read also

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Lisney Property Market Outlook: Irish Property Market Poised for Steady Growth in 2026

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Inflation in Romania Slows to 9.6% but Remains Above Forecast

Riots in Mexico Disrupt Air Links to Resort Destinations

Riots in Mexico Disrupt Air Links to Resort Destinations

UK House Prices Stabilise After 2025 Slowdown

UK House Prices Stabilise After 2025 Slowdown

Israel Housing Market Eyes a Reset in 2026

Israel Housing Market Eyes a Reset in 2026

Real Estate Investment Declines in Southeast Europe in 2025

Real Estate Investment Declines in Southeast Europe in 2025

Вusiness / Tourism & hospitality / Analytics / Research / Georgia / Tourism Georgia / News 08.02.2025

Hotel Bookings in Batumi Continue to Grow Even in Off-Season

Investment company Galt & Taggart has published a report summarizing the performance of Georgia's tourism industry in Q4 2024 and throughout the year. Analysts highlighted a sharp increase in hotel bookings in Batumi and projected further growth in visitor numbers and revenues across the country in 2025.

Q4 2024 Overview

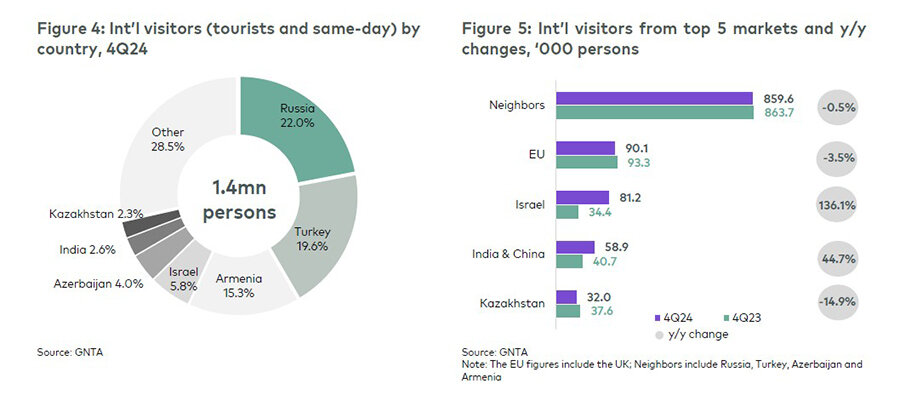

Visitor Arrivals

The number of international visitors in Q4 2024 grew by 5.1% year-on-year to reach 1.4 million.

The main segment of tourists increased by 8.4%, while day-trip visits declined by 4.8%.

Tourism levels have fully recovered from the pandemic, reaching 100.8% of Q4 2019 levels.

Total visits in 2024 were 100.2% of 2019 figures.

The year-long tourism recovery was largely driven by a strong Q1 performance (106.4% recovery).

The increase in Q4 arrivals was primarily due to a 136.1% surge in visits from Israel, a 15.4% rise in Russian tourists, and a 44.7% increase in arrivals from India and China.

The majority of visitors came from:

Neighboring countries (60.9%)

EU nations (6.4%)

Israel (5.8%)

India & China (4.2%)

Kazakhstan (2.3%)

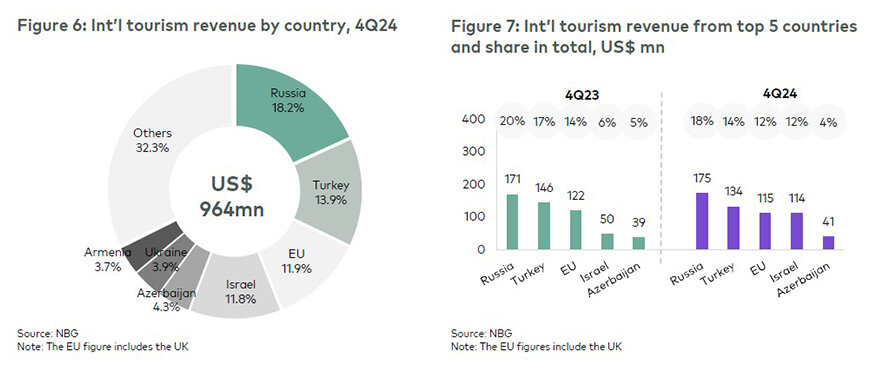

Tourism Revenue

Tourism revenue in Q4 2024 reached $963.7 million, marking a 10.3% increase compared to the same period in 2023.

The highest revenue growth was recorded in October and November.

