Germany’s Housing Crisis in 2025: How the Construction Deficit Is Reshaping the Market

In 2025, Germany continues to face a shortage in new housing construction, a structural issue that remains a key driver of price growth and declining affordability. According to Reuters, citing the Federal Institute for Research on Building, Urban Affairs and Spatial Development (BBSR), the country needs to build at least 320,000 new apartments annually over the next five years to meet rising demand.

However, in 2024, only 216,000 building permits were issued—the lowest figure since 2010. This growing gap is fueled by immigration, population growth, and slower construction rates.

Construction Slowdown Hits Major Cities

The housing deficit is especially pronounced in major cities like Berlin, Munich, Hamburg, and Frankfurt:

In Berlin, developer Covivio has postponed over 1,000 apartments in the Lichtenberg district.

In Munich, Instone Real Estate suspended a large residential project due to financing and material costs.

Developers note that current interest rates and inflationary pressures make many projects financially unviable. The sector, which was booming until 2022, was unprepared for the European Central Bank’s aggressive rate hikes, rising material costs, and labor expenses.

As a result, hundreds of projects have been frozen over the past two years, and some companies have gone bankrupt.

Bureaucracy & Delays Add to the Pressure

Beyond economic constraints, developers cite administrative delays as a key issue. Building permit approvals—especially for multi-unit projects—often take two years or more, which reduces investment appeal and slows supply response.

Market Outlook: Recovery or Prolonged Stress?

According to Jochen Moebert, senior economist at Deutsche Bank Research, Germany’s lingering recession is slowing wage growth and reducing housing affordability. Although falling mortgage rates may help, they won’t fix the physical housing shortage, which will likely persist until the end of the decade.

Prices Begin to Climb Again

According to Destatis, housing prices in Q4 2024 increased 1.9% year-on-year, marking the first real recovery after a decline that started in 2022.

Apartment prices in large cities rose 2.5%

House prices rose 2.2%

Average Property Prices in 2025

Based on Centrarium, the average price per square meter in early 2025 was €4,161, a 0.9% increase from January 2024.

According to Guthmann, Berlin remains among the most expensive cities:

New builds: €8,280/m²

Existing properties: €5,380/m²

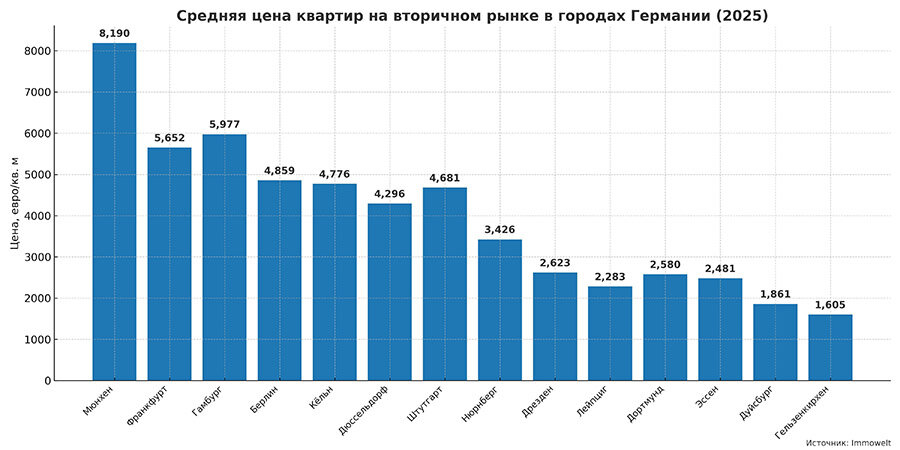

Immowelt reports average secondary market prices as of April 1, 2025:

Apartments: €3,162/m²

Houses: €2,767/m²

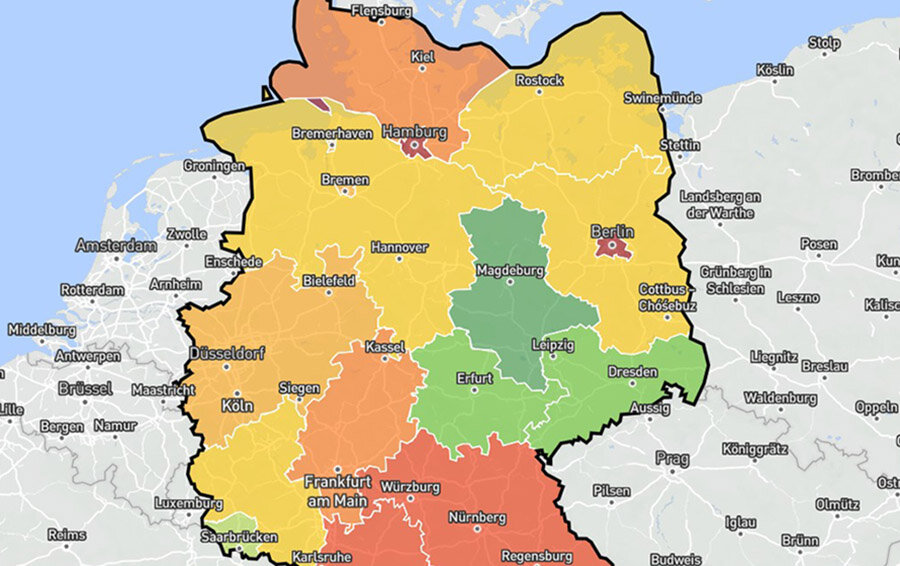

Cities with the highest prices:

Munich: €8,190/m²

Frankfurt: €5,652/m²

Hamburg: €5,977/m²

Berlin: €4,859/m²

Cities with more affordable housing:

Leipzig: €2,283

Dresden: €2,623

Dortmund: €2,580

Essen: €2,481

Duisburg: €1,861

Gelsenkirchen: €1,605 (lowest)

Rents Continue to Rise

Centrarium reports that rental rates across Germany rose 6.38% over the past year, reaching an average of €13.55/m². In Berlin, the increase reached 16.1%—a reflection of strong demand and limited supply.

According to Sebastian Schneider, senior real estate analyst at BayernLB, many potential buyers are forced to rent as they cannot afford down payments. Without a boost in new construction, housing will remain unaffordable for many households.

Forecast: Price Growth to Continue

A Reuters poll in early 2025 projected an average 3.5% increase in property prices by year-end. But nearly two-thirds of analysts believe the actual growth may be lower, citing:

Economic uncertainty

High construction costs

Risk of tightening credit conditions

Pressure on consumer purchasing power