Forbes Georgia: «The Attractiveness and Danger of the Real Estate Market. Beware of Cheap Prices»

The Georgian real estate market is actively developing and growing. Over the past two years, the volume of transactions in the market has almost tripled. Favorable investment conditions, growing market potential, high tourist demand for real estate, make it more and more attractive. The market holds both good opportunities for an investor to earn money on capitalization and rental income. But, like any other market, it is fraught with risks and dangers. And the biggest of them is in its cheap segment, negatively affecting the reputation of the market and disappointing buyers who were attracted not by quality and advantages, but by low price. Let’s consider this situation on the example of the Batumi market.

Why apartments, apartments and rooms in hotel residences can become a problem if they cost less than 2-2.5 thousand dollars per square meter?

On the Batumi market there are offers of different price categories, from record-breaking cheap apartments for $800 (or even $600) far from the sea to luxury options for $4.5 thousand per 1 m2. What is the reason for such a difference in prices and why cheap real estate can be both a joyful purchase and a real headache for the buyer.

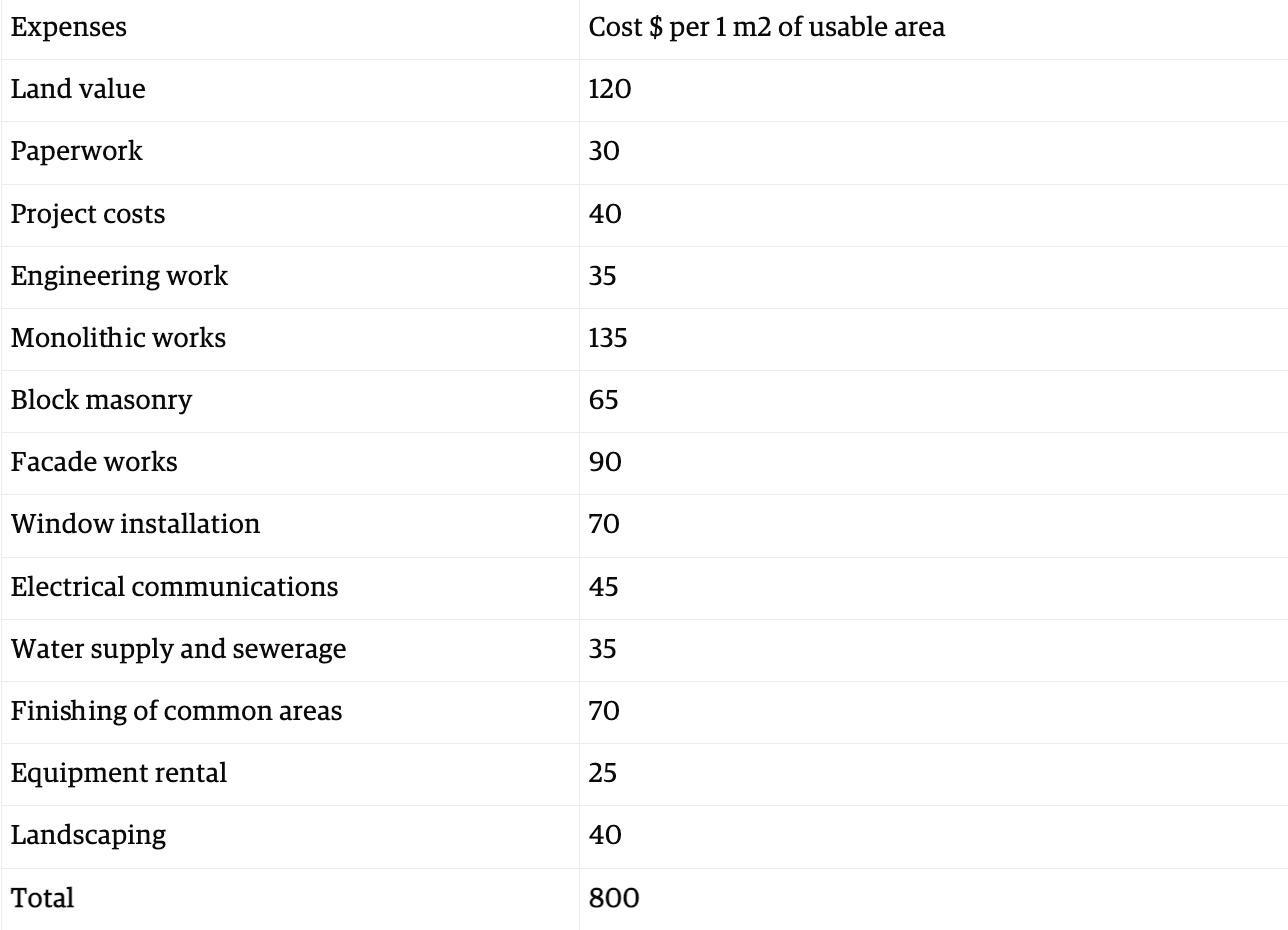

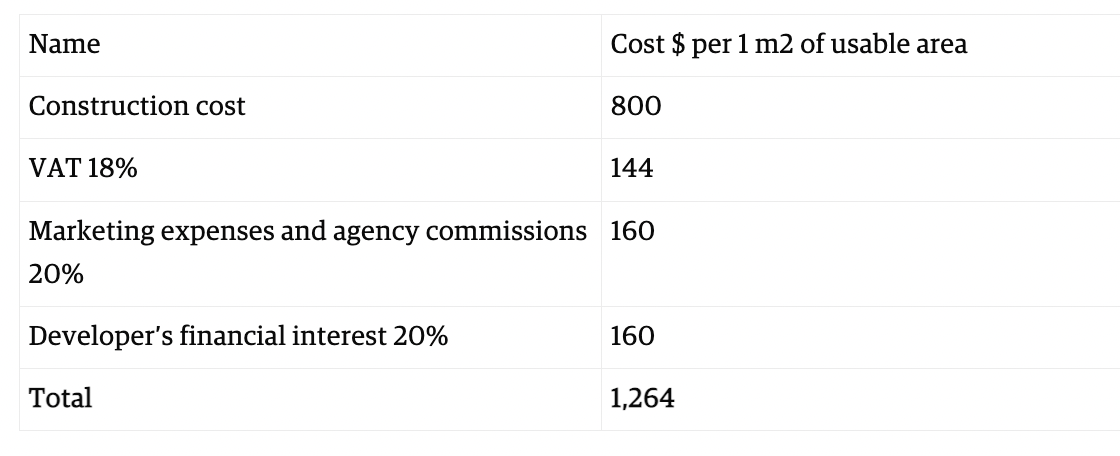

What makes up the price of an apartment at prices for 2023:

1.Construction cost. The cost per square meter in an apartment in a new building is at least $800 per square meter at prices for 2023. This includes the cost of land, paperwork, construction and engineering work, design work.

2. VAT. From above, the developer must lay the value added tax, which is 18%.

3. Marketing expenses and agency commissions. These are the costs of attracting buyers, which make up an additional 20% of the cost estimate.

4. The financial interest of the developer on average is another 20%. It is not customary to work with a lower estimated margin among normal Georgian developers.

It is important not to confuse real estate in a black frame and a white frame and not to compare the prices of one with the prices of the other – after all, these are two different products.

