Analytics / Research / Ratings / Netherlands / Iceland / Switzerland / Greece / Italy / France 28.02.2025

How Much Do Pensioners Receive in Europe?

Pension income directly affects the quality of life in old age. European countries have different pension systems and payout amounts. According to experts, the highest pensions are granted in Luxembourg, Iceland, and Switzerland. At the same time, the Netherlands is considered to have the best-organized pension system. However, Greece, Italy, and France spend the highest percentage of their GDP on pensions.

Pension Payment Levels

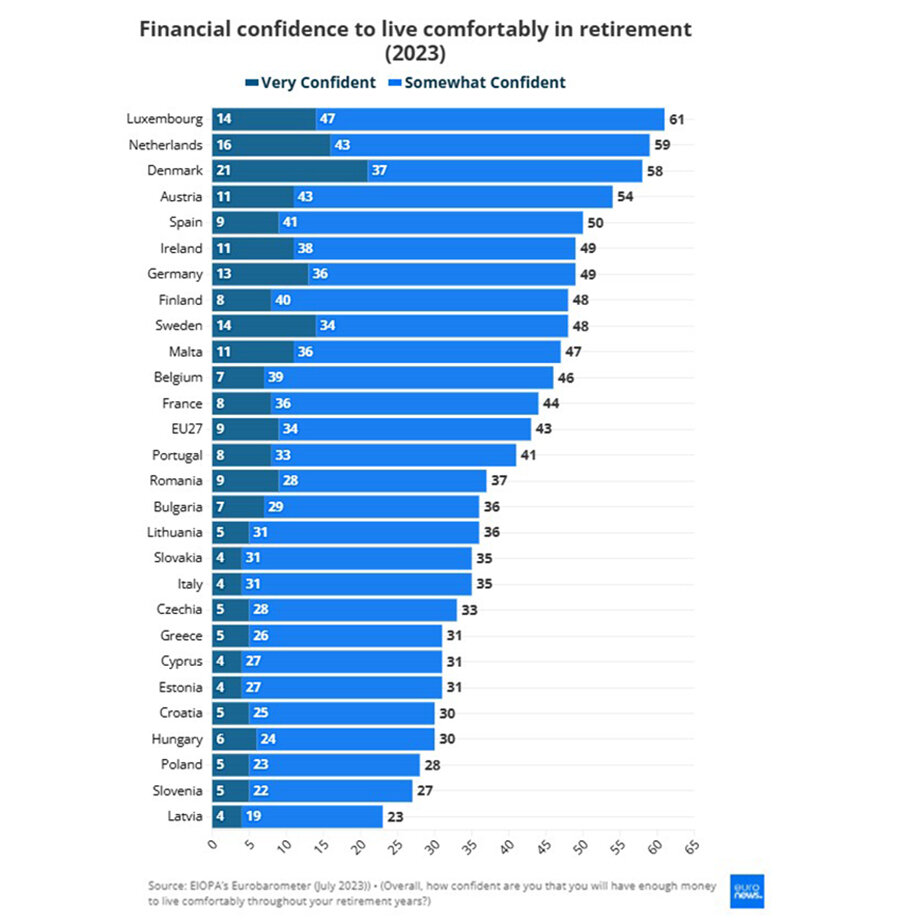

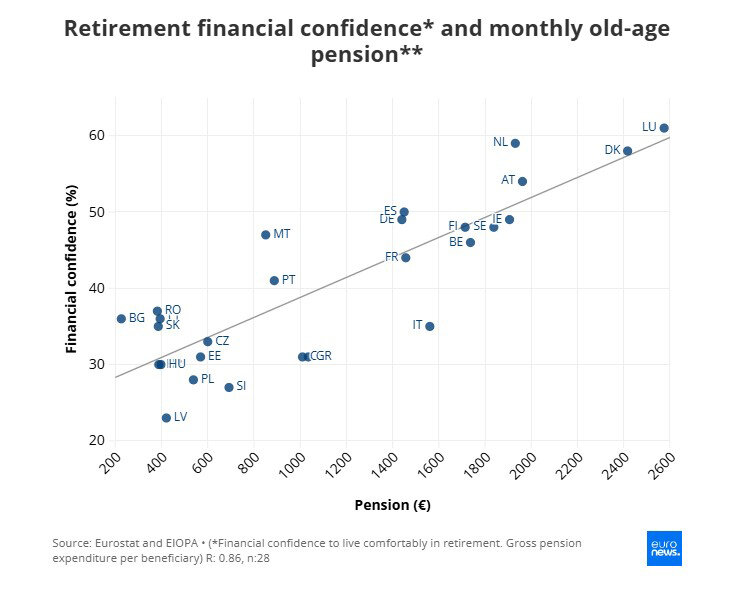

According to Euronews Business, pensions based on wage earnings during employment are the primary source of income for most Europeans aged 65 and older. However, less than half of EU consumers are confident that they will have enough money to live comfortably on these payments. In some countries, this confidence level drops to 30% or even lower.

