read also

Storm Kristin Reprices Portugal Property Risk

Storm Kristin Reprices Portugal Property Risk

London Heathrow Airport: 228 Delays and 48 Flight Cancellations

London Heathrow Airport: 228 Delays and 48 Flight Cancellations

Batumi Housing Market: Prices Rose by 17% in 2025 — TBC Capital Report

Batumi Housing Market: Prices Rose by 17% in 2025 — TBC Capital Report

Spain’s Property Market Tops 700,000 Home Sales in 2025

Spain’s Property Market Tops 700,000 Home Sales in 2025

Corruption Perception Deteriorates Across Southeast Europe

Corruption Perception Deteriorates Across Southeast Europe

EU Plans Schengen Visas Beyond Five Years

EU Plans Schengen Visas Beyond Five Years

US Real Estate Investment: Housing, Industrial and Retail Lead

The United States remains one of the key destinations for global capital. Colliers analysts note that investment volumes in the real estate sector are set to keep growing. Investors are taking advantage of opportunities created by more attractive pricing and improving fundamentals across the core asset classes. At the same time, risks remain, linked to a possible economic slowdown and the geopolitical environment.

Rising Activity

Market conditions in the US are gradually aligning in favour of further strengthening of investment dynamics. There are still hundreds of billions of dollars in dry powder waiting to be deployed. Over the first nine months of 2025, the market attracted $66.2 billion in capital — more than in all of 2024 ($65.5 billion). David Amsterdam, President of Capital Markets, notes that investors see greater relative value in debt financing than in equity. In the coming months, capital flows are expected to intensify particularly in this direction.

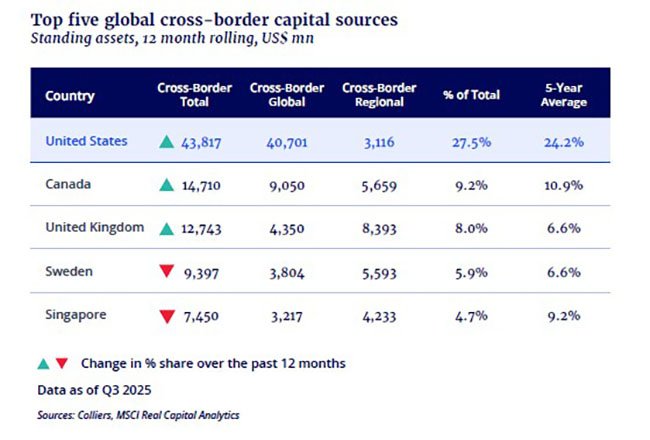

The US is the largest single source of cross-border capital. Over the past twelve months, such investment reached $43.8 billion, of which $40.7 billion came from global deals and $3.1 billion from regional ones. The country accounts for 27.5% of total global cross-border volumes, significantly above the five-year average of 24.2%. Institutional investors, including NBIM, GIC, EQT and Brookfield, are ramping up activity in various segments, including offices. Although foreign inflows have remained selective in recent quarters, renewed international capital would accelerate deal volume and support further market recovery.

Sources of Capital and Market Strategies

Some players continue to work in partnership with pension funds, investment managers and family offices, but the most intense activity is currently seen in the private capital segment. Institutional investors and REITs are returning to the market gradually, helping to rebuild liquidity, especially for larger transactions.

Higher overall activity is allowing long-term investors to acquire assets below replacement cost — a typical feature of the early recovery phase. Liquidity in the multifamily and industrial sectors remains solid and is already above pre-crisis levels. At the same time, total deal volume has not yet returned to the highs of late 2020–early 2022.

The commercial mortgage-backed securities (CMBS) market is posting record results. Strong issuance, steady demand and sufficient liquidity are supporting transactions in excess of $1 billion, as well as deals involving high-quality office properties. Deal structures are also evolving: instead of the classic ten-year terms, investors are increasingly using five-year maturities, reflecting expectations of future benchmark rate cuts.

Priority Segments

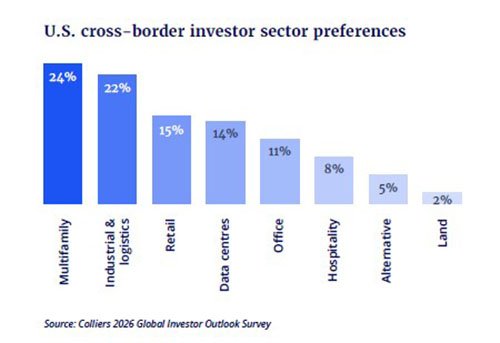

Investors continue to focus on multifamily and industrial-logistics real estate, which account for 24% and 22% of total allocations respectively. They are followed by retail assets (15%), data centres (14%), offices (11%), hotel properties (8%), alternative assets (5%) and land (2%).

