Deposit Program (KKM) on August 23, closing an anomalous chapter in the history of citizenship-by-investment (CBI) programs, when government guarantees against depreciation effectively turned bank deposits into savings instruments. The removal of this protection means devaluation will continue to intensify and real estate will depreciate in hard-currency terms. Capitalization losses may amount not merely to 50% but considerably more.

Aran Hawker, co-founder of CIP Turkey, says the deposit option accounts for a minority of Turkish CBI applications and that “about 10% of inbound inquiries are for the deposit route.” This pathway requires a lira deposit equivalent to $500,000 to qualify for citizenship, but currency protection no longer applies—so all FX risk sits with applicants.

Hawker has consistently advised against the deposit option even when it carried government guarantees. His skepticism stems from timing mismatches between protection periods and deposit terms. He explains that he has “watched the Turkish lira fall for 30 years, and if they give you two years of protection on a three-year deposit, it can devalue 100% overnight.” According to him, even seasoned bankers who thought they could hedge their positions “are literally in tears—they still have another year to go on the deposit and they’re watching their money melt away.”