read also

Spring Break shifts toward private luxury villas: trend changes

Spring Break shifts toward private luxury villas: trend changes

Albanian rents rise as investment returns fall

Albanian rents rise as investment returns fall

Italy Raises Flat Tax to €300,000

Italy Raises Flat Tax to €300,000

Storm Kristin Reprices Portugal Property Risk

Storm Kristin Reprices Portugal Property Risk

London Heathrow Airport: 228 Delays and 48 Flight Cancellations

London Heathrow Airport: 228 Delays and 48 Flight Cancellations

Batumi Housing Market: Prices Rose by 17% in 2025 — TBC Capital Report

Batumi Housing Market: Prices Rose by 17% in 2025 — TBC Capital Report

Вusiness / Real Estate / Investments / Analytics / Research / Czech Republic / Slovakia / Serbia / Romania / Hungary / Bulgaria 10.10.2025

Central & Eastern Europe: Investment Growth and Key Risks

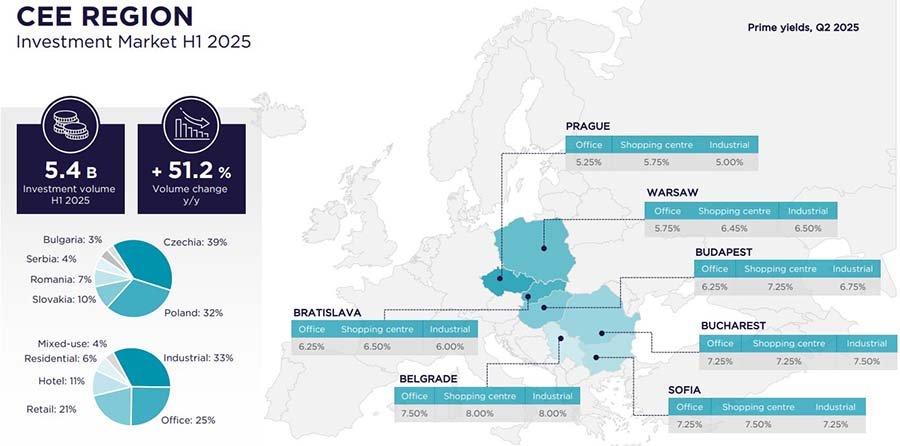

In the first half of 2025, investment in Central & Eastern Europe (CEE) commercial real estate rose 51% to €5.36 billion, Cushman & Wakefield experts note. The leaders are Czechia and Poland, while Slovakia’s record jump was driven by a few large one-off deals. Stronger domestic capital and growing interest in industrial assets are tempered by risks from inflation, limited prime supply, and geopolitical uncertainty.

Countries and Sectors

The bulk of H1 2025 capital was concentrated in three countries. Czechia led with €2.08 bn (39%) of all deals. Poland ranked second with €1.71 bn (32%). Slovakia reached €536 mn (10%) thanks to large industrial portfolios. Together, these three accounted for 80%+ of regional flows. The remaining four held less than one-fifth: Romania — €391 mn (7%), Hungary — €275 mn (5%), Serbia — €211 mn (4%), Bulgaria — €154 mn (3%). This mix underscores the region’s reliance on a few core economies.

