China's Housing Market: Price Stabilization and Global Influences

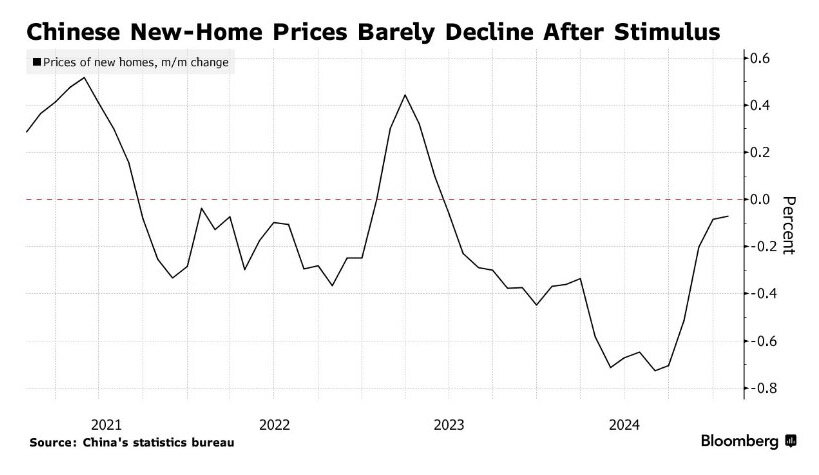

In January 2025, the decline in new home prices in China slowed for the fifth consecutive month, indicating the first signs of market stabilization, Bloomberg reports. These changes come amid government support measures, but many experts remain skeptical.

According to China's National Bureau of Statistics, prices for new homes in 70 cities (excluding government-subsidized housing) dropped 0.07% compared to December, when the decline was 0.08%. Meanwhile, secondary housing, which is less subject to state regulation, fell 0.34%, up from 0.31% the previous month.

On an annual basis, new home prices fell 5.43% (compared to 5.73% in December), while existing home prices dropped 7.8% (vs. 8.11% the month before). Growth in medium- and long-term household loans, which serve as a proxy for mortgages, suggests a potential improvement in housing sales. In January, the volume of such loans increased by 493.5 billion yuan ($69 billion), marking the highest level in a year.

First Signs of Real Estate Market Stabilization

These positive developments indicate that the real estate market may be stabilizing. Analysts expect a gradual recovery in the housing sector, which has experienced a downturn for over three years. Citigroup Inc. analysts noted that since February 2025, their outlook on the sector has become less pessimistic, with new home sales exceeding expectations. China's Minister of Housing, Ni Hong, also reported that positive trends persisted in January and February. The government plans to increase lending to qualified developers to expand urban redevelopment projects.

China’s active intervention in the sector includes supporting China Vanke Co., one of the country's largest developers, which has not yet defaulted. Authorities are drafting a plan to provide 50 billion yuan ($6.9 billion) in financing for the company in 2025. However, consumer confidence remains fragile, especially after leadership changes and reports of record losses of $6.2 billion at China Vanke, raising investor concerns.

Government Measures and Global Trade Tensions

Premier Li Qiang has promised to accelerate the construction of safe, eco-friendly, and smart “quality homes.” People's Bank of China Governor Pan Gongsheng stated that the country is shifting towards a consumer-oriented policy, emphasizing higher household incomes and stronger social security systems. He also claimed that real estate-related risks have been "significantly reduced."

Signs of stabilization or even slight recovery in the housing market could help China offset the economic impact of new U.S. tariffs on Chinese goods. Forbes reminds that on February 4, 2025, Trump imposed a 10% tariff on Chinese goods, doubling it in early March while exempting shipments under $800. In response, China has introduced tariffs of 10-15% on U.S. imports. While a trade war is the last thing China needs, officials insist they are "ready to fight to the end."

Expert Forecasts: Recovery Still a Long Way Off

Reuters analysts predict that despite price declines easing, a full market recovery is not expected until 2026. They highlight that 70% of household wealth is tied to real estate, which at its peak accounted for about a quarter of China's economy. With growing economic uncertainty, consumers are holding onto their cash.

China Real Estate Information Corp experts underline that a continued decline in property sales points to ongoing market challenges. According to their data, sales among China's top 100 developers fell by 3.2% year-over-year, totaling 227.6 billion yuan ($31.4 billion) in January.

A Moody’s report states that key indicators do not yet suggest the market has hit rock bottom. In 2025, contracted sales are expected to decline further, albeit at a slower pace. Fitch Ratings analysts forecast a 5% drop in Chinese home prices in 2025, with new home sales decreasing by 10%. Experts believe that China’s real estate sector recovery remains a long-term challenge.