Вusiness / Real Estate / Investments / Analytics / Research / United Kingdom / Real Estate Britain 19.07.2025

Commercial Real Estate in the UK in 2024: Market Analysis and Outlook

Photo: Knight Frank

Knight Frank has published its Q4 2024 report on the UK commercial real estate market. The analysis covers key segments – from offices and warehouses to retail and specialized assets – and shows early signs of recovery after a period of high inflation and interest rates, with growing investor interest.

Offices: Recovery and Challenges

Despite high rates and structural uncertainty, the UK office real estate market showed signs of revival in 2024. Leasing and investor activity grew, although risks remain due to limited supply of prime properties and underperforming secondary stock.

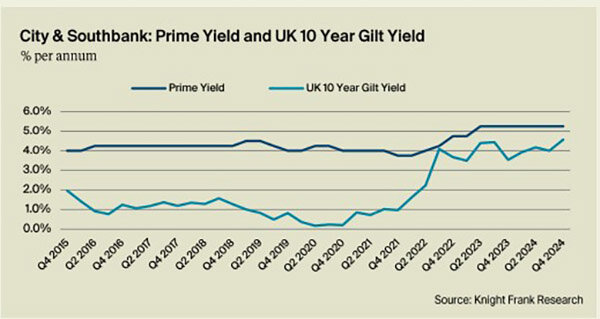

In London’s City and Southbank, Q4 transactions rose by 17.7%, reaching 2.1 million sq ft — 33.9% above the long-term average. Newly built and refurbished spaces made up 68.1% of leases (1.4 million sq ft), reflecting high-quality demand. Yet annual investment volume remained 70.8% below the average.

West End activity jumped 54.2% in Q4, with annual turnover at £3.9 billion (25.4% below average). Larger deals are rising, and yields remain stable at 3.75%.

Docklands and Stratford showed moderate dynamics: Q4 leasing totaled 77,000 sq ft, 58.2% below average. Universities led demand, but there was no investment activity. Yields stood at 7.50%.

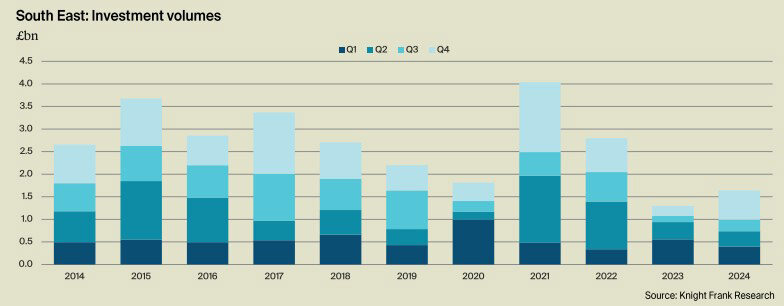

In South East, Q4 investments grew by 154% to £648 million — a two-year high. Annual volume reached £1.64 billion (+25%). Cambridge led the market due to biomedical and repurposing asset deals. Average deal size was £16.1 million, below trend.

Leasing hit a five-year high at 3.63 million sq ft in 2024, with 888,000 sq ft in Q4. Oxford and Reading posted 12–13% growth. Demand was strong for new and Grade A spaces (80% share).

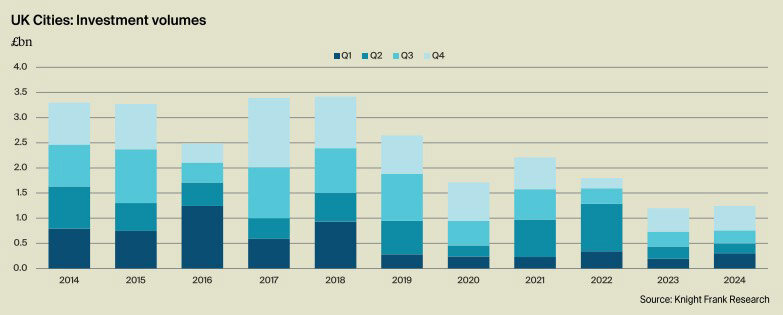

UK Cities leasing hit 5.6 million sq ft (+18%) – the best since 2019. Professional services led with over 25% of deals. Grade A vacancy dropped to 9.5%, total to 13%. A 4 million sq ft shortage of quality space is forecasted.

Investments in UK Cities totaled £1.24 billion (+4%), still 24% below the five-year average. Average deal size shrank. Private capital led inflows. Prime yields dropped 25 bps to 6.50%, signaling sentiment improvement.

