Real Estate / Investments / News / Analytics / Russia / Turkey / Georgia / United Arab Emirates / Thailand 08.07.2025

Russians Returning to the Overseas Real Estate Market

Russian demand for overseas real estate began to rebound in 2025 after a decline triggered by sanctions and payment difficulties. From January to June, interest in buying property abroad increased by 6.5% compared to the end of 2024, reports Kommersant. Market participants note that the strengthening of the ruble and the desire to diversify assets have encouraged Russians to return to the international market.

According to Prian.ru, from January to June, demand for overseas real estate grew by 6.5% compared to the previous half-year, although year-on-year it recorded a 24% decline. Analysts from Tranio report similar figures, noting a 6.4% increase in interest. Tatiana Burlakovskaya, CEO of Golden Brown agency, estimates client activity grew by 10–15% over the half-year, while Olga Pankina, COO of Whitewill Dubai, also observed a 10–15% increase in demand year-on-year. These figures indicate that the recovery trend is not isolated and is confirmed by multiple sources.

Alexander Shibaev, Business Director of Kalinka Middle East, highlights a noticeable surge of interest in certain destinations: in Thailand, annual growth could reach 20%, while the Maldives could see 10–15%. Artem Knyazev of Samolet Property Group Bali adds that in Bali, after a 24% drop last year, the number of inquiries rose by 18–20% in the first half of 2025. According to him, currency fluctuations have been the main driver of investors returning to the market.

Philipp Berezin, Lead Analyst at Prian.ru, emphasizes that interest in overseas properties is recovering after a decline that started in the autumn of 2023. Among the reasons for the slump, experts cite sanctions, which complicated money transfers, and the advance demand observed in 2022 and early 2023. According to Berezin, the ruble’s strengthening has again improved the affordability of overseas transactions for Russians. Meanwhile, experts from Whitewill Dubai note that 40–50% of Russians view foreign real estate as an investment for rental income or resale, with returns linked to foreign currency.

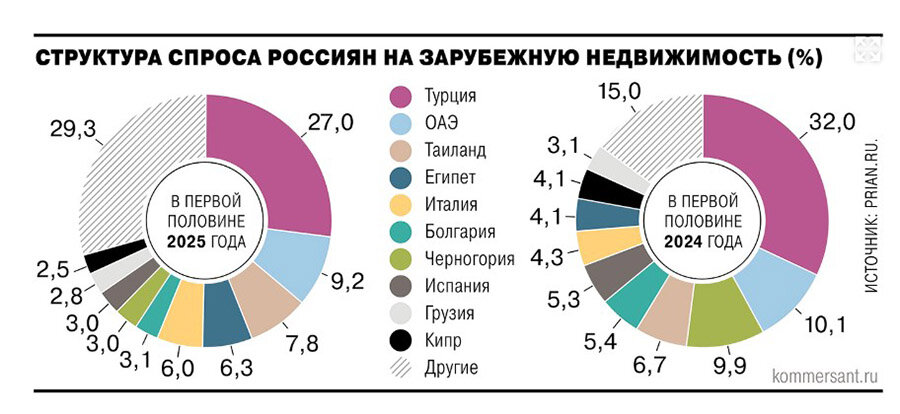

According to Prian.ru, Turkey remains the leader, accounting for 27% of all inquiries, although this share has declined by 5 percentage points over the year. The UAE holds second place with 9.2% (down from 10.1%), while Thailand has strengthened its position, increasing its share to 7.8%. Growing interest is also noted in Egypt and Cambodia, where seaside properties can be purchased with entry thresholds starting at $50,000. Georgia remains relevant, attracting Russians with low property prices on the Black Sea coast and investor-friendly legislation.

According to experts from TBC Bank, the residential real estate market in Tbilisi confidently outpaces the capitals of Eastern and Southeastern Europe in terms of a combination of housing affordability and investment returns, particularly amid rising foreign interest.

The average cost of housing in Tbilisi is around $2,100 per square meter, which is 50–60% lower than prices in Sofia and Bucharest, where they exceed $3,300. For comparison, in Belgrade, the cost per square meter is twice as high as in the Georgian capital. TBC experts emphasize that this price difference attracts investors to Tbilisi over more expensive European capitals.

In 2022–2023, a massive influx of foreign nationals—remote workers, digital nomads, and relocators—caused a sharp increase in rental rates in Tbilisi. This ensured investment yields of around 9% annually, significantly higher than the European average and the highest among all the capitals analyzed in the study. The closest competitors in terms of returns were Chisinau, Bucharest, and Belgrade, but none reached Tbilisi’s level.

The real estate market in Batumi is even more attractive for investors, where 84% of buyers are foreigners, according to Galt & Taggart. Among them, Russian citizens lead with 18%, followed by Israeli citizens with 10%. The remaining 57% are from other countries, including Kazakhstan, Ukraine, and the European Union.

Earlier, analysts from Intermark Global noted that in 2024, the number of transactions by Russians involving overseas real estate for investment purposes fell by 30%, while purchases for relocation abroad dropped by 13%. According to this platform, Thailand remained the leader in the number of purchases by Russians, accounting for a quarter of overseas transactions. However, interest in this country fell sharply: demand dropped by 40% compared to 2023. In Indonesia, primarily in Bali, 17% of Russians’ overseas transactions took place. The UAE ranked third, where Russians’ transactions in 2024 remained at the 2023 level, according to Intermark, although Tranio recorded a 21% decline in interest.

Turkey, once the favorite, has fallen to fourth place: the number of transactions involving Russians has more than halved. According to the Turkish Statistical Institute, around 24,000 properties were sold to foreigners in 2024, 32% less than in 2023. Experts attribute the decline to inflation, the devaluation of the lira, and the tightening of immigration policies, making investments in Turkish real estate increasingly risky. Georgia was not listed in this ranking, but it continued to be one of the key destinations for Russians, as indicated by other analysts. For example, in Tranio’s research, Georgia ranked second in growth, with an increase of 10%.

Tatiana Burlakovskaya estimates that in 2025, the average budget for overseas real estate transactions among Russians was $250,000–270,000, which is 8–10% higher than last year’s figures. Such amounts typically allow buyers to purchase apartments with one or two bedrooms. Expensive properties costing from $500,000, which were previously popular in Europe, are now hardly in demand due to low interest amid the lack of air connections and ongoing geopolitical risks.

Ekaterina Nikitina, founder of Nevestate agency, believes that the positive trend in the overseas real estate market will gradually strengthen, as some buyers have the capital and seek mobility, security, and alternative jurisdictions. However, Tranio analysts do not expect sharp fluctuations in demand without significant external events, while Philipp Berezin emphasizes that geopolitical risks remain the main barrier to the return of interest in European real estate.

See also:

Chinese and Russian Buyers Show Less Interest in Thai Real Estate

How the Turkish Real Estate Market Has Changed: Apartment Prices Rise, Sales Grow

Dubai Launches Platform for Fractional Real Estate Investments via Tokens

Gonio: The Future of Georgia’s Black Sea Resort and Investment Hub

Latvia’s Parliament Approves Ban on Real Estate Deals for Russians and Belarusians

Подсказки: Russia, real estate, overseas property, investments, Georgia, Turkey, Thailand, Dubai, Batumi, Tbilisi, property market, Russian investors