read also

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

New research highlights rising hotel tax compliance costs in the United States

New research highlights rising hotel tax compliance costs in the United States

Вusiness / Real Estate / Investments / Analytics / Research / Germany / France / United Kingdom / Spain / Italy / Poland / Romania / Netherlands 22.08.2025

European Real Estate Investment 2025: Colliers Research

In Q2 2025, the European commercial real estate market showed signs of recovery. Colliers’ report highlighted an increase in large transactions and growing interest in alternative segments such as data centers and student housing. These trends reflect investors’ readiness to act more decisively even amid economic uncertainty.

The main feature of the quarter was the rise in large deals, with transactions above €100 million increasing. Institutional investors were more active, entering the market through fund recapitalizations and portfolio acquisitions. Colliers cited Redevco’s interest in pan-European logistics investor Roebuck and the joint acquisition of an industrial-logistics portfolio in France by Oxford Properties and AustralianSuper. At the same time, the market showed higher selectivity. While no major distress was observed, assets under pressure began to emerge, signaling a shift in the risk balance and opening new opportunities for investors.

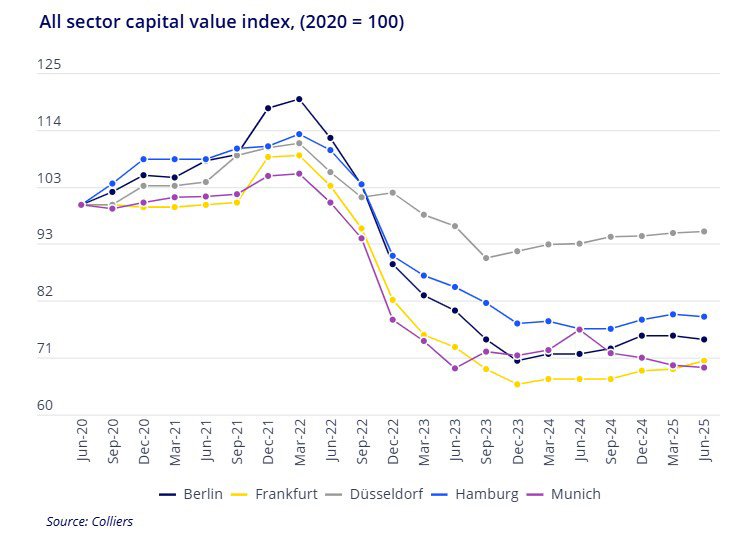

Germany

Conditions improved, but deal activity in H1 2025 remained subdued. Investment volumes in the commercial sector fell 5% compared to the same period in 2024. Recent uncertainty limited momentum, yet value-add strategies—particularly in offices—gained traction. The residential sector moved in the opposite direction, posting an 8% increase thanks to active portfolio transactions.

A surge in office supply is expected in H2 2025, as developers complete projects and institutional investors seize opportunities to sell amid the end of the interest rate cutting cycle. While capital for large-scale deals remains limited, even a small demand uptick could quickly shift the segment’s dynamics.

