Вusiness / Real Estate / Investments / Analytics / Research / Reviews / Georgia / Real Estate Georgia 13.08.2025

Batumi Real Estate Market: Steady Growth and Major Investments

The Batumi housing market continues to see growth in both sales and prices, along with strong rental yields, according to a Galt & Taggart report for Q2 2025. Stable demand is supported by the development of tourism infrastructure, active construction in coastal areas, and interest from foreign buyers.

Sales and Prices

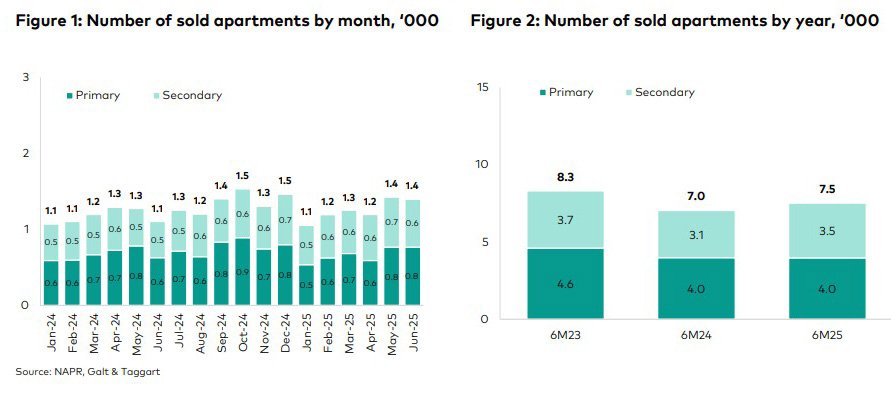

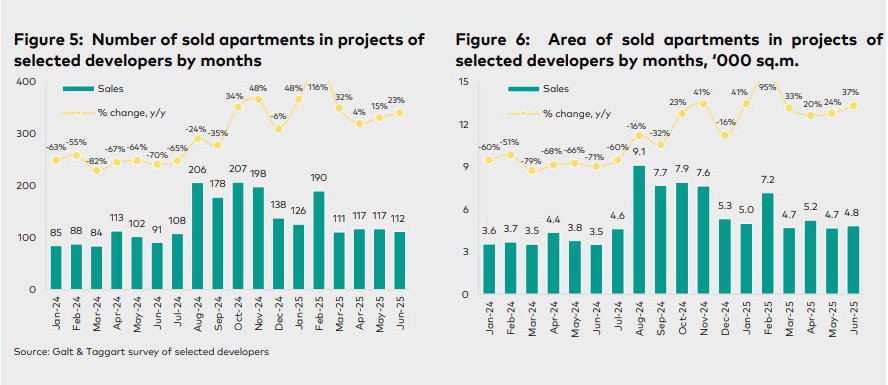

In Q2 2025, 4,018 apartments were sold in the city, up 9.5% from the same period in 2024. The secondary market saw the most significant growth at 23.4%. Official primary market data showed a minimal decline of 0.5% due to registration delays. Actual activity is higher: developer surveys indicate that new-build sales increased by 13.1% quarter-on-quarter and by 37.3% in H1.

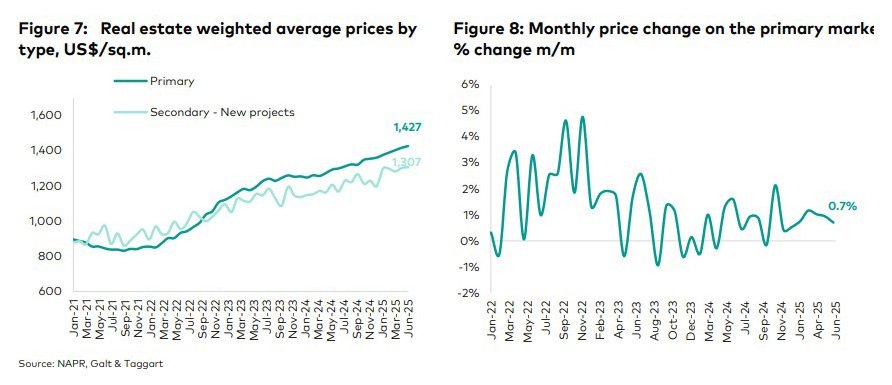

Prices maintained their upward trend. In June 2025, the average price per square meter on the primary market reached $1,427, up 2.7% from Q1 and 13.5% year-on-year. In the “new secondary” segment (buildings permitted after 2013), the average price was $1,307 per sq m, rising 0.7% quarter-on-quarter and 11.5% year-on-year. The average “white frame” price in the primary segment reached $1,547 per sq m.

