Turkey’s Home Purchase Demand Index Drops

Photo: Unsplash

In May 2025, Turkey’s index of demand for home purchases dropped by 11.3% compared to April, while demand in the rental segment increased by 9.6%, according to a report from Sahibindex, prepared in cooperation with BETAM.

Indices: Purchase vs Rental

According to the study, real housing prices in May fell by 6.2% compared to the same period in 2024. In Istanbul, property prices decreased by 6.4%, in Izmir by 3.1%. The only exception was Ankara, where a slight increase of 0.4% was recorded. However, compared to April, the real price index grew for the first time since July 2023, rising by 1.1 points to reach 155.9. This could indicate a slowdown in the downward trend, though the annual data remains negative.

The average price per square meter in Turkey was 36,275 lira ($907), which is 27.1% higher in nominal terms than a year earlier. In Istanbul, the figure reached 50,000 ($1,250), in Izmir 43,333 ($1,083), and in Ankara 29,303 ($732). This growth reflects inflationary pressure, under which current prices are increasing despite a decline in their real purchasing power.

A different picture was observed in the rental market. The real rent index in May increased by 2.6% compared to the previous month, reaching 178.9. On an annual basis, the index declined by 1.8% across the country, but positive dynamics were seen in the three largest cities: Istanbul (+3.9%), Izmir (+3.3%), and Ankara (+1.8%). Nominally, rental prices grew by 32.9% year-on-year nationwide.

Growing interest in rentals is also reflected in demand indices: compared to April 2025, the indicator rose by 9.6%. Compared to May last year, it remained 1.2% lower, which the report’s authors attribute to seasonal factors.

Conversely, the home purchase demand index dropped from 172.0 in April to 152.5 in May. Despite this, it remains 30.2% higher year-on-year, indicating an overall increase in interest. Nonetheless, short-term dynamics suggest a cooling in buyer activity, possibly due to high prices and inflation expectations.

Official Statistics

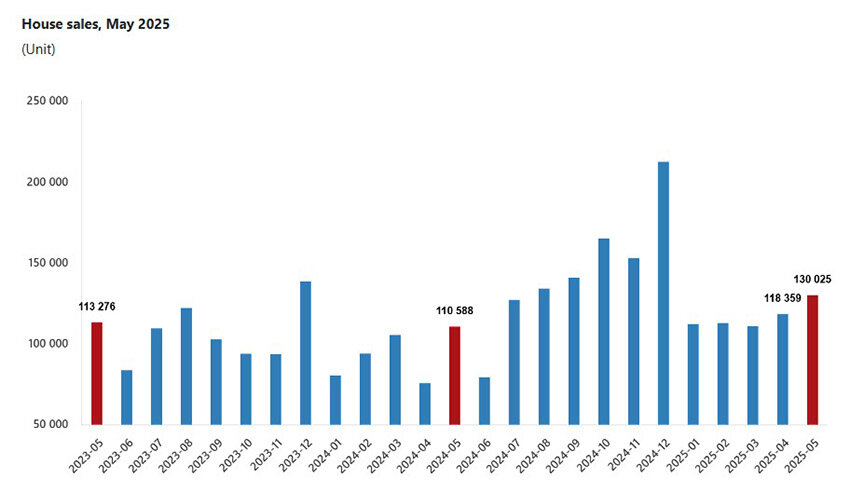

Official data indicates a significant increase in transactions among local residents and a continuing decline in the number of deals involving foreigners. The Turkish Statistical Institute (TÜİK) reports that in May 2025, a total of 130,025 residential properties were sold in the country, 17.6% more compared to the same period in 2024.

The highest number of transactions was recorded in Istanbul (22,103), Ankara (11,975), and Izmir (7,817). The lowest figures were in Ardahan (48), Bayburt (67), and Gümüşhane (91). In the first five months of 2025, 584,170 properties were sold nationwide, an increase of 25.4% compared to the same period in 2024.

