Housing Completions in Europe to Drop to a 10-Year Low

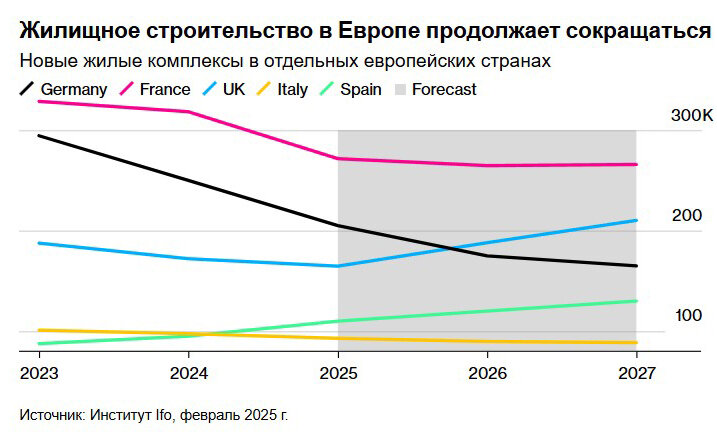

In 2025, Europe is expected to complete 1.5 million new residential units, a 5.5% decrease from 2024, reported by Bloomberg, citing research from Euroconstruct, conducted in collaboration with Ifo and other institutes.

Experts highlight that weak economic growth, declining public investment, and persistently high construction costs are hindering the recovery of housing construction in Europe. The decrease in new builds further reduces the supply of affordable housing, putting additional pressure on already strained real estate markets.

These effects are particularly evident in Germany, where new housing construction is projected to decline by 18% in 2025. Between 2023 and 2027, the country is expected to experience a 44% drop in new housing completions—the steepest decline in Europe. "High construction costs in Germany are currently preventing a rapid market recovery," explained Ludwig Dorffmeister, an economist at Ifo. "However, with population growth, housing construction in other European countries is gradually resuming."

According to Jones Lang LaSalle, Germany's real estate market recovery will be slow. After years of prosperity, a sudden surge in interest rates and construction costs has led to the bankruptcy of some developers, as bank financing dried up and transactions stalled. Germany has been hit the hardest by the real estate crisis in Europe.

Problems are mounting, and political disagreements are not helping to resolve them. According to Germany’s Council of Economic Experts, the country’s growth potential has shrunk to 0.4%. Bloomberg Economics analysts estimate that to recover, Germany will need to increase annual investment in infrastructure and other public goods by about one-third, to €160 billion—equivalent to more than 1% of GDP.

Experts at the German Institute for Economic Research (DIW) in Berlin acknowledge the critical combination of economic downturn and structural challenges but anticipate a gradual recovery and growth in 2025. Colliers and JLL predict a moderate increase in transaction volume in 2025, but the overall number of deals will remain significantly below long-term averages, indicating ongoing difficulties in the sector.

The European Commission expects inflation to decline in 2025, while household real incomes continue to recover. Consequently, private consumption is set to rise, albeit at a slow pace. Easing monetary policy is expected to support investment recovery. Growth in the construction sector will resume, driven by a rebound in housing and infrastructure demand, as evidenced by rising order volumes and mortgage loans.

In the UK, where housing has become a central political issue, housing construction is projected to grow by 12%. However, in December 2024, the sector's business activity index showed the fastest contraction in six months. The housing sub-index fell from 55.2 to 53.3 in just one month, raising concerns for Prime Minister Keir Starmer, who pledged to build 1.5 million homes over five years. The program's implementation has slowed as private developers reduced projects in response to declining demand and high interest rates.

The Labour government's budget is impacting various market segments. The most immediate effect follows the decision to reinstate stamp duty in April 2025, which has shifted some purchases to the first quarter. The unexpected exemption of residential property from capital gains tax has been offset by an increase in stamp duty on additional properties from 3% to 5%, which could reduce supply in the private rental sector. Major markets may also see shifts due to changes in non-resident taxation. Overall, the new budget could lead to higher inflation and, consequently, a slower reduction in mortgage rates.

Developers may ramp up construction if the real estate market recovery accelerates in 2025 as interest rates decline. Tim Moore, Director of Economics at S&P Global Market Intelligence, stated that December data indicates a "slowdown in growth rates" in the sector, with companies reporting "barriers in the form of high loan interest rates and the impact of uncertain consumer confidence."

Data also points to continued wage pressures in the construction sector: prices charged by subcontractors are rising at the fastest pace since April 2023. Business surveys show that commercial construction and civil engineering continue to grow, but both sectors are experiencing a slowdown in pace.

