Global Investment Outlook for 2025

Oliver Salmon, Director of Savills World Research, believes real estate investors can anticipate better times ahead as cyclical challenges subside. Markets are expected to recover, with increased investment activity and capital values projected for 2025, according to Savills.

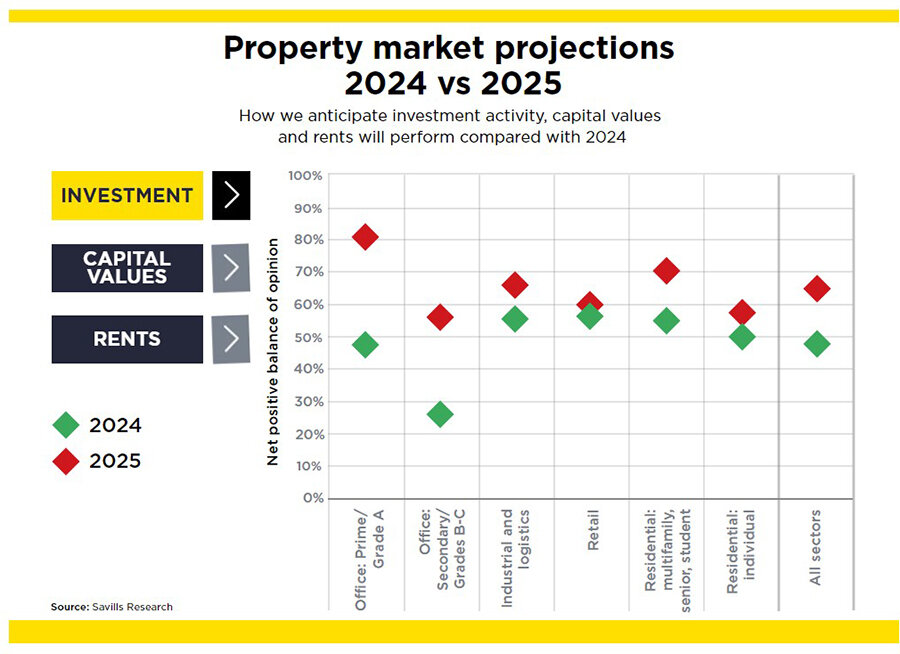

Following several sobering years, the tides are shifting, Savills’ research indicates. Cyclical factors that have impacted real estate values and investment activity are easing, paving the way for a budding recovery that should gain momentum in 2025. Nearly three-quarters of respondents to Savills’ annual survey across various markets and sectors foresee improvements in investment activity, with a similar proportion expecting capital values to rebound.

After years of divergence between occupational and investment markets, 2025 is expected to realign fundamentals, with capital market trends reflecting occupational market drivers like demand and rental growth.

Mature economies, previously dominated by rising interest rates that suppressed commercial property prices irrespective of market fundamentals, are poised for stronger recovery. Sustained demand and rental stability, particularly for prime assets, signal a more favorable trajectory as global interest rates stabilize.

Conversely, in emerging markets such as India, robust economic growth and significant catch-up potential will continue to attract investors. However, structural challenges in Hong Kong and mainland China, combined with oversupply in key real estate sectors, are likely to temper activity in 2025.

Prime Office Markets

Savills experts are most optimistic about prime office spaces, which have exceeded post-pandemic expectations due to tenant preference for high-quality properties. Supply constraints in many global cities are expected to drive rental and investment growth before new developments can meet demand.

Secondary office markets also show promise. The significant revaluation of assets has created opportunities for value-add investors and alternative uses. Opportunistic buyers may target heavily discounted properties in distressed markets.

Residential, Industrial, and Logistics Sectors

Demand for residential, industrial, and logistics properties remains robust despite potential market normalization. Housing affordability issues in some markets are slowing rent growth, but fundamental drivers remain strong. Structural trends, including demographic shifts, technological advancements, and economic fragmentation, will sustain long-term demand in these sectors.

Industrial and logistics assets, critical to core investment strategies, are set to be priorities across many markets. Developers targeting supply-constrained markets could find significant opportunities.

In retail, selective investment is expected, with investors gravitating toward diverse, high-risk, high-reward segments. Alternative real estate sectors, such as data centers, are gaining traction, particularly as artificial intelligence (AI) advances.

Key Macroeconomic Drivers

More favorable economic conditions will support market activity in 2025, notes Paul Tostevin, Savills’ Director of World Research. Demographic, environmental, and technological factors will simultaneously pose challenges and create opportunities.

The economic stability anticipated in 2025—five years after the onset of COVID-19—marks a turning point. Reduced fears of a global recession, combined with declining inflation, rising wages, and robust employment, are set to drive household incomes and consumer spending. Improved financial conditions and lower interest rates in many regions will bolster global equity markets, indirectly supporting real estate recovery.

Regional Highlights

Georgia: The Georgian real estate market is projected to grow at an average annual rate of 5.69% until 2029, per Statista. Georgia's favorable investment climate and booming tourism industry are driving demand. Batumi, in particular, recorded a 49% year-over-year increase in primary housing transactions.

Global Investment Growth: Savills forecasts global real estate investment turnover to rise by 27% in 2025, reaching $952 billion. By 2026, it is expected to surpass $1 trillion for the first time since 2022.

Sectoral and Structural Trends

Housing and Workforce Demand

Urban migration is fueling residential demand, while aging populations in Western countries create opportunities for senior living and healthcare facilities.

Environmental Considerations

Decarbonization remains a priority, with ESG (Environmental, Social, and Governance) factors increasingly influencing investment decisions. Climate risks, highlighted by extreme weather events in 2024, are pushing sustainability to the forefront.

Technological Integration

Technology is reshaping real estate operations, from data centers to AI-driven management systems. Its role in enhancing tenant satisfaction, environmental outcomes, and profitability will expand.

Legislative Factors

Governments aiming to address housing affordability through rent control must balance tenant protections with incentivizing new development.

Geopolitical Influences

Geopolitical tensions, particularly in the Middle East, will impact oil prices and investor sentiment. Changes in global trade policies, especially under a potential Trump administration, could alter supply chains and real estate dynamics.

The global real estate market is poised for a recovery in 2025, driven by stabilizing economic conditions, structural demand, and declining interest rates. While challenges persist, particularly in regions like China and Hong Kong, opportunities abound in core and emerging markets. By aligning strategies with technological advancements, ESG priorities, and demographic trends, investors can navigate the complexities of 2025 to achieve sustainable growth.