U.S. Commercial Real Estate 2025: Construction Slowdown and Revised Investment Strategies

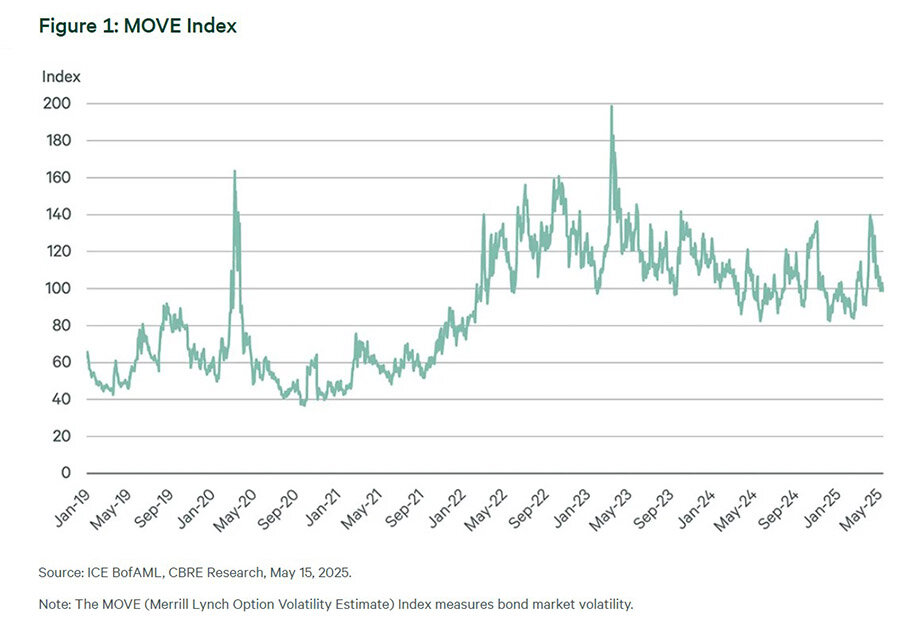

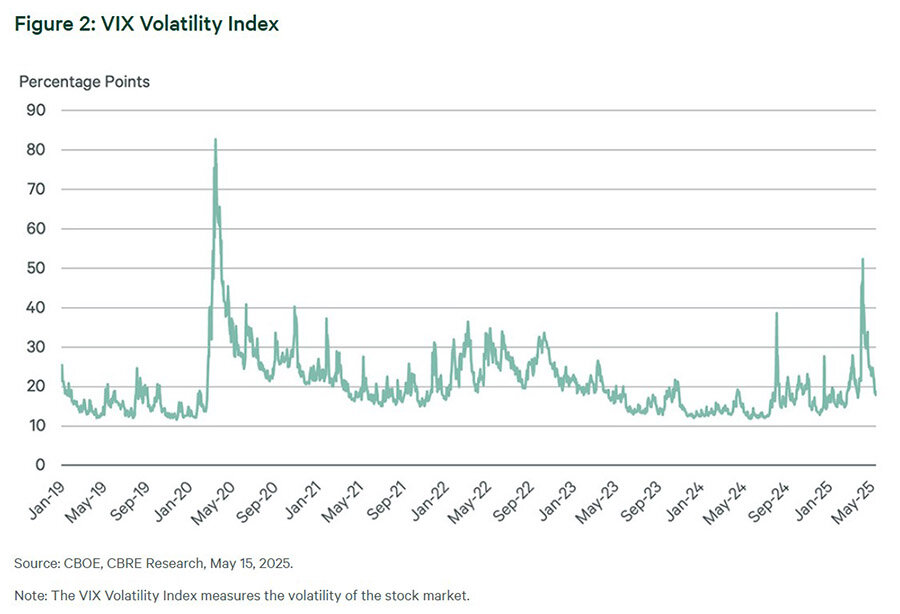

In Q1 2025, U.S. GDP fell by 0.3%, mainly due to a surge in imports ahead of new tariffs and a reduction in government spending. Meanwhile, unemployment rose to 4.2%, and yields on ten-year bonds remained high, holding steady in the 4–4.5% range.

Rising construction and financing costs, coupled with macroeconomic uncertainty, are prompting developers to pause new projects. Tenants are adopting a wait-and-see approach to minimize costs, while investors are reassessing priorities and focusing on sectors with resilient demand. CBRE’s analysis covers key sectors: offices, warehouses, retail properties, multifamily housing, and capital markets.

Logistics and Warehouses

The logistics and warehouse sector showed stable performance, with transaction volume exceeding 189 million sq. ft. in Q1. The main driver was demand from 3PL logistics companies offering integrated services from storage to delivery. Due to market shifts, property owners have started negotiating lease extensions up to 24 months before leases expire, whereas previously they delayed talks in hopes of securing better rates.

Growing trade volumes with Canada and Mexico are enhancing the importance of logistics hubs along the I‑35 corridor, which spans the U.S. from south to north through key logistics cities like Dallas and Kansas City. However, rising tariffs and declining consumer demand could reduce warehouse demand, particularly among cost-sensitive tenants such as large and small businesses.

