read also

Georgia / Tourism Georgia / Israel / Tourism Israel / Tourism & hospitality / Analytics / Research 10.05.2025

Israel and India are competing for Georgia as a top destination for their tourism

In 2024, Georgia achieved record figures in the tourism sector, welcoming around 7.4 million international travelers, of which 5.1 million were tourists. Tourism revenues reached $4.4 billion, which is a 7.3% increase compared to 2023, according to Interfax.

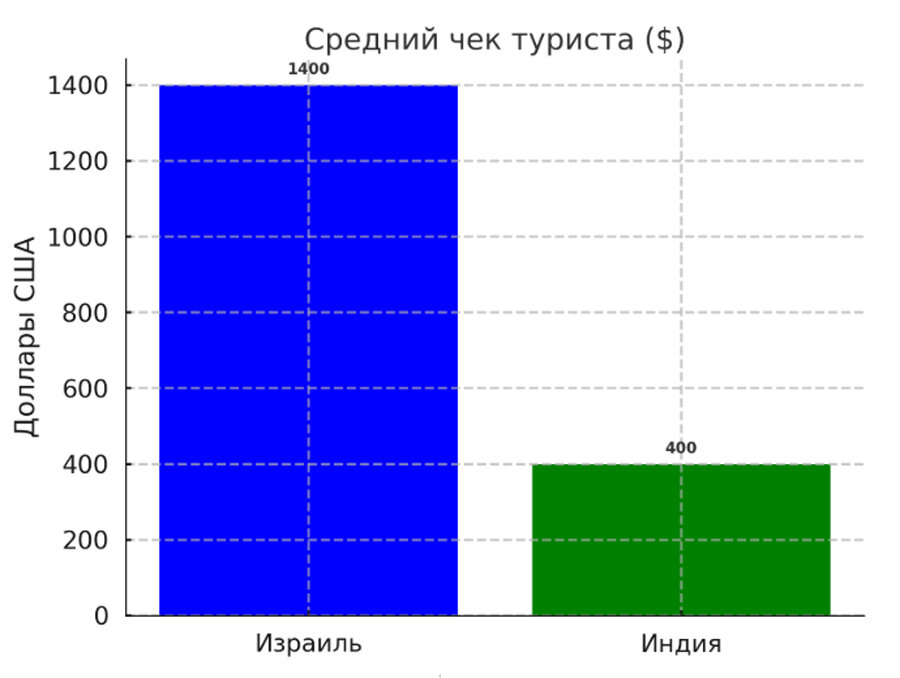

Two strategic upward trends are Israel and India. In 2024, Georgia was visited by 310,982 Israeli tourists, which is 43.3% more compared to the previous year. Revenues from Israeli tourists amounted to $128.3 million. Indian tourists also showed significant growth, increasing by 46.8% to 124,335 people in 2024.