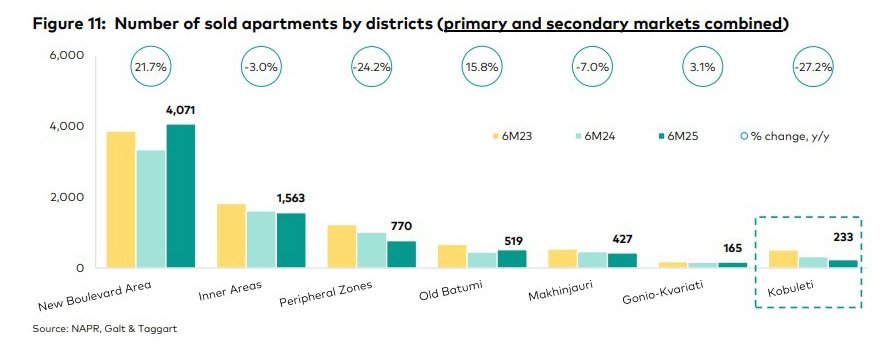

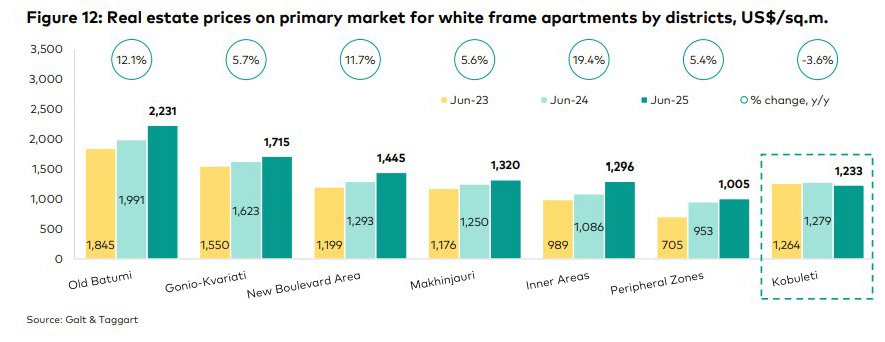

In H1 2025, the New Boulevard district remained the sales leader with 4,071 units sold, up 21.7% year-on-year. The average price increased by 11.7% to $1,445 per sq m, supported by a well-developed seafront with diverse amenities, parks, and strong tourism infrastructure.

Inland districts ranked second with 1,563 deals, though sales fell 3%. The average price rose 5.4% to $1,320 per sq m, suggesting a shift in demand toward coastal zones. Old Batumi increased sales by 15.8% (519 deals), maintaining its status as one of the most desirable areas, with the highest average price at $2,231 per sq m (+12.1% YoY). Peripheral areas saw a 24.2% drop in sales (770 deals), but prices jumped 19.4% to $1,005 per sq m, offering high-yield potential.

The Gonio–Kvariati suburb stands out with a 3.1% rise in sales (165 units) and a 5.7% price increase to $1,715, with a wide range from $1,150 to $5,800 per sq m. The location combines mid-range and premium seaside complexes, attracting investors to international hotel-branded projects known for reliability and profitability. Development plans for Gonio–Kvariati are part of a regional program and will bring significant changes.

In Makhinjauri, sales dropped 7% (427 deals) with prices at $1,296 per sq m (+5.6% YoY). In Kobuleti, the decline was sharper at -27.2% (233 deals), with prices down 3.6% to $1,233 per sq m.

Investment Focus

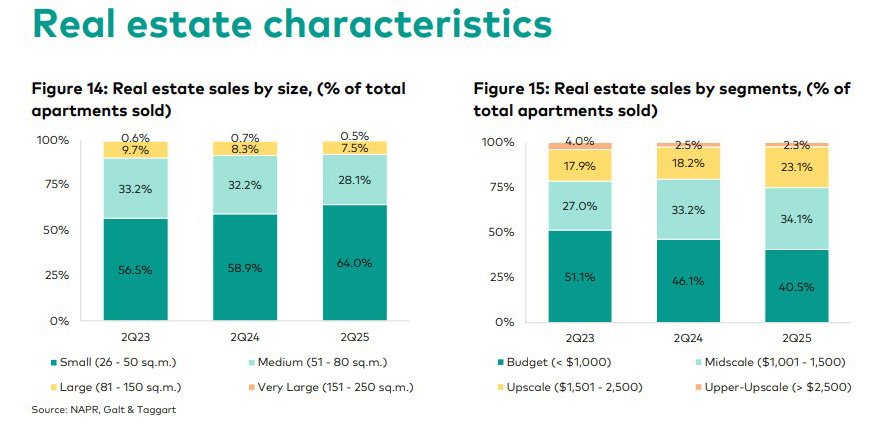

The price structure of purchases is shifting toward higher-end properties: the share of units under $1,000 per sq m fell from 51.1% in 2023 to 40.5% in 2025. The $1,001–1,500 range grew to 34.1%, while units priced $1,501–2,500 now account for 23.1% of the market.

The market remains investment-driven, with purchases aimed at rental income. Compact formats dominate: in 2025, apartments of 26–50 sq m made up 64% of transactions, 51–80 sq m accounted for 28.1%, 81–150 sq m for 7.5%, and units over 150 sq m just 0.5%.