Industrial & Logistics: Investment and Demand Surge

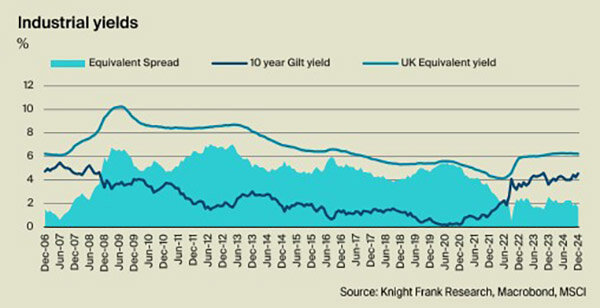

The industrial market ended 2024 on a strong note. Q4 investments hit £2.5 billion (+7.2% QoQ), sharply up from £1.1 billion in Q4 2023. Full-year investment reached £8.4 billion, up from £6.5 billion in 2023. Q4 was the best since Q3 2022 due to high demand and competitive bidding for prime assets.

Investor profiles shifted: private capital, REITs, and listed firms now represent 17% of deals (vs. 7% in 2021). Foreign buyers fell from 62% to 51%. Prime warehouse yields with 15-year leases dropped 25 bps to 5.25% — first fall since revaluation cycle began. MSCI UK industrial yields also fell to 6.22%.

Rental deals for spaces over 50,000 sq ft totaled 35.7 million sq ft (+19% YoY). Secondary asset deals grew to 52%, up from 48% in 2023.

Vacancy rose 10 bps in Q4 to 7.3%, still below pre-pandemic norms. Speculative supply dropped 10% to 11.8 million sq ft, tightening availability for 2025. Annual rent growth hit +5.5%, up from +4.7% in 2023.

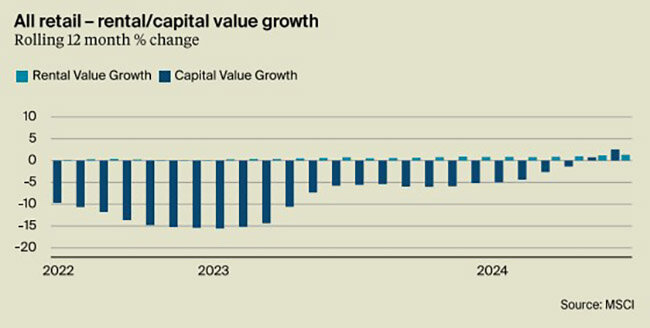

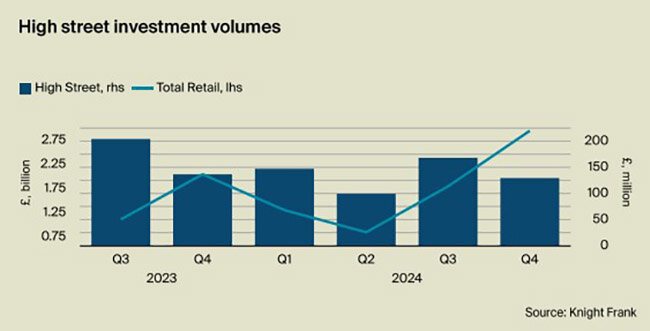

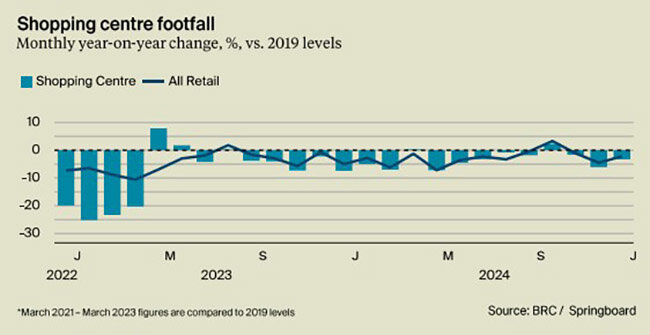

Retail: Leasing Recovery and Positive Signs

Retail closed 2024 on a stable note. Holiday sales were strong. Real household income rose 5.6% vs. 2.5% inflation. December turnover hit £60 billion (+3.5%). Consumer confidence improved. Q4 vacancy fell 20 bps to 13.8%. Investments grew to £2.9 billion — the highest in years. Warehouse formats dominated (58%). Shopping center yields fell 25 bps, showing regained trust.

High Street Retail was volatile. Sales rose 3.5% in December after slow months. Annual growth in non-food items hit 4.3%. Top segments: books (+9.8%), watches (+9.8%), jewelry (+5.9%), cosmetics (+11.4%). Chains like Greggs and Sosandar are expanding. Vacancy fell to 13.8%, rents rose 1.7%. However, the segment contributed just 4% of investments.

Shopping Centres saw 3.5% sales growth; non-food up 6.8%. Cosmetics (+20.4%) led gains. Q4 deals hit £970 million; full year reached £2 billion. Yields fell to 8%.

