Russians Flee the UAE Amid Shelling

Russians Flee the UAE Amid Shelling

Chaos at London and Manchester Airports: 293 Delays and 66 Flight Cancellations

Chaos at London and Manchester Airports: 293 Delays and 66 Flight Cancellations

Flight Delays and Cancellations in Italy: More Than 200 Disruptions

Flight Delays and Cancellations in Italy: More Than 200 Disruptions

Canada Aviation Disruptions: 226 Delays and 42 Cancellations in a Single Day

Canada Aviation Disruptions: 226 Delays and 42 Cancellations in a Single Day

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Attack on Dubai, February 28, 2026: Timeline of Events and Impact on the Real Estate Market (Updating)

Russians in Israel Join Forces to Leave: War in the Middle East

Russians in Israel Join Forces to Leave: War in the Middle East

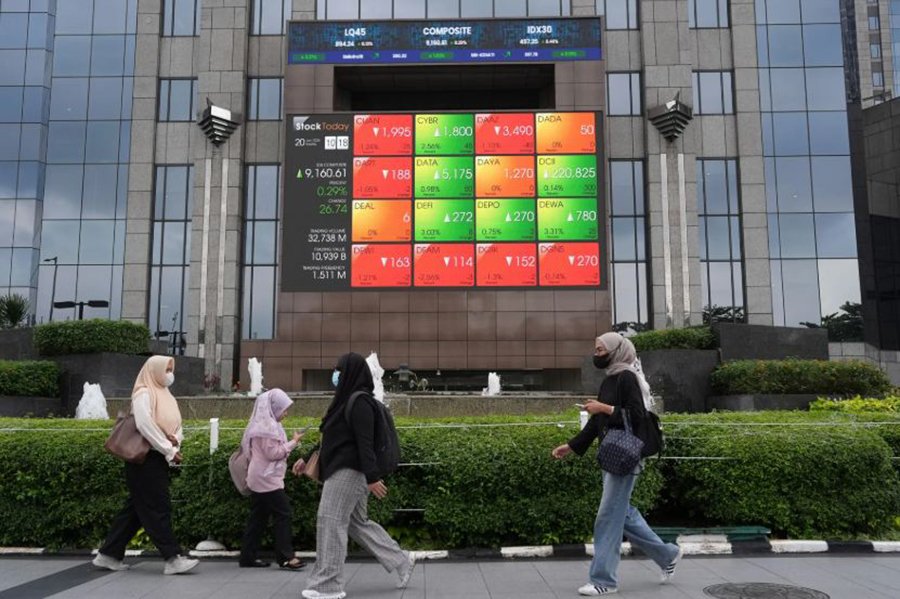

Indonesia Risks Losing Emerging Market Status: Risks for Investors

MSCI Warns of Possible Downgrade to Frontier Market

Indonesia may be downgraded in the global classification of financial markets from emerging market status to the frontier market category, Bloomberg reports. The trigger was a warning from MSCI, which pointed to problems with corporate governance, transparency, and a low level of free float, a combination that has already led to a sharp sell-off on the country’s stock market and increased risks for international investment.

MSCI’s Assessment Framework

MSCI is a global analytics and index company that develops stock market indices and financial market classifications used by institutional investors worldwide. MSCI indices serve as benchmarks for the largest investment funds, pension systems, and asset managers when allocating capital across countries, regions, and sectors.

The company determines which markets are classified as developed markets, emerging markets, or frontier markets, based on factors such as market size, accessibility for foreign investors, liquidity, and regulatory quality. MSCI’s decisions directly influence global investment flows and can lead to large-scale reallocations of capital between countries.

MSCI’s Main Concerns

The key issues relate to shareholder disclosure rules and ownership structures in the stock market. MSCI said that current reporting standards in Indonesia may encourage opaque ownership structures, increasing the risks of insider trading, price manipulation, and unfair market practices.

