read also

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Israel Housing Market Eyes a Reset in 2026

Israel Housing Market Eyes a Reset in 2026

Real Estate Investment Declines in Southeast Europe in 2025

Real Estate Investment Declines in Southeast Europe in 2025

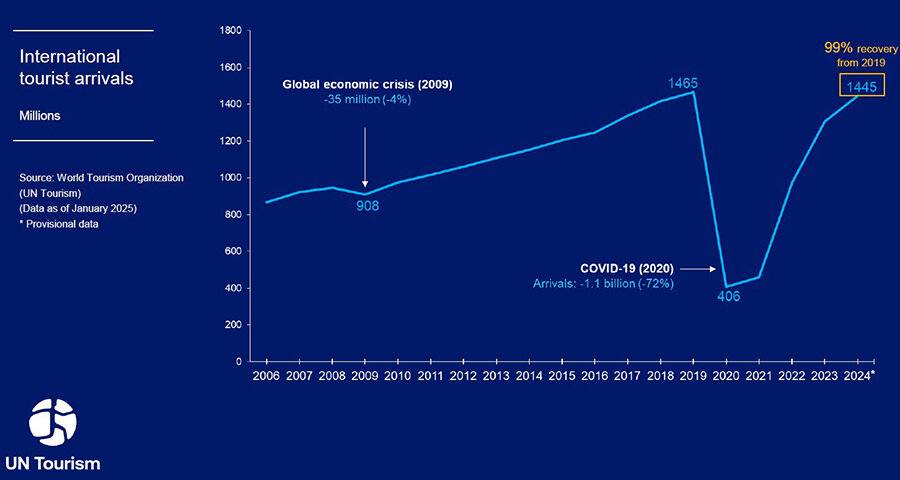

International Tourism Fully Recovers After the COVID-19 Pandemic

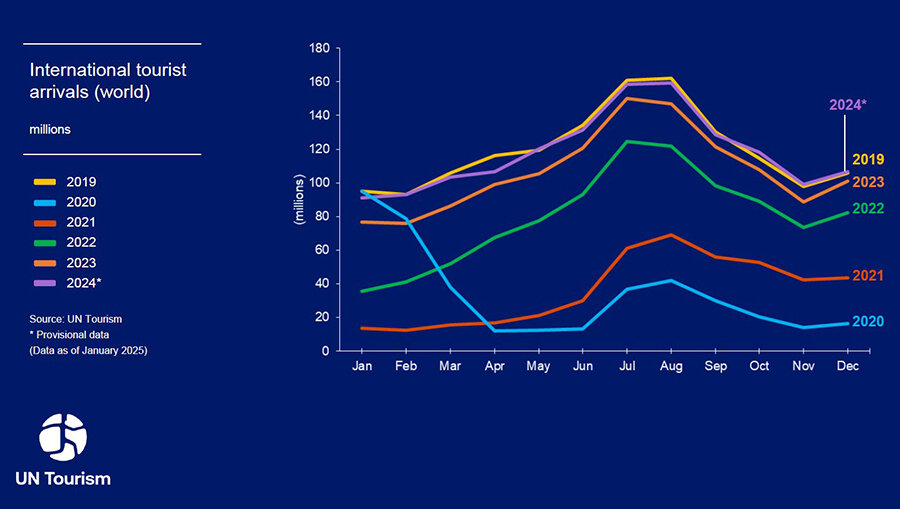

The UN Tourism World Tourism Barometer reports that in 2024, approximately 1.4 billion travelers took international trips, reaching 99% of pre-pandemic levels. This marks an 11% increase compared to 2023, with 140 million more trips recorded.

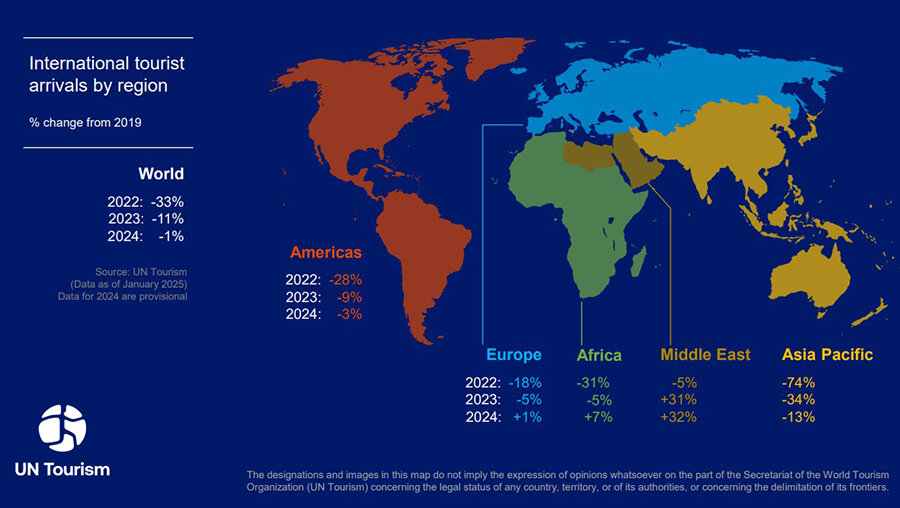

Regional and Country-Specific Tourism Trends

The Middle East remained the strongest-performing region compared to 2019, recording 95 million international arrivals in 2024—32% above pre-pandemic levels and 1% more than in 2023.

