Global Economic Trends 2025

Bloomberg has analyzed recent developments in the global economy, markets, and geopolitics, highlighting key changes in Japan, China, South Korea, the United States, European countries, and emerging markets. Experts note that many governments are pursuing cautious policies while awaiting clearer economic signals.

Asia-Pacific Region

Japan

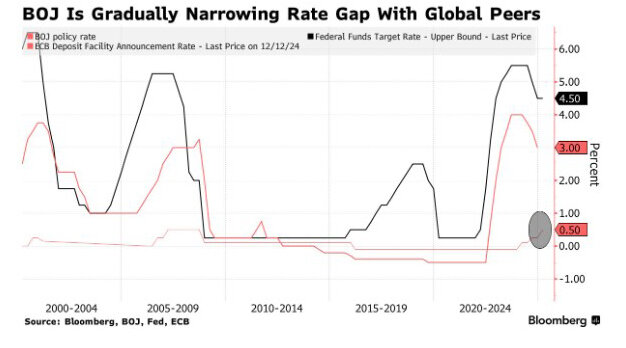

The Bank of Japan (BOJ) raised its key interest rate to 0.5% in late January 2025, marking the highest level since 2008. This move signals the end of Japan's ultra-loose monetary policy and a major shift after nearly two decades of zero or negative rates. The decision was based on confidence that inflation remains stable.

Core consumer prices (excluding fresh food) rose by 3%, significantly exceeding the BOJ’s 2% target. Inflation forecasts have been revised upward, reaching at least 2% for the first time since records began.

Moving away from negative rates reflects optimism about economic resilience but also poses risks for businesses and households accustomed to cheap credit. Higher interest rates could impact consumer spending, corporate investments, and government debt servicing.

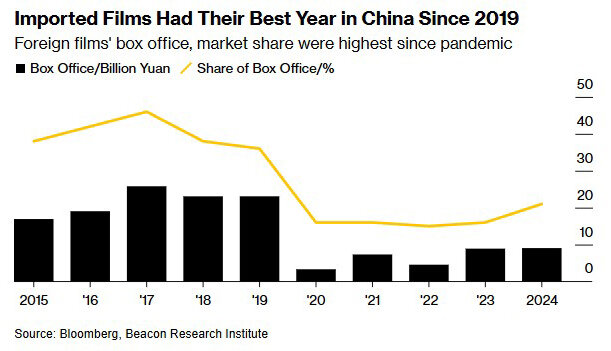

China

In recent years, President Xi Jinping’s administration has imposed strict controls on cultural and entertainment industries, particularly in film, to curb Western influence. However, as officials attempt to boost consumer spending to support China’s slowing economy, early signs suggest some restrictions may be easing.

South Korea

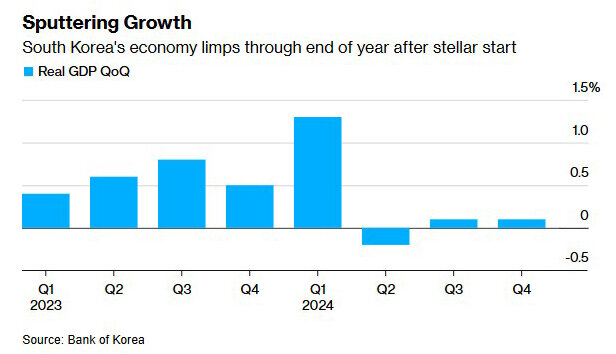

South Korea’s economy slowed down in late 2024, partly due to the short-lived martial law declared by President Yoon Suk Yeol, which weakened consumer confidence. Concerns over potential U.S. tariffs have also dampened investment and spending. In 2024, the economy grew by 2% overall.

United States

Housing Market

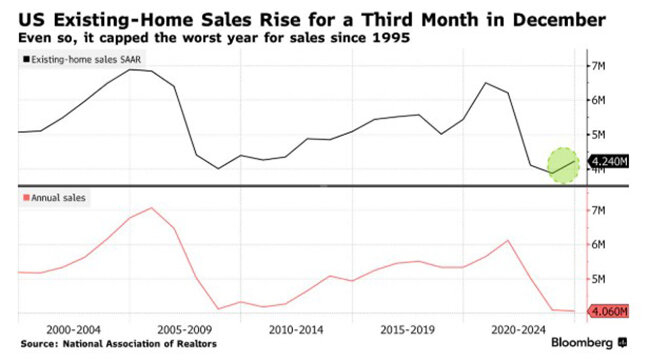

U.S. existing home sales rose for three consecutive months through December 2024. However, the year marked the worst housing sales performance since 1995, when the U.S. population was 70 million smaller. The last time the market experienced a three-year decline was during the 2006 housing crisis and the 1980s-1990s recessions. Despite this, the housing market entered 2025 with some signs of recovery.

