Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Russians Flee the UAE Amid Shelling

Russians Flee the UAE Amid Shelling

Chaos at London and Manchester Airports: 293 Delays and 66 Flight Cancellations

Chaos at London and Manchester Airports: 293 Delays and 66 Flight Cancellations

Flight Delays and Cancellations in Italy: More Than 200 Disruptions

Flight Delays and Cancellations in Italy: More Than 200 Disruptions

Canada Aviation Disruptions: 226 Delays and 42 Cancellations in a Single Day

Canada Aviation Disruptions: 226 Delays and 42 Cancellations in a Single Day

Russians in Israel Join Forces to Leave: War in the Middle East

Russians in Israel Join Forces to Leave: War in the Middle East

Airbnb and Hotels: How Short-Term Rentals Are Changing the Hotel Real Estate Market

Why investments in hotels and hotel real estate once again look more reliable than apartments

Short-term rentals via Airbnb and similar platforms have been perceived as a threat to the hotel industry for almost 20 years, however an analytical review by the Lighthouse platform shows that the market is gradually entering a more mature phase of development. As a result, the position of hotels is strengthening, and assets of this type are increasingly seen as a more resilient format for investments in overseas real estate.

Investments in hotels and hotel real estate: what is happening in the market

A hotel is fundamentally different from apartments: it is a specialized commercial asset that cannot simply be withdrawn from the market at any time. Hotels are focused on year-round occupancy and stable cash flow, which makes investments in hotels more predictable compared to short-term rentals.

That is why in countries with well-developed tourism — from Turkey to the UAE — hotel real estate is increasingly viewed as a core investment asset rather than a niche business.

Apartments and short-term rentals: a seasonal supply model

Supply in the short-term rental segment has a pronounced seasonal nature. An analysis of six resort markets in North America for 2024 shows that after the April peak of the spring break season, the number of available properties began to decline as early as May. In South Padre Island, supply continued to fall for four consecutive months immediately after the high season ended.

This means that apartments enter the market mainly during periods of peak demand and disappear just as quickly, while hotels continue to operate in a stable mode regardless of seasonality.

Apartments as an indicator of future hotel demand

In most tourist destinations, short-term rentals are booked earlier than hotels. This is especially typical for large groups and premium travelers, who reserve the most attractive properties well in advance.

This dynamic turns the apartment market into a leading indicator of demand: if the best short-term rental properties are sold out months ahead, growth in hotel occupancy becomes almost inevitable.

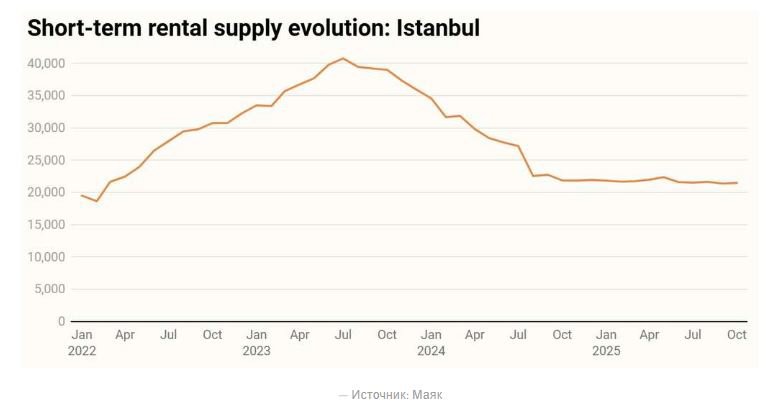

Regulation and real figures: the case of Istanbul

One of the most illustrative examples of legislative impact is Istanbul. After the introduction of a national licensing system in 2024, short-term rental supply fell by 38%.

At the same time, the structure of the market changed: 82.29% of the remaining properties are owned by multi-property owners, while the average figure for the Europe–Middle East region stands at 66.57%. As a result, the market became smaller in volume but more professional and competitive for hotels.

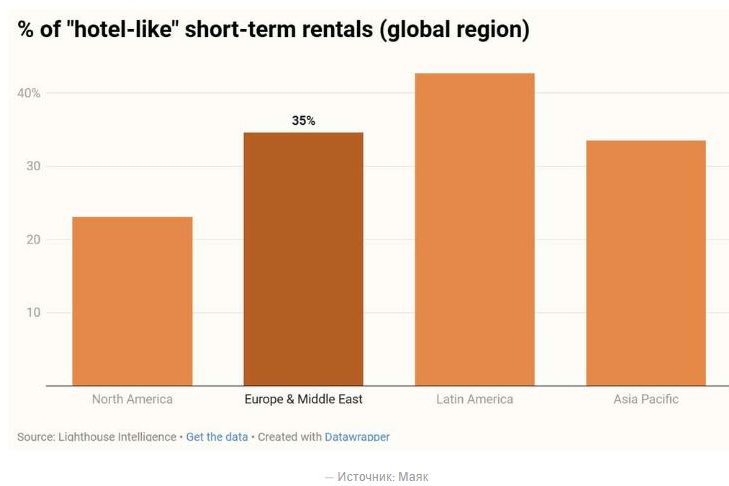

Hotel-like apartments and the level of threat to hotels

Not all short-term rental properties compete with hotels in the same way. Some apartments effectively replicate the hotel model: central location, the ability to book for one or two nights, standard amenities, and high turnover.

In Mexico City, the share of such properties reaches 57%, making the market particularly sensitive for the hotel industry. In New York, by contrast, due to strict regulation, the number of similar apartments has declined noticeably, and pressure on hotels has decreased.

Why hotels win thanks to infrastructure and safety

An analysis of listings in Mexico City shows that less than half of short-term rental properties indicate the presence of basic safety features — a first-aid kit, smoke detector, fire extinguisher, or bedroom door locks. A gym is available in only a small share of properties.

For hotels, this creates a structural advantage: safety, service standards, a 24-hour front desk, concierge services, and infrastructure are built into the product from the start and do not depend on an individual owner.

Buy a hotel or apartments: how investors think

The choice between buying a hotel or investing in apartments is increasingly reduced to an investment strategy. Apartments may offer higher potential returns during peak periods, but they come with seasonality and regulatory risks.

Hotels and hotel real estate provide more stable cash flow and predictability. That is why queries such as “buy a hotel”, “hotels in Turkey”, or “buy a hotel in Dubai” are increasingly associated with long-term investments rather than speculative deals.

Investments in overseas real estate: why the focus is shifting to hotels

Analysts at International Investment note that amid tighter regulation of short-term rentals in different countries, hotels are gradually regaining their role as a core asset in the tourism economy. Investments in hotels are becoming not only a way to profit from tourism, but also a tool for capital preservation.

In this sense, hotel real estate is increasingly perceived as one of the most resilient segments within the structure of investments in overseas real estate — especially in tourist countries with high occupancy and stable international demand. Among such markets, experts increasingly highlight Georgia, where the premium segment has also begun to develop and is becoming more in demand. The largest luxury project is being implemented in the resort area of Gonio. The hotel complex Wyndham Grand Batumi Gonio, in addition, is among the branded properties popular with both tourists and investors. Such assets combine several key stability factors at once: an international operator, predictable occupancy, a transparent management model, and a clear revenue structure.

In an environment where traditional rental formats are increasingly facing regulatory risks, hotel projects with professional management are becoming a more predictable and long-term instrument for investors. In essence, the market is returning to a simple logic: capital flows to where there is real demand, a stable tourist flow, and minimal dependence on political and administrative decisions.