The multifamily sector is entering a new phase: development pipelines are constrained while demand remains robust. David Goodhew, Executive Managing Director in Boston, notes that this combination is opening up fresh opportunities for investors across the country.

In the industrial and logistics sector, easing supply pressure is laying the foundation for stronger performance in the coming years. On a number of markets, rental corrections are limiting the previously widespread strategy of systematically repricing leases to current market levels.

Capital is shifting toward the southern US states, where both asset classes benefit from slower new supply. This supports key fundamentals and underpins further rental growth. Core central markets remain in favour and continue to attract investors; as the fundamentals improve, rental growth is likely to accelerate.

Offices, Retail and Hotels

The office sector is beginning a gradual recovery. Transaction volumes are picking up as investors increasingly believe that the most challenging phase of the cycle has passed. Fundamentals are stabilising: Manhattan and San Francisco are showing a noticeable rebound in business demand. However, vacancy remains elevated, and many deals require significant additional capital expenditure to reposition and re-lease properties.

In the retail segment, operators have strengthened their positions by combining online and offline channels. Low levels of new construction support healthy fundamentals and create room for rental growth. At the same time, retail remains highly sensitive to consumer sentiment: a weakening in the broader economy or labour market can quickly depress sales. Outcomes are expected to vary significantly by brand, format and location.

Hotel real estate is benefiting from limited new supply. Investors with strong operating capabilities are delivering outperformance. However, rising costs and labour shortages are weighing on margins, while softer international tourism is putting pressure on occupancy in some markets.

Data Centres and Life Sciences

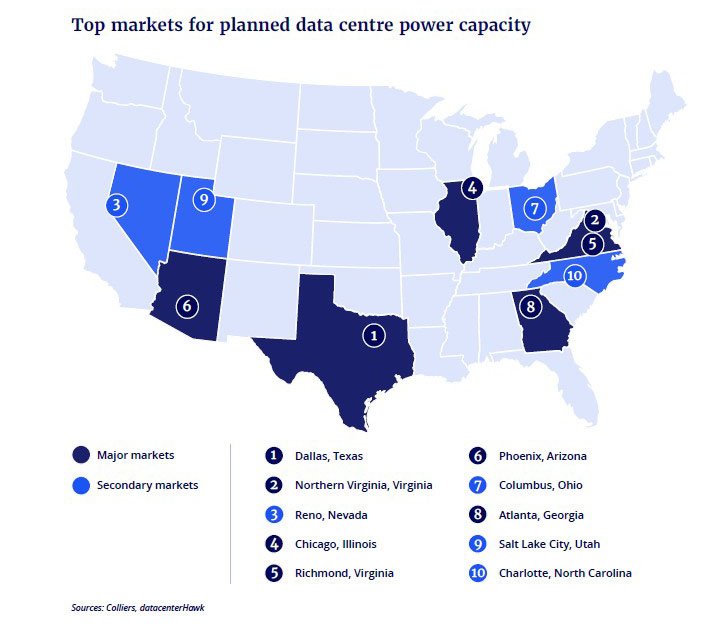

Demand for data centres is growing rapidly, with individual deal sizes hitting record levels. The geography of the sector is expanding beyond the largest hubs to include secondary and even tertiary markets. At the same time, barriers to entry remain high: the cost of new projects often exceeds $1 billion. Access to power capacity has become the key constraint on further development. Investors are actively acquiring sites, securing grid connections and raising capital at historically elevated levels. Competition from real estate and infrastructure funds is intensifying, and specialist expertise is increasingly critical for building sustainable platforms.

In the life sciences and biotech segment, new development is slowing, which is helping stabilise the market. Recovery is likely to begin on the strongest established campuses. At the same time, regulatory changes and shifts in funding structures are putting pressure on demand and lengthening decision-making cycles.

Outlook for 2026

In 2026, investors are expected to focus on several key themes. In the office market, early movers will be able to take advantage of more attractive pricing for assets in major cities with resilient tenant demand. Slower construction will create additional income opportunities in the multifamily and industrial sectors. Secondary markets will remain important entry points for data-centre strategies.

A sharp economic slowdown could increase stress in segments where pressure is already visible. Investment in artificial intelligence and data-centre infrastructure will continue to support US GDP growth and further strengthen the link between technological development and real estate performance. Labour market trends and consumer confidence will be critical indicators: any deterioration could cap rental growth in both residential and retail segments.

A cyclical downturn remains the most likely factor that could prevent a broader market recovery next year. Additional risks are linked to geopolitical tensions, potential policy shifts, conflicts and elevated uncertainty.

Подсказки: US real estate, investment, multifamily, industrial, logistics, retail, data centres, offices, hotels, Colliers