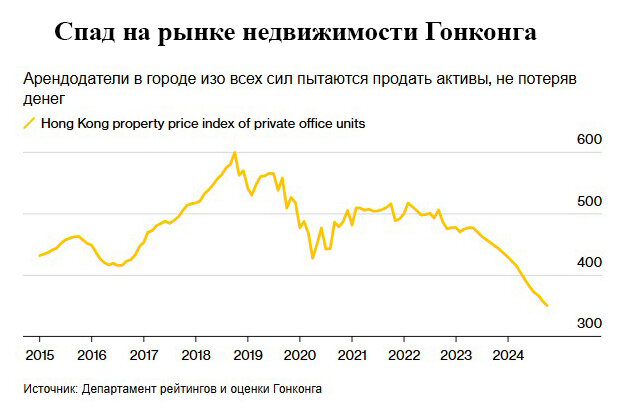

Hong Kong’s Commercial Real Estate Sector Faces One of Its Worst Declines

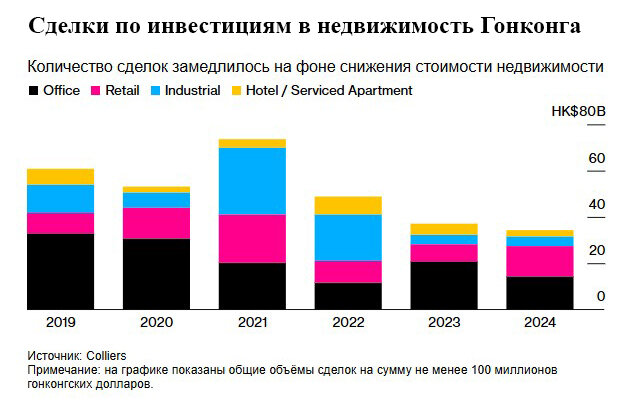

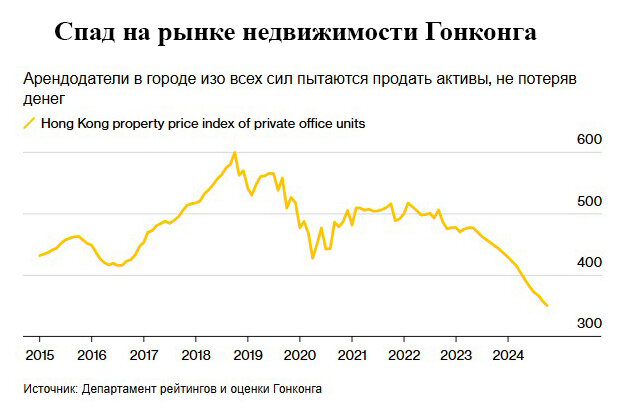

Average prices for office buildings, shopping malls, and other commercial properties in Hong Kong have dropped by more than 40% compared to their 2018 peak, leading to a sharp decline in collateral values for bank loans, Bloomberg reports. Defaults among property owners and developers are rising, with no clear signs of recovery.

Banks Are Forced to Sell Off Distressed Assets

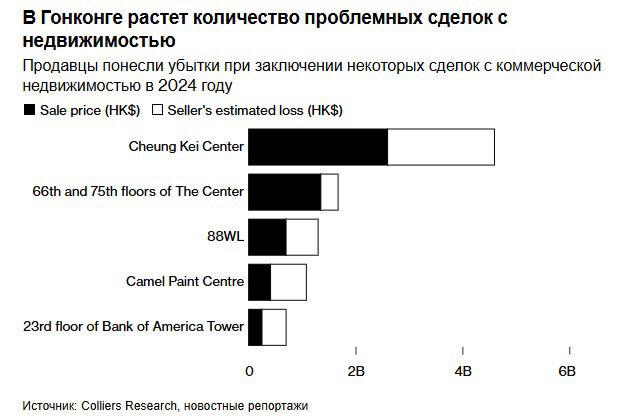

Hong Kong banks, previously unwilling to sell troubled assets at a loss, are now being forced to do so. In November, Cheung Kei Center was sold for HK$2.6 billion (US$334 million), marking a significant distressed sale.

