U.S. Mortgage Rates Nearing a Critical 7% Threshold

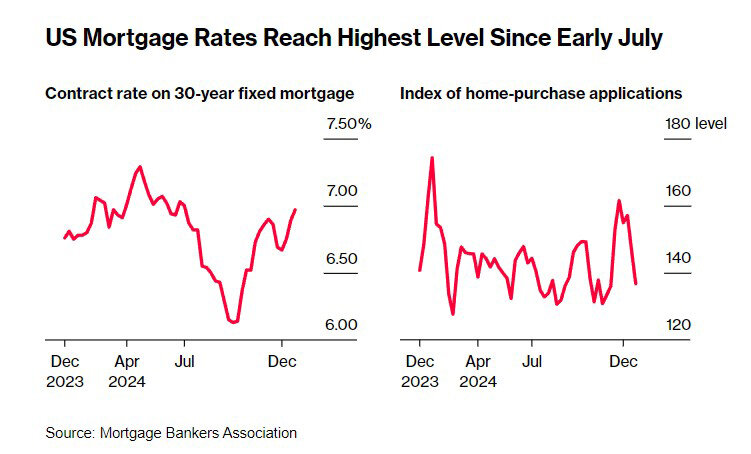

The average 30-year fixed mortgage rate climbed to 6.91% as of January 2, 2025, up from 6.85% a week earlier, according to Freddie Mac data cited by Bloomberg. The Mortgage Bankers Association (MBA) index rose by eight basis points to 6.97% for the period ending December 27, marking a six-month high.

Soaring borrowing costs continue to pressure affordability and demand. The MBA purchase applications index dropped nearly 7%, hitting its lowest level since mid-November. Mortgage rates typically track Treasury yields, which rose in late December as Federal Reserve policymakers signaled a slower pace of rate cuts in 2025 due to persistent inflation concerns.

Freddie Mac’s Chief Economist Sam Khater noted that rates remain elevated compared to early 2024, with ongoing market headwinds. Odeta Kushi, Deputy Chief Economist at First American Financial Corp., suggested that even a stabilization of mortgage rates at high levels could support a gradual housing market recovery, provided the Fed continues to ease its benchmark rate.

Housing Market Remains Resilient Despite Rate Hikes

Earlier, 30-year fixed mortgage rates jumped from 6.72% to 6.85%, reaching their highest level since July 2024. However, home sales activity increased, suggesting that buyers are adjusting to higher borrowing costs.

According to Redfin Corp., the number of pending home sales rose 4.1% year-over-year in the four weeks leading up to December 15, 2024. Meanwhile, new home listings climbed 7.6%, reflecting renewed seller confidence following the November elections. The 6% year-over-year increase in home prices has also incentivized sellers, with price levels now comparable to October 2022 highs.

Mortgage applications increased 18% month-over-month, suggesting that buyers gained confidence after rates briefly dipped to a two-month low of 6.6%.

The market for new single-family homes saw a 5.9% jump in November, reaching 664,000 units, while housing supply hit its highest level since late 2007. Builders closed postponed deals, particularly in storm-affected southern states, while incentives such as price discounts and a 6.3% year-over-year drop in median sales prices (to $402,600) helped drive transactions.

Freddie Mac’s Sam Khater acknowledged that despite a slight rebound in new and existing home sales, the market continues to suffer from an extreme housing shortage.

“Consumers appear to have adjusted their mortgage rate expectations and are taking advantage of improved inventory,” said NAR Chief Economist Lawrence Yun.

“Buyers are no longer waiting for a significant drop in mortgage rates.”

Federal Reserve’s Stance and Economic Impact on Housing

Housing affordability remains under threat due to high home prices and borrowing costs. Following its December 17-18 meeting, the Federal Reserve signaled that rate cuts in 2025 would be more gradual than initially expected.

The Fed continues to view interest rates as restrictive, according to Forbes. Inflation was projected to increase by 2%, but this failed to materialize in 2024, making it unlikely for 2025 as well. While further cuts in short-term rates remain possible, policymakers want to see tangible progress on inflation before acting.

Consumer credit expansion slowed in 2024, but household savings levels remain high due to pandemic-era stimulus payments. This could make consumer spending a key driver of economic growth in 2025.

Over the past 12 months, U.S. consumer spending grew nearly 4%, outpacing inflation. Wages are rising faster than prices, but construction spending on residential and commercial buildings has declined. However, data center and semiconductor plant investments have offset this weakness.

U.S. exports stagnated in 2024, while imports increased. A strong dollar has made American-made goods more expensive abroad, while cheaper imports have gained traction among U.S. businesses and consumers.

Trade Policy and Macroeconomic Risks in 2025

The new U.S. tariff policy and potential retaliatory tariffs from trade partners could weaken domestic economic growth. While a full-scale trade war is unlikely to trigger a global recession, it could stifle economic expansion.

Economic forecasts suggest that productivity growth will slow in 2025 due to tighter immigration policies, while GDP growth could dip to 2.1% in 2025 and further decline to 1.6% by late 2026.

However, AI-driven productivity improvements could help offset economic slowdown, potentially boosting inflation-adjusted GDP despite a shrinking labor force.

The overall outlook remains highly uncertain. While some economic sectors show resilience, tight monetary policy, high borrowing costs, and external trade risks could weigh on the U.S. economy in 2025.