read also

Japan Corporate Bankruptcies Hit 13-Year High

Japan Corporate Bankruptcies Hit 13-Year High

Japan’s New Condo Prices Reach Record High

Japan’s New Condo Prices Reach Record High

European Gas Prices Surge Amid Middle East War

European Gas Prices Surge Amid Middle East War

EU prepares new foreign investment screening rules

EU prepares new foreign investment screening rules

Collapse of Air Travel in the Middle East

Collapse of Air Travel in the Middle East

New research highlights rising hotel tax compliance costs in the United States

New research highlights rising hotel tax compliance costs in the United States

Office Leasing in 2025: Less Space, Higher Demands — C&W Study

In 2025, companies’ top priority remains cutting office costs, as noted in the latest Cushman & Wakefield and CoreNet Global report. At the same time, new trends are taking shape: flexible hiring strategies, modern, amenity-rich workplaces, and technology adoption are all gaining importance.

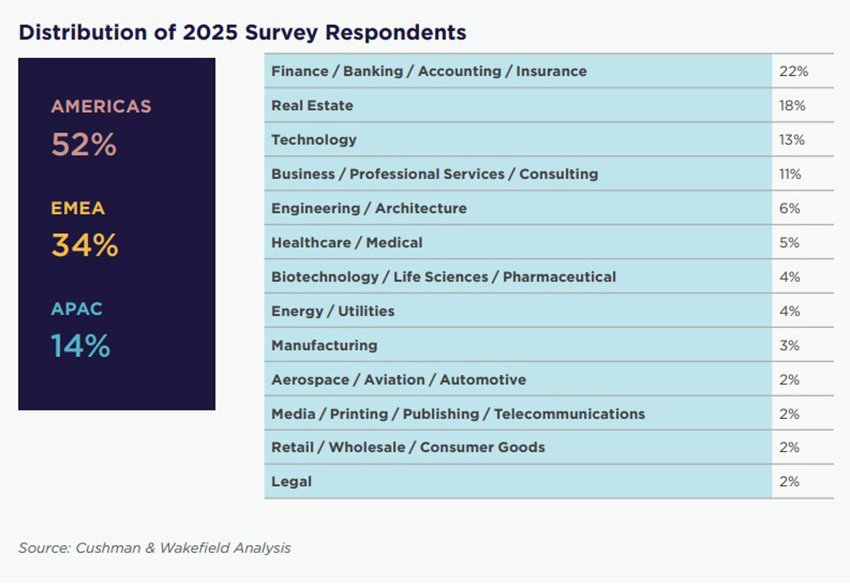

This biennial study tracks how workplace strategies and priorities evolve. What Occupiers Want 2025 reflects the views of 235+ corporate real estate (CRE) leaders across regions and industries. The surveyed companies manage ~340 million sq ft of office space and employ 8.1 million people worldwide. Respondents are concentrated in the Americas (52%), followed by Europe, the Middle East & Africa (34%), and Asia Pacific (14%). Finance, real estate, and technology form the largest industry groups.

Costs and Uncertainty

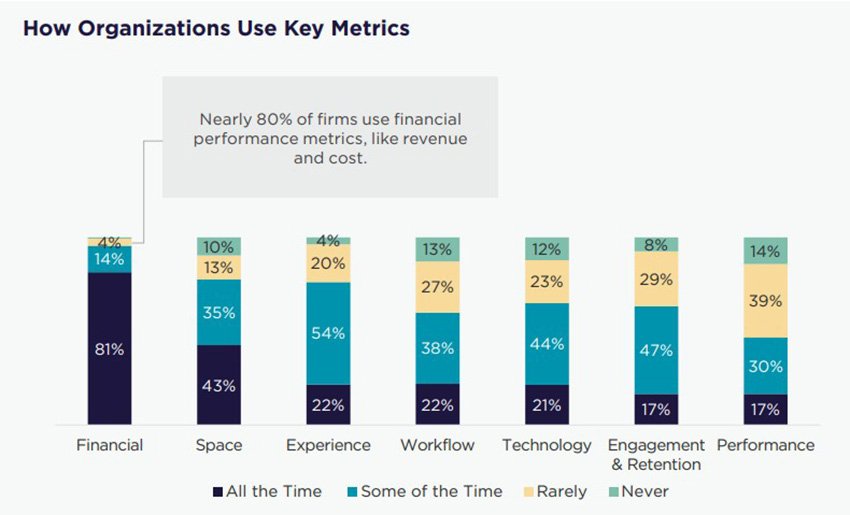

Financial control remains the main yardstick: 81% of companies track cost, returns, and space efficiency metrics continuously, and another 14% do so occasionally. By comparison, spatial metrics are used regularly by 43%, employee experience by 22%, technology by 21%, and engagement/retention by only 17%. Anything beyond direct financials is still viewed as secondary.

