read also

Вusiness / Real Estate / Research / Analytics / Reviews / USA / China / Germany / Japan / United Kingdom / France / Italy / Russia / Canada 23.12.2025

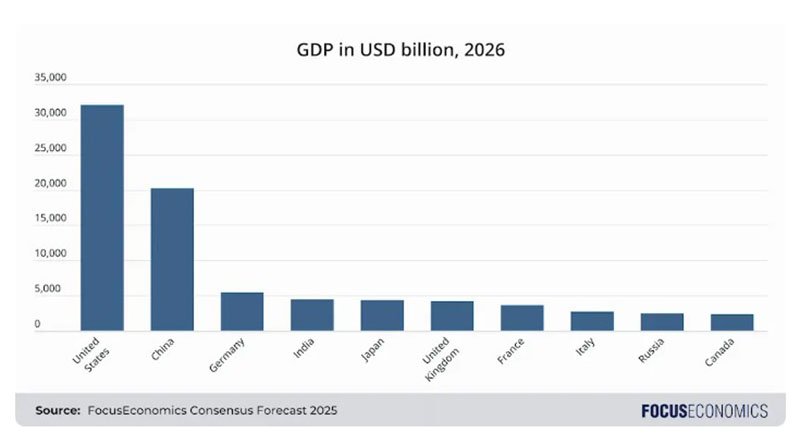

Top 10 World Economies in 2026: Focus Economics Forecast

In 2026, the top 10 world economies will broadly retain their familiar configuration, however differences in growth dynamics between countries will become more pronounced, forecasts Focus Economics. For developed markets, demographic and structural constraints will come to the fore, while several Asian economies will maintain higher growth potential. In these conditions, a high nominal GDP will not automatically translate into a high standard of living.

Five of the largest economies will be located in Europe, three in Asia, and two in North and South America. Most of these economies, particularly the G7 countries, are already wealthy, but the list will also include several emerging markets that remain relatively poor on a per capita basis, with their large economic size driven by massive populations. In most top-10 countries, potential growth rates are below the global average because capital levels are already very high, but two Asian economies defy this trend.

1. United States – AI, finance, and healthcare

GDP 2026: $32.1 trillion

US GDP remains the largest in the world and in nominal terms accounts for more than a quarter of global output. The country is also among the leaders in GDP per capita. The technology sector, centered around Silicon Valley, holds a dominant global position and shapes the development of artificial intelligence, biotechnology, and software. The financial sector is highly developed, while healthcare and pharmaceuticals play a major role. Manufacturing, despite its reduced scale, remains competitive in aerospace, defense, and automotive industries.

According to the consensus forecast, economic growth over the remainder of the decade will average around 2% per year, compared with 1.4% for the eurozone and less than 1% for Japan. At the same time, the US has the highest income inequality among G7 countries, aging infrastructure, and high healthcare costs. Public debt continues to rise, and the budget deficit is expected to remain larger than in other advanced economies.

2. China – electronics, machinery, and textiles

GDP 2026: $20.2 trillion

China’s GDP accounts for nearly 20% of global output. Economic growth is driven by investment and export-oriented manufacturing. The share of private consumption remains around 20 percentage points lower than in advanced economies. China holds leading positions in global production of electronics, machinery, and textile goods.

In recent years, authorities have emphasized technological self-sufficiency and increasing the share of high value-added products, channeling substantial subsidies into priority industries while restricting foreign participation in sensitive sectors of the economy. This policy has led to the rise of national champions, including Huawei and Tencent in technology and BYD in electric vehicle manufacturing. State support has also helped China secure leading positions in global solar panel production.

Key constraints include high corporate debt, the need to adapt to a shrinking and aging population, weakness in the real estate market, and persistent geopolitical tensions with Western countries.

3. Germany – services and manufacturing

GDP 2026: $5.4 trillion

Germany remains Europe’s largest economy. Services dominate GDP, but the share of manufacturing is roughly twice as high as in other G7 countries. The backbone of this model is the Mittelstand—a dense network of medium-sized industrial firms. Key strengths include a skilled workforce, prudent fiscal policy, and a favorable geographic location.

In recent years, Germany’s economic position has been weakened by rising global trade tensions, difficulties in adapting to new technologies, and increased competitiveness of Chinese companies, particularly in the automotive sector. Volkswagen’s 2024 announcement of plans to close several plants became a telling signal of these trends.

Additional challenges include population aging, dependence on fossil fuel imports, and political fragmentation amid the rise of the right-wing AfD party. Since 2018, Germany’s GDP growth has consistently lagged the G7 average. Despite the announcement of a €500 billion stimulus package, analysts expect this trend to persist in the coming years.

4. India – services and IT

GDP 2026: $4.5 trillion

Over the past decade, India’s GDP has more than doubled. At the same time, the country lacks a large industrial sector despite the government’s Make In India initiative. The main growth driver remains services, with a particularly strong IT industry: the two largest companies, Infosys and TCS, employ around one million people. Pharmaceuticals also play a significant role, especially in generics. Agriculture accounts for about one-fifth of the economy but remains less productive and vulnerable to climate risks.

Regulatory complexity and bureaucratic barriers remain additional obstacles for business. Tense relations with the US also weigh on the outlook: in 2025, Donald Trump imposed high tariffs in response to continued purchases of Russian oil. According to the consensus forecast, India’s economy will remain one of the fastest-growing in Asia in the coming years. With deeper reforms, growth could be significantly higher. Forecast growth below 7% per year remains noticeably weaker than in China.

