Australia’s Rental Price Growth Continues to Slow Down

Rental prices in Australia remain high compared to the 10-year pre-COVID average, but the national market has now passed the peak of the recent rental boom, according to CoreLogic experts. This assumption is supported by the fact that the median rental rate increased by only 0.4% in December, marking the smallest change in the fourth quarter since 2018 (0.2%).

Rental Growth Slows Further in 2024

Over the past three months, rental growth continued to decelerate: rental prices increased by 4.8% over the year, following an 8.1% rise in 2023. This represents the lowest annual rental growth since the 12 months leading to March 2021, when rents increased by 3.6%.

CoreLogic economist Kaitlyn Ezzy noted that rental affordability remains a major constraint on rental price growth. Since the start of the COVID-19 pandemic, rental prices have surged by 36.1% nationwide, equivalent to an increase of $171 per week or $8,884 per year at the median level.

In September 2024, renters were spending approximately 33% of their pre-tax annual income on housing costs, the highest share since 2006. As a result, some Australians have postponed moving out of their family homes, while others have opted for larger households to share rental costs.

This shift toward larger households has been observed across different property types. Detached houses saw higher rental growth on both a quarterly (0.6%) and annual (5.0%) basis compared to the apartment sector (-0.2% and 4.2%, respectively).

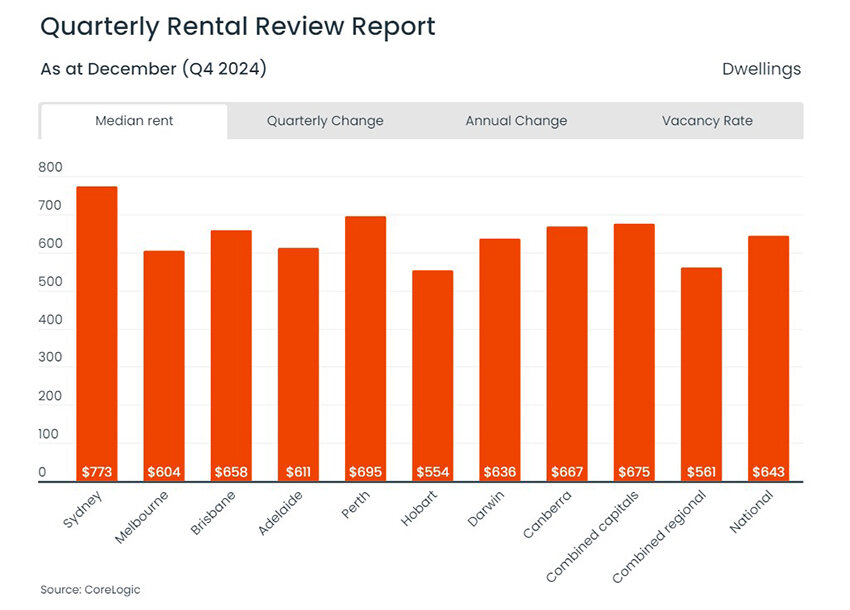

Capital City Rental Trends

In most capital cities, rental price growth slowed over the past year, particularly in Sydney and Melbourne, where rental increases dropped from 9.9% and 11.0% in 2023 to 3.0% and 4.1% in 2024, respectively.

However, rental growth remained positive in Hobart (6.0%) and Canberra (2.6%). Despite a slight quarterly decline in rental prices, Sydney retained its position as the most expensive city in Australia for renting, with a median rent of $773 per week.

Due to a stronger rental increase, Perth overtook Canberra to become the second-most expensive rental market, with a weekly median rent of $695, while Canberra followed at $667 per week.

At the other end of the spectrum, Hobart remained the most affordable city for renters, with an average weekly rent of $554, making it the only capital where median rent stayed below $600 per week. Melbourne ranked as the second-most affordable city, with a typical rent of $604 per week, followed by Adelaide ($611 per week).

Rental Yields and Market Conditions

Gross rental yield at the national level remained steady at 3.7% over the past year. This is 50 basis points above the recent low of 3.2% recorded in January 2022, but still below the 4.2% average observed in the decade before the pandemic.

In Melbourne, a 3.0% decline in housing prices, combined with moderate rental growth (4.1%), led to a 29-basis-point increase in rental yield over the year to 3.71%.

In contrast, double-digit property price growth in Brisbane (11.2%) and Adelaide (13.1%) caused yields to decline by 31 and 21 basis points, bringing them to 3.63% and 3.66%, respectively.

Rental yields in other capital cities fell by 30 basis points over the past year, from 4.5% to 4.2%. In Sydney, the rental yield remained unchanged at 3.0%, while some cities saw slight increases:

Hobart: 4.4% (+30 basis points)

Darwin: 6.7% (+21 basis points)

Canberra: 4.1% (+12 basis points)

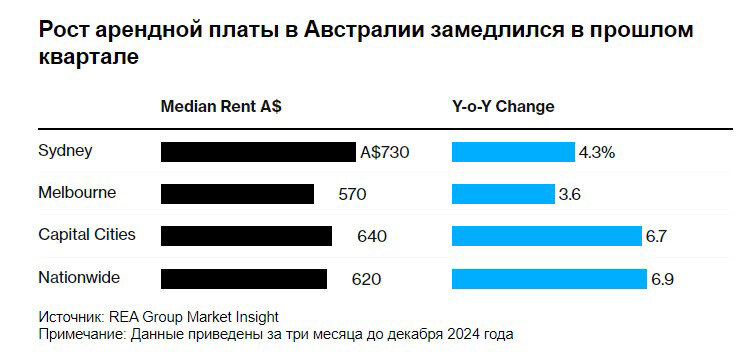

REA Group Reports a Similar Slowdown

According to Bloomberg, citing data from REA Group Market Insight, rental prices increased by 6.9% in the three months to December compared to the previous year, but this also points to a slowdown in rental market growth. The report notes that this is the lowest growth rate since 2021.

The report estimates that the median national rent in December stood at $620 AUD per week ($386 USD). In capital cities, rental prices increased by 6.7% year-over-year in the October–December period. However, Sydney and Melbourne—Australia’s two largest rental markets—have seen no rental price changes for six months.

Market Outlook for 2025

REA Group’s senior economist Paul Ryan believes that rental price growth is slowing nationwide as market conditions ease. The number of available rental properties has increased, while rising living costs are limiting the affordability of potential renters.

Experts anticipate that rental prices will continue to grow moderately in 2025. The housing market is expected to be one of the key issues in the upcoming federal election on May 17. The Labor government, led by Prime Minister Anthony Albanese, is working to address housing affordability by limiting immigration and incentivizing the construction of rental housing.