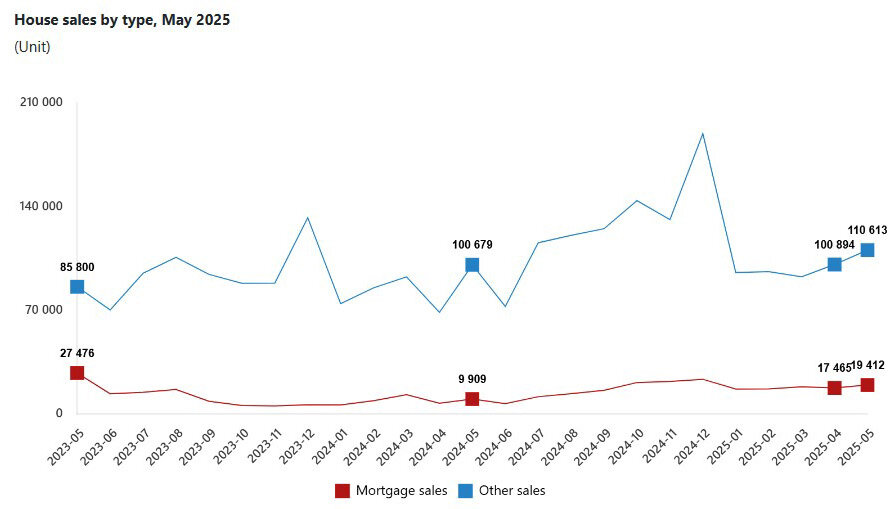

Mortgage sales surged significantly: in May, there were 19,412 such transactions, up by 95.9% compared to a year earlier, making up 14.9% of all deals. Over the five months, mortgage sales totaled 88,606 (+98.7%). Of these, 4,674 transactions in May and 21,062 since the beginning of the year were for new properties. Sales without using a mortgage also increased—by 9.9% year-on-year. In May, their number was 110,613, accounting for 85.1% of all transactions. From the start of the year, the figure grew by 17.7% to reach 495,564.

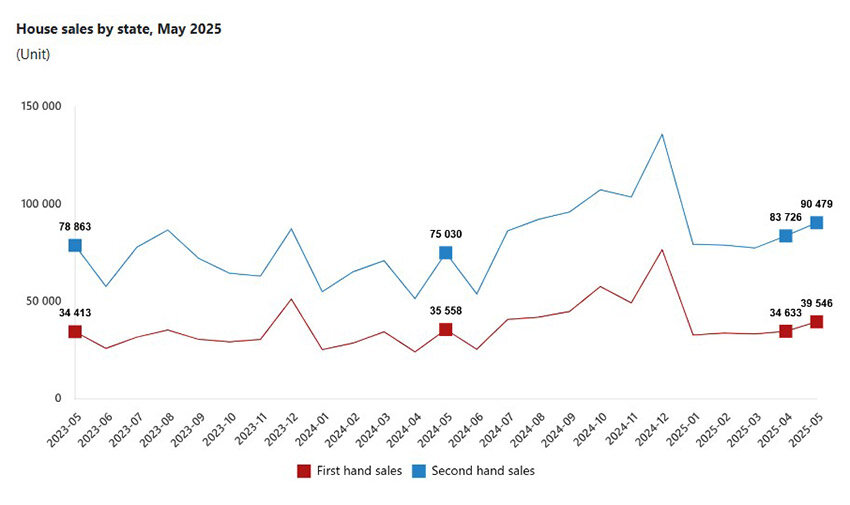

The primary housing market showed an increase of 11.2%, with 39,546 new properties sold in May (30.4% of all transactions). Over five months, 174,055 deals were concluded (+17.7% year-on-year). The secondary market showed even more dynamic growth: 90,479 properties sold in May (+20.6%) and 410,115 since the beginning of the year (+29%).