Warehouse & Logistics

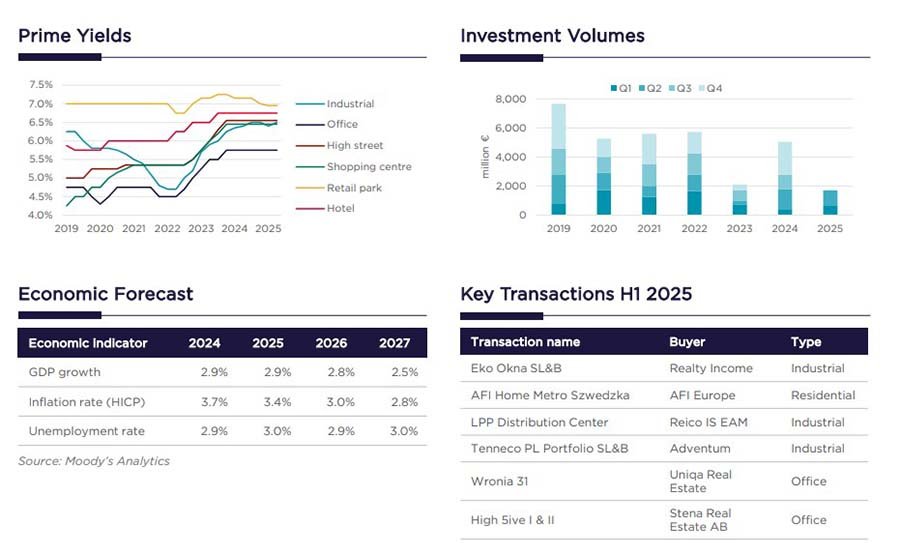

This sector led in H1 2025 with roughly one-third of all investment (€1.77 bn). In Slovakia, logistics/warehouse assets made up 58% of deals (€310 mn); in Poland — 41% (€700 mn); in Czechia — 28% (€580 mn).

Key transactions included Blackstone’s purchase of the Contera portfolio and a sale-and-leaseback of Eko-Okna for €253 mn with Realty Income.

Prime yields: 5.25–5.50% in Czechia & Poland; ~6% in Romania & Slovakia.

Outlook: Industrial should remain the most resilient segment, supported by e-commerce and global fund interest. However, volumes hinge on large portfolio deals; without them, totals may ease.

[quote]From housing to logistics: how Poland’s real estate market is evolving]

Offices

Offices retained the #2 spot with €1.34 bn (~25%). In Bulgaria, offices were 70% of investment (€108 mn) including Business Park Building 15 and Business Center Oskar. In Hungary, the share was 51% (€140 mn); in Serbia — 41% (€87 mn). Czechia saw €480 mn (23%), Poland €390 mn (23%). Notable deals: Wronia 31 and High 5ive I & II in Warsaw, and Visionary in Prague.

Prime yields: 5.5–6% in Prague & Warsaw; 6.5–7% in Bucharest & Bratislava.

Outlook: The key challenge is the large stock of outdated assets. Modern ESG-certified buildings with long leases should hold demand, while secondary stock faces obsolescence risk and capex needs, widening the market split.

[quote]Construction in Bulgaria accelerates: Burgas leads]

Retail

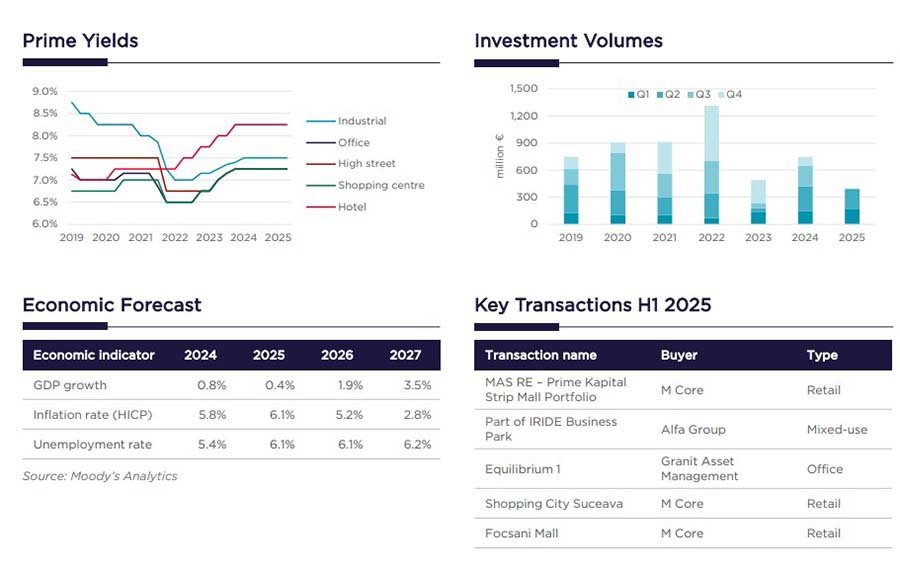

Retail captured about 21% of the regional market (€1.13 bn). In Romania, retail was 42% of national deals (€164 mn) including Shopping City Suceava and Focșani Mall. In Slovakia, retail reached 27% (€145 mn), led by the Tesco Galleries portfolio sale. In Czechia, volumes exceeded €450 mn (22%), largely due to Atrium Flora.

