read also

Real Estate / Investments / Analytics / Reviews / Research / Georgia / Real Estate Georgia 16.07.2025

Real Estate in Tbilisi: Israeli Citizens Lead Among Foreign Buyers

Demand for real estate in Tbilisi from foreign buyers remains steady. Israeli citizens became the largest group of foreign buyers in Tbilisi during January–May 2025, accounting for 11% of all sales in projects by major developers. Russian buyers made up 2%. Another 10% came from buyers from other countries, according to a report by Galt & Taggart.

Transaction and Construction Dynamics

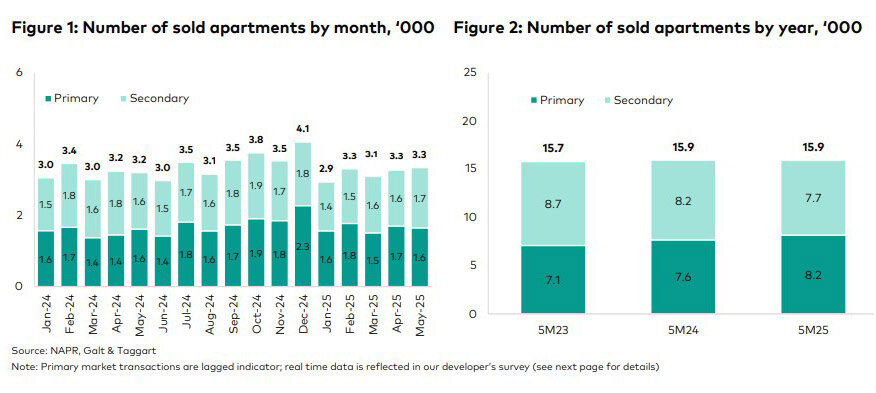

In January–May 2025, Tbilisi recorded 15,865 apartment transactions totaling $1.2 billion. In May, sales increased in both the primary and secondary markets, exceeding the average level for the first four months of 2025 by 6.4% and 11.8%, respectively.

According to the Public Registry, as of May 25, the total number of apartment transactions in Tbilisi was 3,325 units. Sales of existing housing rose by 6.5% compared to the same period in 2024, although for the five months combined, the figure decreased by 6.4%. The number of transactions in the primary market, where figures are affected by registration delays, increased by 2.2% year-on-year.

Building permits for residential construction in May covered 202,700 sq. m, down 18.3% from a year earlier, marking the lowest level since early 2023. Over the five-month period, the total area of new permits reached 1.2 million sq. m (-1.1%). The largest volume was concentrated in the districts of Saburtalo (68,000 sq. m) and Didi Dighomi (61,000 sq. m), although their share has been declining for the second year in a row.

A survey of major developers, covering about 45% of the entire primary market, confirms a recovery in activity. In May, sales in these projects were 6.4% higher than the average for January through April. Year-on-year growth reached 48.1%. Over the five months, these projects sold 3,179 apartments—nearly the same as a year earlier. In complexes scheduled for completion in 2025, 81% of apartments have already been sold. Notably, most of these transactions are conducted using in-house installment schemes offered by developers.