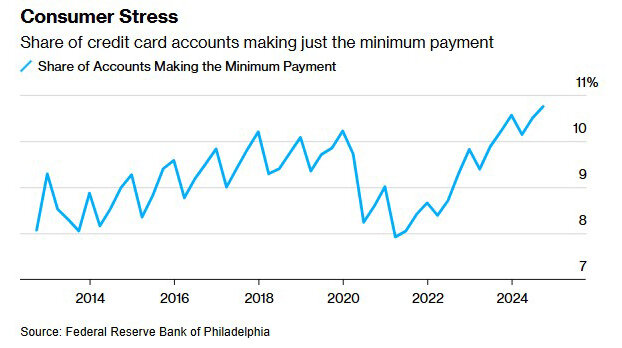

Consumer Debt

Americans are paying down an increasing share of their credit card debt, even as interest rates remain at near-record highs. This reflects growing financial strain on consumers. The share of borrowers making only minimum payments reached its highest level in recorded history in 2024.

Europe

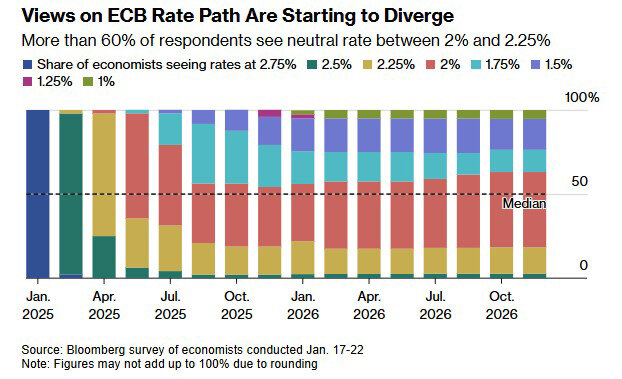

Concerns over inflation are resurfacing. A survey of economists suggests that the European Central Bank (ECB) may pause rate cuts this spring. The base forecast for four 0.25% rate cuts in 2025 remains intact.

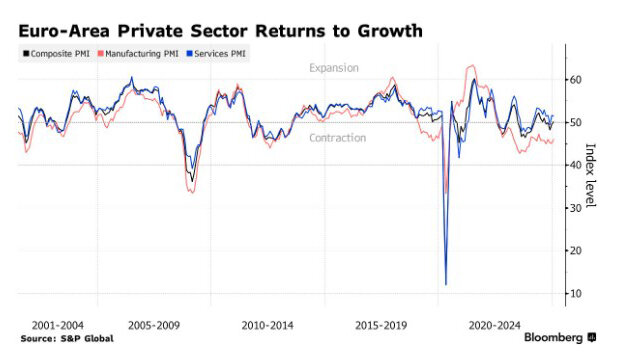

The Eurozone private sector expanded in January for the first time in three months, surprising analysts. Despite slight improvements in the struggling manufacturing sector, significant economic recovery is still distant.

Latin America

Mexico

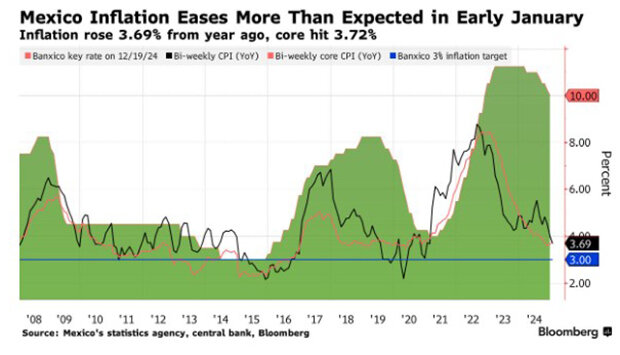

Annual inflation slowed more than expected, increasing the likelihood of a significant interest rate cut at the next central bank meeting. The declining inflation rate provides policymakers with more room for monetary easing.

Brazil

Authorities have introduced measures to control food price inflation without implementing strict market regulations. The plan includes lowering import duties on cheaper foreign goods, while the Finance Ministry is exploring supply chain optimizations.

Central Bank Policies

Japan is pursuing aggressive tightening

Norway kept rates unchanged but signaled a cut in March

Turkey enacted another major rate reduction

Malaysia, Uzbekistan, and Paraguay held rates steady

Ukraine raised rates to fight inflation and stabilize the economy

Singapore eased monetary policy for the first time in five years due to slowing economic growth

Diverging central bank actions highlight the widening gap in global monetary policies. While Japan and Turkey are making bold moves, the U.S. Federal Reserve and ECB are adopting a cautious approach, waiting for clearer economic signals.

Amid inflation risks, uncertain growth, and rising debt burdens, the trajectory of the global economy in 2025 will be shaped by:

- Regional economic policies

- Geopolitical factors

- Market trends