As a result, we get $1,264 per square meter of ordinary housing without interior decoration in a black frame – that is, without repair and decoration, without furniture and appliances.

In what cases can the price be lower?

There are different reasons for the low price:

Discount at the excavation stage. The builder needs money. This is not necessarily a bad reason. Maybe the money is needed for development, and therefore the developer lowers the price below cost to the detriment, but the developer has money for construction. It is easy to identify such a situation: The price is reduced at an early stage of sales (up to 20% of the saleable area), and then the closer the project gets to completion and the fewer apartments remain for sale, the higher the price will be. So the developer will achieve the optimal average price for himself upon completion of the project.

But there is another scenario: the developer has no money and therefore is trying to attract them at the expense of a low price. The developer will start the construction with cheap sales, and then will not have enough money to complete it and you will be left with an unfinished apartment.

Poor quality construction. If the developer has saved on construction, they may lower the price, but you are unlikely to want to get a discount at this price. For example, the house will not have heat and waterproofing, low-quality finishing materials or a building block were used. The house will collapse, it will be moldy and damp, and repairs will have to be done every year. But even in this case, the price below $1000 per 1 m2 should cause concern.

The developer, in order to sell the object, sets an unprofitable low price, and then does not have enough money to complete the construction due to incorrect calculation of the cost. The developer can pay the costs by selling the next building. This is how the pyramid is formed. If you buy real estate before the pyramid collapses, you will be lucky, if not, you won’t.

What about “turnkey”?

Finishing “turnkey” and a complete set of the equipment means a new rise in price.

