Australia’s Property Market and Stock Performance in 2024: A Comprehensive Analysis

CoreLogic economist Caitlin Ezzy reported that, including capital growth and dividend income, the Australian stock market grew by 11.4% in 2024, outpacing the property sector, which grew by 8.3% compared to 2023. While equities took the lead, real estate remains the cornerstone of Australian wealth.

The total value of residential real estate in Australia is estimated at $11.1 trillion, far exceeding the combined value of Australian superannuation funds ($4.1 trillion) and the Australian Securities Exchange ($3.3 trillion). However, according to CoreLogic data, the property market delivered its weakest performance in years during 2024.

Sales and Rental Trends

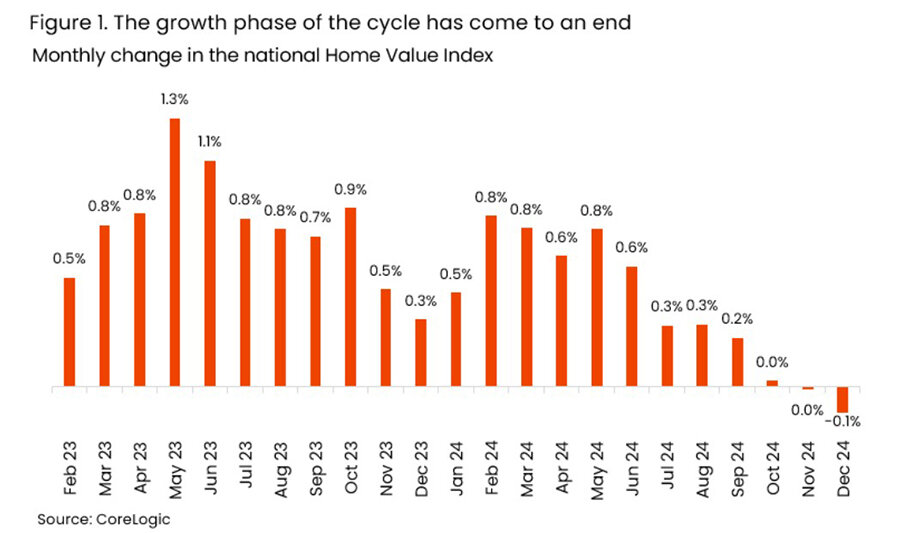

After 21 months of continuous growth, during which housing values increased by 14.3%, the CoreLogic Home Value Index (HVI) recorded a decline. Following its peak in October, the index stabilized in November (-0.01%) and declined by -0.1% in December. The cyclical slowdown is unsurprising, as the monthly growth rate in housing values had been decelerating since June 2024.

In December, 33,676 units were sold, bringing the annual total to 531,573 units. Despite an 8.3% annual growth in sales activity, December sales dropped by 1% compared to Q4 2023 and by 6.2% relative to the five-year average. The average time on market increased to 33 days for the three months ending in December, up from 28 days for most of 2024. Although selling conditions shifted in favor of buyers, the average vendor discount rate slightly narrowed to -3.6% in Q4 2024, compared to -3.8% in the same period of 2023.

The overall rental yield from housing, incorporating both capital growth and rental income, fell short of expectations. “Despite some resilience in the first half of the year, housing value growth slowed in the longer term due to stock accumulation and higher interest rates,” Caitlin Ezzy explained. “Similarly, normalized net overseas migration and increased household sizes contributed to a deceleration in rental price growth throughout the year.”

As a result, housing delivered a total return of 8.3% for the calendar year 2024, down from 13.5% in 2023 and trailing the 11.4% return from the Australian stock market. Over the last decade, housing outperformed stocks in six out of ten years, achieving a cumulative return of 132.6%, compared to 126.4% for equities.

The national rental index rose by 4.8% year-on-year as of December, a sharp decline from 8.1% growth in 2023 and 9.5% in 2022. CoreLogic attributes this slowdown to normalized migration, larger household sizes, and affordability challenges pushing renters to consolidate living arrangements or delay moving out of family homes.