Housing Prices

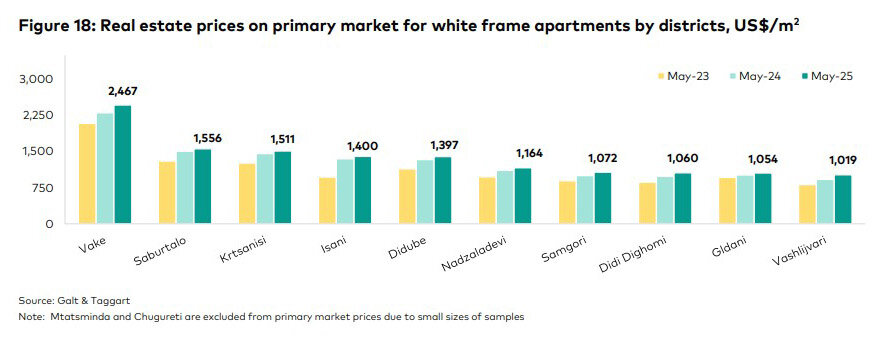

Significant price differences persist across Tbilisi’s districts in the primary market. According to Galt & Taggart, the highest average price for apartments in white frame condition was recorded in Vake at $2,467 per sq. m. This was followed by Saburtalo ($1,556), Krtsanisi ($1,511), Isani ($1,400), and Didube ($1,397). The most affordable districts remain Vashlijvari ($1,019), Gldani ($1,054), Didi Dighomi ($1,060), and Samgori ($1,072). These figures reflect a stable pricing hierarchy: districts with developed infrastructure and high investment appeal maintain strong price levels.

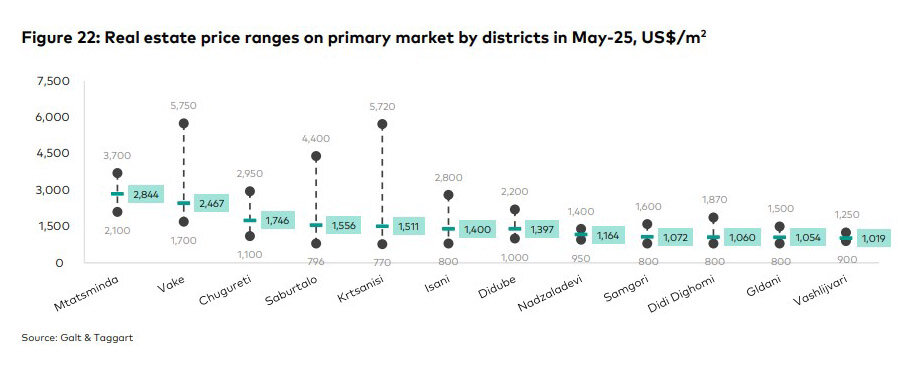

The districts of Mtatsminda and Chughureti were not included in the overall comparative analysis of average prices in the primary market due to a limited number of transactions but are presented separately. In May, the average price in Mtatsminda was $2,844 per sq. m, while in Chughureti it was $1,746, corresponding to the price levels of central districts.

Price ranges within the same district also show high variability. In Vake, prices ranged from $1,700 to $5,750 per sq. m; in Krtsanisi, from $1,100 to $5,720; and in Saburtalo, from $1,000 to $4,400. In Chughureti, prices ranged from $1,100 to $2,950, while in Mtatsminda they varied between $2,100 and $3,700.

More affordable districts such as Samgori, Didi Dighomi, and Gldani exhibited narrower price ranges. For example, in Samgori, prices ranged from $800 to $1,600 per sq. m; in Gldani, from $800 to $1,500; and in Didi Dighomi, from $800 to $1,870. Even within a single district, price spreads can reach 100% or more, reflecting the diversity of formats, locations, and housing categories.

Thus, Tbilisi’s primary market remains multilayered, offering both affordable options in the mass segment and higher-end properties in premium complexes. This makes the market flexible and attractive for both budget-conscious buyers and investors seeking quality, income-generating assets.