The strongest contributors to revenue growth were:

Israel (+128% YoY)

Other non-traditional markets (+18.9%)

Russia (+2.5%)

Main revenue sources:

Russia (18.2%)

Turkey (13.9%)

EU visitors (11.9%)

Israel (11.8%)

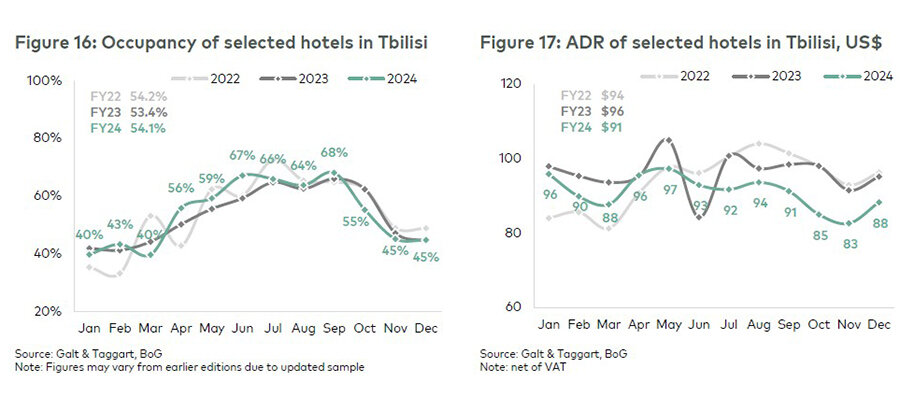

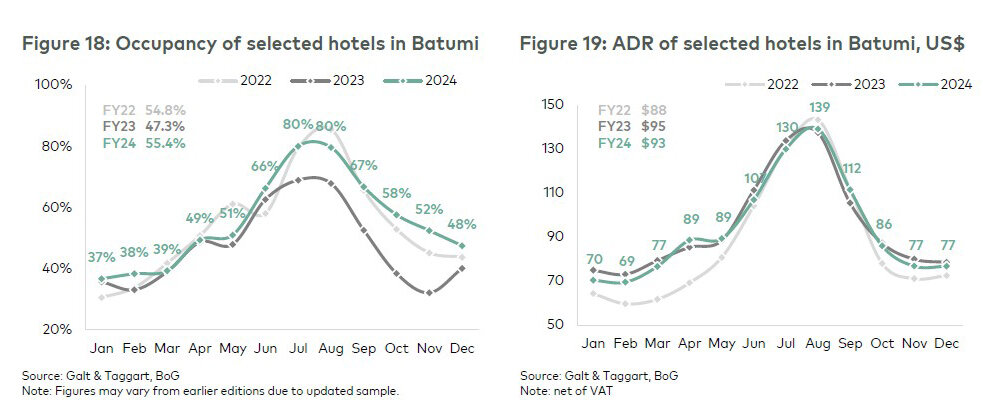

Hotel Industry Performance

While Tbilisi hotels saw a decline in Q4, Batumi hotels experienced significant growth:

Average occupancy rose from 36.9% in Q4 2023 to 52.5% in Q4 2024.

ADR (Average Daily Rate) remained stable.

According to Galt & Taggart, the growth in Batumi's hotel industry was driven by an increase in arrivals from the Middle East, accounting for over half of all overnight stays in the city.

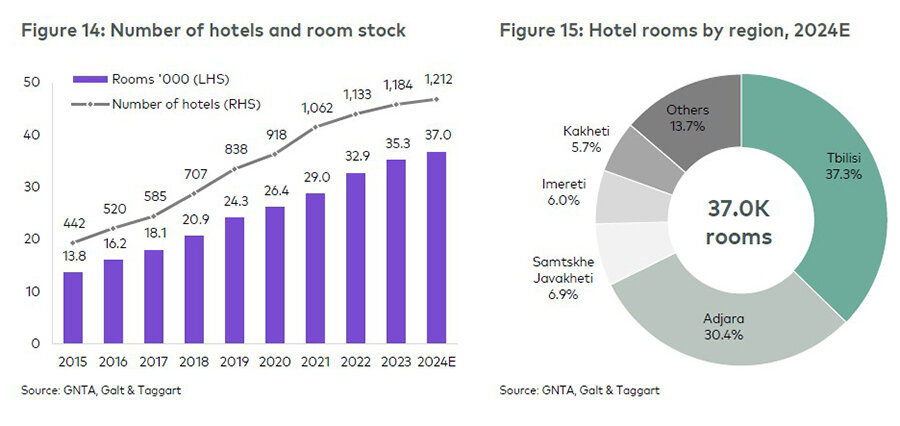

Hotel & Airbnb Market

The number of hotels in Georgia grew by 2.4% YoY, reaching 1,212 units.

