read also

Real Estate / Investments / Analytics / Research / Ratings / USA / Japan / Switzerland / United Arab Emirates / Netherlands / Canada / Spain / Germany / United Kingdom / France / Italy 26.09.2025

Housing Market Bubble Risks in 2025 – UBS Data

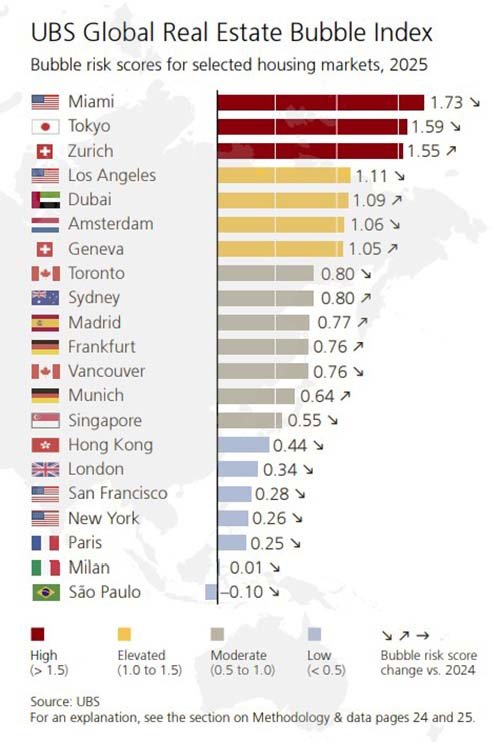

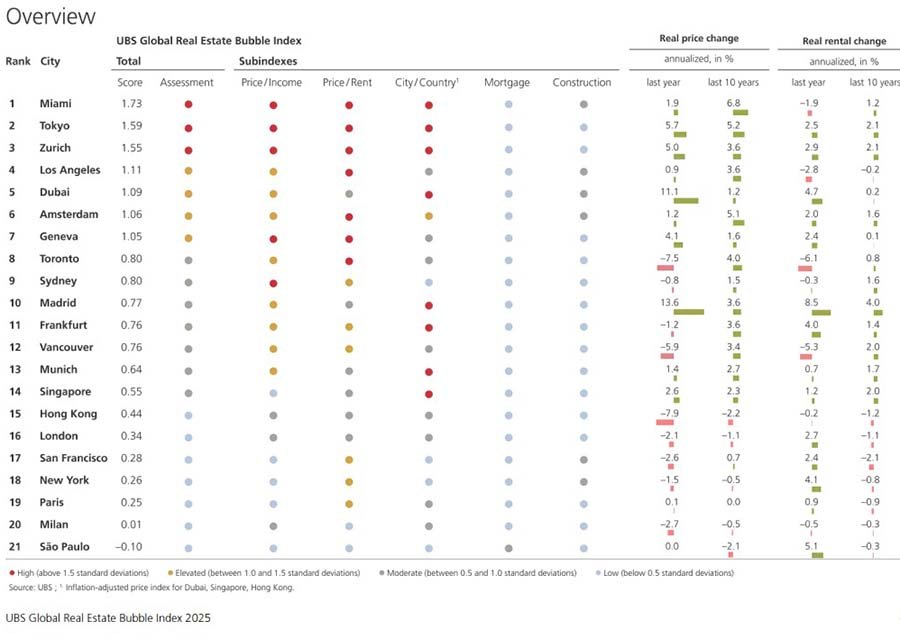

Housing market overheating risks have been declining for the third consecutive year, note UBS analysts. Prices in major cities have stabilized, and speculative demand has decreased, although affordability for buyers remains extremely low. The most overheated market is Miami, followed by Tokyo and Zurich. London, Paris, and Milan have shifted into the low-risk zone.

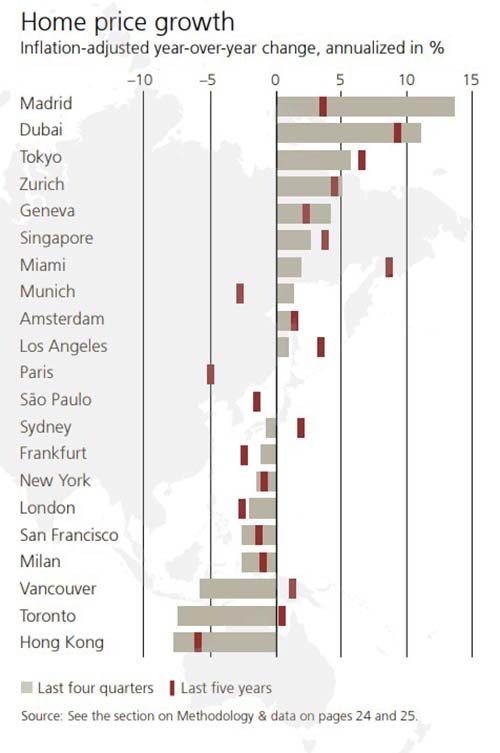

Housing prices in major cities have remained almost unchanged over the past year, marking the weakest result in a decade. In the eurozone, the dynamics were close to zero, while in the U.S. growth slowed significantly, and in London, Paris, Vancouver, and Hong Kong prices continued to decline. The opposite trend is seen in Madrid, where real growth reached 14%, in Dubai with an 11% increase, and in Tokyo with more than 5%. Over a five-year period, Dubai and Miami led the way, gaining nearly 50%. Tokyo (+35%) and Zurich (+25%) also saw significant increases, while Paris and Hong Kong lost more than 20%.

