Real Estate / Analytics / Research / Estonia / Germany / Greece / Portugal / Bulgaria / Hungary / Litva / Slovenia / Croatia / Finland / Sweden / France / Italy 17.04.2025

Is Europe Facing a Housing Bubble? ECB Warns of Widespread Overvaluation

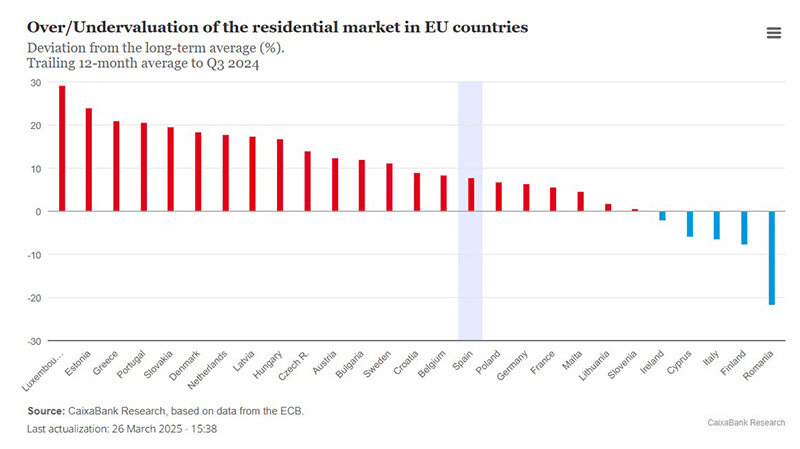

House prices in Europe are showing signs of serious overvaluation. A recent study by Caixabank, based on data from the European Central Bank (ECB), notes that 80% of housing markets across the EU are experiencing overvaluation, with Luxembourg, Estonia, Greece, and Portugal leading the list of overheated markets.

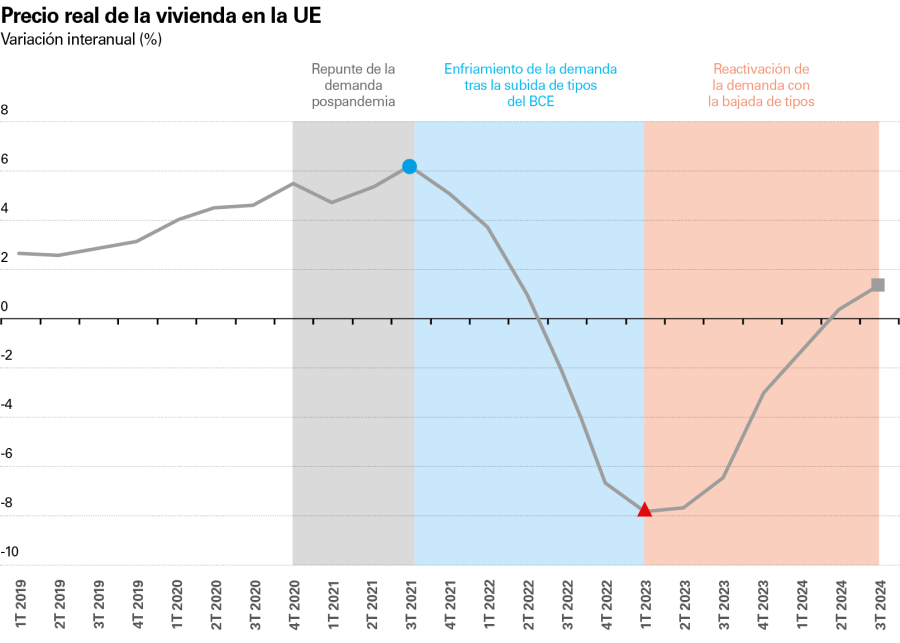

The study highlights that monetary policy has been the key driver of price dynamics over the past five years. The real estate boom began in 2020, fueled by pent-up demand, low interest rates, and accumulated savings. After a peak in 2022, prices corrected as interest rates rose to fight inflation. But in 2024, demand and price growth resumed.