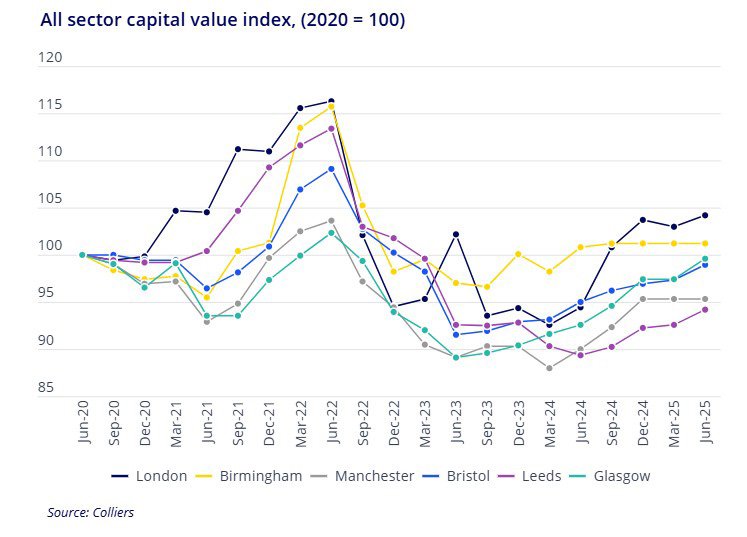

United Kingdom

Investment activity in H1 2025 remained around 30% below average. Yet rising foreign investor interest suggests a gradual revival. Short-term uncertainty persists, but asset appreciation, looser commercial lending, and rate cut expectations are paving the way for recovery. Colliers expects full-scale growth in 2026, with 2025 volumes likely below last year’s level.

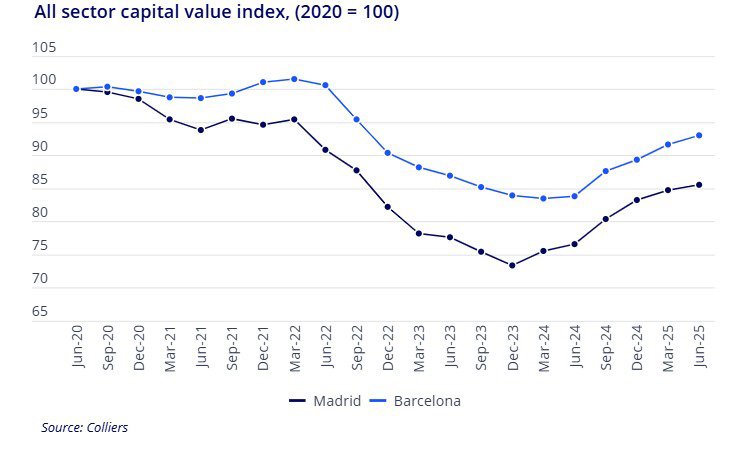

Spain

Investment volumes reached €8.3 billion by July 2025, up 44.2% year-on-year. Hotels led the way (€1.8 billion, of which €1.2 billion in Q2), followed by retail (€1.5 billion), alternative assets such as data centers (€1.5 billion), residential (€1.4 billion), offices (€1.2 billion), and industrial-logistics (€793 million). The outlook for H2 remains positive thanks to stable yields and favorable financing conditions.

Italy

Investments totaled €5.3 billion in H1 2025, up 52% from last year. According to Colliers, this is the second-highest H1 result in a decade and 30% above the historical average. Milan led with €1.6 billion (30% share), followed by Rome (€700 million). Foreign investors accounted for 60% of activity.

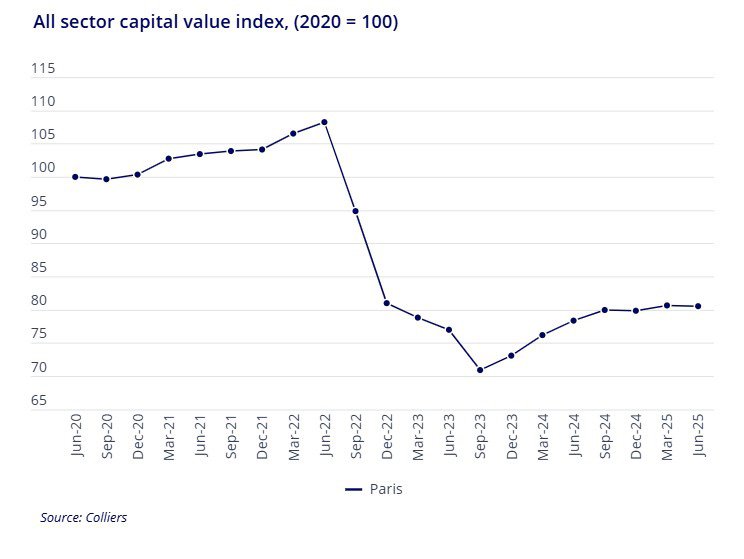

France

Commercial property investment rose to €5.75 billion in H1 2025 (+30% y/y). Most growth came in Q1 (€3.5 billion). In Q2 activity slowed to €2.2 billion (–8% y/y). The full-year forecast is now €14 billion, a 10% rise over 2024.

