read also

War Spreads Beyond the Middle East: Strike on Europe

War Spreads Beyond the Middle East: Strike on Europe

Milan Emerges as Europe’s Hottest Luxury Housing Market

Milan Emerges as Europe’s Hottest Luxury Housing Market

Eurozone Economies Face a Cautious 2026

Eurozone Economies Face a Cautious 2026

Airports in the Krasnodar Region Face 155 Flight Delays

Airports in the Krasnodar Region Face 155 Flight Delays

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Russians Flee the UAE Amid Shelling

Russians Flee the UAE Amid Shelling

Challenges Persist Across All Real Estate Sectors in Denmark

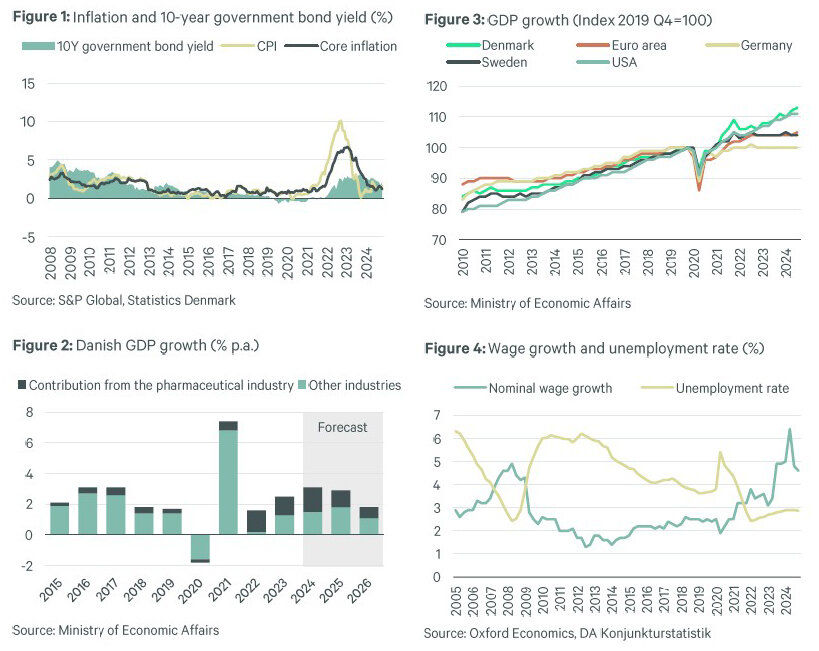

Throughout 2024, the Danish real estate investment landscape showed signs of improvement, laying a stronger foundation for 2025, as highlighted in a study by CBRE. A reduction in interest rates and rising incomes had a positive impact on the market. However, challenges remain across all sectors, particularly concerning older and lower-quality assets. The financial burden of maintaining such properties is expected to reduce overall investment efficiency.

Residential Market

Residential real estate remains Denmark’s largest asset class, with increasing interest in purpose-built student accommodation (PBSA). While housing costs have decreased as a proportion of income, affordability issues persist due to high mortgage rates, rising prices, and a limited rental market.