Between 2020 and 2024, nominal house prices in the EU rose by 26%, though inflation-adjusted growth was just 2% above pre-pandemic levels (Q4 2019).

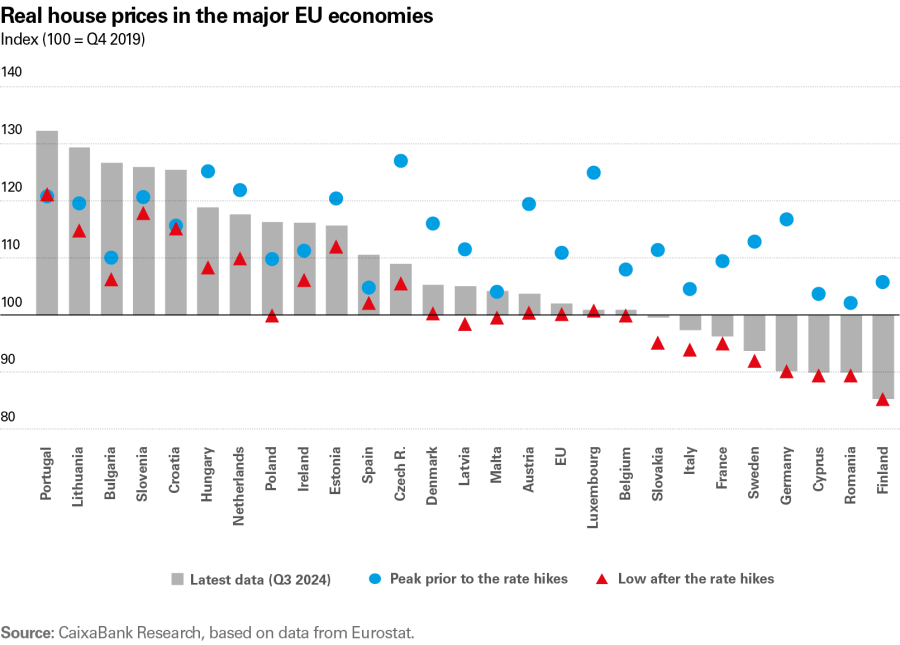

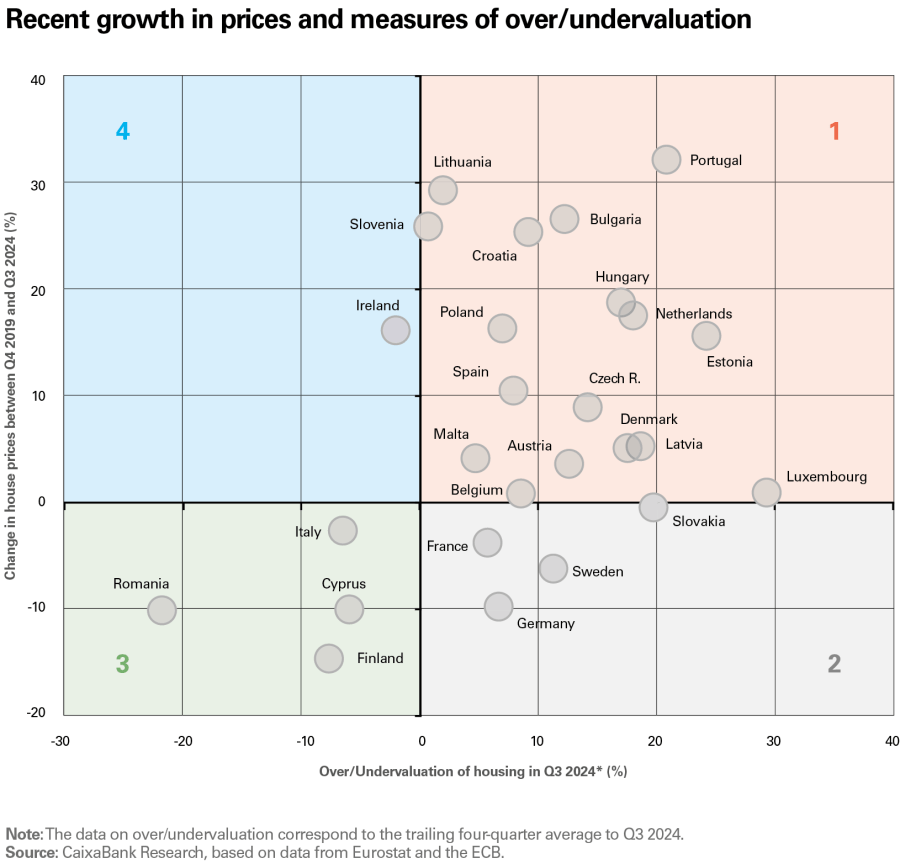

Countries like Portugal, Lithuania, Bulgaria, Slovenia, and Croatia exceeded previous peak price levels, with real prices rising over 25% since late 2019. In contrast, Germany, France, Sweden, Italy, and Finland saw price stagnation or decline after the 2022 rate hikes. Germany, for example, saw a 17% surge in property prices by 2021, followed by a 23% drop by late 2024 — resulting in an overall 10% decline over five years.

According to the ECB, more than 80% of EU countries show signs of housing market overvaluation. Luxembourg, Estonia, Greece, and Portugal show overvaluations between 20% and 30%, while Romania, Finland, Italy, Cyprus, and Ireland remain undervalued.