In the Americas, cost is also the primary driver, but business growth and M&A rank second, while talent acquisition and retention come third. In Asia, companies focus first on costs and people, followed by operational efficiency and growth. In Europe, the priorities flip: hiring and retention are most often cited as decisive; costs are second. The top five also include corporate brand and client relationships, highlighting a broader view of the office’s role.

Leaders point to uncertainty as the core challenge—from political and economic volatility to difficulty forecasting workplace scenarios. Many firms struggle to predict attendance and its impact on ROI. Shifting work habits—hybrid and remote—challenge the office’s traditional function. Against this backdrop, ESG slid to eighth globally, though it remains among the top priorities in Europe and Asia, often ranking first or second.

Operating Model Changes

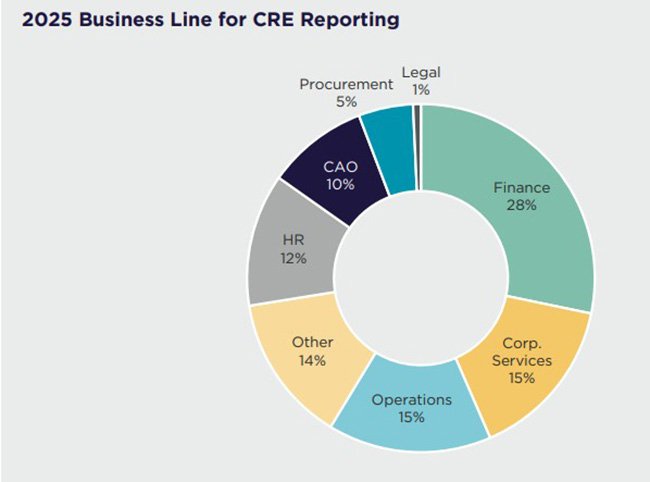

In 2025, 28% of CRE teams report into Finance. Another 15% sit in Corporate Services, 15% in Operations. 12% roll up to HR, and 10% to the CAO. The rest are spread across Procurement, Legal, and other functions.

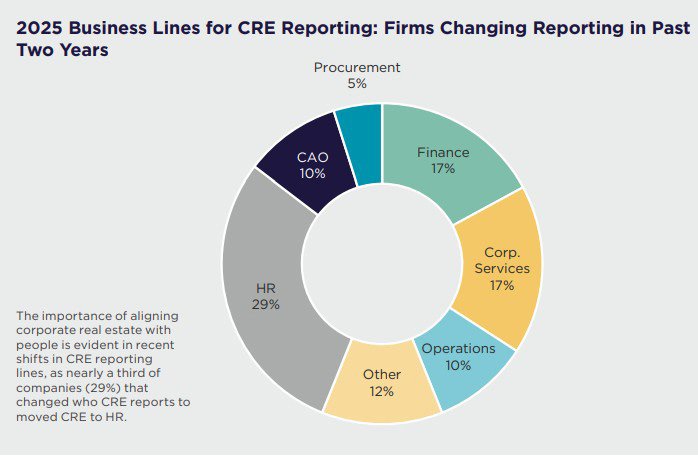

The structure has shifted notably over two years. Among companies that reorged reporting lines, almost 29% moved CRE under HR—a sign that offices are now tied not only to asset optimisation and costs but also to culture and people outcomes.

Different leadership layers keep their own emphasis: Finance and the C-suite demand strict cost control and utilisation; HR views the workplace as a tool for engagement and connection.