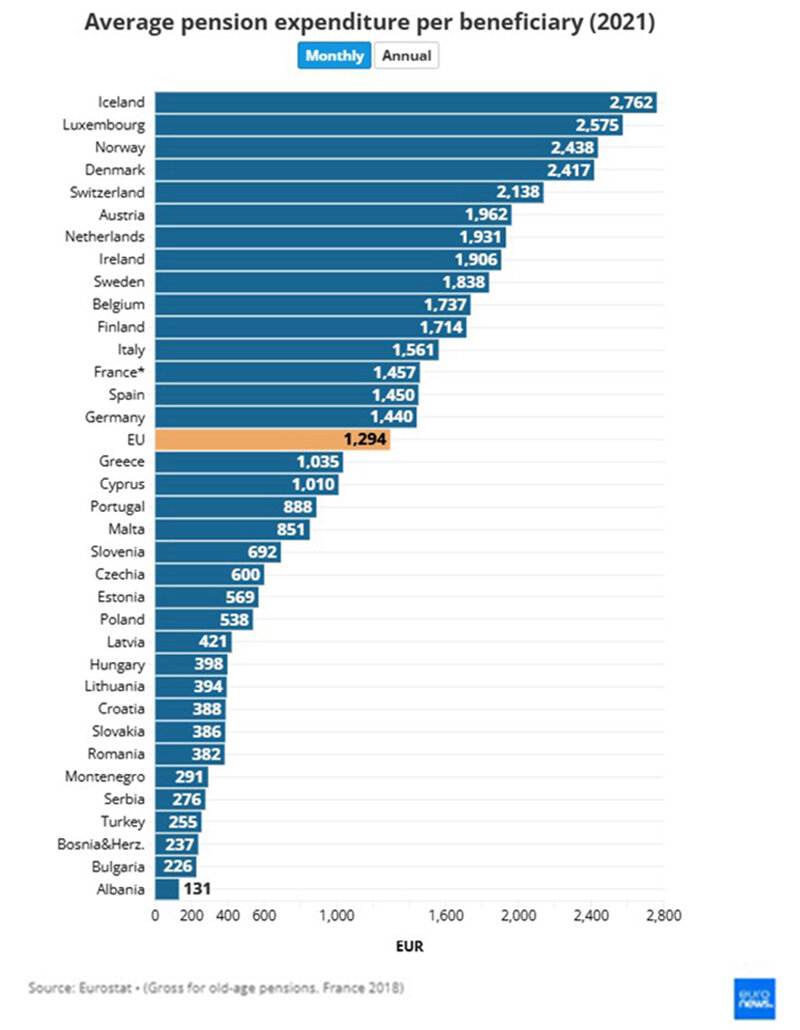

Eurostat notes that old-age pensions in Europe vary significantly, both in nominal terms and purchasing power (PPS). To simplify the data, Euronews Business converted annual pension incomes into monthly amounts, dividing them by 12 months.

In 2021, the average monthly pension expenditure per recipient in the EU ranged from €2,575 in Luxembourg to €226 in Bulgaria, with an EU-wide average of €1,224. If we include the European Free Trade Association (EFTA) and EU candidate countries, Iceland had an average of €2,762, while Albania recorded just €131.

The old-age pension per recipient exceeded the EU average in all four largest EU economies:

- Italy – €1,561

- France, Spain, and Germany – around €1,450

Northern European countries also reported higher-than-average pensions, while the lowest-ranked countries were in the Balkans. The average pension expenditure in Luxembourg is almost 11 times higher than in Bulgaria, highlighting major disparities. Even excluding Luxembourg as an outlier, the EU average is still nearly six times higher than in Bulgaria. Experts attribute these differences to variations in price levels and living costs.