Africa welcomed 74 million tourists, surpassing 2019 by 7% and showing a 12% increase from 2023.

Europe, the world's most visited region, recorded 747 million international arrivals in 2024, surpassing pre-pandemic levels by 1% and growing 5% year-over-year. This was driven by strong intra-regional travel demand. However, Central and Eastern Europe still face challenges due to ongoing geopolitical conflicts.

In North and South America, international arrivals reached 213 million, 97% of 2019 levels but still 3% below pre-pandemic figures. However, the Caribbean and Central America have already exceeded 2019 levels. Compared to 2023, the region saw a 7% growth.

The Asia-Pacific region continued its rapid recovery in 2024, reaching 87% of pre-pandemic levels (316 million arrivals), a significant jump from 66% at the end of 2023. The region recorded a 33% year-over-year growth, adding 78 million additional visitors.

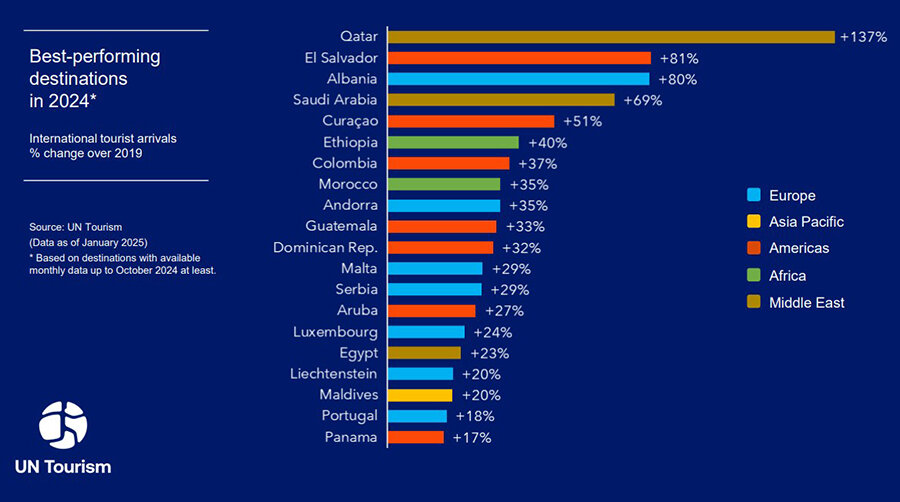

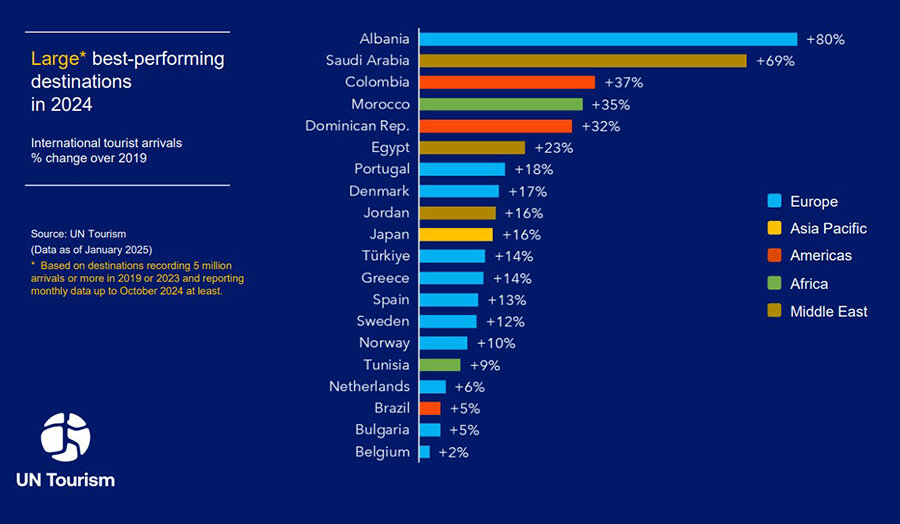

Among individual countries, El Salvador (+81%), Saudi Arabia (+69%), Ethiopia (+40%), Morocco (+35%), Guatemala (+33%), and the Dominican Republic (+32%) surpassed pre-pandemic arrivals. Meanwhile, Qatar (+137%), Albania (+80%), Colombia (+37%), Andorra (+35%), Malta (+29%), and Serbia (+29%) reported remarkable growth in late 2024 compared to the same period in 2019.

