Housing Prices Accelerate Across the EU: Portugal, Bulgaria, and Croatia Lead the Growth

Photo: Unsplash

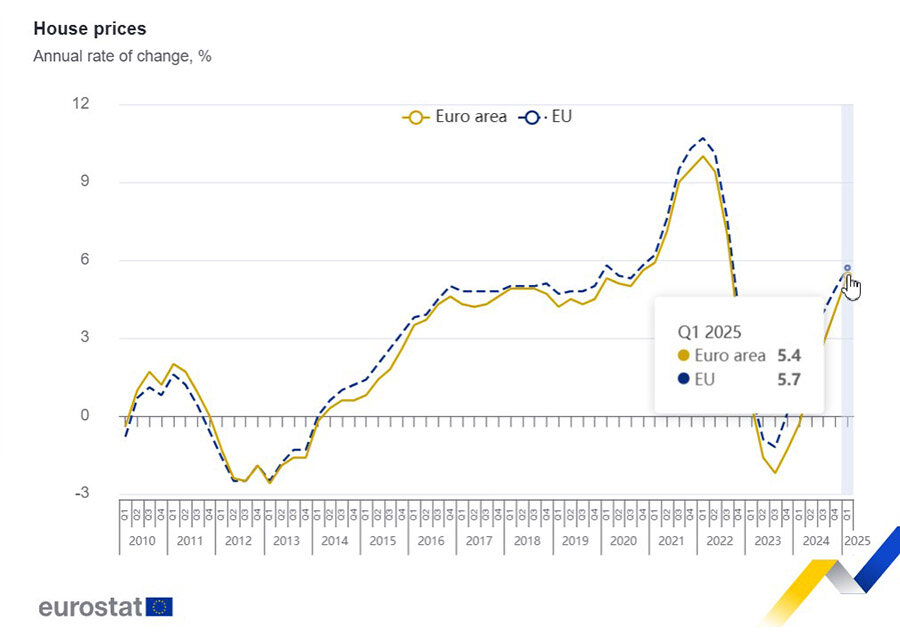

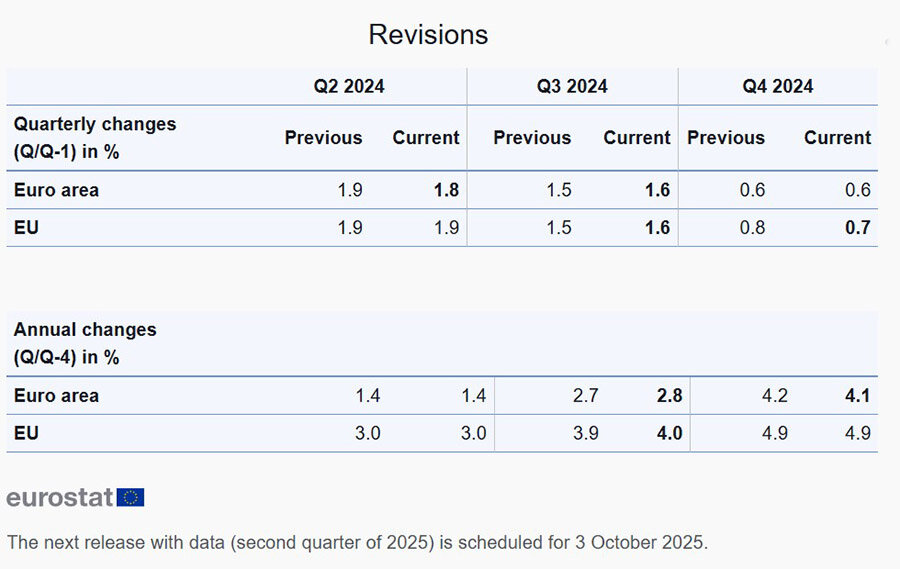

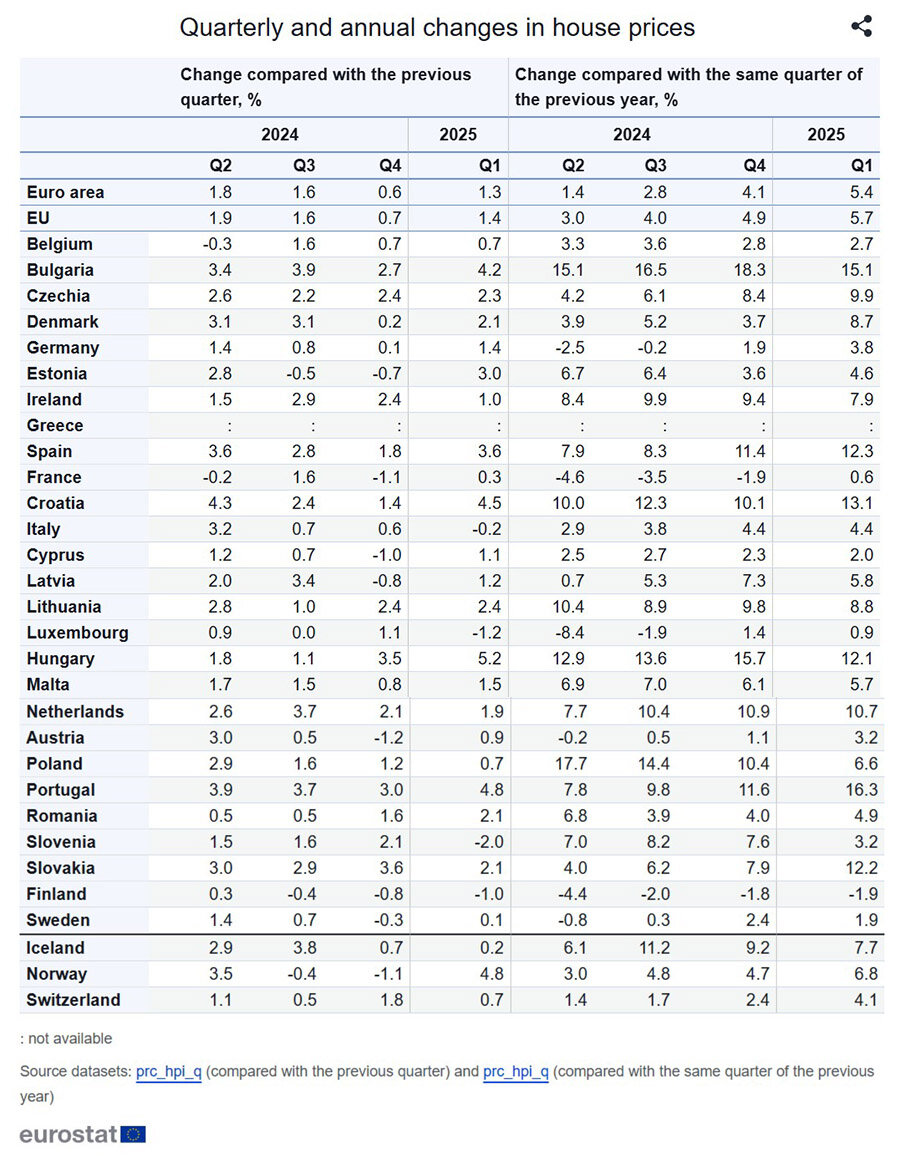

The cost of real estate in Europe continues its steady rise. According to Eurostat data, in the first quarter of 2025, the HPI index increased by 5.4% in the euro area and by 5.7% in the EU compared to the same period last year. For comparison, in Q4 2024, the figures stood at 4.1% and 4.9%, respectively. Over the first three months of this year, growth was 1.3% and 1.4%.

The most significant increase has been observed in Southern and Eastern Europe. Portugal led the way (+16.3%), followed by Bulgaria (15.1%) and Croatia (13.1%). High values were also recorded in Slovakia (12.2%), Spain (12.3%), Hungary (12.1%), the Czech Republic (9.9%), and Lithuania (8.8%). In Italy and Germany, the increase was 4.4% and 3.8%, respectively. In France, where a decline had previously been noted, an increase of 0.6% was registered at the beginning of 2025—the first since early 2023.

