Construction in Bulgaria Accelerates: Burgas Leads the Way

Between April and June 2025, the Burgas region ranked second in Bulgaria in terms of the volume and number of newly launched residential projects, surpassing Varna and Plovdiv. The total area of new developments jumped by almost 65% compared to the first quarter and by 51% year-on-year, Investor.bg reported, citing data from the National Statistical Institute.

In Q2, construction began on almost 157,000 sq. m of housing in Burgas — equivalent to 1,647 apartments. The average unit size is 95 sq. m, the smallest among Bulgaria’s four largest regions. This activity stands out in contrast to declining volumes in other major centers.

Sofia, Plovdiv, Varna – Mixed Trends

In Sofia, the total area of new construction grew by 80% quarter-on-quarter but remained 17.1% lower than in the same period of 2024. This follows a sharp 53% drop in Q1. Between April and June, 1,914 apartments were launched in the capital, totaling over 258,000 sq. m, with an average size of 135 sq. m — the largest among key regions.

Plovdiv, which was the only region showing growth at the start of 2025, saw a slowdown in Q2: down 6% year-on-year and 3% compared to Q1. The quarter saw 1,189 units started, totaling around 150,000 sq. m, with an average size of 125 sq. m.

Varna also recorded a decline: an 8.7% quarterly increase was not enough to offset a 45.7% annual drop. Q2 construction included 819 units, totaling just over 85,000 sq. m, with an average unit size of 104 sq. m.

National Overview

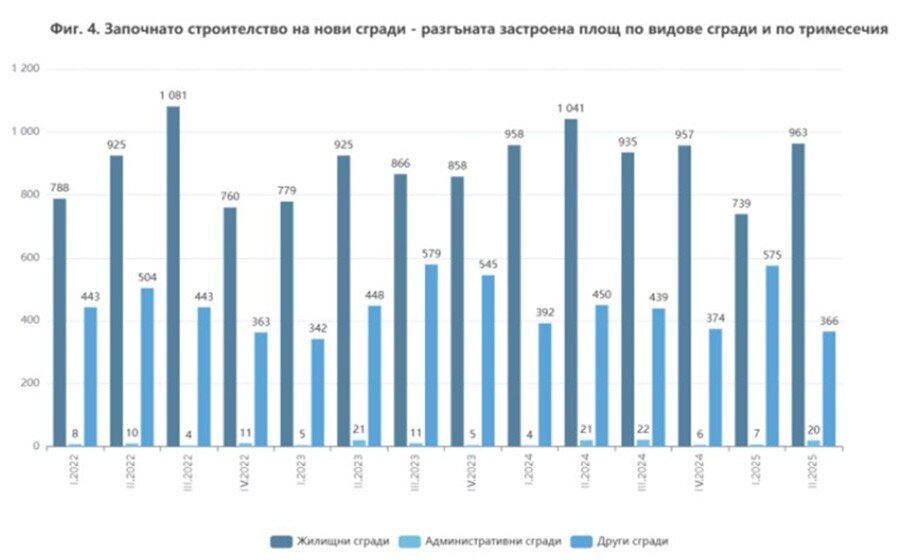

Across Bulgaria in Q2 2025, 1,640 residential buildings began construction — up 14.6% from Q1. The total area rose 30.3% to over 963,000 sq. m, and the number of apartments increased by 32.4% to 8,064. However, compared to Q2 2024, there were declines of 3.7%, 7.5%, and 8.5% respectively.

Bulgaria also began construction of 23 administrative buildings and offices with a total area of almost 19,800 sq. m, along with 644 “other purpose” buildings totaling 366,500 sq. m. The administrative sector saw growth both quarterly and annually, while the “other buildings” category increased only compared to Q1.

Building Permits and Price Dynamics

In Q2, 2,049 residential building permits were issued — 1.7% fewer than in Q1. Total permitted area exceeded 1.3 million sq. m (+0.2%), while the number of apartments approved reached 10,089 (+4.6%). Year-on-year, the first two indicators rose by 5.9% and 9.5% respectively, but the number of apartments fell by 1.8%.

The European Commission has estimated Bulgarian housing to be overvalued by 10–15%. In Q3 2024 alone, the average price per square meter jumped 16.5% year-on-year, and by 87% compared to 2015. In Q1 2025, prices rose 15.1% year-on-year, with the secondary market (+16.2%) outpacing new builds (+13.4%). Among major cities, Ruse led with a 25.4% price increase, followed by Varna (+18.4%), Plovdiv (+17.9%), and Sofia (+14.1%).

The gap between the capital and regional markets continues to widen. In Sofia, prices range from €1,980 to €2,225 per sq. m (up 16% year-on-year), in Varna — €1,550–1,676, Plovdiv — €1,150–1,328, and Burgas — €1,200–1,300. Tourist areas, including Bansko, have seen growth exceeding 8–10% annually.

Outlook

According to Novinite.com, Bulgaria’s housing market is on track for an 18% price increase in 2025. Analysts expect a 10% rise by year-end, followed by stabilization in 2026 after the country adopts the euro. Transaction volumes may decline to around 80,000 annually, while nominal prices will continue growing at about 10% per year. Adjusted for inflation, real price growth will be around 6% annually — considered sustainable — with demand shifting toward higher-quality, energy-efficient properties.

Подсказки: Bulgaria, Real Estate, Burgas, Varna, Plovdiv, Sofia, Construction, Housing Market, Euro Adoption, Property Prices, Investment