read also

Real Estate / Investments / Analytics / Research / Reviews / Austria / Real Estate Austria 19.04.2025

Is it Profitable to Invest in Austrian Real Estate? Prices, Rental Rates, and Yields in 2025 – a Study by International Private Investment

At the end of 2024, Austria’s real estate market showed mixed trends depending on the property type, region, and price segment. The international investment agency International Private Investment analyzed up-to-date data on prices, rental rates, yields, and market dynamics.

Residential Real Estate

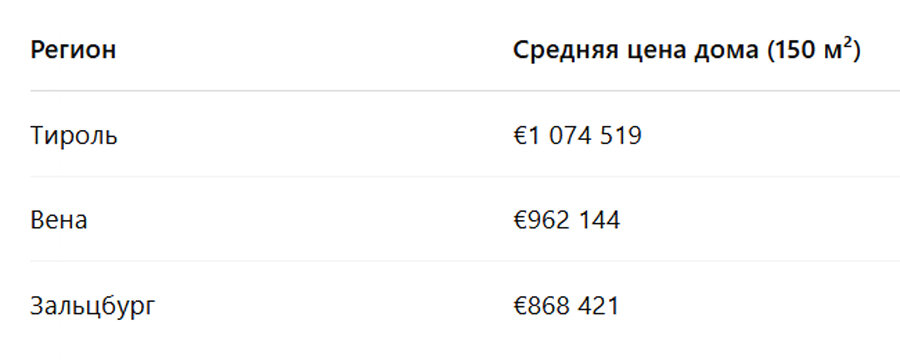

Average property prices (150 m²) by region

In 2024, according to ImmoScout24, the highest average prices for 150 m² houses were recorded in Tyrol at €1,074,519, a 2% increase from 2023. Vienna ranked second at €962,144 with a 1% increase. Salzburg ranked third, with an average home price of €868,421 and the highest national growth rate at 5%.

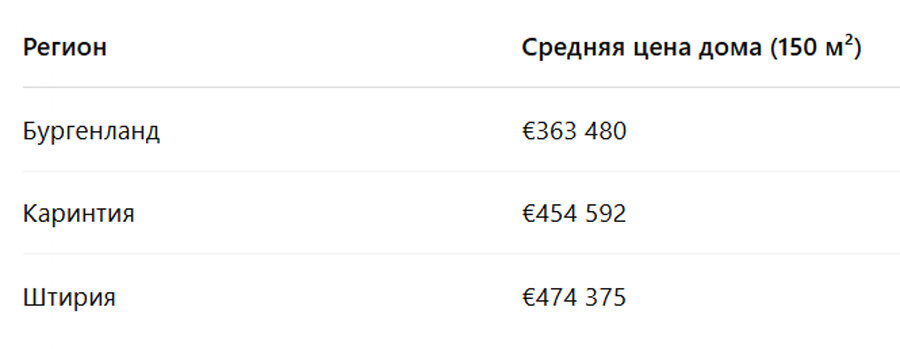

Vorarlberg showed an average price of €825,000 and a 5% decline. Lower Austria and Upper Austria recorded average prices of €538,400 and €497,144 respectively — without specific growth data. In Styria, prices dropped 6% to €474,375. Carinthia saw an average price of €454,592, and Burgenland €363,480, with a 3% decline.

Price dynamics by housing segment

The steepest price drop in 2024 occurred in the mid-range segment — down 7.3% compared to the previous year. The budget segment fell by 4.8%. The premium segment lost 4.2%.

The only segment to show growth was luxury real estate, where prices rose by 0.2%, indicating steady demand at the top of the market, according to RE/MAX Austria.

Commercial Real Estate

Office rental rates in Austria reached up to €28 per square meter per month in the premium segment, according to Chambers and Partners. The main factors driving rental growth are a lack of new supply and rising construction costs.

The average yield on retail properties in 2024 ranged from 5.25% to 5.5% per year. Supermarkets and neighborhood formats were in highest demand. Interest in large shopping malls remained weak.

Rental Yield of Residential Property by City

In 2024, Vienna offered the highest average rental yield from residential real estate at 4.12% annually. Graz yielded 3.66%, and Salzburg — 2.71%, which, according to Global Property Guide, reflects high property prices and moderate rental demand in the latter.

Yield by Districts in Vienna

In the Favoriten district (10th district), a studio costing €147,450 generated €844 in monthly rent, resulting in an annual yield of 6.87% — one of the highest in Vienna.

In the 22nd district, Donaustadt, a two-room apartment cost €439,000 and rented for €1,396, yielding 3.82%.

In the upscale 19th district, Döbling, a three-room apartment valued at €1,080,000 rented for €3,249 per month, giving a 3.61% yield.