Negative annual dynamics were observed only in Finland (–1.9%). On a quarterly basis, declines were also noted in Slovenia (–2.0%), Luxembourg (–1.2%), and again in Finland (–1.0%). Slightly positive results were seen in Cyprus (+2.0%) and Sweden (+1.9%).

Compared to the end of 2024, the most notable quarterly increases were shown by Portugal (+4.8%), Hungary (+5.2%), and Croatia (+4.5%). This indicates sustained high demand, including from investors. In several countries, on the other hand, negative figures were recorded, which may signal a local correction.

In the largest EU economies, the situation remains mixed. Germany continues its stable recovery, with +1.4% compared to the previous quarter and +3.8% year-on-year. In France, growth is limited to 0.3% over three months and 0.6% for the year. Italy shows minimal changes: –0.2% in Q1 and +4.4% compared to early 2024. Poland, which previously showed one of the highest growth rates, is losing momentum. While in mid-2024, the annual figure exceeded 17%, by early 2025, it had dropped to 6.6%. Similar dynamics are observed in Lithuania (from 10.4% down to 8.8%) and Latvia (from 7.3% down to 5.8%).

Eurostat clarifies that the HPI index covers transactions made by households for the purchase of all types of housing—both new and existing. The aggregate indicator is calculated as a weighted average, considering GDP in purchasing power standards. The data are not seasonally adjusted and do not include figures for Greece, which remain unavailable.

According to Catella research, in the first quarter of 2025, the average price increased to €5,696 per square meter, up 0.9% compared to the end of 2024. The most expensive cities remain Geneva (€15,720), Zurich (€13,870), and London (€13,440). The lowest values were recorded in the Finnish cities of Jyväskylä and Oulu—around €2,240.

In some locations, price hikes were particularly pronounced. In Madrid, prices rose by 11.9% in the second half of 2024; in Gothenburg by 10.5%; and in Copenhagen by 9.6%. Meanwhile, this is happening against the backdrop of declining new construction volumes. In 2024, fewer than 250,000 building permits were issued in Germany—26% fewer than the previous year. In France, construction volumes returned to 2016 levels, while in the Netherlands, there was an 11% decrease. According to CBRE, the housing deficit in Europe is estimated at around 9.6 million units, or 3.5% of the entire housing stock.

The increasing cost of ownership is accompanied by rising rental burdens. In the first quarter of 2025, the average rental rate in Europe stood at €20.02 per square meter per month, which is 2.4% higher than in Q4 2024. The highest rates were recorded in Dublin (€40), London (€39.3), and Geneva (€34.5). The most affordable cities remain Leipzig (€10.3), Liège (€11.05), and Graz (€11.1).

In Germany, rental rates have increased across all cities covered by the research. In Munich, rates reached €24.5 per sqm, in Frankfurt €19.5, and in Stuttgart €18.3. Despite high levels, demand remains stable, indicating a persistent shortage of supply.

The average yield on residential real estate in Europe in Q1 2025 was 4.58%, unchanged from the second half of 2024. The highest yields were recorded in Cork and several Polish cities (ranging from 5.75% to 6.25%), while the lowest were in Stockholm (2.5%), Zurich, and Geneva (both at 2.7%).

According to Eurostat, the share of tenants living in overcrowded housing rose from 20.4% in 2014 to 24.4% in 2024. The increase was particularly noticeable in Germany—from 11.5% to 18.4%. In Belgium, the figure rose by 9 percentage points, in Spain by 8, and in Ireland by 7.9.

The European Commission notes that in 2024, the house price-to-disposable income ratio exceeded 145% of the 2000–2019 average. Particularly high levels were recorded in Austria, Germany, and the Netherlands. Analysts at Catella emphasize that these trends pose risks to social and economic stability.

Read also:

Life and Costs in Europe in 2025: A Detailed Guide

The EU Tightens Rules for Visa-Free Suspension: New Grounds and Longer Periods

Summer 2025: Interest in Travel to Europe Declines Due to Prices and Geopolitical Uncertainty

Business Visas for Entrepreneurs in Europe: Where It’s Easier for Foreigners to Start a Business in 2025

VAT Changes in Central and Eastern Europe in 2025: Key Reforms and New Risks