Вusiness / Real Estate / Analytics / Reviews / China / Real Estate China / News / Investments 11.04.2025

Five Years of Crisis: What’s Happening to China’s Housing Market

China’s real estate sector is now entering its fifth consecutive year of downturn. Despite repeated government support and debt restructuring efforts, the ongoing price collapse, record losses among developers, and rising non-performing loans at banks highlight deep structural issues. As Bloomberg reports, the latest losses from Vanke serve as a new warning signal.

From Boom to Bust

The current real estate model in China began after the 1998 market liberalization, which lifted restrictions on private home sales. At the time, only one-third of the population lived in cities; now it’s over two-thirds. Urbanization triggered a construction boom, heavily incentivized by local governments through land sales.

From 2000 to 2022, housing prices grew nearly sixfold. At its peak, the sector accounted for up to 25% of GDP and around 80% of household assets. By 2019, the total estimated value of China’s housing market reached $52 trillion.

The boom was fueled by debt. Developers borrowed heavily—including from foreign investors—and pre-sold homes long before completion. In cities like Shenzhen, housing became less affordable than in London or New York. To contain the risks, the government imposed strict credit limits in 2020 and later pandemic-related controls.

The introduction of the “three red lines” policy, limiting developer leverage and cash flow, led to a liquidity crunch. Construction halts due to COVID-19 further worsened the situation. By 2021, major developer Evergrande defaulted on over $300 billion, followed by Country Garden and Sunac in 2022. This marked the beginning of a systemic crisis.

Escalation in 2023–2024

In 2023, home prices posted their steepest drop in nearly a decade. By May 2024, the inventory of unsold new homes hit 400 million square meters. New housing starts fell to a 20-year low. Household debt exceeded 145% of disposable income, while mortgage delinquencies rose to a four-year high. Many homeowners had to sell at a loss, adding further pressure on prices.

August 2024 saw the largest price decline since 2015. Despite new stimulus efforts, sales remained sluggish, and developers continued to delay new projects.

State-backed developer Vanke, once seen as a stable player, reported a record loss of 49.5 billion yuan ($6.8 billion) in March 2025. This followed a sales slump to the lowest level in a decade, signaling deep financial stress across even the strongest firms.

State Developers & Bank Response

With private developers retreating, state-owned developers increased their land purchases. For example:

Jinmao acquired a Shanghai site for 9 billion yuan after 184 rounds of bidding.

Greentown became the third-largest developer in China, with nearly half its sales in Hangzhou.

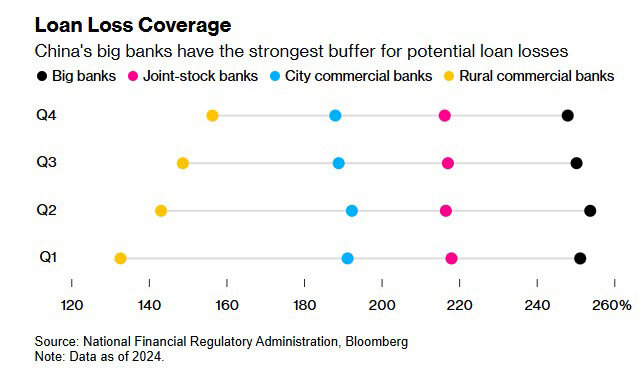

Meanwhile, banks, especially state-owned, began aggressively writing off bad loans. In 2024 alone, they disposed of 3.8 trillion yuan ($532 billion) in non-performing real estate loans, according to Bloomberg.

According to Fitch’s Elaine Xu, this helps clean up bank balance sheets and reallocate credit to more productive sectors.

Signs of Stabilization, But Risks Remain

Despite ongoing pressure, early 2025 brought hints of price stabilization. According to China’s National Bureau of Statistics, the pace of monthly price declines slowed for five straight months, with a drop of just 0.07% in January.

Mortgage issuance also increased sharply, reaching 493.5 billion yuan ($69 billion)—the highest monthly figure in over a year.

Housing Minister Ni Hong said the market was showing signs of "bottoming out and gradual improvement", aided by new stimulus measures and recovery in top-tier cities.

However, related sectors like steel and construction remain under pressure. In March 2025, rebar prices hit a six-month low despite the usual seasonal demand spike, while new housing starts in January–February fell 30% year-over-year, the worst start to a construction season in two decades.

According to Wood Mackenzie analyst Lawrence Zhang, the real estate sector remains a key barometer for China’s commodity demand. UBS forecasts that stabilization could begin in 2026, starting with China’s largest cities.

Подсказки: China, housing market, real estate crisis, Vanke, Evergrande, property sector, mortgages, construction, Chinese economy, banks, stimulus, urbanization, UBS forecast