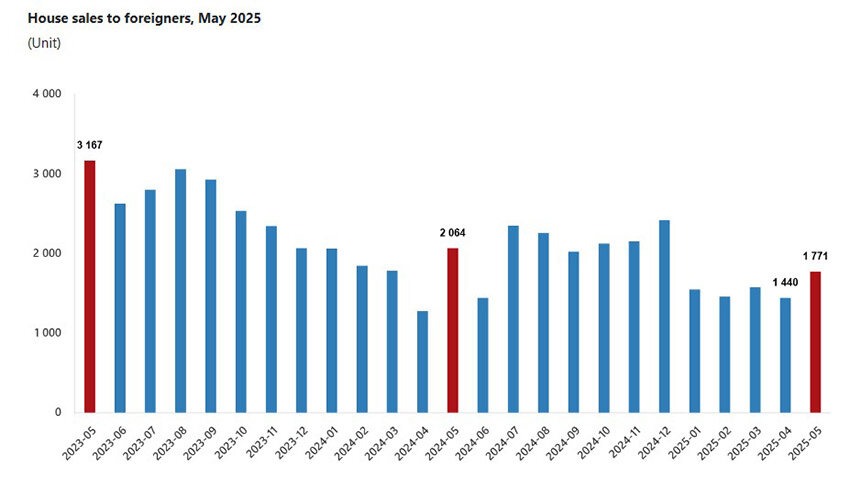

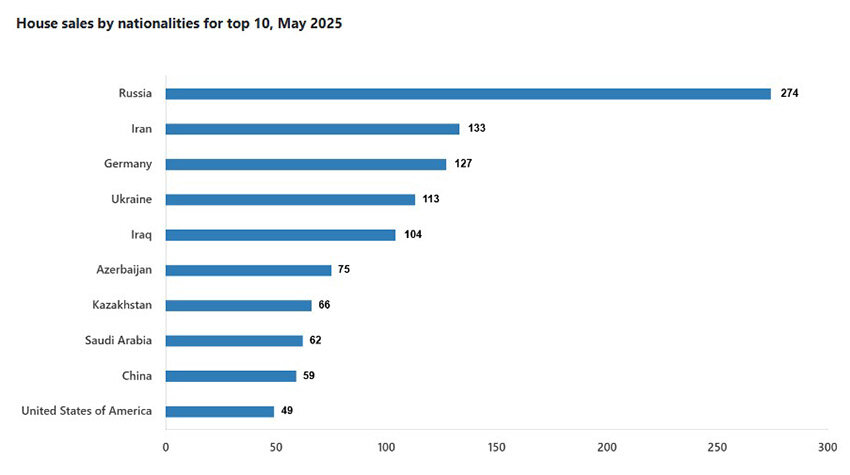

Sales of properties to foreigners in May decreased by 14.2% compared to last year, down to 1,771—representing 1.4% of the total market. Foreigners most frequently purchased real estate in Istanbul (648 properties), Antalya (594), and Mersin (145). The largest number of transactions involved Russian citizens (274), followed by Iranians (133) and Germans (127). From January to May, sales to foreigners decreased by 13.7% compared to the same period in 2024, totaling 7,789 properties.

Market Outlook

According to analysis by Investropa, Turkey’s residential property market is projected to maintain complex dynamics in the second half of 2025. Despite steady growth in nominal prices, real property values continue to decline due to high inflation. This means that purchasing power in real estate is decreasing, even though nominal figures in lira are rising.

Investments are increasingly focused on new developments with energy-efficient features, “smart” apartments, and properties in resort areas. There is growing interest in real estate with high rental potential, especially amid stable demand in the short-term rental segment.

Forecasts suggest nominal price growth of 15–25% annually through 2025–2026. Expected inflation easing to 25–30% by the end of 2026 could stabilize real prices or allow for moderate growth. Gradual interest rate cuts and completion of infrastructure projects—including urban redevelopment and new metro lines—could become growth drivers in certain districts, particularly in Ankara and Istanbul.

Analysts also warn of several risks that could impact the property market in the second half of 2025, including a sharp depreciation of the lira that could lower property values in dollars by 20–30%, as well as political instability that could reduce demand by 10–15%. Other noted threats include a potential global economic downturn, possible changes in foreign property ownership regulations, and natural disaster risks, including earthquakes in Istanbul. These factors could significantly influence investment sentiment and price dynamics in the short term.