Out-of-town Retail Parks saw record £1.7 billion in Q4. Key deals: British Land (£441M) and Brookfield (£674M). Vacancy dropped to 6.5%, yields to 5.15%.

Leisure remained stable. Restaurant revenue grew 1.1–1.2%, bars +1.3%. Annual investment: £175.8M (above five-year average). Secondary Leisure Parks yield 15%. Foodstores saw record consumption in December: average spend £460 (+2.1%), turnover £13B. Tesco’s sales rose 3.8%, market share +0.8 p.p. Yields dropped to 4.75%.

Central London remains competitive: Oxford Street vacancy fell to 10%, best in 7 years. Footfall in West End up 2.3%. Annual investments reached £895 million — nearly double average. Key deals: Global Holdings (£200M) and Brookfield (£185–205M). Prime yields: 4%.

Specialized Assets: Selective Growth

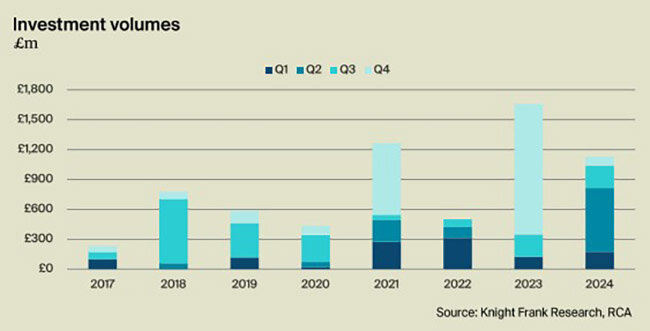

Data centers hit a record £1.13 billion (+13.3% above post-COVID average). KKR’s £315 million acquisition in London was the largest deal. Vacancy fell to 6.25%. Grid limitations in West London may delay new connections until 2036.

Healthcare transactions exceeded £2 billion — a post-2022 high. Institutional and foreign investors led. Key deals: Hartford Care, Signature Living, Berkley Care, and Care UK (Welltower).

Care homes remain stable: average occupancy 88.8%, weekly rate up 7% to £1,170. Bed shortages persist: only 519 new beds in a decade, despite a 16% increase in over-65 population. By 2050, a shortage of 200,000+ beds is expected.

Life sciences posted £3.25 billion in venture capital — second-highest in history. Fewer deals but high-quality projects. Pension fund reform supports long-term biotech/pharma funding.

Top investments: £279 million from Eli Lilly; joint Oxford projects worth £100+ million. Government allocated £520 million for pharma and life sciences R&D.

Total investment in the “Golden Triangle” (Oxford–Cambridge–London) hit £622.5M, matching 2023. Q4 deals reached £332.1M, including Danaher (Cambridge, £125M) and Imperial College (London, £115M).

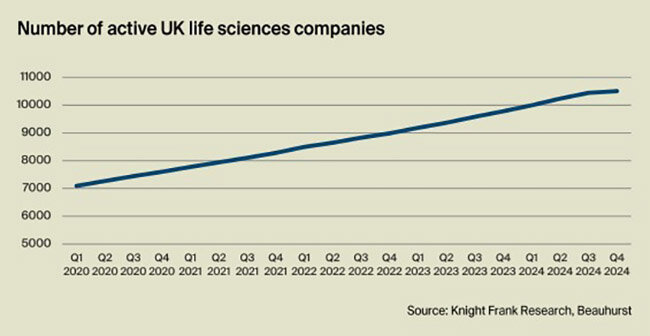

Leasing activity remained subdued: 539,700 sq ft in 2024 (–38% YoY). 70% of leasing was in Oxford (+49%), while Cambridge remained flat. Over 9,500 active life science firms operate in the UK, but pharma job listings continue to decline.

Outlook: Economic Trends and Capital Flows

According to Knight Frank, global growth is projected at 3.3% for 2025–2026, below the 2000–2019 average. The IMF raised the US GDP forecast to 2.7% for 2025, while the Eurozone outlook was cut to 1.0%. Eurozone inflation is expected to slow to 2.4% (2025) and 1.8% (2026).

UK GDP outperformed in H1 2024, slowed in H2. 2025 growth forecast was revised up to 1.6%. Inflation fell to 2.5% in December. Oxford Economics sees a peak at 3.3% in Q3 2025, with a return to 2% by the decade’s end. Unemployment is at 4.4%, well below the 6.7% long-term average.

Capital market activity rose 21% YoY to £46.6 billion, still 18% below the 10-year average. Foreign investor activity grew 59% in Q4. London retained its top status for global capital inflows for the fifth year. Rate cuts and price stabilization are expected to drive deal volume in 2025. Private capital will continue to lead market activity.

Despite challenges, macroeconomic recovery and investor re-engagement are laying the groundwork for a cautious rebound in UK commercial real estate.