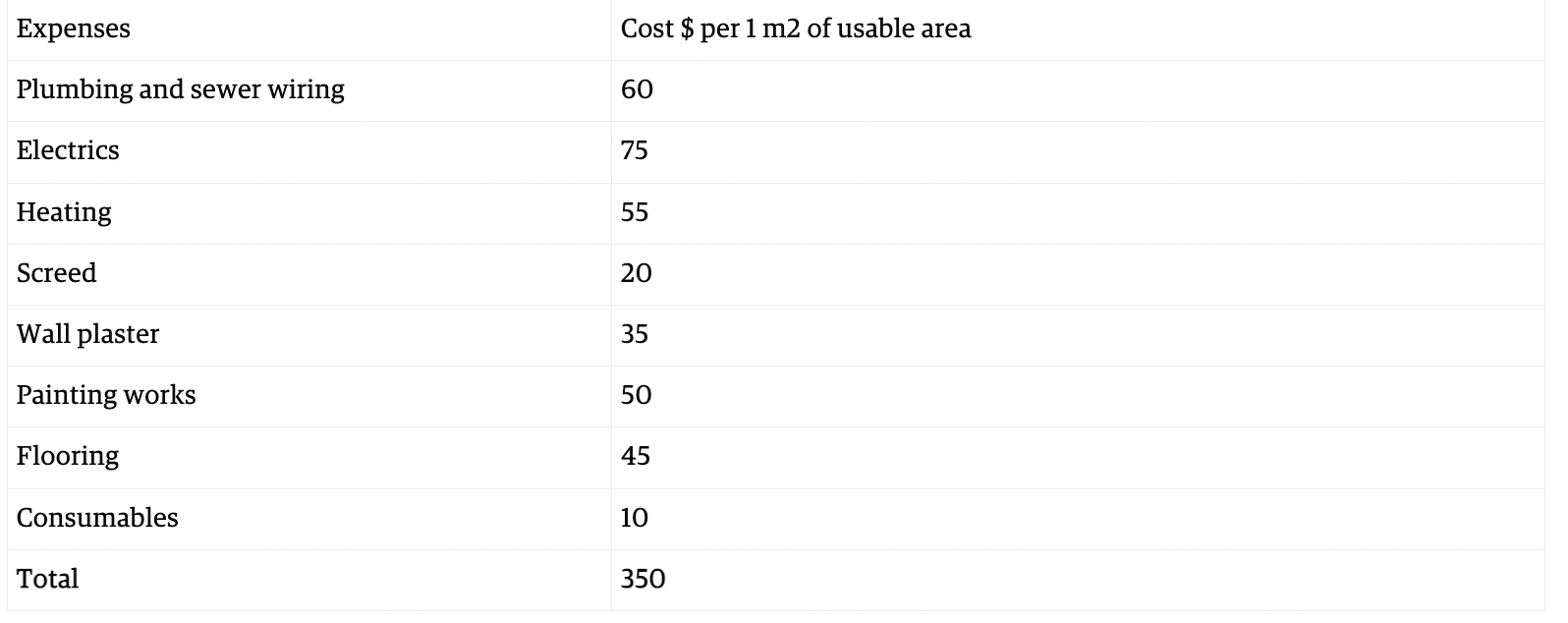

The average repair cost for a developer, as for a wholesaler, is $350 per square meter. If you do the repair yourself, you will have to pay more.