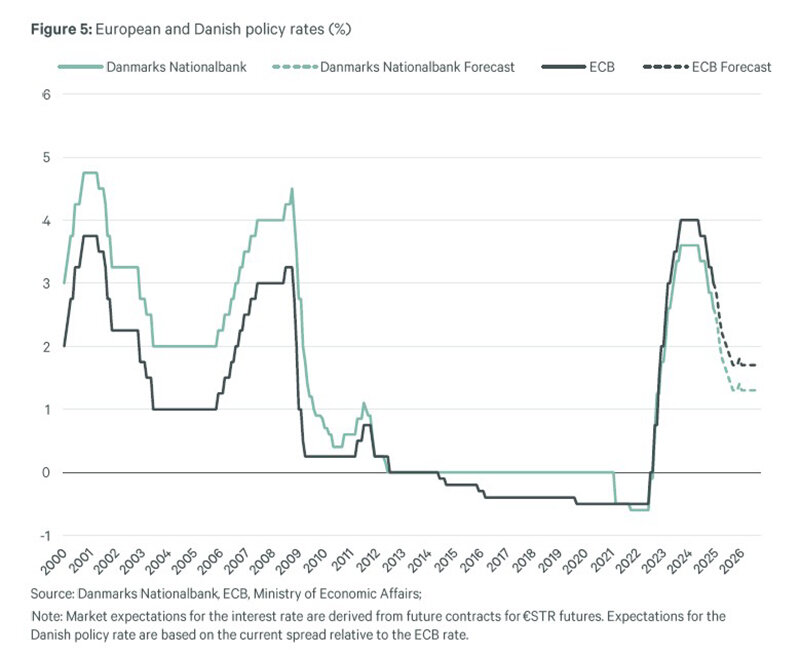

Over the past five years, fixed mortgage rates have increased from 1.5% to 3.5%, making homeownership less accessible, particularly for young buyers. For new borrowers, conditions have worsened, though existing mortgage holders pay an average rate of 2.7%. A gradual decrease in interest rates may improve affordability in 2025.

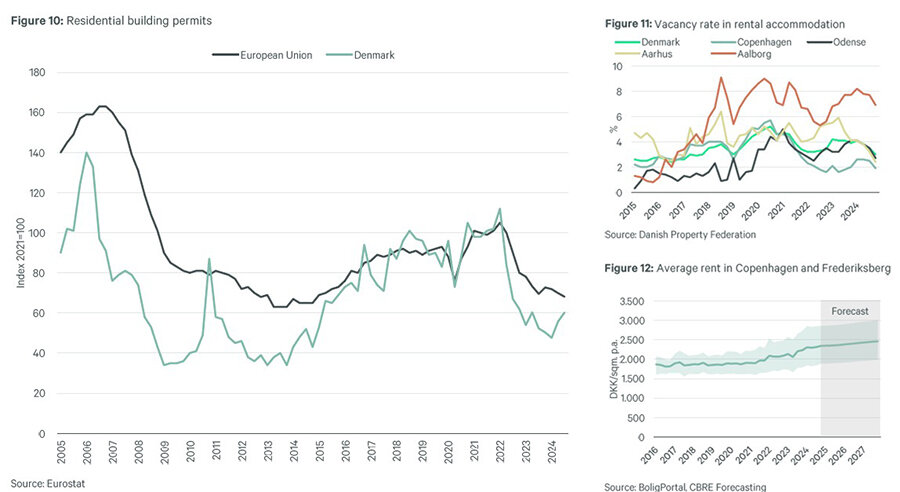

In 2023, a typical couple spent 64% of their income on purchasing an 80 sqm home, compared to 39% on rent. This gap is expected to persist into 2025. Rental vacancy rates remain critically low: less than 2% in Copenhagen and around 3% nationwide. With no major supply increase expected, rental prices are set to rise further. Privatization and investment-driven purchases may shrink the available rental stock, exacerbating affordability issues.

Construction permits have declined by more than 40% since 2022, despite rising demand. Denmark’s municipal development plan aims to build 40,000 new homes over 12 years, but high costs continue to deter developers. In 2025, a rise in permit approvals is expected due to increasing property values.

The housing market remains resilient, driven by income growth and a stable job market. Home prices are expected to rise by 4-5% in 2025-2026, maintaining a high entry barrier. Student housing is emerging as the most attractive investment due to rising demand and improved living conditions.

Logistics Sector

Supply chains and inventory levels have stabilized, but weak consumer confidence has reduced demand for logistics space. Demand in 2024 was lower than in previous years, though improvement is expected in 2025.

Absorption rates have dropped, and vacancy rates have risen by 70 basis points in the past year. Tenants now have more negotiating power, creating favorable leasing conditions. The premium logistics market remains more resilient, though rental growth will be moderate.

In 2025, average European industrial rental growth is projected at 1.8%, with Denmark slightly higher at 2.0%. Location remains a key factor, with growing demand for properties near workforce hubs and end consumers.

E-commerce demand has slowed but remains a major driver of logistics real estate. By 2028, online sales will exceed 20% of Denmark’s total retail transactions. The expansion of reverse logistics (handling returns) will require additional warehouse space.