"Banks realize that if they don’t sell their commercial real estate, its value will continue to decline," said James Mak, Sales Director at Midland Commercial Realty Ltd. "They are being forced to sell at a loss because that’s the reality of the market now."

Banks Under Growing Pressure

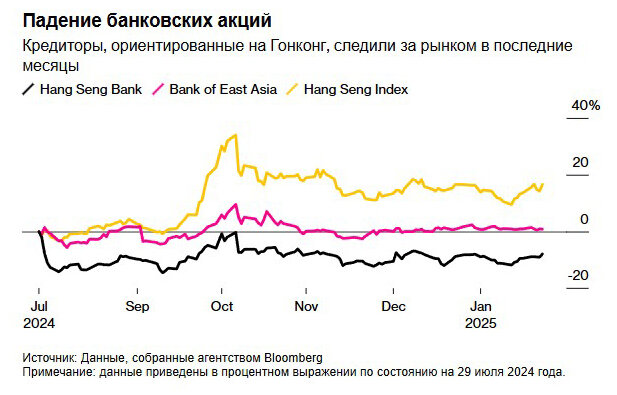

Credit analyst Karen Wu from CreditSights noted that most Hong Kong lenders have significant exposure to real estate. While the downturn is unlikely to trigger a systemic banking crisis, pressure on commercial property loan portfolios is intensifying.

- $80 billion in loans across the five largest banks – Hang Seng Bank Ltd., HSBC Holdings Plc, Bank of East Asia Ltd., Bank of China (Hong Kong), and Standard Chartered Plc – are at risk due to rising office vacancies and declining rental income.

- Bloomberg Intelligence analysts warn that falling property values may force banks to write off more loans in 2025.

- Hang Seng Bank reported a sharp increase in distressed commercial real estate loans to HK$13.5 billion by mid-2024, raising its bad loan ratio from 0.8% to 9.6%.

Forced Property Takeovers and Distressed Sales on the Rise

- 40% of commercial property transactions in 2024 were sold below their original purchase price, compared to 21% in 2023.

- Banks are repossessing assets from struggling borrowers. Chiyu Banking Corp. took control of a commercial building in Sheung Wan worth HK$1.298 billion after the borrower defaulted on a HK$1.5 billion loan.

- The Cheung Kei Center sale led to HK$2 billion in losses for lenders, including Hang Seng Bank and two Chinese banks, after seizing the property from businessman Chen Hongtian.

Additional Bank Losses

- Bank of East Asia reported losses after selling an office floor in Wan Chai for HK$145.9 million, despite being originally secured by a HK$198 million loan to Skyfame Realty, which later collapsed into bankruptcy.

- Fitch Ratings estimates that the loan-to-value ratio for commercial real estate loans averaged less than 50% in 2024, meaning that HK$200 million worth of assets back every HK$100 million in debt.

Future Outlook: More Declines or Stabilization?

- Since 2019, Hong Kong’s commercial and residential property values have fallen by at least HK$2.1 trillion.

- Goldman Sachs warns that even if commercial property prices drop another 35%, banks will likely manage the losses due to their strong capital reserves.

- Colliers predicts discounts of up to 60% on distressed properties.

- PwC's Raymond Kwong notes that many loans were issued 3-5 years ago, when property prices peaked, leaving banks with a tough choice: sell at a loss or wait for an uncertain market recovery.

Meanwhile, the International Monetary Fund (IMF) has lowered its GDP growth forecast for Hong Kong in 2025 from 3% to 2.7%, citing rising economic risks and financial dependence on China.

The Hong Kong real estate market remains under pressure, with banks, developers, and investors facing tough decisions in 2025.