Montenegro’s Ministry of Finance Predicts a Decline in Real Estate Prices

Montenegro’s real estate market is overvalued due to rising foreign investments, reports Vijesti. The Ministry of Finance forecasts a gradual correction in property prices to align with fair market value, as stated in the country’s Economic Reform Program (PER).

The report highlights that the latest assessment of price deviations from their fundamental value (2006–2024) shows that real estate prices in Q2 2024 were moderately overvalued—though less so than at the end of 2023.

While prices are slowly adjusting, the decline is not as sharp or immediate as during the 2008–2009 financial crisis.

“The adjustment process is expected to be gradual, reducing the risk of a housing bubble, which will have a positive effect on financial stability,” the report states.

Current Market Trends: Real Estate Prices in Montenegro

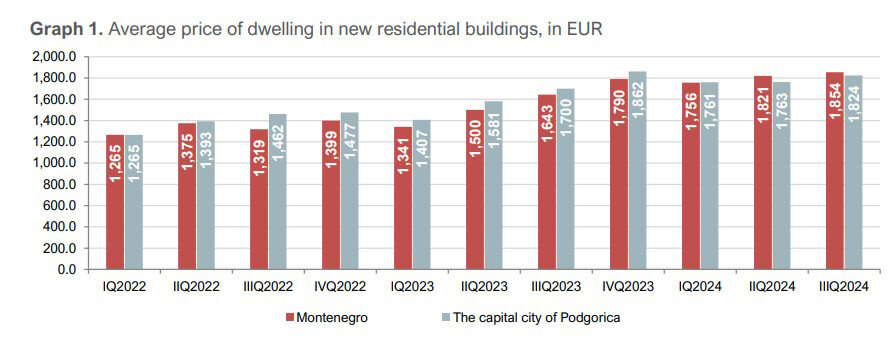

According to Montenegro’s Statistical Office (Monstat), in Q2 2024, the average price per square meter for new housing was €1,820:

- Podgorica: €1,760 per sqm

- Coastal region: €2,110 per sqm

- Central region: €960 per sqm

- Northern region: No new apartment sales recorded during this period

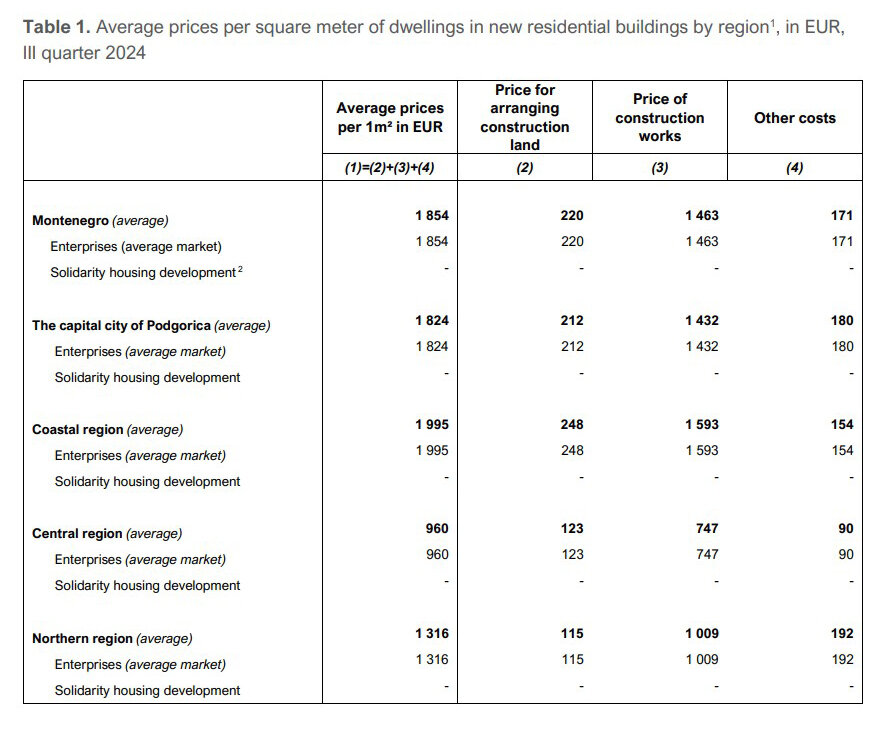

Monstat’s Q3 2024 data shows a nationwide average of €1,854 per square meter, with specific price points as follows:

- Podgorica: €1,824 per sqm

- Coastal region: €1,995 per sqm

- Central region: €960 per sqm

- Northern region: €1,316 per sqm

Numbeo’s Market Estimates (January 2025)

The real estate platform Numbeo estimates average prices as follows:

- Podgorica: €2,216/sqm (city center), €1,784/sqm (outside center); Rental yield: 5.05% – 5.37%

- Tivat: €2,666 – €3,166/sqm; Rental yield: 4.77% – 6.40%

- Budva: €2,625 – €2,887/sqm; Rental yield: 5.12% – 6.21%

- National Average: €1,814 – €2,316/sqm; Rental yield: 5.54% – 5.70%

Foreign Investments & Market Dynamics

Real estate prices in Montenegro are significantly influenced by Foreign Direct Investment (FDI) rather than actual construction costs.

FDI in real estate accounted for 6.4% of GDP annually from 2021, compared to 3.5% between 2015 and 2020.

Foreign buyers—mainly from Serbia, Turkey, Germany, Russia, and the USA—invested €237 million in Montenegrin real estate in the first seven months of 2024.

This represents a 9% decline compared to the same period in 2023.

Financial Risks and Banking Sector Stability

A sharp drop in real estate prices could impact Montenegro’s banking sector, as real estate serves as a significant collateral source for loans. However, the government has implemented macroprudential measures to mitigate risks, ensuring financial stability.

Concerns Over Money Laundering in Real Estate

The Council of Europe’s MONEYVAL committee previously warned of suspicious real estate transactions in Montenegro. Their report indicated that:

Real estate is the most common method of money laundering in the country.

Enhanced oversight of cross-border cash transactions is needed.

The banking sector and casinos are also vulnerable to illicit financial flows.

Organized criminal groups, including those involved in cryptocurrency transactions, have reportedly used digital assets to purchase properties, making it difficult to trace the origin of funds. Crypto transactions in Montenegro remain largely unregulated.

Impact of "Golden Passport" Program Cancellation

Montenegro ended its Golden Passport program on December 31, 2022. This program previously allowed foreign investors to obtain citizenship through real estate investments.

To further combat shadow economy issues, the government is considering new real estate regulations, including:

Banning direct property sales and advertisements by owners – Transactions would only be allowed through licensed agencies, potentially increasing prices by at least 3%.

Increased property taxes – As of January 1, 2024, the government raised property transfer taxes from 3% to 5-6% for certain categories, primarily affecting commercial and high-end residential properties.

Market Risks and Investor Recommendations

Real estate due diligence is crucial in Montenegro, as tens of thousands of properties remain unregistered or non-compliant with legal standards.

Some properties cannot be officially registered, making resale and ownership transfers risky.

Investors should verify developer credentials and legal documentation before purchasing property.

Montenegro's real estate market is currently in a correction phase, with prices expected to gradually decrease rather than experience a dramatic crash.

The government’s focus on financial stability, money laundering controls, and tax adjustments will shape the market over the next few years.

However, with foreign investment slowing, the real estate sector faces uncertainty, particularly as new regulations and compliance measures reshape the investment landscape.