read also

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Israel Housing Market Eyes a Reset in 2026

Israel Housing Market Eyes a Reset in 2026

Real Estate Investment Declines in Southeast Europe in 2025

Real Estate Investment Declines in Southeast Europe in 2025

Вusiness / Investments / Analytics / Research / Ratings / Germany / USA / United Kingdom / France / Japan / China 12.03.2025

Prospects for the Development of Megacities

Experts at Kearney evaluated the development and prospects of 156 megacities, considering investments, markets, digital technologies, and entry and residency conditions. The study highlights the rise in conflicts, social unrest, economic instability, and environmental disasters. Despite these challenges, and in some cases because of them, cities are experiencing a resurgence and increasing adaptability.

Global Cities Index

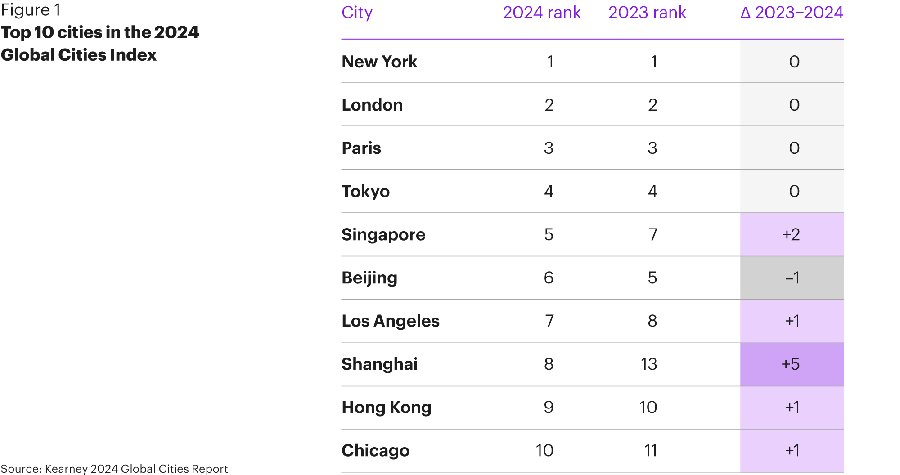

The study assessed two key indices. The first, the Global Cities Index (GCI), measures how well megacities attract, retain, and generate global flows of capital, people, and ideas.

GCI includes five key areas:

- Business activity

- Human capital

- Information exchange

- Cultural experience

- Political engagement

These areas are measured through 31 indicators, such as market dynamics, education levels, access to information, cultural and entertainment opportunities, and the presence of international public organizations.

The latest study introduced two new evaluation criteria: internet speed and the presence of data centers. These additions boosted rankings for cities with developed digital infrastructure, such as Shanghai, Singapore, Chicago, Dallas, and Frankfurt. Overall, many cities maintained their previous positions, with only a few experiencing significant ranking shifts.

Top Global Cities

New York has retained the #1 spot for the eighth consecutive year, remaining the world leader in business activity. The city holds a strong position among major global service firms and tech startups ("unicorns"). Additionally, New York improved its standing in human capital, particularly in higher education levels. In digital metrics, the city ranked 15th in data centers and 2nd in internet speed.

London also maintained a strong position but slipped slightly due to a decline in business activity and stricter entry restrictions to the UK, affecting its human capital ranking. However, the macro-economic situation remains stable, and London improved its capital markets ranking, climbing from 11th to 8th place. However, slow internet speed (97th globally) lowered London's overall information exchange score.

Paris continues to hold 3rd place globally, demonstrating strong growth in economic performance. The city significantly improved its business activity ranking, particularly in capital markets and top-tier services. A 28% increase in air traffic volume, likely due to preparations for the 2024 Olympics, played a key role. However, this factor is temporary and may not repeat in the future. Paris also maintained 1st place in human capital, with improvements in higher education and a 5th place ranking in the new “ease of entry” metric.

Tokyo has remained 4th for a decade, showing stable growth in business activity. This year, the city improved its position due to more international conferences and new unicorn companies. While capital markets rankings remained unchanged, education and innovation potential continue to strengthen Tokyo’s position. The city also earned an almost perfect score (9.56) in ease of market entry, reinforcing its business appeal.

Singapore entered the top 5 for the first time, rising from 7th place. This growth is driven by improvements in business activity, human capital, and information exchange. An increase in international conferences and five new unicorn companies boosted the city’s competitiveness. Singapore also saw a 9.6% rise in postgraduate degree holders over the past year. Its modern digital infrastructure helped secure 3rd place in information exchange, contributing to its rise in rankings.