Particular attention is being paid to the low level of free float. A significant share of listed companies in Indonesia is controlled by founders, families, or large conglomerates, leaving only a limited portion of shares available for public trading. This structure increases volatility, reduces liquidity, and makes it harder for large institutional investors to enter and exit positions.

MSCI notes that it does not formally set a minimum free float requirement for country classifications. However, this indicator plays a key role in assessing market accessibility. For individual securities to be included in the emerging markets investment universe, MSCI requires a free float of at least 15% over a certain period, with some exceptions.

Features of an Emerging Market

Country classifications are used by global index providers to assess the level of development of financial systems, investment accessibility, and the depth of stock markets. In this framework, an emerging market sits between frontier and developed markets: the economy is considered large and liquid enough for international capital, but still carries elevated risks related to regulation, transparency, and investor protection.

For global funds, this status has direct practical implications. Trillions of dollars are allocated automatically based on indices, and many investment structures are allowed to operate only in markets classified as emerging. A downgrade to frontier market status means that a significant number of such funds would be forced to reduce or fully exit their positions.

Why Frontier Status Is Risky

A downgrade to frontier market status could trigger large-scale foreign capital outflows, as index-tracking funds would be required to cut their exposure to Indonesian stocks. Analysts at Goldman Sachs estimate that passive outflows alone could reach $13 billion in an extreme scenario.

The exit of such volumes would put additional pressure on the national currency and increase the economy’s dependence on domestic funding sources and official financing. This, in turn, could lead to higher borrowing costs for companies and the government, weaker bank lending, and lower investment in infrastructure and business.

Frontier markets include Bangladesh, Sri Lanka, Vietnam, and Pakistan. These markets typically attract smaller and more volatile capital flows, as many large funds are prohibited from holding frontier assets. Over the longer term, this implies risks of slower economic growth, weaker job creation, and declining interest from global investors. For the stock market, it also means lower liquidity and higher volatility, especially with limited participation from large international institutional players.

Response from Authorities and Regulators

Indonesian regulators said they plan to double the minimum free float requirement to 15% from February as part of a broader stock market reform. The measure is aimed at improving liquidity and reducing ownership concentration among controlling shareholders.

Authorities also expect to involve the newly created sovereign wealth fund Danantara, which may act as a long-term institutional investor and support the market during periods of heightened volatility. Plans to diversify the ownership structure of the stock exchange and channel more institutional capital into equities have also been accelerated.

The government intends to expand investment limits for insurance companies and pension funds, allowing them to allocate a larger share of their portfolios to equities. These measures are seen as an attempt to offset potential declines in foreign demand with domestic capital.

Economic Background

Even before MSCI’s warning, Indonesia’s economy was facing slower growth and rising fiscal risks. The budget deficit reached 2.92% of gross domestic product in 2025, close to the legal ceiling of 3%, and analysts warn it could exceed that limit in 2026.

President Prabowo Subianto’s administration has increased pressure on the central bank by involving it in financing priority government programs. In January, the president appointed his nephew as deputy governor, raising investor concerns about the independence of monetary policy.

Additional pressure comes from the trade conflict initiated by the administration of US President Donald Trump, which has led to falling export orders, layoffs, and the suspension of some foreign investment projects. Following this, foreign funds began reducing exposure to Indonesian assets, citing high valuations, political risks, and regulatory uncertainty.

Regional Impact

Indonesia remains the largest stock market in Southeast Asia by capitalization, so a potential downgrade could reshape global investment portfolios across the entire region. A reduction in Indonesia’s weight in major indices would automatically lower Southeast Asia’s overall share in global capital allocation.

As a result, part of the flows could be redirected toward larger and more liquid Asian markets, primarily China, India, and South Korea. For investors, this means a shift away from regional diversification toward individual national markets with stronger institutions and more predictable regulatory frameworks.

Analysts at International Investment note that Indonesia’s situation may serve as a signal for other emerging economies. The importance of corporate governance, transparency, and investor protection continues to grow, while market classification is increasingly turning from a formal label into a real economic factor that directly affects access to global capital.