read also

Bank of Korea Allows for Easing in 2026 Amid Housing and Currency Risks

Photo: Unsplash

The Bank of Korea may cut interest rates next year, while planning to tighten oversight of the financial system and the foreign-exchange market, Bloomberg reports. Risks related to rising housing prices and high household debt persist in the country. Any decision on additional monetary easing will depend on a comprehensive assessment of inflation and economic growth.

Inflation in South Korea is expected to remain close to the central bank’s target, although price pressures could intensify faster than anticipated. Key factors cited include a weaker national currency and a recovery in domestic consumption. The economic growth outlook предполагает a gradual return toward potential rates, but it remains dependent on both global and domestic conditions.

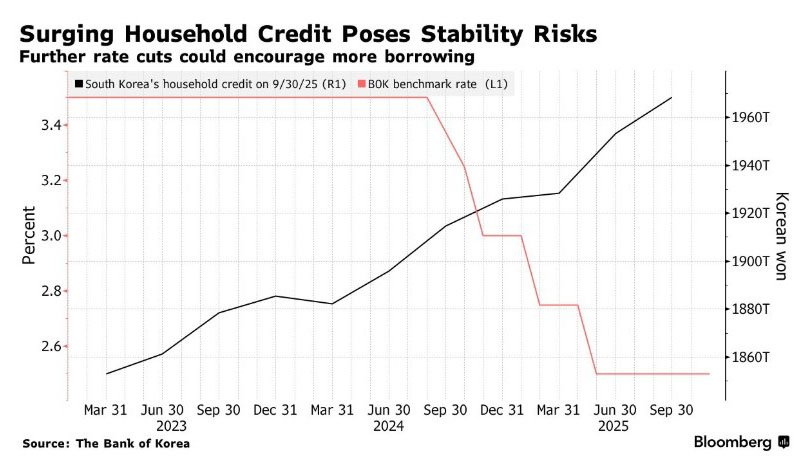

At its November meeting, the central bank kept the benchmark interest rate unchanged at 2.5%, with opinions among board members split. Three of the six policymakers allowed for the possibility of additional easing in the coming months, signaling a weakening consensus in favor of further rate cuts compared with the previous meeting. Market expectations have also shifted toward a longer pause. According to a Bloomberg survey conducted in December, economists pushed back their forecast for the next rate move to the fourth quarter of 2026, whereas it had previously been expected much earlier. Some analysts believe South Korea’s monetary easing cycle has already come to an end.

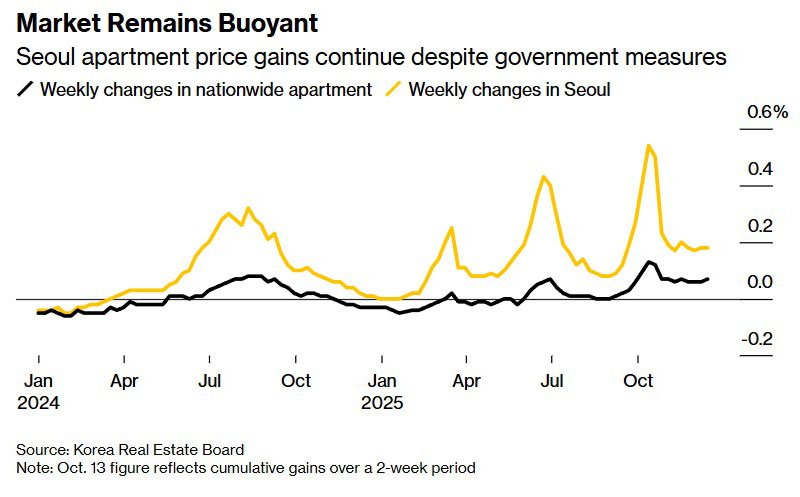

From a financial stability perspective, the Bank of Korea highlights risks in the housing market—particularly in Seoul and surrounding areas—as well as elevated household debt levels. Housing prices in the capital continue to rise despite government measures aimed at cooling demand. According to the Korea Real Estate Board, apartment prices have increased for 46 consecutive weeks, with year-to-date gains reaching 8.3%. Persistent demand was one of the factors behind the Bank of Korea’s decision to refrain from cutting rates in November, amid concerns that cheaper borrowing could fuel speculative activity and increase debt burdens. The central bank stresses that the buildup of financial imbalances requires constant monitoring and a cautious approach to further easing.

The foreign-exchange market remains an additional source of tension. The South Korean won strengthened sharply after authorities pledged “strong determination” to prevent excessive weakness in the currency. The exchange rate rose by 1.8% to 1,455.5 per dollar, marking its biggest daily gain in six months. A day earlier, the won had weakened to 1,484.65 per dollar, nearing its lowest levels since the global financial crisis of 2009.

The rally followed a series of consultations between the central bank and the finance ministry over the past two weeks amid accelerating won depreciation. Markets interpreted the authorities’ actions as a signal of readiness for more active smoothing of currency fluctuations. The finance ministry announced a package of tax measures to stabilize the foreign-exchange market, while the National Pension Service began more systematic hedging of currency risks. The Bank of Korea said it intends to strengthen monitoring of the won and confirmed its readiness to deploy stabilization measures in the event of sharp swings or signs of speculative behavior. The regulator also emphasized that it will continue coordinating closely with the government on financial stability and liquidity support.

Analysts at International Investment note that the combined macroeconomic and financial environment leaves the Bank of Korea with a narrow corridor for policy decisions. Even with inflation under control, the regulator faces the risk of widening imbalances in the housing and currency markets, raising the cost of potential policy mistakes. As a result, any rate cut in 2026 is likely to be treated as an exception rather than the start of a new easing cycle.

Подсказки: South Korea, Bank of Korea, interest rates, monetary policy, housing market, currency market, won