Imbalances between housing prices, rental rates, and incomes remain the main sign of overheating. In high-risk cities, prices have risen by nearly a quarter over the past five years, while rents increased by about 10%, and household incomes by only around 5%. In less overheated cities, the opposite pattern is observed: real housing prices fell by about 5%, while rents and incomes remained almost unchanged. This gap confirms that the growth is driven not by fundamentals, but by investment demand.

Housing affordability remains extremely low in many megacities. In Hong Kong, buying a 60 sq. m. apartment requires about 14 annual incomes of an average worker; in London and Tokyo – more than 10 years. In Paris, the figure is around 9 years, in Milan – about 8 years. In New York and San Francisco, purchasing a home takes about 7 annual salaries, and slightly more in Los Angeles. A more balanced situation is observed in Miami, where about 5 years of income is enough, while São Paulo is the most affordable – less than 4 years.

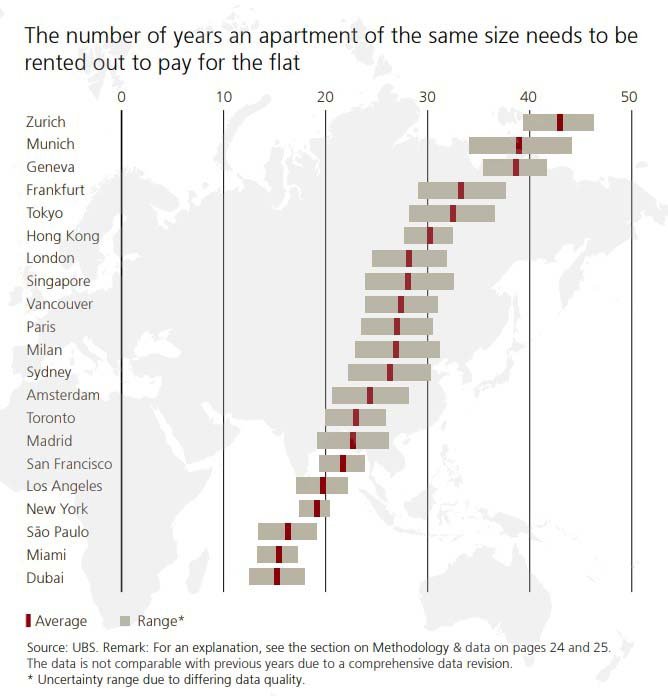

Payback periods through rental highlight major differences between markets. In Zurich, it takes 43 years for an apartment purchase to pay off; in Geneva, Munich, and Frankfurt – 30–31 years. In Milan and Paris it takes 27 and 25 years, in Los Angeles – 23, in Singapore, Vancouver, and Toronto – 22. New York and San Francisco show similar results – 21 years each. In Dubai, the payback period is around 15 years, and in São Paulo – 12–13.

Risk categories:

High – Miami (index 1.73), Tokyo (1.59), and Zurich (1.55). These markets have shown the fastest price growth in recent years with minimal increases in rents and incomes;

Elevated – Los Angeles, Dubai, Amsterdam, and Geneva – in the range of 1.0 to 1.5. These cities are characterized by high prices with relatively low yields, making them vulnerable to changes in interest rates and economic conditions;

Moderate – Singapore, Sydney, Vancouver, Toronto, Madrid, Frankfurt, and Munich (0.5–1.0). Growth has slowed in these cities, but imbalances remain. In Madrid, for example, housing rose 14% over the past year, while in Frankfurt and Munich prices are 20% below their 2022 peak;

Low – London, Paris, Milan, New York, San Francisco, and São Paulo (below 0.5). Housing in London is 20% cheaper than its 2016 peak, and Paris lost the same percentage in five years. São Paulo shows the lowest index among all cities in the study (–0.10), making it the most resilient market in the sample.

Outlook. UBS experts believe that the key factors for real estate markets in the coming years will be inflation levels and central bank policies. The expected rate cuts in 2026 could support housing demand, especially in cities where affordability is critically low. At the same time, a structural shortage of new construction will continue to limit supply in major metropolitan areas. Under these conditions, real estate will remain a sought-after safe-haven asset, but it is precisely the imbalance between prices, rents, and incomes that will determine which cities stabilize and which face further corrections.

Read more:

Global Real Estate Outlook: Investors Compete for Top Locations

The Ultra-Wealthy Are Growing in Number: Demand for Luxury Real Estate Will Increase

Investment Priorities 2025: Where Global Capital Is Heading