Poland

Over 60 deals worth €1.7 billion closed in H1 2025, matching last year’s level. Industrial-logistics dominated with €700 million (40%), followed by offices at €400 million (25%). Nearly half of office deals occurred outside Warsaw. Foreign investors provided 50% of inflows, while domestic investors set a record €260 million (15%). Activity is expected to rise in coming quarters.

Netherlands

Investment [leech=https://infogram.com/colliers-emea-capital-markets-snapshot-q2-2025-1h0r6rzkvggzl4e?src=embed]fell[/leech

] to €2.9 billion in Q2 2025 from €3.1 billion a year earlier. Office and retail segments showed annual growth, and large portfolios are expected to boost H2 activity.

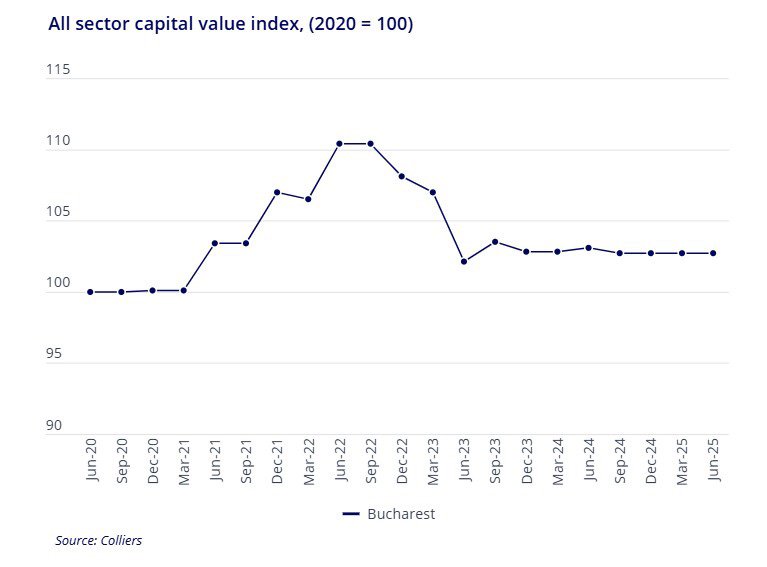

Romania

Romania recorded its largest office deal in three years in Q2, underscoring investors’ interest in diversifying into high-growth local markets in Central and Eastern Europe.

Outlook

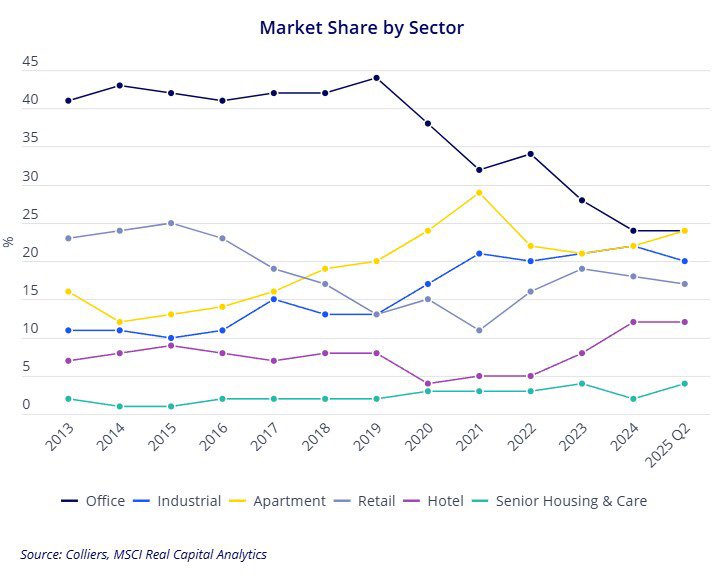

Industrial-logistics assets remain the focus, though data centers and student housing are emerging as strategic alternatives. Political risks and economic slowdown continue to limit momentum, but Colliers highlights that demand for quality assets remains strong. The diversification of strategies and broader availability of alternative segments are laying the foundation for gradual market strengthening in H2 2025.