The total number of rooms increased by 4.7% YoY, reaching approximately 37,000.

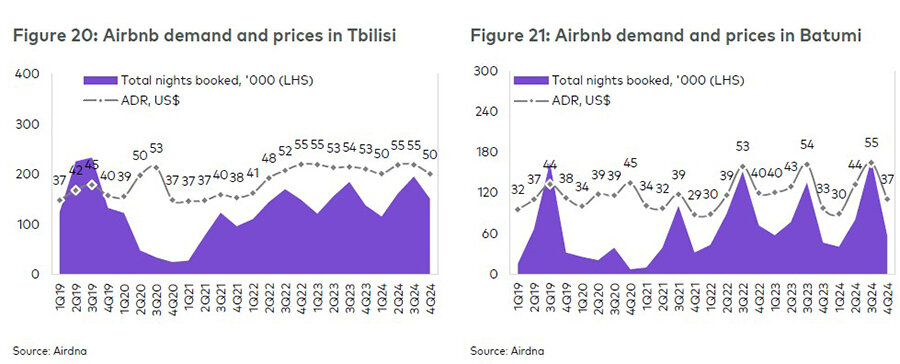

Airbnb demand rose by 9.5% in Tbilisi (151,300 booked nights in Q4).

Airbnb demand in Batumi surged by 20.8% to 56,200 booked nights.

Airbnb pricing trends:

In Tbilisi, the average ADR dropped to $50 (-4.6% YoY).

In Batumi, the ADR increased to $37 (+13.4% YoY).

According to the Georgian government, in 2012, there were fewer than 800 hotels in the country.

By 2024, this number had grown to almost 2,400, with the total capacity rising from 23,000 to 108,000.