Broad Market Trends

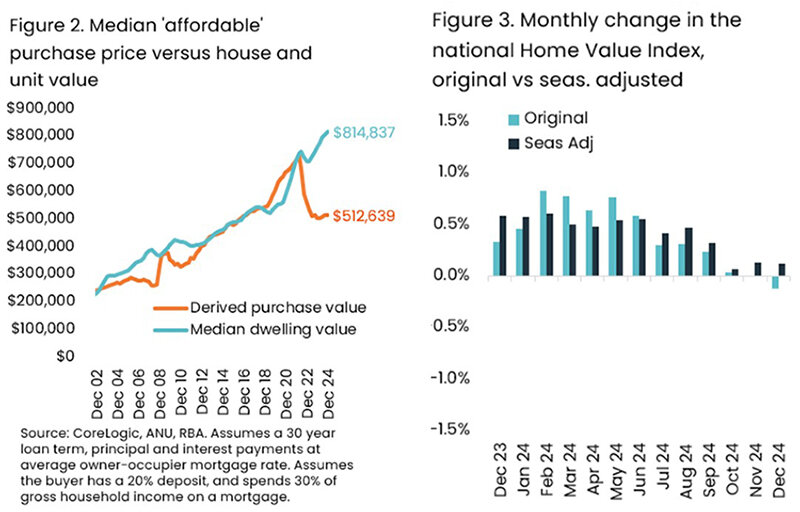

According to CoreLogic Head of Research Eliza Owen, demand for housing declined due to a growing gap between incomes, borrowing capacity, and housing costs. This has been exacerbated by slowing economic growth and “higher and more prolonged” interest rates.

In December, 33,676 units were sold, bringing the annual total to 531,573 units. Despite an 8.3% annual growth in sales activity, December sales dropped by 1% compared to Q4 2023 and by 6.2% relative to the five-year average. The average time on market increased to 33 days for the three months ending in December, up from 28 days for most of 2024. Although selling conditions shifted in favor of buyers, the average vendor discount rate slightly narrowed to -3.6% in Q4 2024, compared to -3.8% in the same period of 2023.

The overall rental yield from housing, incorporating both capital growth and rental income, fell short of expectations. “Despite some resilience in the first half of the year, housing value growth slowed in the longer term due to stock accumulation and higher interest rates,” Caitlin Ezzy explained. “Similarly, normalized net overseas migration and increased household sizes contributed to a deceleration in rental price growth throughout the year.”

As a result, housing delivered a total return of 8.3% for the calendar year 2024, down from 13.5% in 2023 and trailing the 11.4% return from the Australian stock market. Over the last decade, housing outperformed stocks in six out of ten years, achieving a cumulative return of 132.6%, compared to 126.4% for equities.

The national rental index rose by 4.8% year-on-year as of December, a sharp decline from 8.1% growth in 2023 and 9.5% in 2022. CoreLogic attributes this slowdown to normalized migration, larger household sizes, and affordability challenges pushing renters to consolidate living arrangements or delay moving out of family homes.

For nearly two years, this gap has been sustained by buyers less affected by rising interest rates, such as those relying on resale profits or higher incomes. However, expectations of falling rates, which did not materialize, may have weakened demand from these groups.

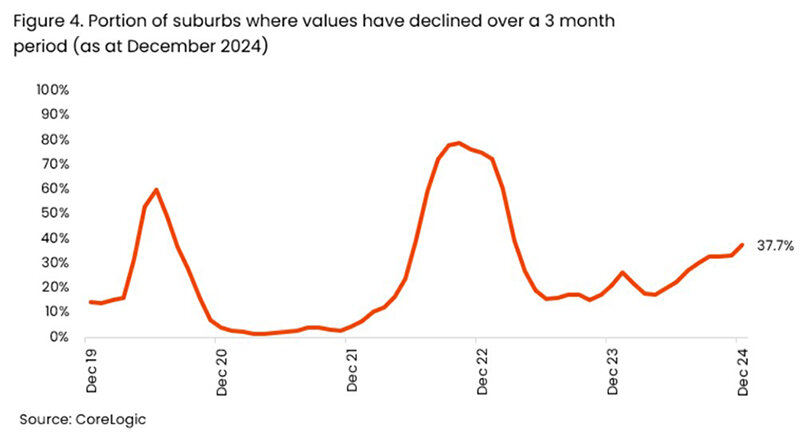

The first notable decline in housing prices coincided with the seasonal slowdown in real estate activity, typically marked by weaker price changes. Adjusted for seasonality, the HVI rose by 0.1% in December, with only five out of 15 Australian capitals and regional markets experiencing declines. Melbourne led the drops with a -0.7% decline, followed by Sydney (-0.6%), Canberra and Hobart (-0.5%), and Victoria (-0.3%). Other regions showed increases ranging from 0.03% in New South Wales to 1.2% in South Wales.

Projections for 2025

A cyclical downturn is expected in 2025, but it may be less pronounced than in previous periods. This is partly due to sellers holding off listings until prices recover, effectively limiting supply during downturns. Forced sales are also unlikely, as the labor market remains tight and most borrowers appear to be managing current interest rates.

Additional support for demand in 2025 may come from improved real income growth as inflation eases, as well as increased borrowing capacity due to potential rate cuts. Underlying these economic factors is a persistent housing shortage relative to population growth and declining construction activity due to limited capacity in the building sector.

Given these dynamics, any decline in housing prices is expected to be moderate and short-lived. However, significant growth is unlikely until affordability and borrowing conditions improve more substantially. Rental growth is also projected to slow further in 2025.