Prime yields: 6.5–7% in Czechia & Poland; 7.5–8% in Romania & Bulgaria.

Outlook: Headwinds stem from shifting consumer habits and costly financing. Investor interest will focus on retail parks and dominant urban centers. Smaller, dated formats will attract capital only with meaningful discounts.

[quote]Romania real estate outlook 2025]

Hotels

Hotels accounted for ~11% (€590 mn). Czechia dominated with €480 mn (nearly a quarter of its national total), including the Hilton Prague (~€300 mn) and Four Seasons acquisitions. Serbia recorded €45 mn (21%) with Falkensteiner Hotel & Danube BC; Hungary reached €28 mn (10%). Elsewhere, hotels remained niche with no large deals.

Prime yields: 5.75–6% in Czechia; 7–7.5% in Serbia & Bulgaria.

Prospects: Performance hinges on tourism. Czechia benefits from rising arrivals and global operators; Serbia & Hungary remain smaller-scale; Bulgaria is seasonal. Branded hotels with global systems and transparent HMA/franchise structures (base + incentive) look more defensive.

[quote]Housing prices in Czechia are rising at record pace]

Residential & Mixed-Use

Together, these accounted for ~10% of CEE investment (~€540 mn). Poland led residential with €290 mn (17% of national total); a key deal was AFI Home Metro Szwedzka. Czechia saw ~€60 mn (3%); Romania ~€10 mn (2%).

Mixed-use was notable in Czechia (€150 mn, 7%), Slovakia (€65 mn, 12%), and Serbia (€38 mn, 18%). These schemes blend residential, offices, retail and hotels, diversifying income and reducing single-use risk.

Prime yields: Residential 4.5–5% in Czechia & Poland. Mixed-use 5–5.25% in Czechia & Slovakia; ~6% in Serbia.

Outlook: PRS/Build-to-Rent and mixed-use should stay relatively resilient, especially in Poland, but limited prime supply and high borrowing costs will cap growth elsewhere.

[quote]Serbia

pledges to legalize informal housing]

Macro Backdrop

In H1 2025, CEE economies saw slower business activity: modest growth, inflation above targets, and expensive credit constrained demand.

Czechia — GDP +1.7%, inflation ~3.5%, policy rate ~5%; year-end GDP seen ~2.2%, inflation ~3%; even at ~4.5% rates, financing remains a hurdle.

Poland — GDP +2.3%, inflation ~4.1%, rate 5.75%; year-end GDP ~2.8%, inflation ~3.5%; conditions improve but debt costs still bite.

Slovakia — GDP +1.9%, inflation ~3.8%, rate ~6%; by year-end ~2.3% growth, slightly lower inflation; high financing costs remain the key constraint.

Romania — GDP +3.2%, inflation ~5.6%; H2 growth >3% with inflation easing toward 5%; attractive but price pressures persist.

Bulgaria — GDP +2.8%, inflation ~4.5%; year-end growth >3% with further disinflation; still too expensive for large leveraged plays.

On the one hand, H2 2025 should bring faster growth and lower inflation, improving sentiment. On the other, costly credit and cautious banks keep liquidity tight and the market selective: capital targets prime, income-secure assets, while secondary stock faces pressure. Expect quality-led resilience and yield spread to define activity into H2 2025.

Подсказки: CEE, investment, commercial real estate, industrial, logistics, offices, retail, hotels, residential, mixed-use, yields, Czechia, Poland, Slovakia, Romania, Bulgaria, Serbia, macro, inflation, financing, geopolitics