read also

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Israel Housing Market Eyes a Reset in 2026

Israel Housing Market Eyes a Reset in 2026

Real Estate Investment Declines in Southeast Europe in 2025

Real Estate Investment Declines in Southeast Europe in 2025

Asia Becomes the Engine of Global Aviation

Asia Becomes the Engine of Global Aviation

Real Estate / Investments / Analytics / Research / Georgia / Real Estate Georgia / News / Reviews 24.01.2025

Georgia’s Real Estate Market: 2024 Overview

The real estate market in Georgia continues to grow, with new developments in Tbilisi and Batumi leading the way. These properties are often sold out during the construction phase, reflecting strong demand. By the end of 2024, the market volume increased once again, solidifying Georgia’s position as a leader in yield potential and offering simple, transparent transaction conditions that surpass those of many other countries.

Tbilisi

According to Colliers Georgia, the number of apartment transactions in Tbilisi grew by 2% in 2024 compared to 2023, reaching 41,284 deals. Market volume rose by 12%, amounting to $2.8 billion. Contracts in new developments increased by 8.5%, while the secondary market saw lower activity, although the average weighted price increased by 13% in suburban areas and 15% in the city center.

In December alone, 4,039 property sales were recorded in Georgia’s capital, a 7% increase from the same period in 2023. Transactions in new developments grew by 14%, with price increases ranging from 1% to 13%, depending on the location. For older apartments, the annual transaction count slightly declined, but prices surged by 16% in suburban areas and by 18–23% in various city districts.

Earlier, Galt & Taggart published a study on Tbilisi’s real estate market in November 2024, noting a 12.3% month-on-month increase in sales by the city’s 16 major developers. Around 96% of apartments slated for completion in 2024 were sold out. This share is expected to decrease to 71% in 2025 due to the expanding pipeline of new projects.

In November 2024, prices for primary-market properties in Tbilisi averaged $1,312 per square meter. Construction permits increased by 74.3% year-on-year. Buyer demographics shifted significantly: the share of Russian buyers fell from 7% to 2%, while Israeli buyers increased their share from 4% to 12%.

The highest prices for new apartments were recorded in Mtatsminda at $2,675 per square meter, followed by Vake at $2,378. Chugureti led the primary market with $1,837 per square meter, while Saburtalo ranked third for secondary-market prices at $1,140. The most affordable new apartments were in Vashlijvari at $991 per square meter, while secondary-market prices in the area averaged $1,096. Didi Digomi and Gldani also ranked among the most affordable districts.

Galt & Taggart estimated Tbilisi’s average rental yield at 9%, surpassing many other capitals worldwide.

Batumi

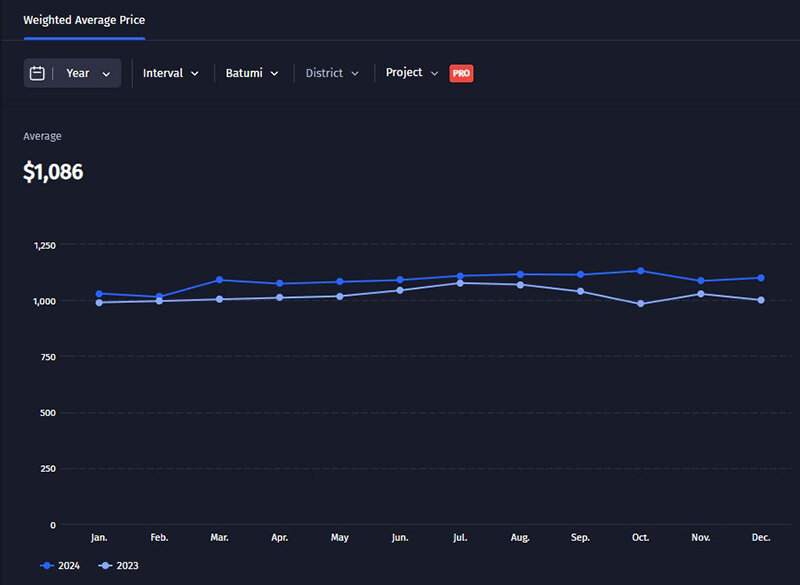

In Batumi, 15,034 apartments were sold in 2024, according to Colliers Georgia, with market volume rising by 6% to $778 million. The average price for new builds increased by 7%, while secondary-market apartments saw a 4% price increase. December recorded 1,426 transactions, a 19% year-on-year increase, with market volume up 28% to $76 million. Deals involving new builds grew by 23%, with prices rising 11% to $1,114 per square meter. Secondary-market prices grew slightly, up 0.2% to $985 per square meter.

Galt & Taggart noted that sales to Israeli citizens in Batumi grew by nearly 55% year-on-year in Q3 2024. Batumi remains one of the most profitable real estate markets in Georgia, with prices continuing to rise, albeit at a slower pace. Over the first nine months of 2024, the total value of apartments sold in Batumi reached $675.5 million. Experts predict further price growth in Batumi, driven by sustained interest from foreign buyers.

Forecasts for 2025

Georgian Prime Minister Irakli Kobakhidze stated that the country’s 9% GDP growth in 2024 highlights a positive economic trajectory. He expressed confidence in surpassing 10% growth in 2025, citing significant potential for further development.

Minister of Economy Levan Davitashvili explained that the base scenario projects 6% GDP growth in 2025, with an optimistic outlook if geopolitical tensions ease and significant changes occur on the international stage. Improved relations with strategic partners could also have a positive impact.

The World Bank has forecasted that Georgia will lead the Europe and Central Asia region in average economic growth between 2024 and 2026, projecting an annual growth rate of 6.7%. The 2024 GDP growth forecast was raised to 9%, up 3.8 percentage points from mid-2024 estimates, while the 2025 projection was increased to 6%. The IMF and other international organizations have similarly revised their outlooks upward, reflecting Georgia’s strong economic performance.