Mortgage Rates Continue to Rise in the U.S.

picryl.com

The average rate for a 30-year fixed mortgage increased from 6.72% to 6.85% in December 2024, reports Bloomberg, citing Freddie Mac. This marks the highest level since July, yet the volume of real estate transactions also grew. Experts forecast continued trends in rising activity in the real estate market through 2025.

Rising Demand Despite Financial Challenges

Despite financial hurdles, some buyers are still closing deals. According to Redfin Corp., the number of home purchase agreements rose by 4.1% year-over-year for the four weeks ending December 15. Additionally, new listings increased by 7.6%. Experts attribute this trend to improved consumer confidence following the November elections. The growth in listings is also driven by rising home prices (+6%), which reached levels last seen in October 2022. Sellers are eager to capitalize on buyer demand.

Month-over-month, mortgage applications increased by 18%, according to Redfin Corp. Buyers are reportedly feeling more confident making significant financial commitments after a summer and autumn slowdown. Another factor encouraging purchases was a temporary drop in mortgage rates to a two-month low of 6.6%. However, rates have since rebounded to nearly 7%.

David Palmer, a Redfin Premier agent in Seattle, noted that last winter was quiet, while this one has seen much more activity, with several properties ready for sale right after New Year’s. “Buyers are entering the market because they’ve come to terms with rates in the 6%-7% range as the new normal. They also know that waiting could mean mortgage rates stay the same, but home prices will rise,” he explained.

Growth in New Home Sales

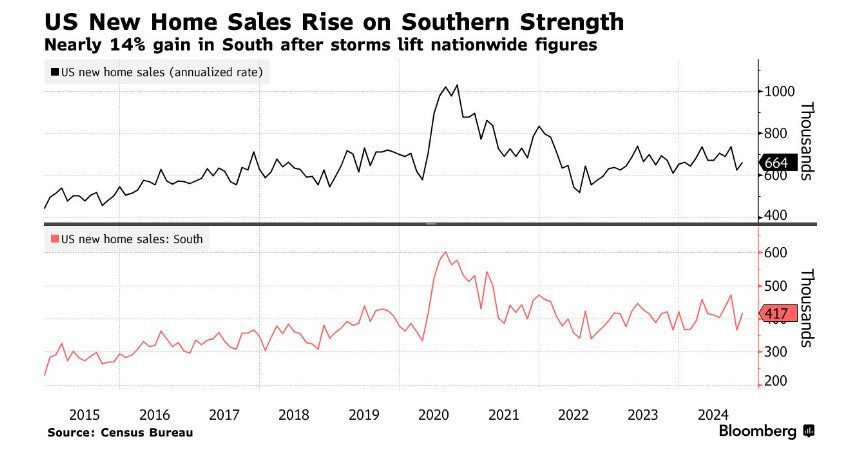

The market for new single-family homes expanded in November by 5.9% to 664,000 units, the highest level of inventory since late 2007, according to government data. Builders and buyers finalized deals that had been delayed due to storms in the southern U.S. Increased sales were also supported by significant discounts and a 6.3% year-over-year decrease in the average selling price, which fell to $402,600.

Developers are optimistic that Donald Trump will reduce bureaucracy and simplify construction processes. However, Wall Street is losing interest in the sector, fearing that developers’ efforts to stimulate sales are cutting into their profits. Additionally, high borrowing costs remain a concern. After hitting an all-time high in mid-October, shares of the iShares US Home Construction ETF have since dropped by 20%.

New home sales are considered a more immediate indicator than sales of previously owned homes, which are recorded at contract closings. However, government data on new home sales is volatile, with a 90% confidence interval estimating the change in sales to range between 12.7% and 24.5%.

Challenges and Hope for 2025

Freddie Mac’s Chief Economist Sam Khater emphasized that despite modest improvements in new and existing home sales, the market continues to face a significant housing shortage. He expressed hope that the strong economy could boost activity in the coming year and potentially increase buyer participation.

In December, the Federal Reserve lowered its benchmark interest rate for the third time, and further reductions are expected in 2025. However, economists warn that rate cuts will likely proceed at a slower pace to ensure sustained progress against inflation. Uncertainty remains about whether the incoming U.S. President, taking office on January 20, will implement higher tariffs, which could significantly impact the economy.

Outlook for the Real Estate Market

In 2025, experts predict lower mortgage rates and increased inventory due to heightened activity from builders and sellers. At the same time, home prices are expected to continue rising. This combination of easing rates and growing supply may support a more balanced and active housing market in the year ahead.