read also

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Sweden Urges Citizens to Hold Cash for Emergencies

Sweden Urges Citizens to Hold Cash for Emergencies

Indonesia Faces Growing Credit Rating Pressure

Indonesia Faces Growing Credit Rating Pressure

Poland Rethinks Rate Cuts as Iran War Risks Rise

Poland Rethinks Rate Cuts as Iran War Risks Rise

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Housing Market Enters Moderate Cooling Phase

UAE Housing Market Enters Moderate Cooling Phase

Turkey’s Housing Market in June 2025: Foreign Sales Begin to Rise

Photo: Pexels

Turkey’s housing market saw a notable revival. Property sales increased in June and throughout the first half of the year. Domestic demand remains the key driver of this recovery. For the first time in a long period, sales to foreign buyers also showed growth, according to the Turkish Statistical Institute (TÜİK).

Overall Sales Trends

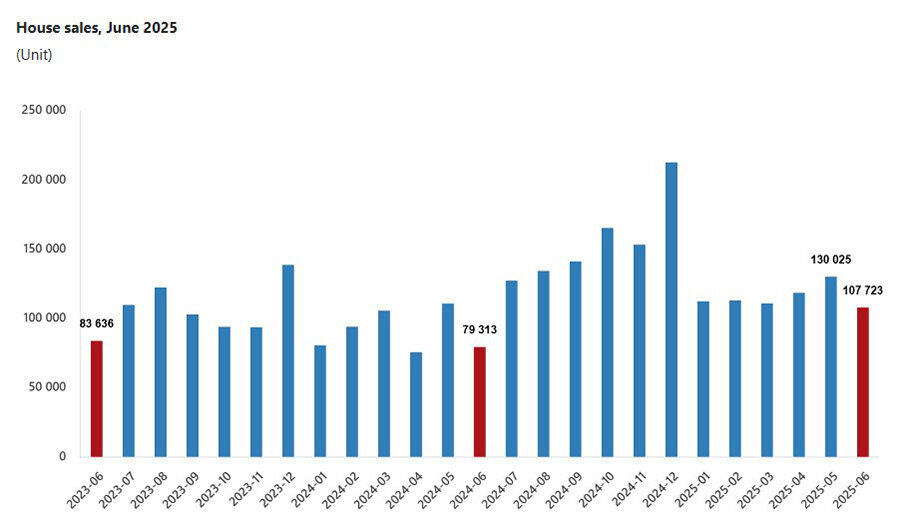

The total number of residential real estate transactions in Turkey continues to rise. In June 2025, 107,723 units were sold, up 35.8% compared to June 2024. The most active regions were Istanbul (17,656 sales), Ankara (9,428), and Izmir (5,987). The lowest sales were recorded in Ardahan (38), Bayburt (62), and Hakkari (81).

During the first half of 2025, 691,893 properties were sold in Turkey, a 26.9% increase year-over-year. The strong June performance exceeded the average semi-annual pace, pointing to growing momentum.

