Seoul’s Rental Market: Yields, Demand and New Restrictions

Photo: Unsplash

Seoul’s rental market on Airbnb is notable for its unusual structure: one-third of listings required a minimum stay of at least 30 nights, as reported by AirROI. The study covers December 2024 through November 2025 and analyzes 16,518 active listings, whose median revenue increased by 15% to 15,361 USD. Strong regulatory oversight and pronounced seasonality continue to shape operating conditions in this segment.

Market structure

The market was dominated by entire-home rentals, which accounted for 73.5% of all listings. Private-room stays represented around 25%. Hotel rooms made up only 0.3% of supply. By property type, houses led with 45.2%, followed by apartments/condos at 43%. Hotels and boutique accommodations formed 11.1%, while unique or unconventional stays accounted for only 1.2%.

Compact units dominated supply: one-bedroom properties represented 50.6% of listings, and together with two-bedroom units accounted for more than 70%. This closely matched demand patterns — primarily solo travelers, couples and business guests. Around 19% of listings accommodated six or more people, providing options for families and groups.

In most cases (34%), hosts required a minimum stay of 30 nights, reflecting tighter regulation and the shift of part of the market toward mid- and long-term stays. Single-night stays were available in 32.6% of listings. The remaining categories were far less common: around 9.5% offered stays of 4–6 nights, and 9% required a minimum of two nights.

Guest profile

Most rentals in Seoul were booked by international travelers, who made up 80.8% of all guests. The leading countries of origin included the United States, Singapore, China and Australia. Domestic travelers represented 19.2%. The largest cities of origin included New York, Taipei, Paris, London and Seoul itself.

Young travelers dominated demand: 50% of guests were born after 2000, while visitors from the 1980s–1990s also remained significant. English was the most commonly used language (42.7%), followed by Korean (14.5%), Chinese, Spanish and French. This demographic composition shaped expectations regarding amenities, communication quality and listing design, which increasingly target young international guests.

Key performance indicators

The average nightly rate in Seoul was 93 USD, with occupancy at 52.7%. The median monthly revenue stood at 1,256 USD. Price segmentation remained pronounced: the most expensive 10% of listings charged from 166 USD per night — typically premium units in top locations. Another 25% held rates above 108 USD. Mid-market properties averaged around 70 USD. The lowest 25% charged approximately 44 USD per night.

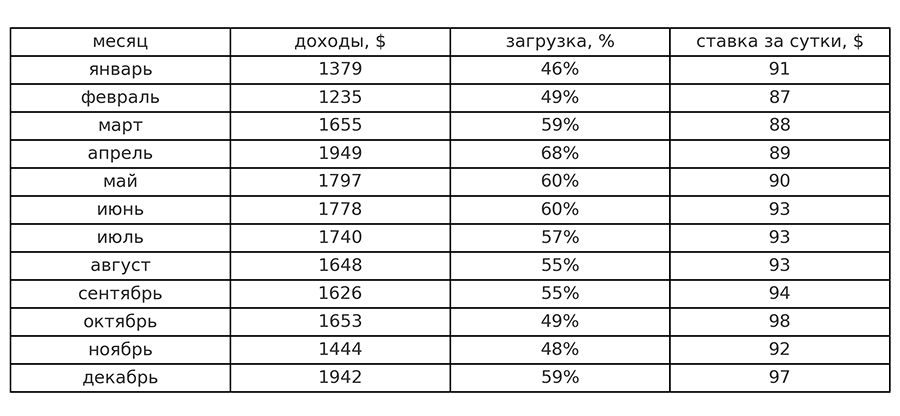

Two clear peaks appeared in the annual rental cycle. In April, revenue reached 1,949 USD with occupancy at 68%. In December, revenue similarly increased to 1,942 USD with the nightly rate rising to 97 USD. The lowest point occurred in February, when revenue dropped to 1,235 USD and the nightly rate fell to 87 USD. October showed a noticeable gap between price and demand: occupancy slipped to 49%, while nightly rates climbed to 98 USD — the highest level of the year.

According to Global Property Guide, gross rental yields in Seoul [leech=https://www.globalpropertyguide.com/asia/south-korea/rental-yields]stand[/leech

] at 4.31%. After accounting for maintenance, utilities, taxes, management and marketing costs, net returns fall to roughly 2.3%, and vacancy periods can push them even lower.

Restrictions and risks

Seoul’s rental market is heavily regulated. Property owners must comply with a growing list of rules and restrictions imposed by authorities. Since 16 October 2025, all Airbnb hosts have been [leech=https://koreajoongangdaily.joins.com/news/2025-08-19/business/industry/All-Airbnb-hosts-in-Korea-now-required-to-register-business/2378864]required[/leech

] to officially register as business operators in order to list their units on short-term rental platforms. Without a valid business registration, bookings are blocked and listings are removed. The requirement applies not only to new hosts but also to properties already operating on the market.

Additionally, officetels and certain studio units — commercial-status properties that do not meet residential criteria — were banned from use as short-term rentals. This reduced the volume of compact units available for Airbnb operations and increased risks for owners, as some properties lost eligibility for short-term stays and were forced to shift to long-term rental or undergo reclassification.

South Korea also tightened real-estate rules for foreigners: as of 26 August, purchasing property in Seoul and surrounding areas is possible only with special government approval.

Experts at International Investment note that such low net yields, combined with a highly regulated market, make Seoul attractive only for long-term investors willing to follow the rules meticulously. Hosts and investors must account for legal restrictions, seasonal income fluctuations, management costs and the risk of properties being excluded from the eligible short-term-rental category.

Подсказки: Seoul, South Korea, rental market, Airbnb, regulations, yields, tourism, property market, foreign ownership rules