The full recovery of international tourism in 2024 also had a positive impact on related industries. According to the UN Tourism report, international air travel and flight operations returned to pre-pandemic levels by October 2024 (IATA). In November, global hotel occupancy reached 66%, slightly below 69% in November 2023 (STR data).

Tourism Revenue in 2024

Preliminary estimates suggest that tourism revenue in 2024 reached $1.6 trillion, 3% more than in 2023, and 4% higher than in 2019 (adjusted for inflation). As global growth stabilizes, average spending per traveler is gradually returning to pre-pandemic levels. After peaking at nearly $1,400 per traveler in 2020-2021, spending settled at around $1,100 in 2024, still above the $1,000 pre-pandemic average.

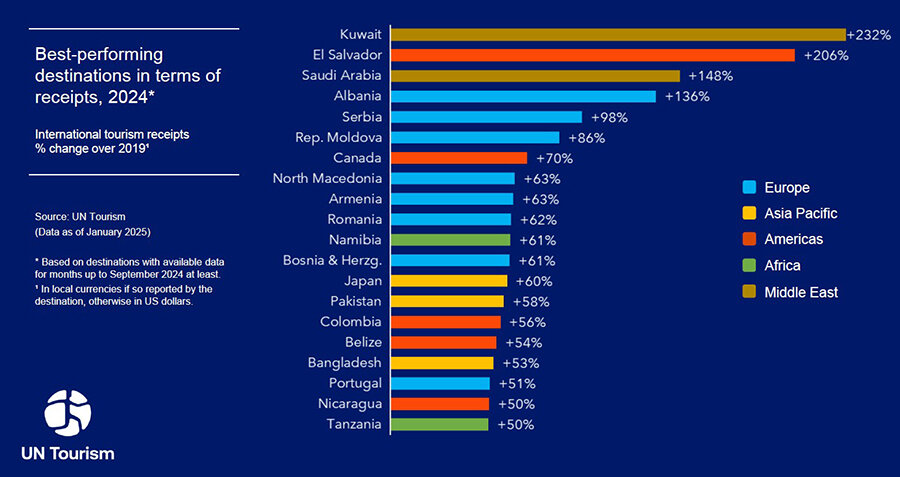

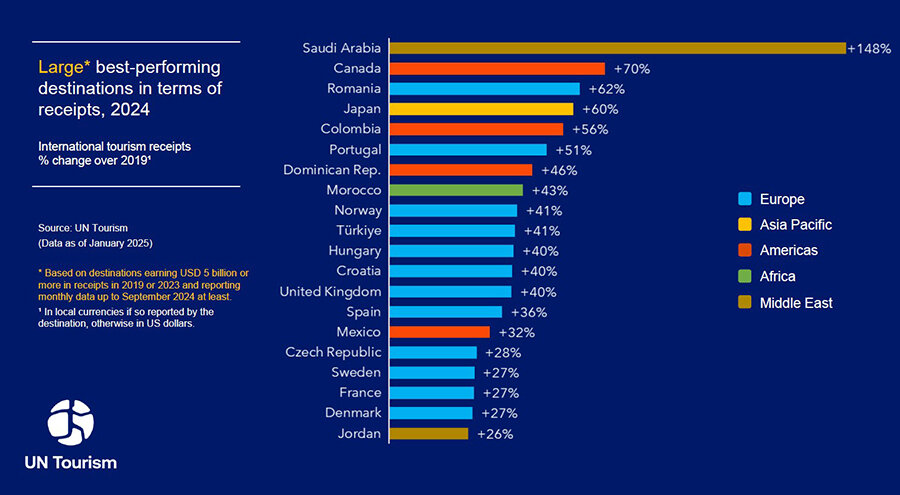

Total tourism export earnings (including passenger transport) reached a record $1.9 trillion, about 3% higher than pre-pandemic levels. Several destinations reported significant revenue growth in the first 9-11 months of 2024, including:

Kuwait (+232%)

El Salvador (+206%)

Saudi Arabia (+148%)

Albania (+136%)

Serbia (+98%)

Moldova (+86%)

Canada (+70%)

Among the top revenue-generating tourism markets, the United Kingdom (+40%), Spain (+36%), France (+27%), and Italy (+23%) saw significant revenue growth compared to 2019.

Meanwhile, Georgia's tourism industry achieved record-breaking performance. The country surpassed its four-year peak in visitor numbers and set a new 14-year revenue record. According to the National Bank, Georgia’s tourism revenue grew from $659 million in 2010 to $4.4 billion in 2024.

Global Tourism Investments

Investments in the tourism sector continue to rise, with growing interest in sustainable and innovative projects, according to a Financial Times report published in collaboration with UN Tourism and Diriyah Gate Company.