5. Japan – cars and robotics

GDP 2026: $4.4 trillion

Since the 1990s, Japan’s economy has significantly lost its global standing. At that time, the country ranked second globally and was closing the gap with the US. A large industrial sector remains, accounting for close to 20% of GDP. Key industries include electronics, automotive manufacturing, and robotics; companies such as Mitsubishi, Sony, and Toyota continue to play leading roles in global markets. Banking and financial services are also significant. The economy is export-oriented and in recent years has consistently posted trade and current account surpluses.

At the same time, rapid population aging and low birth rates weigh on development. Another vulnerability is dependence on imported energy and raw materials, making the economy sensitive to global price fluctuations. Over the remainder of the decade, average GDP growth will be below 1%, one of the weakest rates among G7 countries alongside Italy.

6. United Kingdom – financial services and real estate

GDP 2026: $4.2 trillion

The UK’s main sources of value added remain insurance, financial services, and real estate, primarily through the City of London—one of the world’s leading financial centers. Creative industries, defense, higher education, automotive manufacturing, and pharmaceuticals also play important roles.

At the same time, Brexit has created constraints, particularly for trade and labor mobility with the EU, negatively affecting exports and investment. Some sector-specific agreements with the EU may emerge in the coming years, but a significant rapprochement in economic ties is unlikely. Another challenge is rising demand for public spending amid weak GDP growth, while avoiding a sharp increase in borrowing. The Labour government that came to power in 2024 raised taxes and spending in an attempt to address these issues, but the budget deficit is forecast to remain above 3% of GDP in the coming years.

In the years ahead, UK GDP growth will be around 0.5 percentage points per year lower than in the decade preceding the Covid-19 pandemic, reflecting the long-term negative impact of Brexit on economic dynamics.

7. France – luxury goods and agriculture

GDP 2026: $3.6 trillion

France holds leading positions in the global luxury goods market, including brands such as Chanel, Hermès, and LVMH. The aerospace sector, led by Airbus, also plays a major role. France’s agricultural sector is the largest in the EU, specializing in dairy products, grain, and wine. After Brexit, Paris strengthened its position as a financial center.

Public spending in France accounts for around 60% of GDP, significantly higher than in most European countries. The state holds equity stakes in major companies, including nuclear power operator EDF, aerospace group Airbus, and automaker Renault. The strong role of the state has contributed to one of the highest budget deficits in the EU. Borrowing costs have exceeded those of Greece and Spain.

In the coming years, France’s GDP growth will be below the EU average. Political instability and the need to reduce the budget deficit will weigh on the outlook. Regular mass protests will continue to complicate governance.

8. Italy – luxury goods and machinery

GDP 2026: $2.7 trillion

Italy’s GDP is dominated by services, while the country maintains strong positions in manufacturing, particularly in luxury goods, machinery, and automotive production. Most economic activity is concentrated in the north, with hubs such as Milan and brands like Fiat and Ferrari. Italy is also Europe’s third-largest agricultural producer and is widely known for wine and olive oil production.

In recent decades, economic development has been constrained by political instability, high public debt, inefficiencies in the public sector, and worsening demographics. EU recovery funds have provided some support, but GDP growth is unlikely to exceed 1% both this year and in subsequent years. Italy’s economic weight on the global stage will continue to gradually decline.

9. Russia – oil and gas

GDP 2026: $2.5 trillion

Russia’s economy is heavily dependent on natural resources: oil and natural gas account for more than half of export revenues. This structure supported growth but also made the economy vulnerable to global price swings and energy sanctions. Industry is concentrated in heavy sectors, including defense, chemicals, and metallurgy. Russia is also among the world’s largest grain exporters. After the outbreak of hostilities in Ukraine in 2022, the economy became more reliant on the military sector and public spending, while foreign economic ties shifted toward Asia.

Economic performance proved more resilient than many analysts expected: in 2023 and 2024, GDP growth exceeded 3% due to rising military spending, social transfers, and the authorities’ ability to circumvent sanctions. However, growth slowed sharply in 2025 amid falling oil prices, tighter sanctions, and strikes on energy infrastructure. In the medium term, growth is estimated at around 1.5% per year. A potential end to the conflict in Ukraine would support employment, investment, and exports.

10. Canada – finance and technology

GDP 2026: $2.4 trillion

Canada’s economy is rich in natural resources: oil, forestry, and mining play an important role in exports. Overall, however, GDP is primarily generated by services, with strong positions held by financial and technology companies. In recent years, economic activity was supported by strong demand from the US and rapid population growth of 10% between 2019 and 2024, exceeding historical trends.

At the same time, authorities reduced immigration quotas amid rising unemployment and public dissatisfaction with high housing prices. As a result, population growth in 2025 nearly stalled. Additional pressure came from US tariffs, which restricted exports. Canada’s economy also remains vulnerable to commodity price fluctuations and high household debt.

Conclusion

In the long term, the composition of the world’s largest economies will become more diverse. The share of G7 countries in the top 10 will decline, while a number of emerging economies—particularly Brazil, Indonesia, and Mexico—may move closer to the top tier thanks to population size and catch-up growth potential. At the same time, the relative economic weight of China and India will continue to increase. According to long-term estimates by economists, by 2033 India will become the world’s third-largest economy, and the gap between China’s and Germany’s GDP will widen to roughly $24 trillion versus about $14 trillion at present.

Подсказки: world economy, GDP ranking, economic forecast, Focus Economics, United States, China, Germany, India, Japan, United Kingdom, France, Italy, Russia, Canada