Shanghai entered the top 10 for the first time, securing 8th place. This success is largely attributed to new digital infrastructure metrics, with Shanghai ranking 2nd globally in internet speed and 8th in data centers. These advancements strengthen its position as a technological hub.

Global cities are adapting to deglobalization and economic pressures, finding alternative trade mechanisms and leveraging the digital economy. One example is their response to shipping disruptions, which complicated supply chains and increased freight costs. Despite this, trade-dependent cities like Kuala Lumpur, Dammam, and Rome offset risks through air freight.

Immigration policies have also influenced urban dynamics. The U.S. and the UK lost skilled professionals due to strict visa policies, while Abu Dhabi, Dubai, and Luxembourg gained talent through open policies. Dammam, Bangkok, and Almaty significantly improved their business activity rankings through service sector growth. In AI development and digital technology, European, U.S., and Chinese cities lead, benefiting from advanced infrastructure.

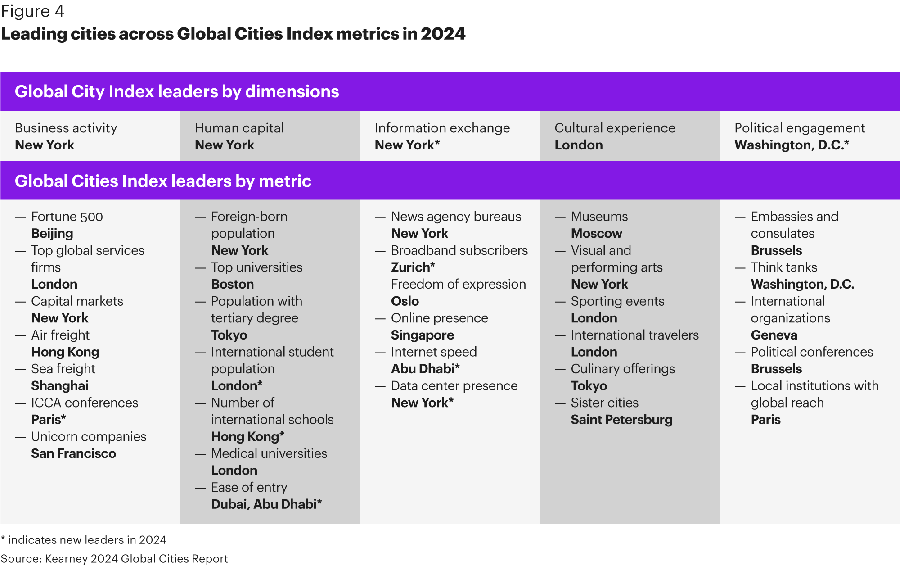

New Category Leaders in 2024 Rankings

- ICCA Conferences: Paris replaced Vienna as the top-ranked city.

- International Student Population: London overtook Melbourne.

- International Schools: Hong Kong now leads, surpassing Melbourne.

- Broadband Subscribers: Zurich and Geneva tied for #1, replacing Paris.

- Ease of Entry (New Metric): Dubai and Abu Dhabi ranked #1.

- Internet Speed (New Metric): Abu Dhabi.

- Data Centers (New Metric): New York.

Global Cities Outlook (GCO)

The Global Cities Outlook (GCO) evaluates 156 cities based on their potential to become future international hubs. It measures urban development across four areas:

- Population well-being

- Economy

- Innovation

- Governance

These categories encompass 13 indicators, including healthcare, social equality, entrepreneurship, and investments.

Top Cities in the GCO 2024 Rankings

1. San Francisco retained its #1 position, excelling in innovation, healthcare, and governance.

2. Munich rose from 9th to 2nd place due to FDI growth and a 26.3% GDP per capita increase.

3. Copenhagen dropped from 2nd to 3rd but remains a leader in governance.

4. Luxembourg stayed 4th, with banking stability and strong entrepreneurship.

5. Seoul jumped from 14th to 5th, driven by improved healthcare and rising FDI.

Global Economic Trends

Geopolitical risks and regulatory tightening in China led to a decline in FDI, with Guangzhou, Shanghai, and Quanzhou dropping significantly. Meanwhile, India, Indonesia, Malaysia, and Vietnam attracted investment, with cities like Mumbai (+28), Kuala Lumpur (+96), Osaka (+47), and Yokohama (+40) improving their rankings.

In the U.S., economic recovery is evident, with lower unemployment and stabilized inflation. All U.S. cities in GCO improved, with San Francisco, New York, Miami, Houston, and Philadelphia showing GDP growth.

Gulf cities like Dubai, Mecca, and Muscat are leveraging innovation and private investment to remain competitive despite global FDI declines.

Despite challenges, cities focused on innovation, sustainability, and security remain resilient and continue strengthening their global positions.