Spain Sees Decline in Housing and Office Yields

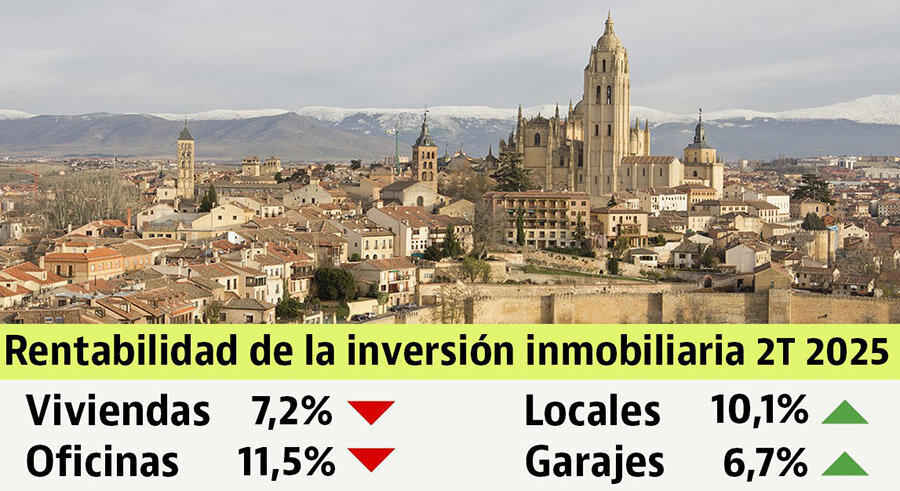

In the second quarter of 2025, the profitability of residential and office real estate in Spain decreased, while returns in the retail segment rose. Garages remain the least profitable asset type, Idealista reports.

Housing

Gross yields from buying residential property dropped from 7.5% in April–June 2024 to 7.2% in Q2 2025. Even at current levels, rental investments remain significantly more profitable than government bonds, whose yields do not exceed 3.2%.

Among provincial capitals, Murcia leads with an 8% rental yield, followed by Jaén, Segovia, Zamora, and Huelva at 7.6% each. Lleida shows 7.5%, Castellón de la Plana 7.3%. Slightly lower returns are recorded in Almería (6.9%), Las Palmas de Gran Canaria, Lugo, and Ávila (6.8% each). Barcelona’s gross rental yield is 5.8%, Cádiz, Madrid, Pamplona, and La Coruña stand at 4.7%, Palma at 4.5%, and the lowest level is in San Sebastián – just 3.7%.

Offices

Office yields also declined — from 12.8% to 11.5% nationwide — but still remain above those of other property types. Seville leads with 12.1%, while many other cities trail: Vitoria (9.8%), Zaragoza (9.7%), Castellón de la Plana (9.4%), Lleida (9.3%), and Burgos (9%).

Yields are lower in Valladolid (8.7%), Córdoba (8.5%), Murcia (8.3%), and Tarragona (8%). In Barcelona, the figure is 7.6%, in Madrid 6.9%. Even lower returns are seen in La Coruña (6.5%), Ourense (6.4%), and Palma (6.3%). Malaga’s office yield is just 5.8%. The report notes the office market is less uniform than other real estate segments, making it difficult to collect reliable statistics for nearly half of Spain’s provincial capitals.

Garages

Garages remain the least profitable asset type, although annual returns rose from 6.2% to 6.7%. The picture varies significantly by city. In Murcia, owners can expect 11.4% yields, Logroño 9.9%, Ávila 8.3%, and Castellón de la Plana 8%. In Barcelona, garage yields are 6.7%, in Madrid 5.4%.

The worst results are in Salamanca (2.7%), Palencia (3%), Granada (3.1%), Palma (3.2%), Ourense (3.3%), and San Sebastián (3.4%) — comparable to, or lower than, government bonds.

Retail Real Estate

Average rental yields for retail properties in Spain rose from 9.7% in June 2024 to 10.1% in June 2025. Murcia tops the list at 12%, followed by Lleida (11.1%), Zaragoza (10.9%), Oviedo (10.8%), Alicante (10.6%), Tarragona (10.4%), Girona (10.1%), and both Santa Cruz de Tenerife and Bilbao (10%). In the largest markets, results are more modest: Barcelona (8.4%), Madrid (7.4%). At the bottom are Cuenca (6.2%), Albacete (6.9%), and Malaga (6.9%).

Outlook

In 2025, Spain’s real estate market is showing moderate cooling but retains a positive trajectory. CaixaBank Research forecasts a 5.3% rise in housing prices in H2 2025. In 2026, growth is expected to continue at a restrained pace, driven by limited supply, migration, and a reduction in household numbers — though high mortgage rates will remain a constraint.

BBVA Research expects a 7.3% price increase in 2025, noting the market is adjusting to slower economic growth and reduced household demand, but the shortage of new housing continues to support prices.

S&P Global points out that rental price pressures will persist in major Spanish cities, mainly due to rising mortgage costs and limited supply, particularly in Madrid and Barcelona. Even if sale prices stabilize, rents could keep climbing.

Knight Frank analysts believe the commercial sector will see yield stabilization in 2025–2026. In the office segment, partial investor interest recovery is possible due to adaptation to hybrid work models, though high borrowing costs will continue to weigh on the market.