Mortgage and Market Segments

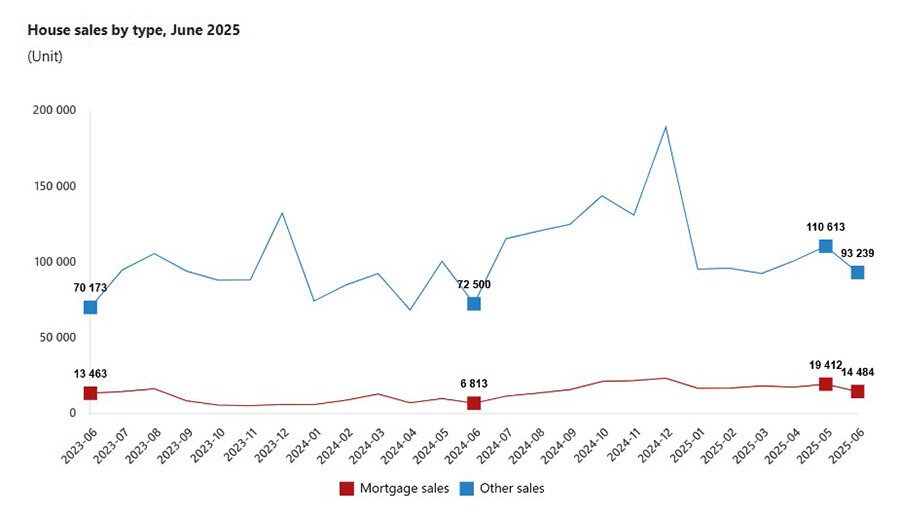

In June, 14,484 mortgage-backed deals were completed — 112.6% more than the previous year, accounting for 13.4% of total sales. For the first half of the year, mortgage sales reached 103,090 — nearly double the same period in 2024. Of these, 3,384 in June and 24,446 for the half-year involved new builds.

Meanwhile, 93,239 transactions were made without loans in June — up 28.6% year-over-year, comprising 86.6% of all deals. In the first six months, this figure rose 19.3% to 588,803.

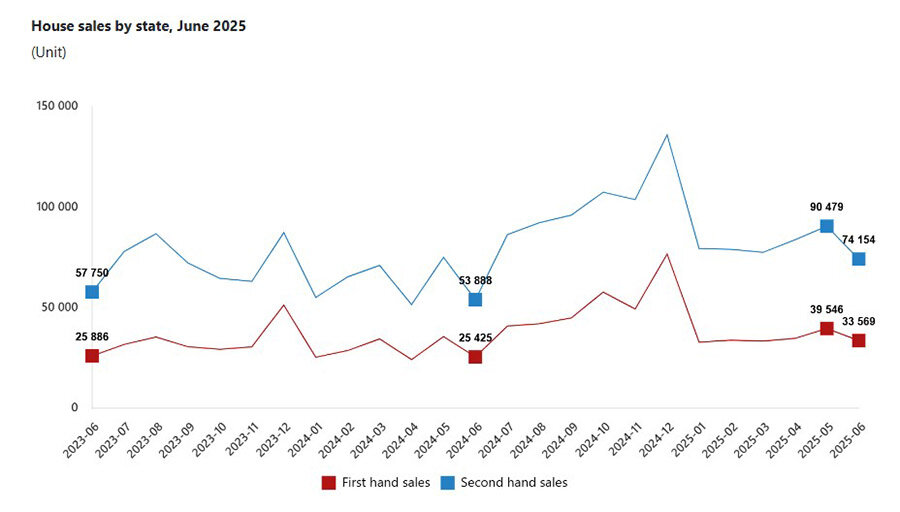

New home sales in June totaled 33,569, an increase of 32% over June 2024. For January–June, they rose 19.8% to 207,624 units. The secondary market showed even stronger dynamics: 74,154 resales in June (+37.6%) and 484,269 year-to-date (+30.3%).

