read also

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Sweden Urges Citizens to Hold Cash for Emergencies

Sweden Urges Citizens to Hold Cash for Emergencies

Indonesia Faces Growing Credit Rating Pressure

Indonesia Faces Growing Credit Rating Pressure

Poland Rethinks Rate Cuts as Iran War Risks Rise

Poland Rethinks Rate Cuts as Iran War Risks Rise

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Housing Market Enters Moderate Cooling Phase

UAE Housing Market Enters Moderate Cooling Phase

Housing Prices in Berlin Rise in Both Sales and Rental Markets

A new report from GUTHMANN notes that Berlin's real estate market has started the new year with noticeable growth. Asking prices have increased by 0.90% compared to the same period in 2024, while rental rates have surged by approximately 16.10%. Prices have risen in 12 out of 21 districts. The upcoming elections at the end of February are expected to have a significant impact on this sector, as various political parties propose numerous initiatives to regulate the market.

The study estimates the average asking price on the secondary market at €5,380 per square meter as of January 28, 2025, while the price for new developments reaches €8,280 per square meter. Rent prices continue to rise, with the gap between current rental rates and new property lease prices wider than ever before.

The difference between asking prices and the notarized transaction price is currently around 6% and is slightly increasing after a temporary convergence. This reflects seller optimism, as they are less cautious when entering the market amid declining mortgage interest rates. At the same time, buyers remain cautious and take advantage of negotiation opportunities. The gap between asking and closing prices varies significantly depending on the type, condition, and location of the property.

Historical Trends and Market Impact

The COVID-19 pandemic drove up property prices in Berlin due to low interest rates and increased focus on quality of life and remote work. The average price per square meter rose from €4,350 in early 2020 to €4,980 in 2021. The outbreak of war in Ukraine in 2022 led to inflation spikes and changes in interest rates. The rising cost of financing reduced demand, causing a slight decline in prices from €5,360 per square meter in 2023 to €5,010 in the last quarter of 2024. However, the downward trend has clearly ended in both the new construction and existing property segments.

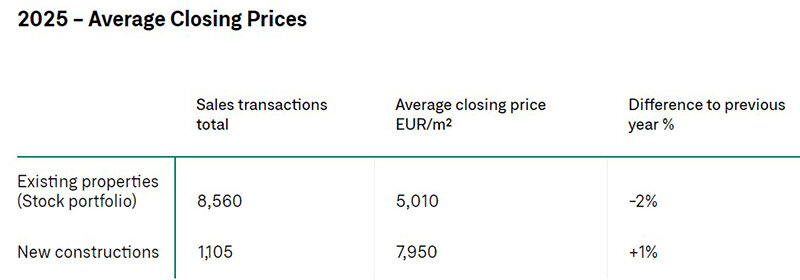

The number of notarized real estate transactions has been declining since 2015, reaching about 9,700 transactions in Q4 2024—8,600 of which were for existing properties and 1,100 for new developments. The slowdown in sales, triggered by the war in Ukraine and subsequent inflation and interest rate issues, remains evident. Sales of new apartments have recently stabilized, whereas the outlook for the secondary market remains uncertain. The primary real estate market in Berlin is concentrated around S-Bahn railway stations, while large-scale new development projects are more decentralized.

