Tourism in Georgia: 6.1 Million Visits and a New Seasonal Record

Photo: Unsplash

In the first nine months of 2025, Georgia recorded 6.1 million visits, a 5.4% increase compared to the same period in 2024, according to the National Tourism Administration. The majority of travelers arrived between July and September, with Russia, Turkey, Armenia, and Israel leading the list of source markets.

The number of international trips rose by 5.6% to 5.33 million, while overnight stays increased by 7.9% to 4.31 million. One-day visits declined by 2.9% to 1.02 million.

By country, Russia remained the top source market with 1.25 million visits (+12.1%), followed by Turkey (963,633; -9.1%), Armenia (720,114; -1.7%), and Israel (293,699; +27.8%). Azerbaijan ranked fifth with 220,168 visits (+34.9%). The strongest growth came from China, up 44.9% to 96,333 visits. Georgia also welcomed more guests from Uzbekistan, India, Saudi Arabia, and various European countries.

Among EU countries, Germany ranked first with 65,968 visits (+5.0%), followed by Poland (64,210; +20.6%), France (26,620; +15.4%), and Italy (21,786; +37%). Spain saw the fastest growth — +44.7% to 17,418 — followed by Ireland (+42.2%), Latvia (+39.8%), Greece (+29.9%), and Portugal (+18.4%).

Between January and September 2025, total visits from the EU reached 394,496, up 13.3% year-on-year. Across Europe, there were over 4.3 million trips to Georgia (+5.4%), accounting for 81.3% of all inbound visits. The East Asia and Pacific region contributed 390,912 visits (+5.5%), the Middle East grew by 6.1% (to 196,751), and the Americas rose by 10.1% (to 60,059).

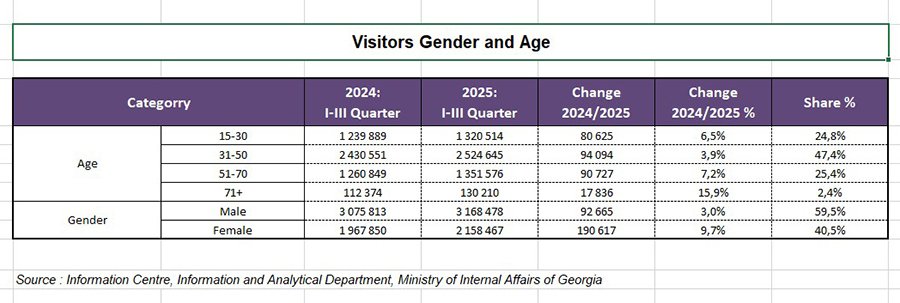

Most visitors were aged 31–50, totaling 2.5 million (47.4% of all arrivals, +3.9%). Those aged 51–70 numbered 1.35 million (+7.2%), while the 15–30 group reached 1.3 million (+6.5%). The 71+ age group showed the fastest growth (+15.9%, to 130,210).

Men made up the majority — 3.1 million visits (+5%), but the number of female travelers rose more sharply — +9.7% to 2.1 million.

Most international trips to Georgia were made by land — over 3 million — although this share decreased by 1.3% year-on-year, reflecting a gradual shift toward air travel, which grew by 17.2% to 2.1 million. Air arrivals now represent 41.2% of the total, driven by new routes from Europe, the Middle East, and Central Asia.

Sea arrivals increased by 9.5% (to 22,156), while rail arrivals rose by 3.6% (to 17,982).

The Tbilisi Airport remains the main entry point — 1.3 million arrivals (+14.8%), followed by Sarpi on the Turkish border (970,164; -8.7%) and Kazbegi (911,401; +2.7%), the top gateway for travelers from Russia.

Sadakhlo recorded over 678,000 (+6.1%), and Batumi Airport saw a 32.9% surge to 419,325, surpassing Kutaisi Airport (376,063; +11.2%). These six checkpoints accounted for over 85% of all international entries, forming the backbone of Georgia’s tourism infrastructure.

The peak flow occurred between July and September, exceeding 2 million visitors (+9%). Tourism remains a pillar of Georgia’s economy: in 2024, tourism revenues rose by 35.4% compared to the pre-pandemic record of 2019, reaching $4.43 billion.

The highest expenditures came from Russian tourists ($823 million). Analysts estimate that in the first nine months of 2025, total revenues reached $3.6 billion — up 2.8% from last year.

Georgia’s tourism sector continues its steady growth trajectory, reinforcing its role as an economic driver. Favorable climate, visa-free access, and expanding air connectivity strengthen the country’s position as a leading destination in the region. Forecasts for the coming years indicate sustained positive momentum and growing interest from Europe, China, and the Middle East.

A notable trend is the expansion of the premium hospitality segment, targeting affluent tourists and long-term investors. International hotel brands are choosing prime coastal areas such as Gonio, where the government is implementing a large-scale transformation program to create a new luxury tourism cluster.

Diversification has become the cornerstone of Georgia’s tourism strategy — balancing mass-market volume with high-value visitors. This structure boosts the sector’s resilience: affordable hotels ensure stability, while luxury projects deliver strong returns and attract long-term investment, enhancing Georgia’s position on the global tourism map.

Подсказки: Georgia, tourism, Tbilisi, Batumi, travel, hotels, statistics, visitors, economy, Asia, Europe, Middle East, Gonio, investment, hospitality