From 2019 to 2023, 1,943 foreign direct investment (FDI) projects were announced in the tourism sector, attracting $106.7 billion in investments and creating 259,800 jobs.

? Regional Investment Highlights:

Europe: 867 projects, representing 44.6% of global investments.

Asia-Pacific: FDI in tourism grew by 59.5% from 2022 to 2023, while total investment rose 125.3%.

Latin America & Caribbean: 221 tourism investment projects brought in $20.5 billion and created 73,400 jobs.

Middle East & Africa: 314 FDI projects worth $18.1 billion, generating 40,700 jobs.

Outlook for 2025: Growth & Challenges

In 2025, international tourist arrivals are expected to grow by 3-5%, assuming continued economic recovery in the Asia-Pacific region and stable growth in other regions. The projection depends on favorable economic conditions, declining inflation, and no major geopolitical escalations.

The forecast reflects a stabilization of growth following the strong post-pandemic recovery of:

✔ +33% growth in 2023 (compared to 2022)

✔ +11% growth in 2024 (compared to 2023)

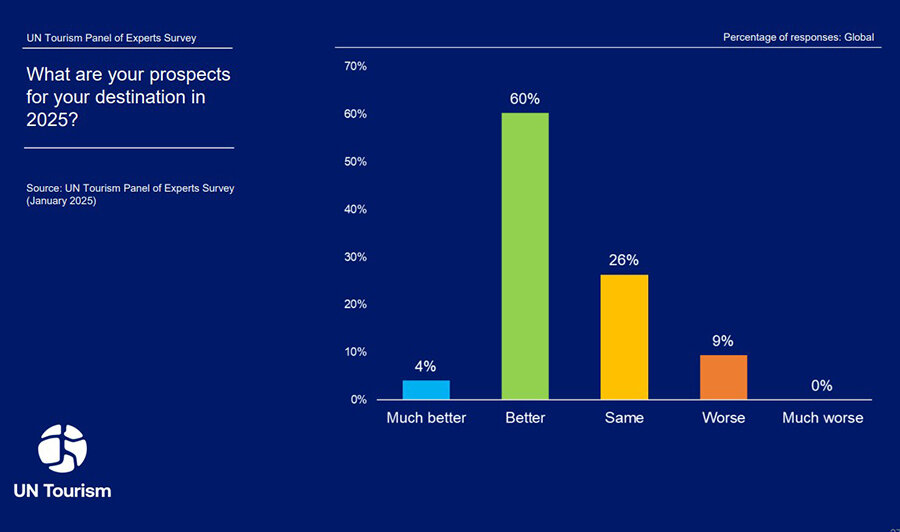

? UN Tourism’s confidence index shows 64% of experts believe 2025 will be “better” or “much better” than 2024, while only 9% expect conditions to worsen.

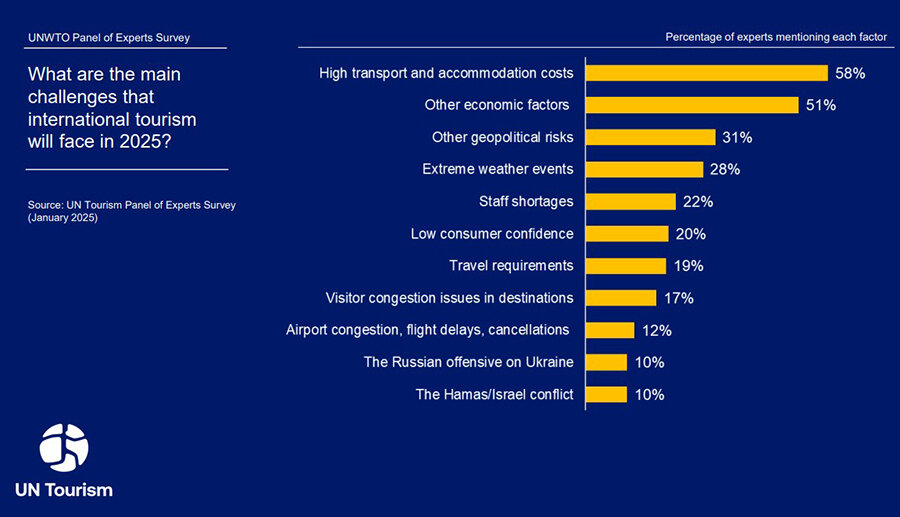

However, economic and geopolitical risks remain significant. Over 50% of surveyed experts cite high travel costs and unstable oil prices as major concerns for 2025. Geopolitical risks (beyond ongoing conflicts) ranked third among key challenges.

The 2025 tourism industry will focus on:

✅ Sustainability – growing interest in eco-friendly travel.

✅ Undiscovered destinations – increased exploration beyond mainstream locations.

✅ Innovation & digitalization – leveraging technology for better services.