Buyer Preferences and Rental Yields

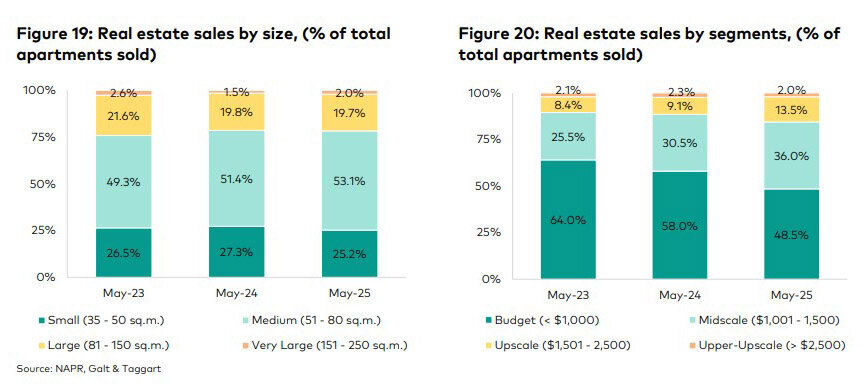

Mid-sized apartments of 51–80 sq. m remain the most popular in Tbilisi, accounting for 53.1% of transactions. Next were units of 35–50 sq. m (25.2%), followed by larger apartments of 81–150 sq. m (19.7%). Large properties (151–250 sq. m) represented only 2% of deals.

The most active segment in terms of transaction volume was the price range of $1,001–$1,500 per sq. m, capturing 53.1% of all sales. The share of budget housing (below $1,000) fell below half for the first time in recent years, to 48.5%. Meanwhile, interest in higher-priced properties has increased: the $1,501–$2,500 segment accounted for 13.5% of the market, up from 9.1% a year earlier.

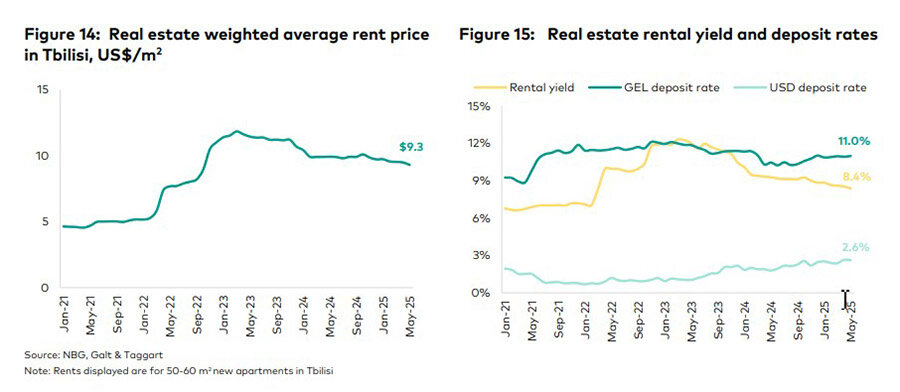

Rental rates in Tbilisi are declining. In May, the average rental price was $9.3 per sq. m (-2% MoM). The most expensive districts remain Vake ($14.3) and Mtatsminda ($11.9), while the most affordable are Samgori ($7.6), Vashlijvari ($7.8), and Gldani ($7.9). The average rental yield in Tbilisi stands at 8.4%, exceeding the levels seen in many other world capitals.

Foreign Capital and Tourism Investment

Georgia attracts foreigners not only with high yields but also with safety and simplified property purchase procedures. For Israeli citizens, who have significantly increased their activity in both Tbilisi and Batumi, many families cannot afford property back home due to extremely high prices—real estate in Georgian cities is 4–5 times cheaper.

Foreign interest in Georgia extends beyond residential real estate. In the hotel and tourism infrastructure segment, there has been an inflow of capital from countries with high geopolitical risks. Large development projects are involving companies from Israel and the UAE. In 2024–2025, investments in the hotel sector became a tool for asset diversification and protection from instability.

International hotel brands like Wyndham, Marriott, Hilton, and Radisson continue to expand their presence in Georgia, helping to improve the sector’s quality. Georgia actively promotes itself as a predictable and open partner, offering investors favorable conditions, including residence permits through property purchases, low taxes, and a growing tourist influx.

These factors are driving sustained demand for hotels and serviced apartments and are strengthening economic ties with Israel and the Gulf states. Investments in real estate, especially in the hospitality sector, are becoming not only a means of earning income but also a pillar of long-term resilience.