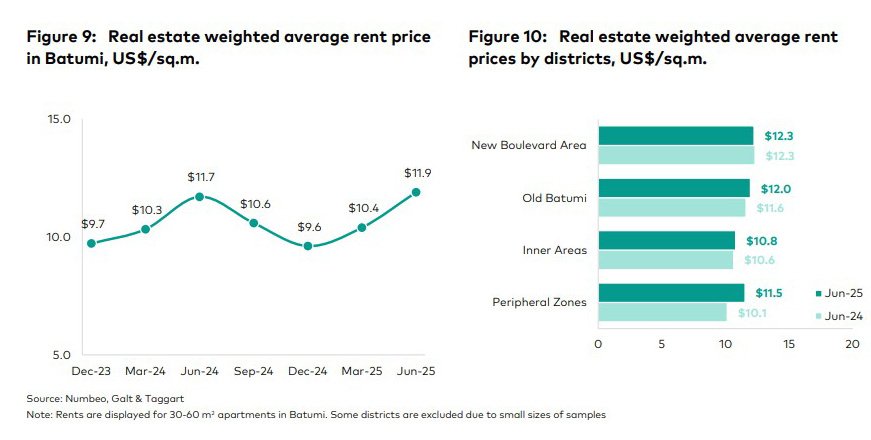

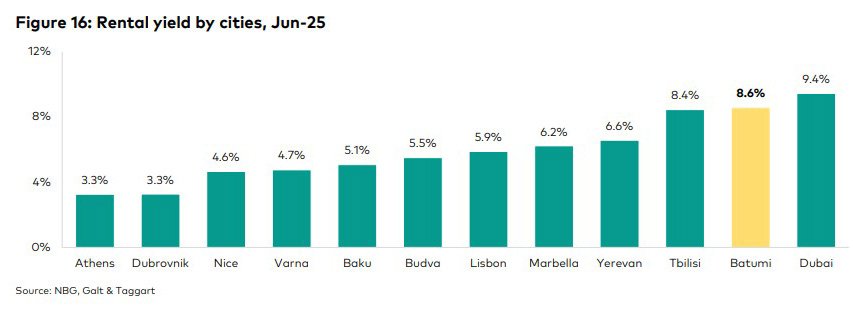

The rental market remains stable and profitable. In June, the average long-term rent for a 50–60 sq m apartment was $11.9 per sq m, up 1.6% year-on-year. Average rental yield in Batumi stood at 8.6% in June 2025, slightly higher than Tbilisi (8.4%) and significantly above Budva (5.5%), Lisbon (5.9%), and Nice (4.6%). Many properties offer even higher returns.

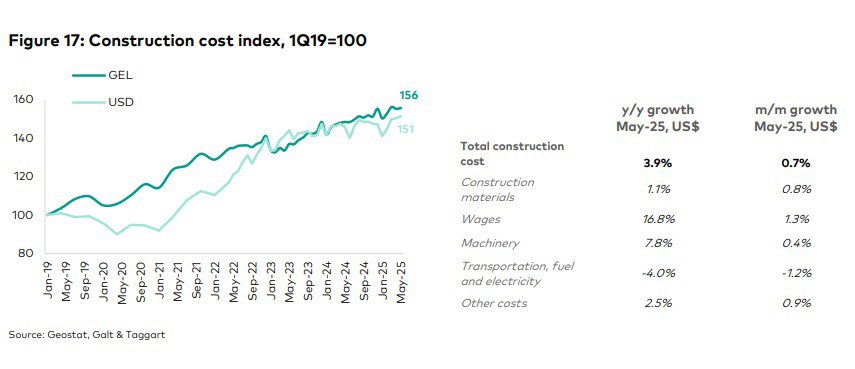

Construction costs continue to rise moderately. In May 2025, the cost index stood at 156 points in GEL and 151 points in USD compared to early 2019. Annual costs rose by 3.9% and monthly by 0.7%. The main driver was a 16.8% YoY increase in wages, while material costs rose just 1.7%. Declines in transport, fuel, and electricity costs (-4.0%) partially offset the increases.

Forecasts and Outlook

Galt & Taggart analysts expect Batumi’s market to keep growing through the end of 2025 in both prices and sales volumes, though at a more moderate pace. Key demand drivers will remain strong tourist flows, low entry barriers, and the potential for further price growth. For investors, the most attractive assets will be liquid beachfront properties and areas with developed infrastructure, including Gonio–Kvariati. Peripheral zones will still offer opportunities for smaller-scale entry investments.

The Georgian government projects continued high GDP growth, with the economy surpassing 100 billion GEL in 2025 and per capita income reaching $10,000. The IMF forecasts Georgia to lead Europe in growth between 2025–2030 with an average of 5.2%.

Major investments are concentrated in infrastructure and tourism. A $6 billion Emaar Group (UAE) project will transform sites in Tbilisi and build the Gonio Marina resort-investment complex in Batumi, featuring residential units, hotels, parks, shopping malls, and a yacht pier.

Tourism remains a key growth driver, with 2024 industry revenues hitting a record $4.4 billion. By 2028, more than 300 hotels with 38,000 beds will open. Large-scale transport upgrades include a new international airport in Vaziani with 18 million passenger capacity, expansion of Kutaisi’s terminal, completion of the East–West Highway, and new routes to Azerbaijan, Armenia, and Turkey. Georgia is strengthening international ties, expanding partnerships with China and the U.S., and aiming for EU membership by 2030.