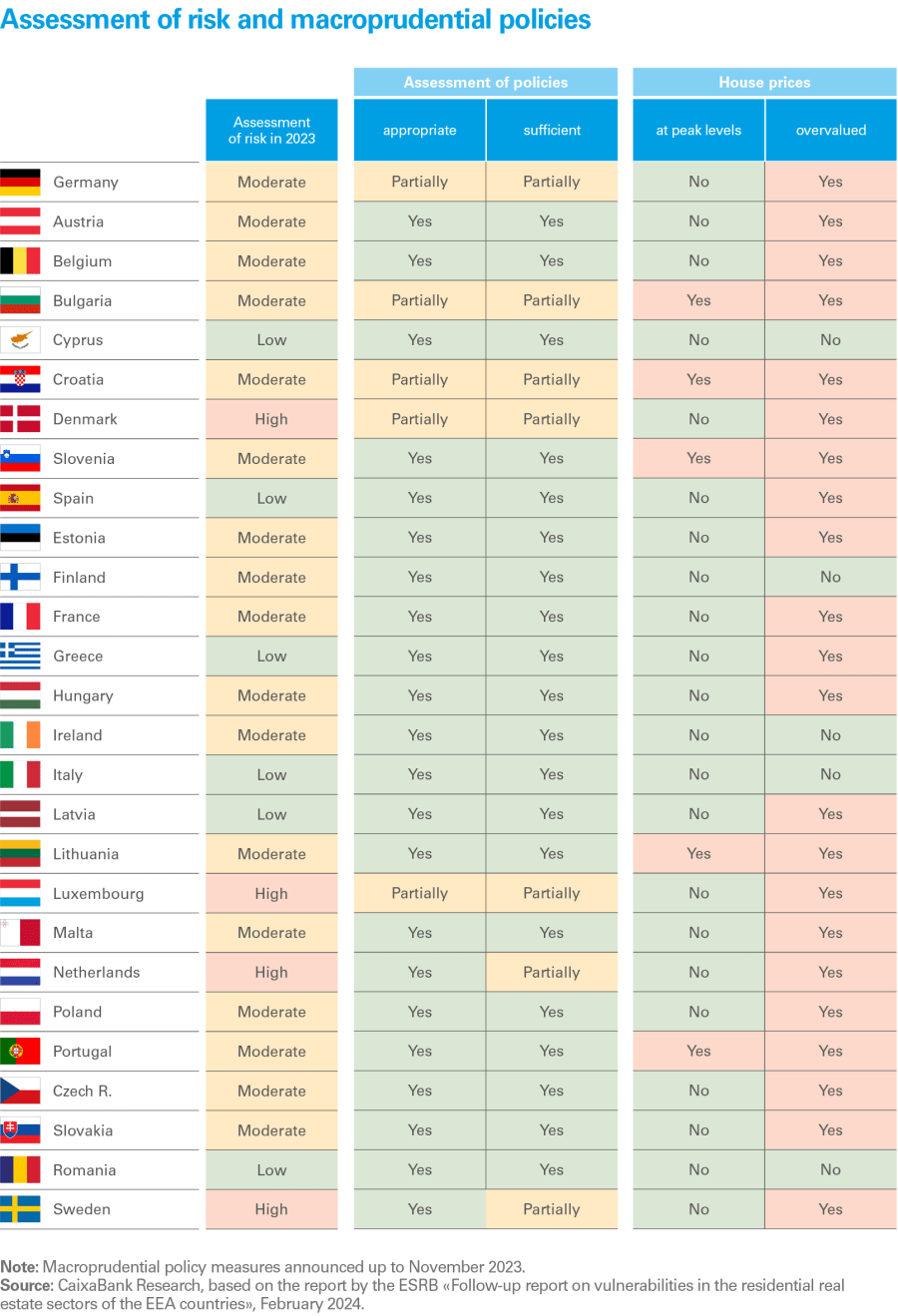

The European Systemic Risk Board (ESRB) has identified Denmark, Luxembourg, the Netherlands, and Sweden as the EU countries facing the highest housing-related systemic risks, based on borrowing trends and mortgage payment capacities.

Countries such as Portugal, Bulgaria, Hungary, and Estonia are flagged for growing housing risks due to recent surges in property prices, even though they have shown responsible macroprudential management so far. Meanwhile, Cyprus, Greece, Italy, Latvia, Romania, and Spain are currently considered to have low systemic housing risk.

Structural Shifts and Investor Sentiment

According to Euroconstruct, Europe’s housing market is undergoing structural changes. In 2025, new housing construction will fall to 1.5 million units — the lowest in a decade. Investors are shifting from commercial to residential real estate, especially in segments with stable demand like multifamily housing and student residences.

Institutional players like Patrizia SE are launching funds with expected returns of 13–15%. Private investors are also eyeing residential properties for reliable rental yields amid declining returns from traditional assets.

In Germany, transaction volumes could reach €40–42 billion in 2025. UK sales are already up 14%, but government housing targets (300,000 homes/year) remain underfunded.

In Western Europe, housing prices are expected to rise 2–3% in 2025, with Scandinavian suburbs seeing 4–5% gains driven by remote work trends. Southern European hotspots like Málaga and Valencia could see 5–6% increases. In Portugal, demand for luxury housing is slowing after changes to the Golden Visa program.

In Georgia, residential and branded hotel developments are booming, making it one of Eastern Europe’s most promising markets.

Risks Ahead

While interest in European real estate remains high, risks abound:

- Rising interest rates may dampen mortgage accessibility and demand.

- Budget housing markets may face oversupply risks.

- Rental regulations across the EU could lower project profitability.

- Geopolitical uncertainty and sanctions limit foreign investment, especially in Eastern Europe.

- Inflation and economic slowdown may impact tenant solvency and increase payment defaults.

- The phasing out of investor residence and citizenship programs may reduce foreign inflows.

Подсказки: Europe, housing market, ECB, real estate, investment, property prices, Germany, Portugal, France, overvaluation, interest rates, mortgage, construction, rental yield, risks