Price Dynamics

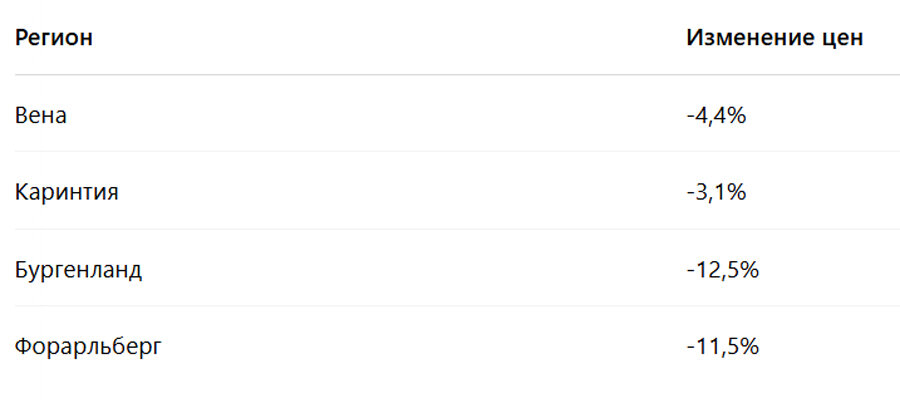

By Region

The sharpest price drops in 2024 were recorded in Burgenland (-12.5%) and Vorarlberg (-11.5%). Vienna saw a price decrease of 4.4%, and Carinthia -3.1%.

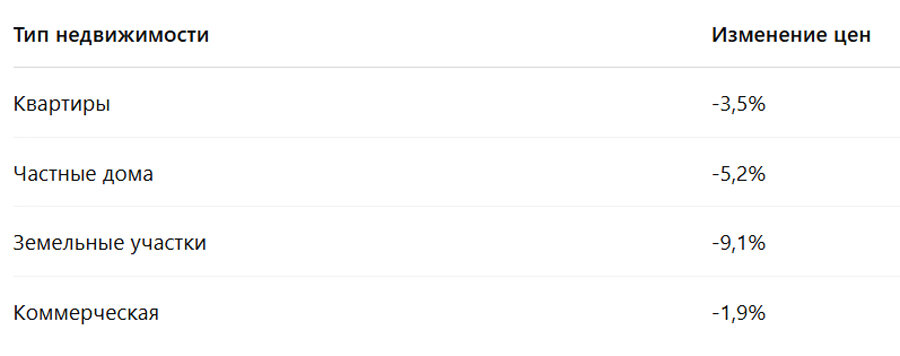

By Property Type

Land plots experienced the steepest drop in 2024 — down 9.1%. Detached houses lost 5.2% in value, and apartments dropped 3.5%. Commercial real estate was least affected, with a decline of only 1.9%.

Also read: Austria issued a record number of citizenships to descendants of Nazi persecution victims in 2024

Most Expensive Real Estate

Top three most expensive regions for home purchases:

Tyrol – average house price €1,074,519

Vienna – €962,144

Salzburg – €868,421

Most Affordable Real Estate

Top three most affordable regions:

Burgenland – average house price €363,480

Carinthia – €454,592

Styria – €474,375

Regions with the Highest Price Growth

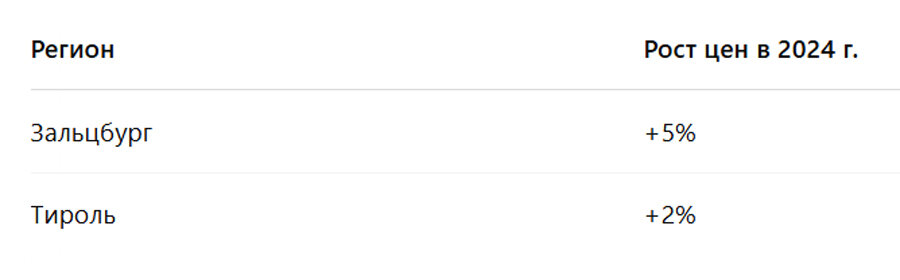

Only two regions saw price increases in 2024.

Salzburg recorded a 5% increase — the highest in the country.

Tyrol rose by 2%, despite already having high property values.

Is Investing in Austrian Real Estate Profitable in 2025?

As of early 2025, Austrian real estate remains one of the most stable assets in Europe. However, its investment appeal has changed significantly compared to previous years, according to experts at International Private Investment.

Capitalization: downward trend persists

2024 saw price declines in almost all segments:

Apartments: -3.5%

Detached houses: -5.2%

Land plots: -9.1%

Price declines occurred in most regions, especially in Burgenland (-12.5%) and Vorarlberg (-11.5%). Salzburg (+5%) and Tyrol (+2%) were the exceptions.

Therefore, expectations for short-term capitalization are not justified — the correction trend continues, particularly in overheated regions and in mid- and low-range segments.

Rental Yield: moderate but stable

Average national residential rental yields:

Vienna – 4.12%

Graz – 3.66%

Salzburg – 2.71%

Targeted investments in low-cost properties in high-rent areas (e.g., studios in Favoriten) can yield up to 6.9%.

Retail real estate (retail parks and supermarkets) offers yields of 5.25–5.5%.

Premium office real estate shows stable demand, rental rates are rising, and investments in Q1 2024 increased by 50% year-over-year.

Falling Prices Attract Long-Term Investors

Real estate prices in Austria corrected in 2024, and for long-term investors, this could be a market entry point offering high asset protection — especially in stable regions (Vienna, Graz, Tyrol). However, expectations of short-term capitalization growth are unrealistic.

For investors focused on rental income, Austrian real estate remains attractive, especially with the right choice of property and location (e.g., affordable Vienna districts with high rental rates).

For investors focused on capital appreciation, the 2025 market remains cautious and generally downward-trending; short-term speculation is not advisable.

Industrial and retail assets offer higher returns than residential properties and appear more resilient in the current macroeconomic context.

Austria in 2025 is a market for cautious long-term investors, not for those expecting rapid capital growth.