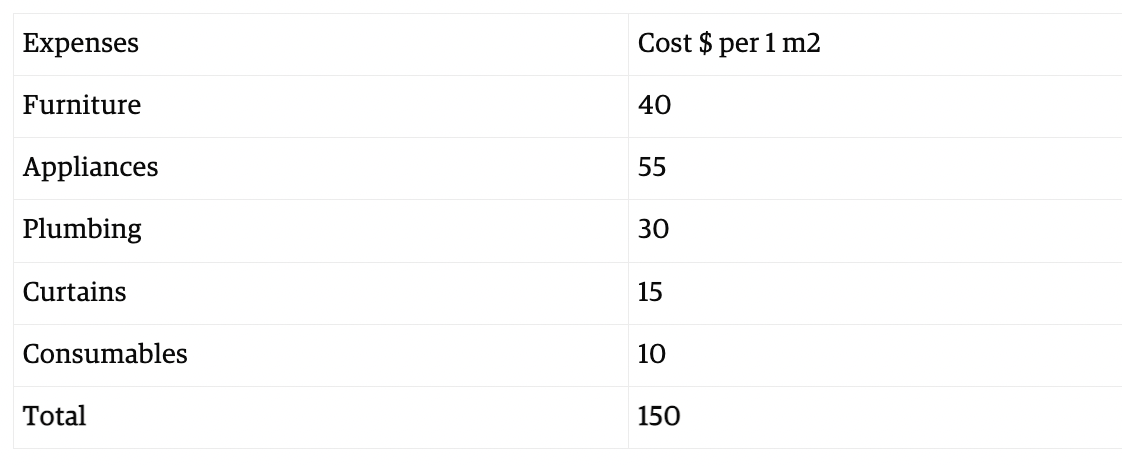

To equip an apartment will cost an average of $150 per square meter. The result is already $1,764 per square meter. Add the developer’s interest in these works in the amount of $100 per square meter and you get $1,864 per square meter.

Expenses for interior decoration of the apartment:

Completion of the apartment with furniture and appliances:

It can be cheaper if low-quality materials and cheap equipment, unskilled labor are used. But the operation of such an apartment will then become a complete disappointment and a constant quest to solve problems.

If you are buying an apartment

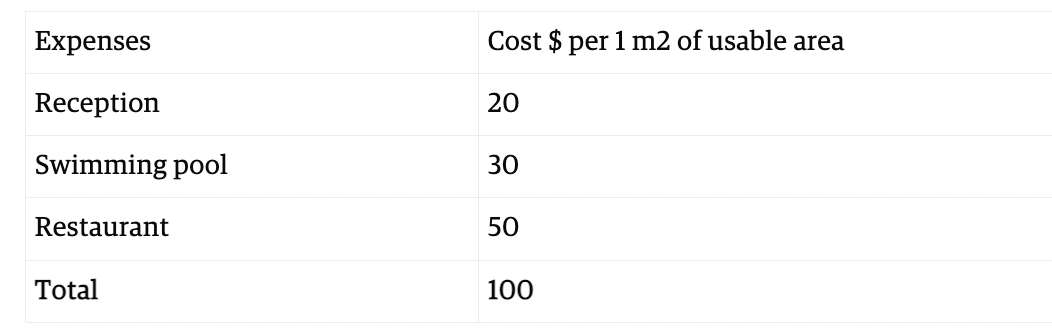

Buying an apartment implies the presence of a minimum infrastructure in the complex. It is not enough for a developer to provide only asphalted parking space. It is necessary to equip at least:

reception;

swimming pool;

restaurant.

The cost of this infrastructure is also distributed per square meter

At the same time, renting an ordinary apartment in Batumi does not cost more than $40 per day. They are rented for a maximum of 90 days per year. This is $3,600 per year, from which you need to deduct the costs of booking services (up to 29%), services of a management company or managing brokers (up to 40%), utilities, cleaning and maintenance. It is not guaranteed that such a “business” will pay for itself. It will be very problematic to recoup or make money on an apartment with such a cost, because at the moment the apartment market in Batumi is oversaturated with the supply of cheap apartments in the rental market exceeds the demand for them.

Hotel residences of international hotel chains

A product of hotels/residences from the world’s leading hotel chains has appeared on the Batumi real estate market: rooms in such a hotel already have a completely different rental price, it is several times higher than the rooms of non-chain hotels and on average 4 times higher than ordinary apartments.

The advantages of a room in an international chain hotel are high investment attractiveness and profitability due to high occupancy of the facility all year round, marketing support and promotion, high recognition, capitalization. For example, in Georgia, renting an ordinary hotel room costs about $50 per day, and a branded one costs from $200 to $1,000+.

Global branded chain hotels are managed by accredited international management companies who take care of room rental, high-quality guest service and management of the entire hotel. This ensures high occupancy and compliance with high network standards. International networks are the best at renting and managing their property professionally, because they have decades of experience or established partnerships with the best property management companies.

What makes up the price of a room in the residence of an international network?

The developer of the residence of the international hotel chain bears additional costs:

The international brand has its own high quality standards, which the developer must strictly comply with, and this requires increased costs. After all, a doorknob model can cost $20, or maybe $70. International brand standards will require more expensive repair and equipment solutions. This is at least an additional $200 to the cost of finishing and equipment.

Mandatory engineering networks in the hotel. This includes not only ordinary communications, but also high-quality ventilation, heating, split systems, low-voltage networks, fire safety systems and much more. They are made according to high international standards, as safety and comfort in the hotel depend on them. For one hotel, the installation of an air conditioning system leads to a rise in price from $100 to $200.

