читайте также

Europe faces widespread travel chaos as 619 delays and 32 cancellations disrupt major airlines across Germany, the Netherlands, Finland, Spain and Poland

Europe faces widespread travel chaos as 619 delays and 32 cancellations disrupt major airlines across Germany, the Netherlands, Finland, Spain and Poland

Thailand takes a bold step to revive tourism by lifting the afternoon alcohol ban ahead of the Christmas and New Year rush

Thailand takes a bold step to revive tourism by lifting the afternoon alcohol ban ahead of the Christmas and New Year rush

Swiss Voters Reject Proposal for 50% Inheritance Tax

Swiss Voters Reject Proposal for 50% Inheritance Tax

The structure of workplace costs in Europe has shifted: Colliers

The structure of workplace costs in Europe has shifted: Colliers

How Terrorism Is Reshaping Middle East Tourism in 2025: Risk, Resilience and Shifting Demand

How Terrorism Is Reshaping Middle East Tourism in 2025: Risk, Resilience and Shifting Demand

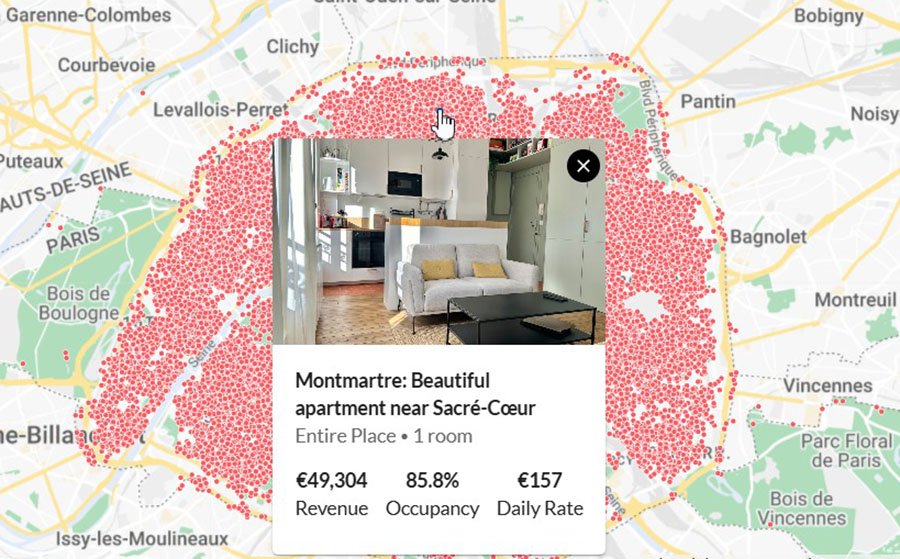

Rental Market in Paris: Rate Dynamics, Occupancy, and Yields

Rental Market in Paris: Rate Dynamics, Occupancy, and Yields

Corporate travel budgets shrink as New York, Las Vegas and San Francisco face declining demand — Booking.com for Business reports

Booking.com for Business has released new data revealing a marked decline in international corporate travel to the United States in 2025. The drop is particularly steep on transatlantic routes: UK-to-US business bookings contracted by 25.67% in the first half of the year, signalling a broader shift in global travel patterns and growing pressure on America’s top business hubs.

Rising travel costs, new tariffs and heightened economic uncertainty have pushed companies to reassess their travel policies, reduce international attendance at events and rely more heavily on remote communication.

A shifting global landscape reshapes US corporate travel

According to Booking.com for Business, the 2025 season marks a major turning point. Corporate budgets are tightening, executive travel is becoming more selective and the hybrid work model continues to limit long-haul business trips. Cities that once relied on stable international flows are now experiencing a noticeable slowdown.

New York remains the largest corporate travel market, benefiting from its role as a global centre for finance, diplomacy and technology. Its world-class infrastructure — from multinational headquarters to the vast Jacob K. Javits Convention Center — has historically secured high volumes of inbound corporate travel. The complex hosts 120 events annually with 102 meeting rooms and 10 halls across six city blocks. Yet even this level of capacity cannot fully shield the city from the drop in international demand.

Las Vegas maintains stability while preparing for major expansion

Las Vegas continues to perform comparatively well thanks to its vast convention ecosystem and unmatched hotel capacity. Despite a slowdown in leisure tourism, business travel volumes held steady. The USD 600 million expansion of the Las Vegas Convention Center — scheduled for completion by late 2025 — is expected to reinforce the city’s competitive position. Global flagship events such as CES remain strong, further supported by new attractions like The Sphere.

San Francisco shows resilience through meetings and tech-driven travel

San Francisco is stabilising on the back of strong meetings and events activity. The Moscone Center hosted 34 events in 2025, generating 657,000 hotel room nights — a 64% increase compared with 2024. The broader Bay Area continues to benefit from Silicon Valley’s technology and finance industries, attracting corporate travellers who often extend their stay for leisure, supporting the rise of bleisure travel.

What the new data reveals about other key cities

Chicago stands out for its unrivalled air connectivity. OAG ranks Chicago O’Hare International Airport as the most connected airport in the US and seventh globally, with more than 65,000 viable connections across 297 destinations at peak capacity.

Orlando continues to dominate the meetings and events market. Cvent ranked it the number one US city for meetings in 2025, supported by expansive convention infrastructure and four connected hotels.

Miami remains a magnet for entrepreneurial activity. Florida leads the nation in new business creation, with 13,238 small enterprises per 100,000 residents — a strong foundation for sustained corporate travel demand linked to startups and SMEs.

Economic pressures reshape the future of US business travel

The downturn in international corporate travel highlights deeper structural challenges for US business destinations. As companies navigate ongoing economic pressures, the need for strategic adaptation becomes more urgent. Cities must diversify demand drivers, expand hybrid event capabilities and leverage innovation ecosystems to remain competitive in a rapidly evolving market.

International Investment analysts emphasize that the decline in transatlantic business travel is not a temporary fluctuation but a long-term structural shift. The sharp drop in UK-to-US demand reflects broader changes in corporate priorities and a global push toward cost optimisation. American business hubs that previously relied on dependable international MICE flows now face the need to modernise their strategies, attract tech-driven events, invest in hybrid formats and enhance their appeal to bleisure travellers. Without these adjustments, key US markets may experience sustained revenue pressure through 2025–2027.