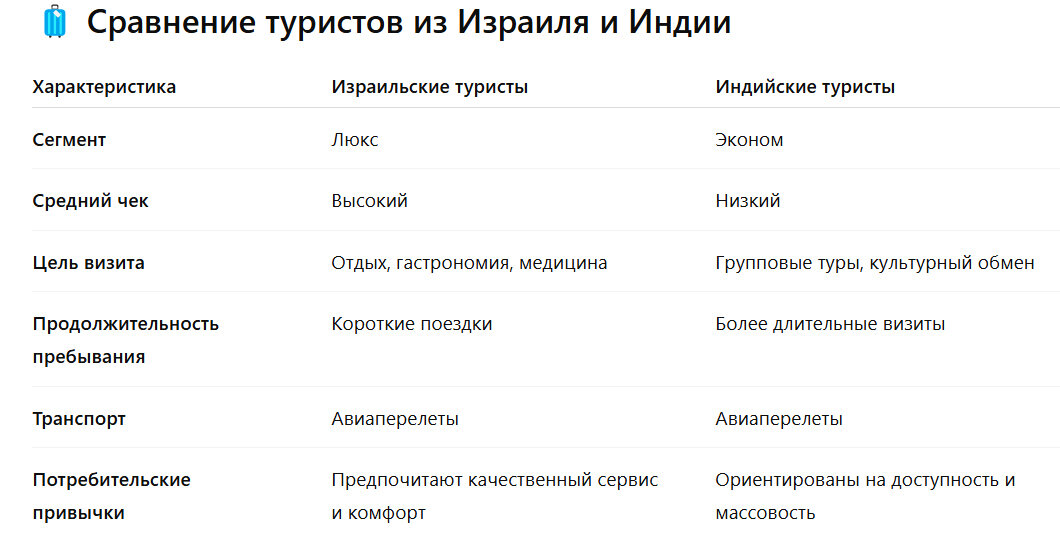

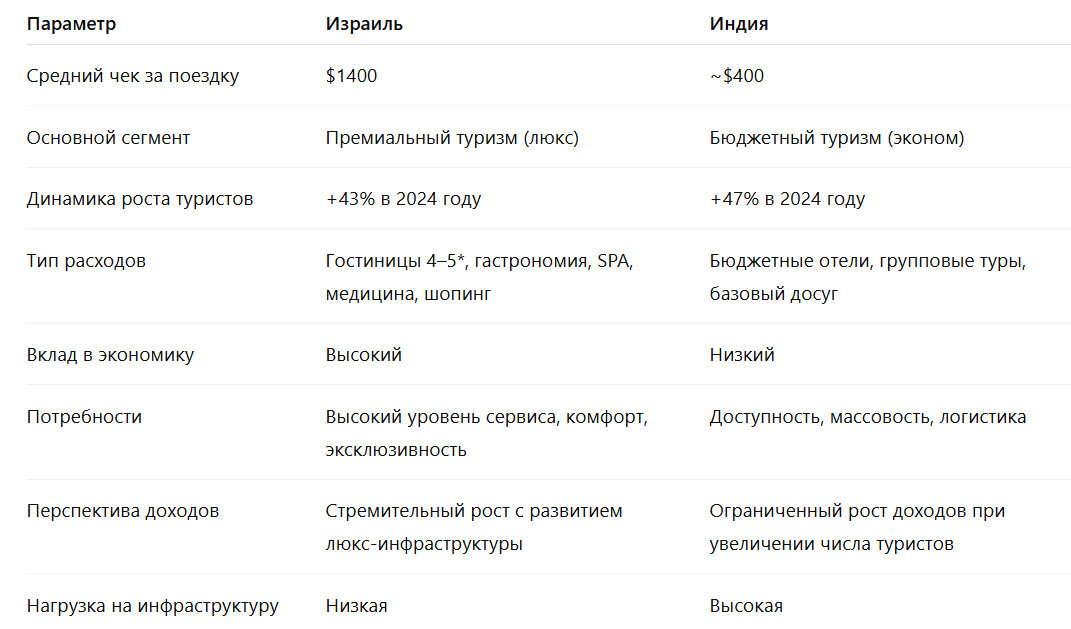

Israeli tourists contribute significantly more to Georgia’s economy per visitor than tourists from India. In 2024, each Israeli tourist spent around $1,400 on average in Georgia. This is without a developed luxury tourism infrastructure, which is only beginning to form in the country. Georgia is already building new high-class hotels, developing spa, fine dining, golf, gastro tours, and rebranding resorts to meet international standards. All of this targets premium demand, primarily from high-income countries including Israel, the UAE, Saudi Arabia, and EU nations.

Indian tourists, despite the impressive increase in visits, represent the budget segment with a low average spend. They contribute significantly less to the tourism industry than even much smaller flows from wealthy countries. Such tourists often save on accommodation, avoid paid tours or services, and frequently travel in budget-organized groups. Their economic contribution is limited—especially when considering infrastructure wear and strain on resources, according to experts at "Business Zone" https://bizzone.info/tourism/2025/1737054057.php.

Comparison of Tourism Potential for Georgia

Israel

– High average spend

– Premium segment

– Strong GDP contribution

– Low infrastructure load

India

– Low average spend

– Mass budget segment

– Small GDP contribution

– High infrastructure load

Outlook for Georgian Tourism and Economy

Market diversification:

The growth of tourism from Israel and India helps reduce dependence on declining traditional markets like Russia and Ukraine.

Revenue increase:

Attracting high-spending tourists, especially from Israel, contributes to increased tourism income.

Infrastructure development:

There is a need to adapt tourist infrastructure to accommodate different tourist segments, including both budget and luxury.

Thus, from a macroeconomic and fiscal perspective, it is more beneficial for Georgia to receive and serve one tourist from Israel than several from India, according to experts at International Private Investment. This is especially relevant given the limited infrastructure and workforce resources. An increase in high-budget tourists will allow tourism to generate more income with less strain on transport, the environment, and urban services.

See also: Overseas Real Estate: Tbilisi Surpasses European Capitals in Housing Affordability and Profitability

Experts recommend to Georgian authorities:

Marketing

Strengthen promotion of Georgia in target high-spending markets, considering cultural specifics.

Infrastructure

Invest in the development of premium tourism infrastructure, including transportation, hotels, and services that meet higher standards.

Logistics

Encourage direct flights and promotional campaigns in high-income countries.

Education

Train tourism staff to ensure a high level of service.

Regulation

Regulate mass budget tourism so that it does not hinder the formation of a quality tourism product.

Taxation

Develop taxation and accounting in the short-term rental and mass tour sectors to prevent revenues from cheap tourism from going unrecorded.

For tourism market operators:

Products and services

Develop tours and services that meet the expectations of more demanding tourist groups.

Partnerships

Establish cooperation with tour operators in Israel to attract tourists.

Service quality

Ensure a high level of service to meet the needs of tourists from different countries.

Considering current trends, Georgia has the potential for further growth in the tourism sector, especially through effective adaptation to the needs of new tourist segments.

Meanwhile

Georgia is seeing a decline in inbound traffic from traditional directions.

Russia:

According to Jnews, although Russia remains the leader in tourist numbers (1,421,923 in 2024), growth was only 0.2%.

Ukraine:

The number of Ukrainian tourists decreased by 19.3% to 118,528.

These markets, along with Turkey, are budget-oriented. The emerging gap is now being filled by tourists from Israel and India, who are competing for Georgia as a top destination. This competition defines two opposing trends in the country's tourism sector. Leading market players are developing Georgia as a global elite resort, while a dead-end "wild market" still seeks to maintain the momentary, low-budget but massive tourist flow.