Technical support and supervision. A very expensive part is the technical supervision and development of the concept, design and layout of the hotel. It is conducted by an international management company accredited by an international hotel chain. Without it, it is impossible to create a hotel that will work efficiently and generate income. The experts of the management company and the brand know and take into account such nuances that an ordinary person, outside the industry, does not even know about. This is about $50 more per 1 m2.

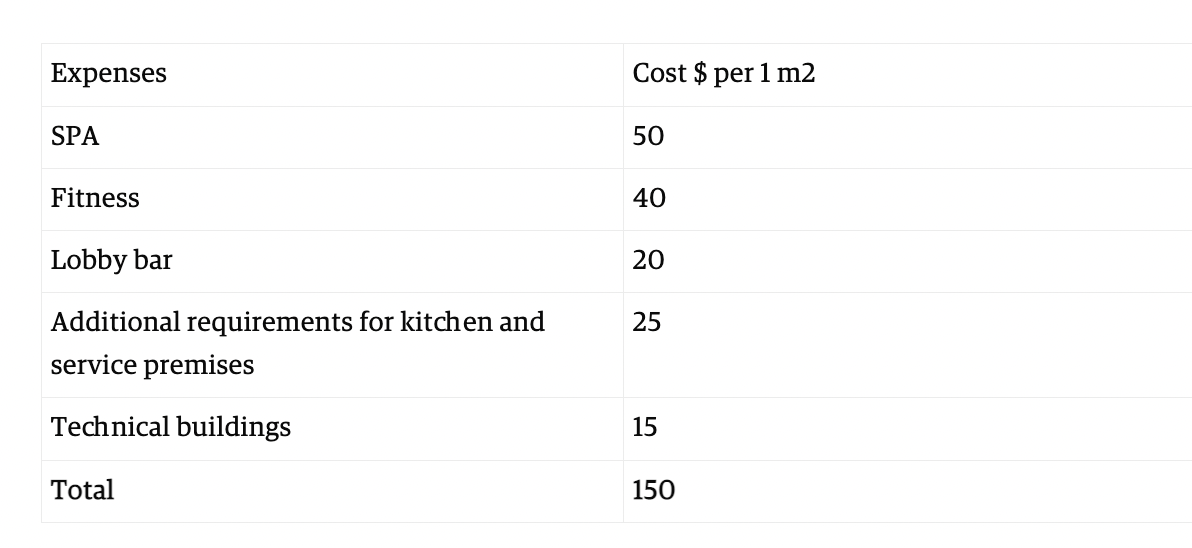

A hotel under a global brand requires a more developed infrastructure than an apartment complex or a residential building. At a minimum, SPA, fitness, lobby bar, restaurant, technical premises, special requirements for kitchen and service premises are required. And all this is at the level of international standards. This will lead to an increase in the cost of infrastructure by another $150.

As a result, one square meter of a room in an international hotel/residence costs at least $2,464 per square meter.

If this is a room is in an all-inclusive hotel

Some hotel complexes promise buyers an all-inclusive format. It sounds tempting and brings many benefits to the buyers of a room in such a hotel – the opportunity to relax and live in a place with a hotel infrastructure or give it to management in order to receive income.

But if we are talking about all inclusive, then the scope of the infrastructure will be greater – with swimming pools, restaurants and other services, which means that the price increase will be twice as high and will not be $150, but $300. So the price will be at least $2,614 per square meter.

What if I found a cheaper offer?

If you find an offer cheaper than the above price of $2800-$3000 per square meter, there may also be several reasons for this:

You are in the early stages of construction with too few units sold. That means you are in luck, prices will rise soon as more units are sold.

The developer incorrectly calculated the cost and there is a high risk that housing will not be completed

The developer is experienced and has completed properties, but the price is still low. Maybe it’s a pyramid. Maybe you are lucky and the pyramid will collapse not on your object, but on the next one.

You buy a problem – if the developer saves on quality, then this is a problem.

Good real estate is presented on the Batumi market both in the segment of apartments and in the hotel segment – from international hotel chains offering the buyer both hotel rooms for investment and hotel residences for life and recreation. Since this is a growing market, you can find real estate in it that is more profitable for investment than developed markets that have already experienced their peak of development and are now experiencing a decline, but it is important to understand that when you buy cheap, you most often buy not real estate, but problems with it. The only free cheese is in the mousetrap.