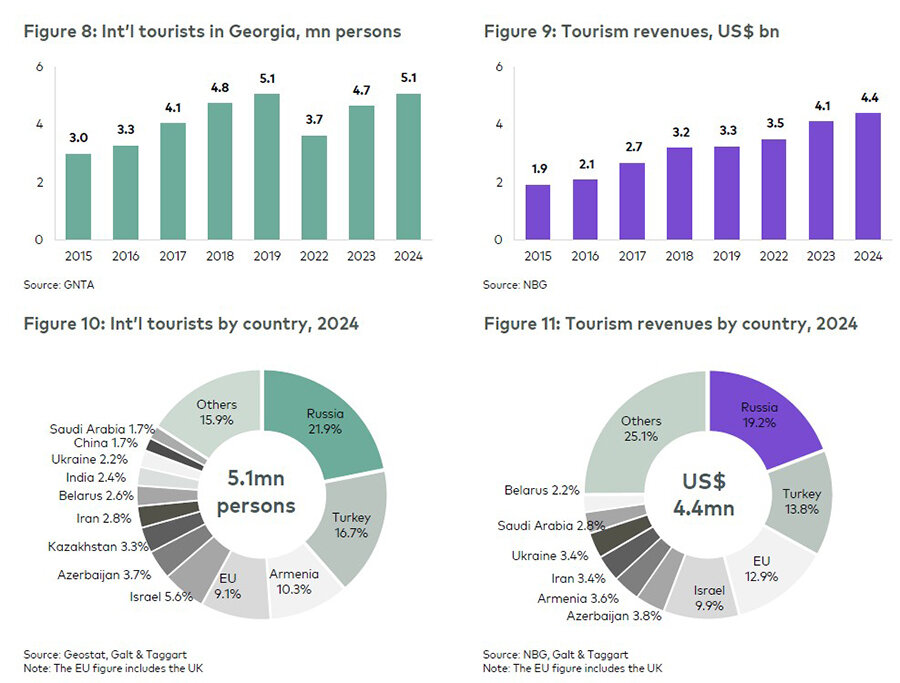

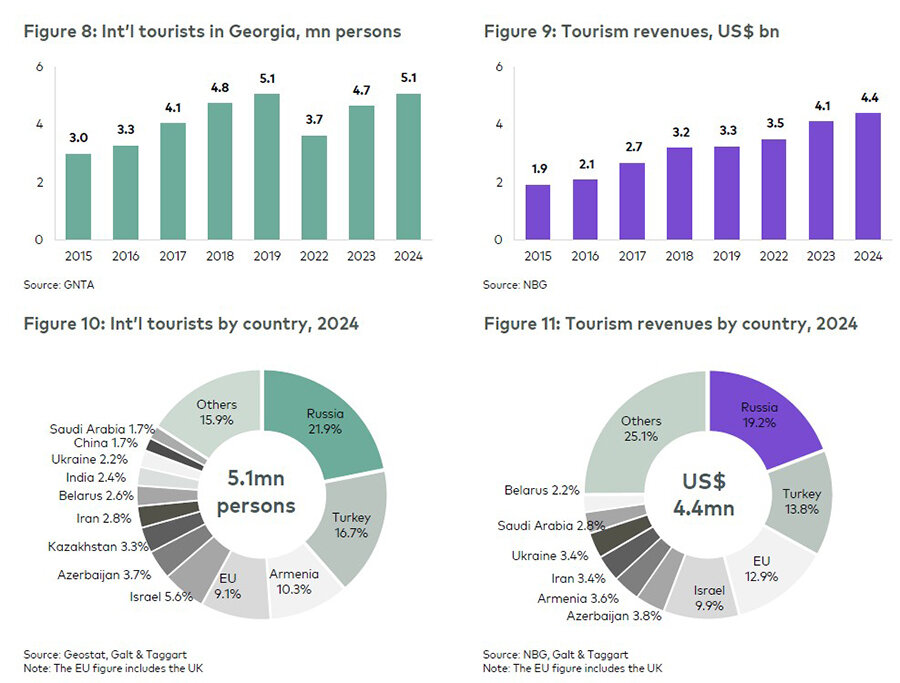

2024 Tourism Figures

Total international visitors: 6.5 million (+4.6% YoY).

Total tourists (overnight stays): 5.1 million (+9%) (78.9% of total visitors).

Day-trippers: 1.4 million (-9.2%).

The main drivers of increased tourism were:

Israel, China, India, Iran, Saudi Arabia, and Central Asia.

Expanded flight routes & relaxed visa rules for India & China.

According to Georgia's National Tourism Administration, in 2024, the country recorded over 7.3 million international tourist visits, 4.2% higher than in 2023.

Top Source Countries for Visitors

1️⃣ Russia – 1.4 million

2️⃣ Turkey – 1.3 million

3️⃣ Armenia – 948,299

4️⃣ Israel – 310,982 (+43.3% YoY)

5️⃣ Azerbaijan – 219,356 (+9.8% YoY)

Among the fastest-growing markets:

China: +83.4% YoY (from 48,304 to 88,583 visitors).

India: +46.8% YoY (to 124,335 visitors).

Uzbekistan: +23.4% YoY (to 64,259 visitors).

Saudi Arabia: +21% YoY (to 88,298 visitors).

Germany: +14.3% YoY (to 78,644 visitors).

Tourism Revenue

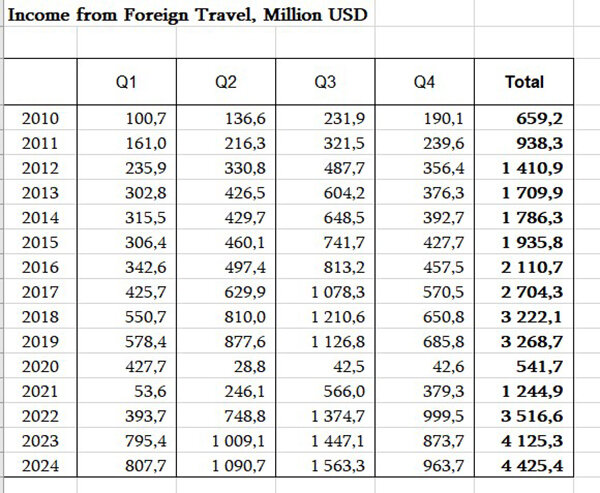

Total tourism income in 2024 reached $4.4 billion (+7.3% YoY).

This exceeds all previous years and sets a new industry record.

According to the National Bank of Georgia, the tourism industry’s revenue growth has been accelerating:

2010: $659 million

2013: $1.7 billion

2016: $2.1 billion

2019: $3.2 billion

2022: $3.5 billion

2024: $4.4 billion

Key contributors to revenue growth:

Middle East & Asia – Israel (+41.6% YoY), Iran (+17.9% YoY), Saudi Arabia (+21.2% YoY).

2025 Tourism Outlook

Projected 2025 tourist arrivals: 5.3 million (vs. 5.1M in 2024).

Positive factors:

Continued growth in Middle Eastern & Asian markets.

Possible land border reopening with Azerbaijan.

Estimated 2025 revenue: $4.5 billion (+$100M vs. 2024).

Georgia's Expanding Hospitality Industry

By 2028, over 300 new hotels are expected to open, adding 18,778 new rooms and increasing capacity to 37,101 guests.

In 2025, 17 new hotels are scheduled to launch, including Hilton Garden Inn Adjara, Hilton Tbilisi, and Wyndham Grand Batumi Gonio.