China’s State Developers Buy Up Urban Land Amid Bets on Market Recovery

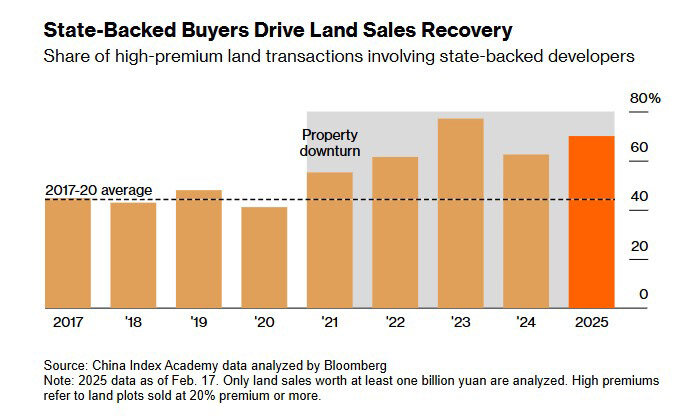

China’s largest state-backed developers are seeing a surge in share prices, driven by aggressive land acquisitions in major cities, Bloomberg reports. This comes as private sector builders continue to struggle and investors anticipate a market rebound favoring financially stable players.

Greentown China Holdings, known for premium land purchases, has seen its stock jump by 71%. China Jinmao Holdings rose 77%, and C&D International increased 40%. All three firms are state-affiliated and have avoided the liquidity crises that hit private giants like Evergrande and Country Garden. Now, they are using the downturn to expand by winning competitive land bids in tier-1 cities, betting on a price recovery in the coming years. According to Jefferies economist Shujin Chen, investors from mainland China and Hong Kong are buying up shares of developers with urban portfolios, signaling confidence in a turnaround led by top-tier cities.

Local Policy Support and Margin Opportunities

This expansion is supported by local governments, which have loosened profitability restrictions on new home sales—allowing developers to expect higher margins. As a result, premium bidding has returned: state firms are now purchasing land above the minimum asking prices.

A standout example is a February 2025 land deal in Shanghai, where China Jinmao, in partnership with Singapore-based Kheng Leong Co., acquired a residential site for 9 billion yuan after 184 bidding rounds. Since November, Jinmao has ramped up its urban presence. According to Morgan Stanley, its contract sales may rise 12% in 2025, following a return to profit in 2024 with 1 billion yuan in net income.

Greentown’s Focus on Hangzhou

Greentown is doubling down on Hangzhou, its home base and one of China’s top AI and tech hubs. In 2024, it acquired land there with an average 22% premium, according to China Index Holdings. Hangzhou’s economy is bolstered by tech giants like Alibaba and DeepSeek, increasing the city’s appeal for long-term investors.

Greentown now ranks third in national sales volume, with nearly 50% of its revenue from Hangzhou. Around 79% of its land bank is in first- and second-tier cities. Bloomberg Intelligence analyst Kristy Hung notes that this concentration in stable urban regions positions Greentown well for early recovery.

A Bloomberg forecast consensus expects Greentown’s net profit to jump 97% in 2025, following a 49% decline in 2024. Raymond Cheng of CGS International Securities calls it a likely winner in the sector’s consolidation wave.

C&D International Bets on Tier-2 Cities

In March 2025, C&D International bought land in Chengdu at more than double the starting price, setting a local record. UBS reports C&D holds one of Chengdu’s largest land reserves. Meanwhile, the city’s secondary housing market shows strength: National Bureau of Statistics data shows five consecutive months of rising home prices, placing Chengdu among the top-performing cities out of 70 tracked nationwide.

China’s top state developers are consolidating power in demand-heavy cities, giving them an edge as private firms falter. UBS real estate analyst John Lam predicts home prices could start recovering by early 2026—driven by current land acquisitions in strategic areas.

Yet, structural pressures remain. According to Reuters, resale prices in China’s 100 largest cities fell 0.7% in April 2025 compared to March, indicating persistent supply-demand imbalances. Still, UBS foresees potential stabilization by early 2026, especially in top-tier hubs like Beijing, Shanghai, and Shenzhen.

Policy Measures and Geopolitical Outlook

The IMF emphasizes that China’s property sector needs systematic aid. Krishna Srinivasan, IMF's Asia-Pacific Director, estimates that China must allocate up to 5% of GDP over 3–5 years to complete stalled projects and protect homebuyers.

In April 2025, China passed a law supporting private enterprise, promising equal treatment for private and state firms, along with modernization incentives. A separate “bad bank” fund to absorb toxic assets and finish frozen projects is under discussion—seen as vital for rebuilding market trust.

Meanwhile, easing US-China trade tensions offers a favorable backdrop. Washington has initiated contact to resume tariff talks, as Bloomberg reports. Although Beijing remains cautious, signs point toward a thaw, potentially boosting demand in export-driven cities and improving the overall investment climate.

Подсказки: China, real estate, property market, land sales, state developers, Greentown, China Jinmao, Chengdu, Hangzhou, UBS, Bloomberg, IMF, housing recovery, 2025 forecast