Logistics property prices are expected to grow 5% annually, making the sector highly attractive for investors. Lower interest rates could further boost investment activity.

Office Real Estate

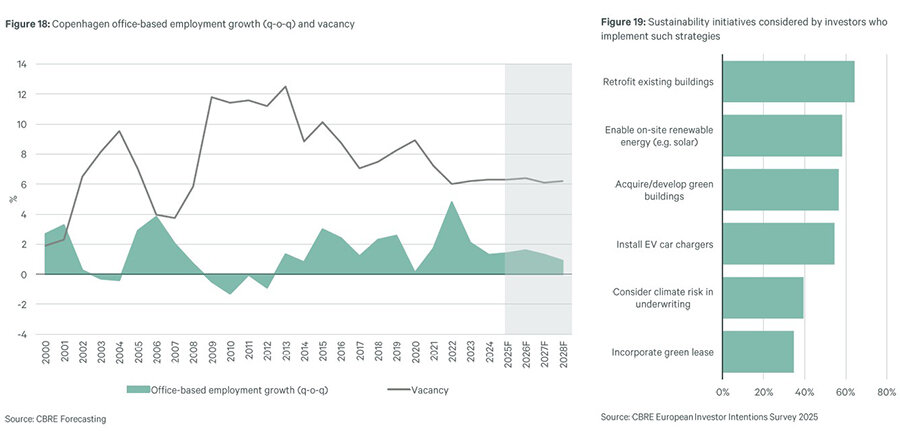

The Danish office market is set for a moderate recovery in 2025, driven by employment growth and stable office occupancy rates. A gradual increase in demand is expected throughout the year, potentially reaching historical leasing activity levels by December.

Demand for high-quality office spaces is increasing, driving market polarization. Premium office spaces will remain highly attractive with low vacancy rates, while older, lower-quality offices will see rising vacancies as tenants opt for modern, flexible workspaces.

Tenants are prioritizing office optimization, seeking high-quality environments for their workforce. This shift will create a more stable and competitive market, though long-term leases remain less popular due to market uncertainty.

Premium office rents are expected to rise, driven by limited new supply, high construction costs, and financing challenges for new developments.

Investment activity was low in 2024, with domestic investors dominating the market. Foreign investors are expected to return in 2025, increasing liquidity and driving large transactions.

Investors are focusing on yield optimization, leading to price corrections in certain sectors. Secondary office assets may be acquired at discounted prices but require capital expenditure to meet new regulatory standards.

##

Retail Real Estate

Retail demand is set to improve in 2025, fueled by income growth, positive economic forecasts, and lower interest rates boosting consumer confidence.

Retail expansion will remain selective, focusing on shopping centers, prime high-street locations, and retail parks. Vacancy rates in premium locations remain high, challenging retailers seeking prime spots. The focus will shift toward enhancing customer experience rather than aggressive expansion.

Grocery stores and retail parks remain top investment choices, demonstrating resilience. High-street retail investments remain limited, as large assets are scarce. Investors anticipate further price corrections, slowing deal activity.

Forty percent of investors expect further price declines in central retail assets, potentially restraining investments in this segment.

##

Uneven Recovery in 2025

Denmark’s real estate investment market is set for a gradual but uneven recovery. Key investment drivers include asset quality, liquidity, and risk mitigation.

Denmark’s economy remains stable, largely due to the pharmaceutical sector, which accounted for 88% of GDP growth in 2022 and contributed 48% in 2023. In 2025, pharma’s influence will decline as other industries gain traction.

Inflation fell below 2% in 2024, supporting economic expansion. Lower banking rates have improved consumer and business confidence. Further monetary easing in 2025 is expected to boost investment conditions.

Potential risks include geopolitical instability, trade disputes, and commodity price fluctuations. However, Denmark remains more resilient than other EU markets. Investors continue to favor industrial and residential assets, while offices face ongoing challenges.

2025 is shaping up to be a year of recovery, though challenges linked to global economic uncertainty persist.