Foreign Buyers Return

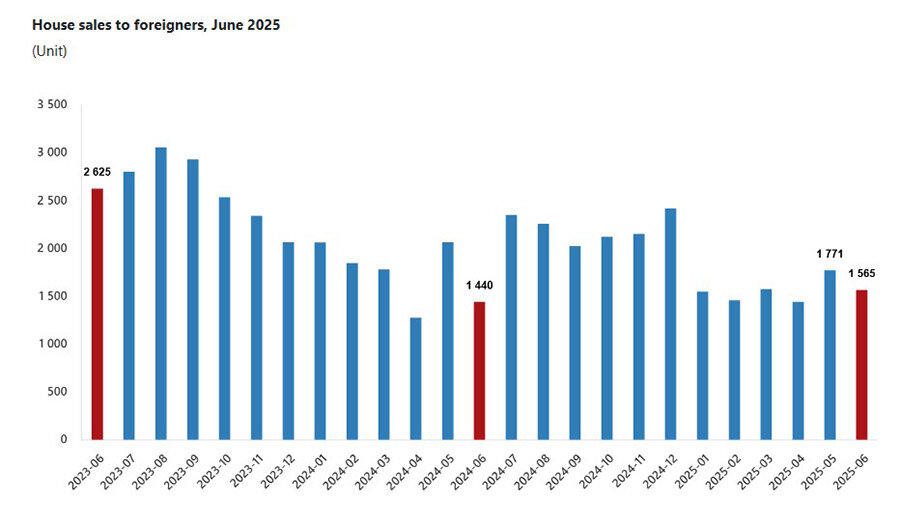

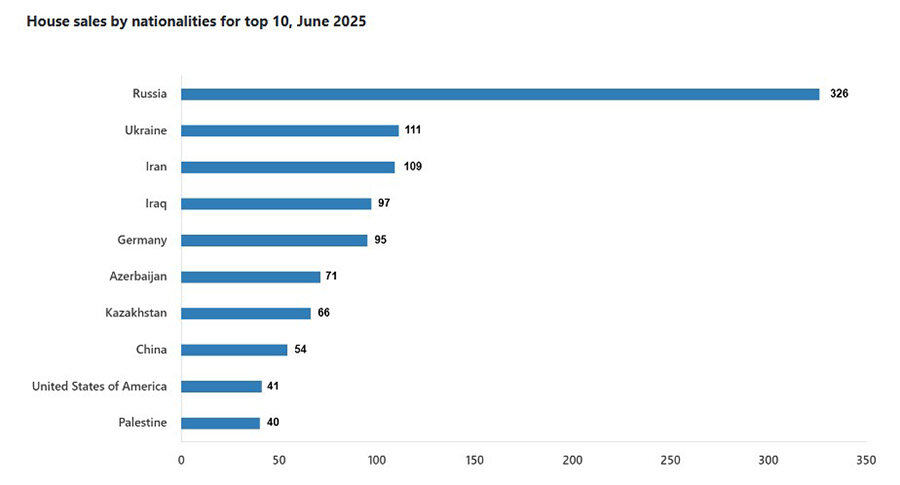

For the first time in over a year, June 2025 saw an 8.7% increase in foreign buyer activity, reaching 1,565 transactions — or 1.5% of the total market. The main buyers were Russians (326), Ukrainians (111), and Iranians (109). Regionally, Antalya led with 603 deals, followed by Istanbul (521) and Mersin (128).

Just a month earlier, sales to foreigners had dropped by 14.2% year-over-year to 1,771. Russia led with 274 deals, followed by Iran (133) and Germany (127). For the first five months of 2025, foreign purchases were down 13.7% to 7,789 units, and for six months — down 10.6% to 9,354.

Expert Forecasts

In the second half of 2025, Turkey’s housing market is expected to continue its upward trend — but the sustainability of this growth is uncertain. According to Investropa, nominal prices are projected to rise by 15–25%, driven by internal demand, a rebound in mortgage lending, and major infrastructure projects. However, with inflation exceeding 50% and a volatile currency, real growth will remain weak. Buyers and investors are losing purchasing power, and pent-up demand is not translating into sustained real value growth.

Analysts also estimate that Turkey’s residential market volume could grow from $110 billion in 2025 to $187 billion by 2030 — implying an average annual growth rate of 11%. Yet these forecasts don’t factor in macroeconomic and political risks, including institutional pressures and increasing authoritarianism.

In July 2025, an Istanbul court sentenced Mayor Ekrem İmamoğlu, leader of the main opposition CHP party, to one year and eight months in prison for insulting a prosecutor, Reuters reports. The move followed his arrest in March on corruption charges and triggered widespread protests, intensifying concerns over democratic backsliding.

Mordor Intelligence projects 6–7% annual growth in 2026, with secondary housing outperforming, while the primary market will depend heavily on mortgage access. Property Turkey expects that interest rate cuts by the Central Bank will trigger a short-term mortgage boom — especially for new builds. However, this effect may be offset by inflation spikes and declining confidence in the Turkish lira.

Other influencing factors include post-earthquake reconstruction programs, new developments in Istanbul and Ankara, and demographic trends. However, major risks remain: high inflation, currency instability, political uncertainty, and delays in state initiatives.

In summary, Turkey’s housing market will likely show nominal growth over the next 12–18 months — but without real gains. In a context of macroeconomic volatility, political pressure, and currency devaluation, short-term gains won’t guarantee long-term stability.

Подсказки: Turkey, real estate, foreign investors, statistics, mortgage, Antalya, Istanbul, inflation, property sales, construction