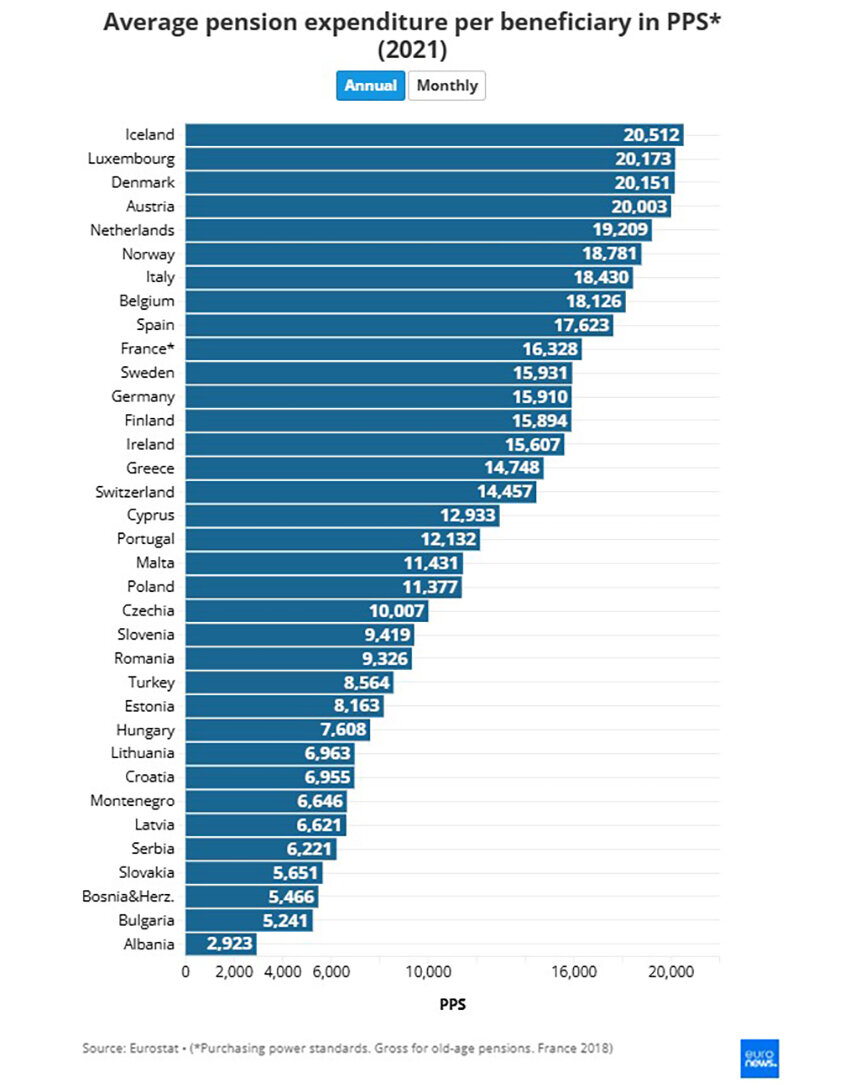

Purchasing Power Standards

Analysts highlight that differences narrow significantly when adjusted for purchasing power standards (PPS)—a unit that equalizes price level differences across countries.

When adjusted for purchasing power, the average pension in Bulgaria is €437, while in Luxembourg, it is four times higher at €1,681.

According to a 2023 Eurobarometer survey conducted by the European Insurance and Occupational Pensions Authority (EIOPA), only 42% of EU consumers are confident that they will have enough money for a comfortable retirement.

Confidence levels vary widely across Europe:

Luxembourg (61%), Netherlands (59%), and Denmark (58%) reported the highest confidence.

The lowest levels were observed in Latvia (23%), Slovenia (27%), and Poland (28%).

Pension Systems and Expenditure

When it comes to pension system quality, the Netherlands consistently ranks first. In the Mercer CFA Institute Global Pension Index 2024, the country scored an impressive 84.8, making its system the most reliable in the world.

The Dutch model is built on three pillars:

State pension (AOW)

Additional corporate contributions

Private savings

The corporate pension system is particularly strong, with many employers offering generous retirement plans. Additionally, the Dutch government enforces strict regulations to maintain stability and sustainability.

In terms of pension fund assets, the Netherlands leads Europe. The Stichting Pensioenfonds ABP, one of Europe’s largest pension funds, managed €498 billion in assets as of 2022, providing financial security for Dutch retirees.

If we analyze pension spending as a percentage of GDP, Greece tops the list, allocating 16.4% of its GDP—the highest in Europe. Other high-spending countries include:

Italy (16.3%)

Austria (15%)

France (14.9%)

Despite high expenditures, concerns remain about the long-term sustainability of these systems, especially in countries with rapid population aging and declining birth rates.

Eurostat data suggests that adjustments may be necessary to keep pension systems viable.

Pension Reforms in Europe

Despite their strengths, many European pension systems face serious challenges. As populations age, the number of working citizens contributing to pension funds declines, while the number of retirees increases. This creates financial pressure on government pension schemes, requiring reforms such as:

Raising the retirement age

Adjusting pension payouts

Several European governments have already taken steps to address these issues, as reported by Reuters.

France recently raised the retirement age from 62 to 64, sparking mass protests.

Germany is implementing gradual pension reforms to balance sustainability and fairness.

The Netherlands consistently adjusts pension policies to maintain long-term stability.

To counteract demographic shifts, many European countries have launched immigration programs to balance the ratio of workers to retirees.

Reuters reports that policymakers are exploring ways to ensure pension sustainability while protecting future retirees' financial security.