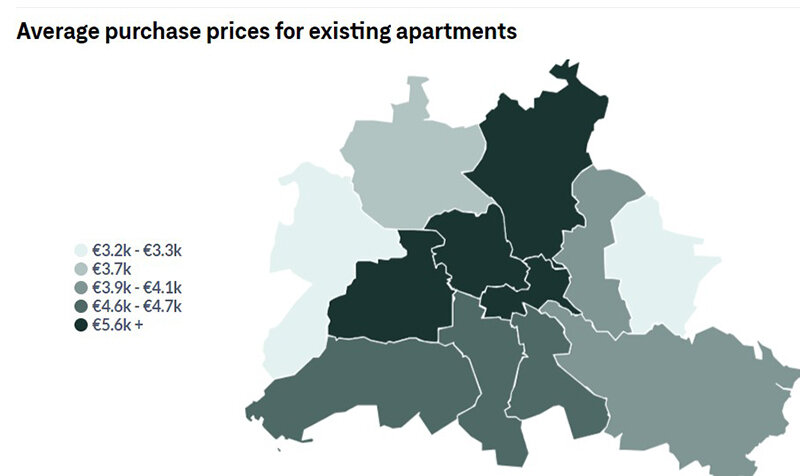

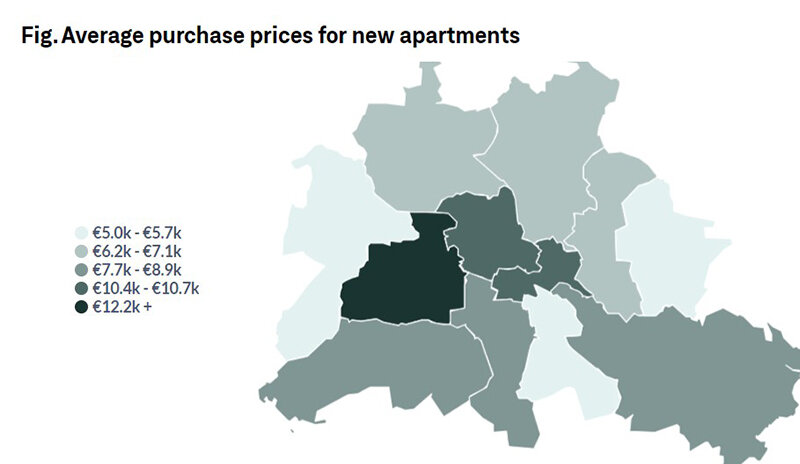

On the secondary market, apartment prices range between €5,600 and €5,800 per square meter from southwest Berlin to the city center and northern districts. The dominant property size is 70 to 76 square meters, selling for an average of €420,000 to €445,000. The cheapest apartments are in Spandau. Newly built apartments in central Berlin are no longer sold for less than €10,000 per square meter. The highest price per square meter in 2024 was recorded in Oranienburgerstraße, Savignyplatz, and Ludwigkirchplatz.

Tax Benefits and Rental Market Challenges

The report highlights that owning property for over ten years allows sellers to avoid paying income tax upon sale, provided the property is not part of a business. Personal use of a property can also lead to tax exemptions if it was used in this capacity during the year of sale and the two preceding years.

The Berlin rental market is influenced by factors such as immigration, population growth, and housing policies. Over the past 20 years, Berlin has undergone significant changes due to increasing demand and a declining vacancy rate. The main focus has been on regulating existing rental prices rather than new construction, which has led to the withdrawal of a substantial number of rental units from the market.

This trend started as an effort to protect local residents, primarily through rent caps and restrictions, which significantly reduced rental supply and created uncertainty for many property owners. Current regulations also discourage new construction and limit price flexibility, prompting landlords to shift properties to the short-term rental market or sell them outright. Since existing rental prices rise very slowly, tenants have little incentive to move into smaller or more affordable units. As a result, larger apartments are increasingly occupied by small families.

Political Influence and Market Forecasts

Experts believe that the Bundestag elections on February 23 will impact Berlin’s real estate market. Political parties have proposed various measures, including rent freezes, expropriation of real estate companies, tax benefits for inherited properties, incentives for non-commercial housing construction, and stricter rent controls. Given the uncertain coalition situation, the outcome remains unpredictable.

Colliers and JLL forecast a moderate increase in transaction volume in 2025, but the overall number of deals is expected to remain significantly below long-term historical averages, indicating continued challenges in the sector. Additionally, geopolitical uncertainty, election results, and economic conditions [“could slow down the gradual recovery of investment markets”].

DIW Berlin experts acknowledge the critical combination of economic downturn and structural issues but anticipate gradual recovery and growth in 2025.

The European Commission forecasts that inflation will decline to 2.1% in 2025 and to 1.9% in 2026. GDP growth is expected to rise from 0.7% this year to 1.3% next year. Real household incomes in Germany are projected to recover, leading to slow but steady increases in private consumption. Easing monetary policy is expected to facilitate investment recovery. The construction sector is likely to rebound, driven by renewed demand for housing and infrastructure, as evidenced by increasing order volumes and mortgage lending.