CBRE forecasts a 5–10% decline in warehouse deal volume in 2025. The most significant drop is expected among large tenants (over 500,000 sq. ft.) and small tenants (under 100,000 sq. ft.).

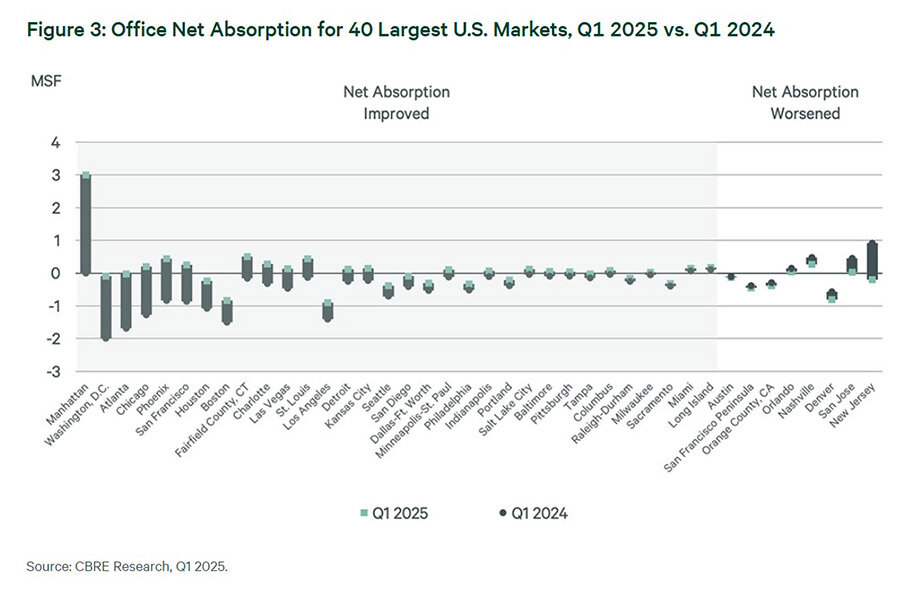

Offices

The office sector saw growth, with leased space increasing 18% quarter-over-quarter, exceeding 54 million sq. ft. The recovery that began in New York’s premium market has spread, with 32 of the 40 largest U.S. markets posting positive net absorption year-over-year.

However, future dynamics will depend on external economic policy. Many companies are freezing new deals, preferring lease extensions over relocations or expansions to avoid additional relocation and build-out costs. Nonetheless, businesses less affected by shifts in external trade remain active in leasing. CBRE forecasts a 4% increase in office leasing activity for 2025. Analysts emphasize that as the market recovers and conditions shift in favor of landlords, tenants should act quickly to secure deals.

Retail

Retail faces less stability. Vacancy rates rose by 10 basis points to 4.8%, and for the first time since 2020, negative net absorption was recorded as total occupied space declined. Discount stores, apparel retailers, and large-format stores remain particularly vulnerable due to supply chain disruptions. Higher trade tariffs could further erode retail margins, leading to fewer new leases. However, limited new supply may constrain vacancy growth, preserving some market activity through lease renewals and selective new deals in prime locations.

Construction and Investments

CBRE reports a reduction in projects under construction. Since 2020, construction costs have increased by 35%, while higher borrowing costs have limited developers’ ability to launch new projects.

In Q1 2025, completions included:

— 4.5 million sq. ft. of retail space, the lowest in a decade;

— about 70,000 new multifamily units;

— 220 million sq. ft. of industrial space, the lowest since 2017;

— 22 million sq. ft. of office space, 82% lower than Q1 2020.

Despite limited new supply, commercial real estate investments rose 14% year-over-year, reaching $88 billion. CBRE estimates that future capital market dynamics will hinge on trade deal outcomes and debt market trends. Despite widening spreads, analysts expect that if bond yields remain between 4–4.5%, investment activity could rise by another 8%.

Risks persist, notably potential bond sell-offs amid concerns over budget deficits, which could impact capital costs. Nevertheless, investor interest remains strong, especially in housing and logistics sectors. Interest in office and retail properties is also increasing. Alternative sectors like data centers and science parks have temporarily lost popularity as investors focus on assets with repriced valuations.

Deal Formats and Outlook

Competition among buyers persists in the housing sector. High long-term interest rates remain the main obstacle, despite financing still being available. Lenders remain active across all segments, albeit with a more conservative approach to risk.

CBRE identifies several promising sectors: Class A offices outside central coastal locations, warehouses along the I‑35 corridor, resilient retail centers with solid tenants, multifamily properties in the Midwest, and data centers. Other promising assets include long-term leased properties, sale-leaseback transactions, distressed assets with upcoming debt maturities, and government-owned properties slated for privatization.

For 2025, CBRE forecasts average U.S. GDP growth of 1.3%. Despite persistent risks, analysts do not anticipate a technical recession, meaning two consecutive quarters of declining GDP.