Housing in Indonesia: Price Growth Slows, Sales Decline

Photo: Unsplash

Bank Indonesia released its Q2 2025 residential property market survey, covering data from 18 of the country’s largest cities. The report shows slower price growth and weaker buyer activity, signaling a cooling market after the post-pandemic recovery. At the same time, the dynamics vary widely across regions.

Indonesian Real Estate Market Statistics 2025 (Q2)

In Q2 2025, the housing price index (IHPR) rose by 0.90% compared to the same period of 2024 (when growth reached 1.07%). On a quarterly basis, the increase was 0.18%, down from 0.25%. This reflects a slowdown in price growth while maintaining a positive trajectory.

By property type, the mid-range segment grew the fastest year-on-year at 1.25% (up from 1.14%). Small houses rose by 1.04% (down from 1.39%), while large houses increased only 0.70% (down from 0.97%). On a quarterly basis, the mid-segment accelerated to 0.44% (from 0.23%), while small and large units slowed to 0.10% and 0.08%, respectively.

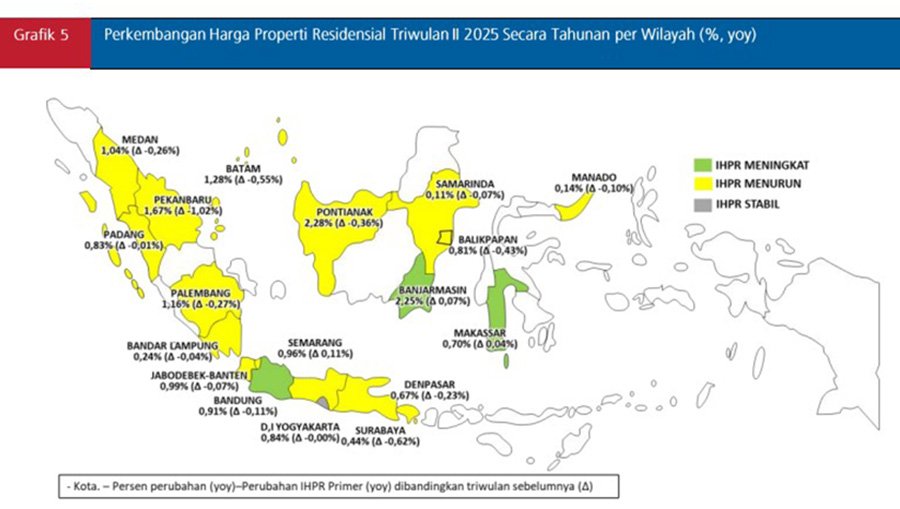

Regional dynamics: Indonesia's Property Price Leaders

The strongest growth among the 18 cities was recorded in Pontianak (+2.28%), Banjarmasin (+2.25%), and Pekanbaru (+1.67%). These secondary markets are driven by local factors such as business activity recovery, infrastructure development, and limited supply. Their pace is several times higher than the national average and provided most of the quarterly momentum.

For foreign audiences, Bali remains the key benchmark. In Denpasar, prices grew 0.67% after 0.90% in Q1, marking a slowdown toward a more stable market. This is not a downturn but a cooling phase: liquidity remains, but price spikes are fading. Valuations increasingly depend on rental yield and credit costs rather than speculative demand.

Sales contraction Indonesian Real Estate Market

Transaction volumes tell a harsher story. Sales fell 3.80% year-on-year after a modest rise in Q1 (+0.73%). Quarter-on-quarter, deals dropped 16.72% after surging 33.92% in January–March. The breakdown highlights a disbalance: the only growth came from small houses (+6.7% YoY, after +23.7% in Q1), while mid-range and large properties plunged –17.69% and –14.95%, respectively.

Financing and risks Indonesian Real Estate Market

Developers continue to rely mostly on equity (78.36%), ensuring resilience but limiting the launch of new projects amid rising costs. For buyers, the key channel is KPR mortgages, accounting for 73.06% of deals. Yet the credit impulse is weakening: mortgage portfolio growth slowed to 7.81% YoY (from 9.13% in Q1) and to 1.32% QoQ (from 2.54%). This directly reduces the conversion of demand into sales.

Bottlenecks include rising construction material prices (19.97%), tax pressure (16.81%), and bureaucratic delays (15.13%). For end-buyers, high KPR rates (11.38%) and large down payments (8.66%) remain major barriers. This explains why demand holds only in the small-house segment, where entry thresholds are lower.

Market outlook Indonesian Real Estate Market

Regional variations are significant. Pontianak, Banjarmasin, and Pekanbaru far exceed the national pace. Larger markets such as Jakarta’s metropolitan area, business hubs, and university towns maintain moderate growth close to the average. Tourist hotspots and several eastern cities, by contrast, show weak dynamics or declines: in Denpasar, growth slowed from 0.90% in Q1 to 0.67% in Q2.

Prices in Indonesia continue to rise moderately, but key supports are losing strength. Without looser mortgage terms and lower construction costs, acceleration is unlikely. Small houses remain in demand, while mid- and large-scale formats will need either price corrections or strong local factors. For developers and investors, this means the market is no longer uniform—decisions on products and pricing must be made city by city.

Meanwhile, regulation is tightening. Indonesia is ramping up control over real estate, and Bali has banned the construction of new hotels and restaurants. Past informality, such as operating without permits, is no longer tolerated: violations now risk severe sanctions, including arrests, as already shown by the Ubud case.

Подсказки: Indonesia, housing market, real estate, Bali, property prices, Bank Indonesia, mortgages, property sales, developers, construction, regulation, tourism