Flexible Hiring and the Rise in Tech Talent Demand

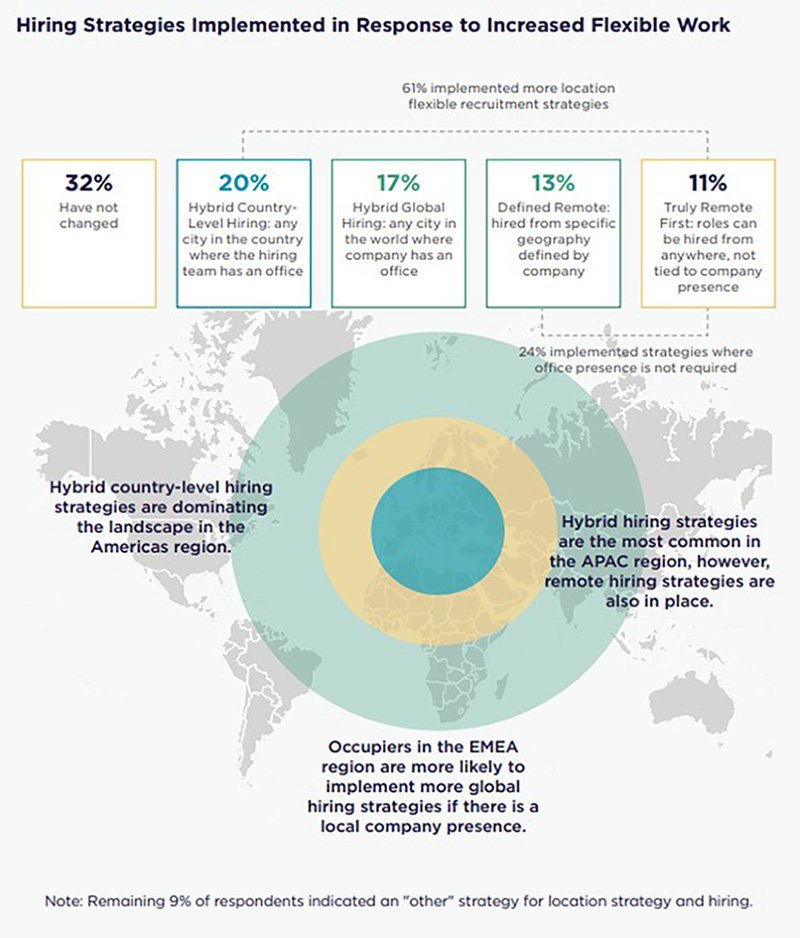

Companies increasingly use their office portfolios to attract talent. According to C&W, 61% of occupiers implemented geographically flexible hiring models; 32% made no changes. Key approaches:

20% hire in any city within the country where the firm has offices;

17% use a global model across countries of presence;

13% limit hiring to a specific region;

11% switched to fully remote hiring with no office ties.

In the Americas, country-wide hiring (any city with a company office) dominates. Europe leans toward global search within existing footprints. Asia favours hybrid models, and shows the fastest growth in fully remote roles.

Tech talent is centre-stage. Demand for IT specialists is steady in the Americas and Europe, and surging fastest in Asia (many firms report 25%+ growth). Financial and banking institutions are the prime driver—~80% of players reported expansion—followed by technology, consulting, and energy.

Stabilisation After the Rightsizing Wave

For two years companies reduced their office footprints; by 2025, 66% of occupiers had cut space. The trend is now easing: only 32% plan further cuts, while 13% intend to expand. Over this period, the average size of leased premises increased by 13%, signalling a shift from blunt optimisation to smarter portfolio management.

Utilisation is following a similar track. Globally, actual occupancy is 51–60%—below pre-COVID’s 65–75%, but well above pandemic lows. In Europe and Asia, 40%+ of companies report occupancy above 50%; in the Americas, only ~20% do.

Many companies now set minimum in-office days. Space planning is evolving: new zones, higher space efficiency, and purpose-built settings support stabilisation and define modern market practices.

New Requirements for Landlords

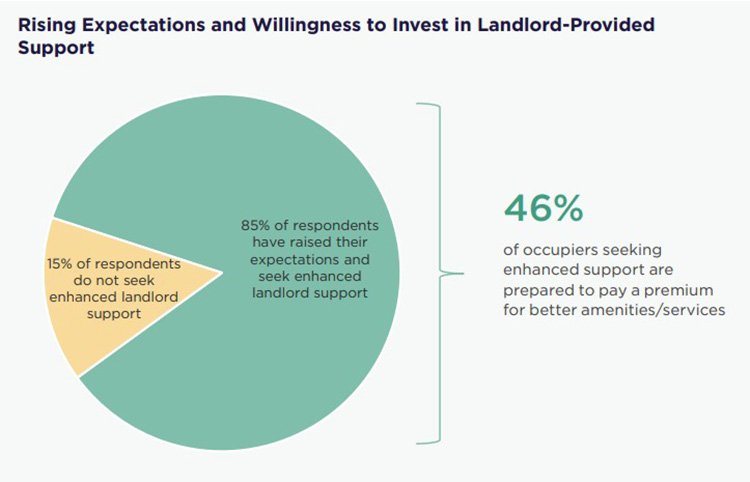

One of the clearest trends is the changing role of landlords. 85% of companies want modern, tech-enabled, community-friendly workplaces; nearly 46% are willing to pay more for them. Since 2019, the prime-office rental premium has risen by 1,150 bps, and now stands at ~98% versus standard buildings.

The office still performs critical functions—supporting collaboration, culture, and client relationships. Yet only 60% of employees feel their workplace truly enables these goals. The report stresses: the office retains value only when delivered as a service that justifies occupier investment. For owners, that’s a path to competitiveness and long-term asset value.

CRE at an Inflection Point

Cushman & Wakefield conclude that CRE is at an inflection point. Financial metrics still dominate, but current methods miss key business outcomes. Leaders must build systems that pair cost discipline with the impact of workplace on culture and performance—reframing real estate as a business-wide resource, not just a finance lever.

Подсказки: office, leasing, 2025, Cushman & Wakefield, CoreNet Global, CRE, costs, hybrid work, flexible hiring, amenities, technology, ESG, tenants, landlords, occupancy, workplace strategy, M&A, growth