In Spain, where authorities are also closely monitoring the real estate market, construction volumes are expected to rise by nearly 49% compared to 2023. The country continues to experience signs of a housing crisis and a supply shortage. To partially address these issues, Spain is shutting down its "Golden Visa" program, which is believed to drive up property prices. Additionally, Spain is considering imposing a tax of up to 100% on property purchases by non-EU citizens.

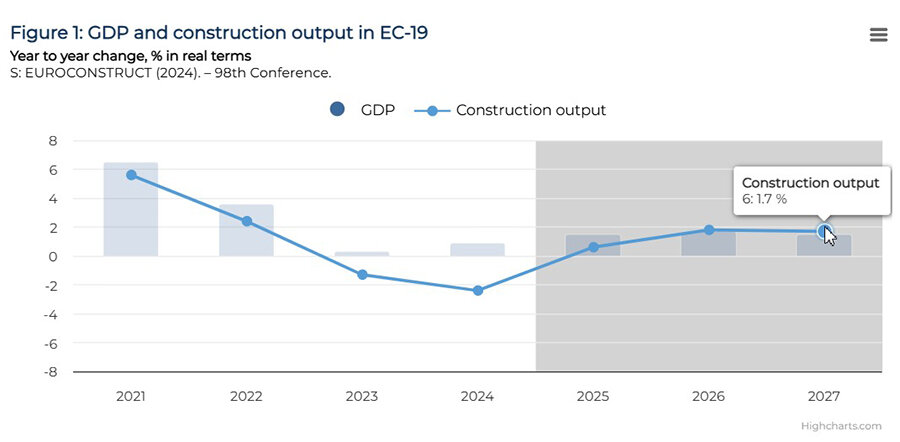

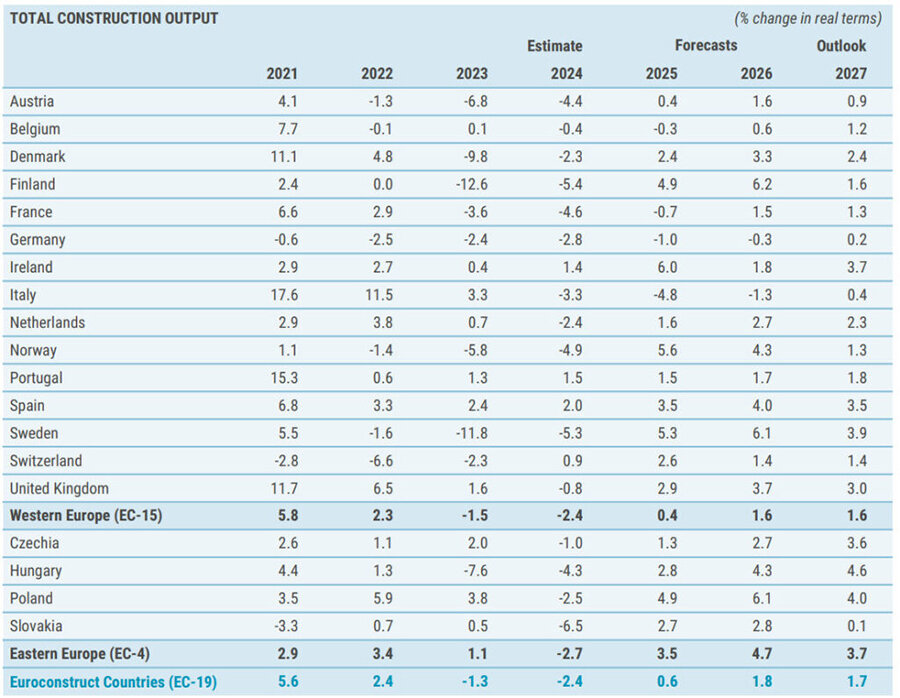

At a European construction sector conference in early December 2024, negative factors such as the situation in Ukraine, potential shifts in U.S. policy, high interest rates, energy costs, and rising labor expenses were highlighted as barriers to construction activity and investment plans. However, a modest positive trend was anticipated for 2025, with a projected 0.6% growth in the construction sector. By 2026, a more significant improvement in the housing sector was expected, driven by demographic factors, economic conditions, and favorable home renovation subsidy programs.

Growth was also expected to resume in the non-residential sector. Experts emphasized that new investments would particularly benefit market segments predominantly funded by the government. Structural policies aimed at achieving "green goals" would drive continuous industry renewal.

Civil construction remains a promising sector, driven by the urgent need to modernize transportation networks and energy infrastructure. The number of new projects in this field is expected to grow significantly over the next two years following a weak 2024, while renovation work will continue at a more stable and moderate pace.

A recent study noted that construction activity will grow more significantly in 2026, with housing completions increasing by 3%.