Housing in the U.S.: Buyer Contract Cancellations Rise as Sales Fall

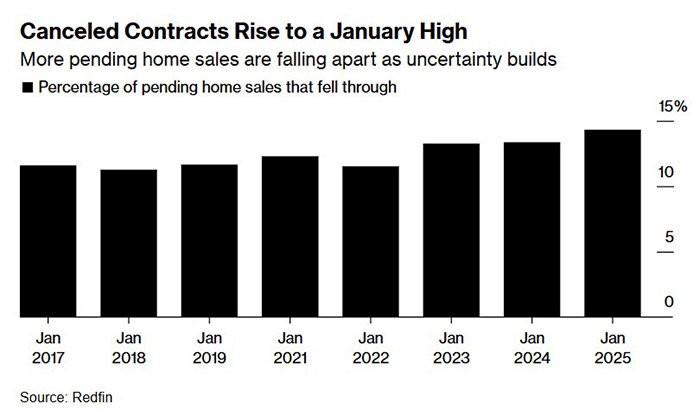

The U.S. housing market is facing growing instability as more homebuyers cancel purchase contracts — particularly in Atlanta, Orlando, Las Vegas, Houston, Jacksonville, and across Florida. According to Bloomberg, citing brokerage Redfin Corp., January 2025 set a record for cancellations.

Buyers are struggling with high home prices, elevated mortgage rates, and economic uncertainty caused by Trump-era trade wars and reduced federal spending. The spike in contract cancellations casts a shadow over the upcoming spring sales season.

Where Are Cancellations Highest?

Redfin reports a “wait-and-see” attitude among many buyers. The highest cancellation rate was in Atlanta (19.8%), followed by Orlando, Las Vegas, Houston, and Jacksonville — each nearing 18%. Analysts suggest growing inventory in some markets is contributing to canceled deals.

Pending Home Sales Hit Record Lows

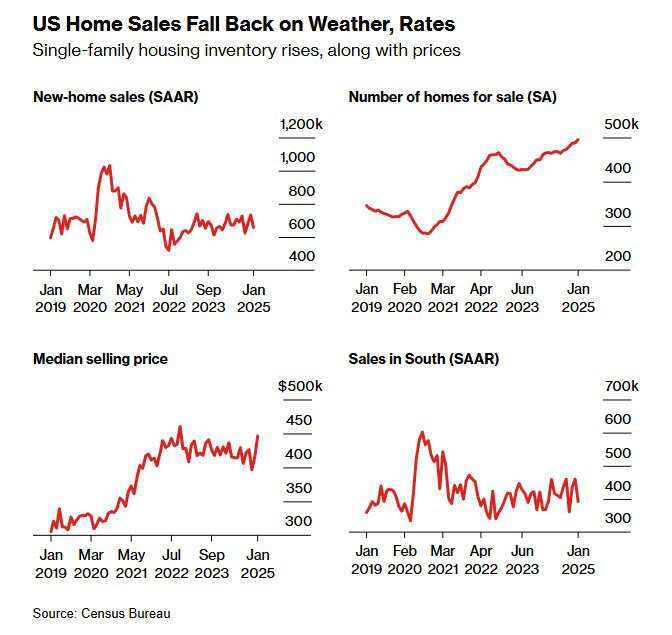

According to the National Association of Realtors (NAR), U.S. pending home sales dropped 4.6% in January to an index level of 70.6, the lowest since 2001 — well below the 0.9% decline economists had forecast.

The South saw a 9.2% decline, the steepest since the start of the Covid-19 pandemic. While heavy snow may have played a role, NAR Chief Economist Lawrence Yun believes high home prices and mortgage rates were the real culprits.

Prices Still Climbing, Rates Still High

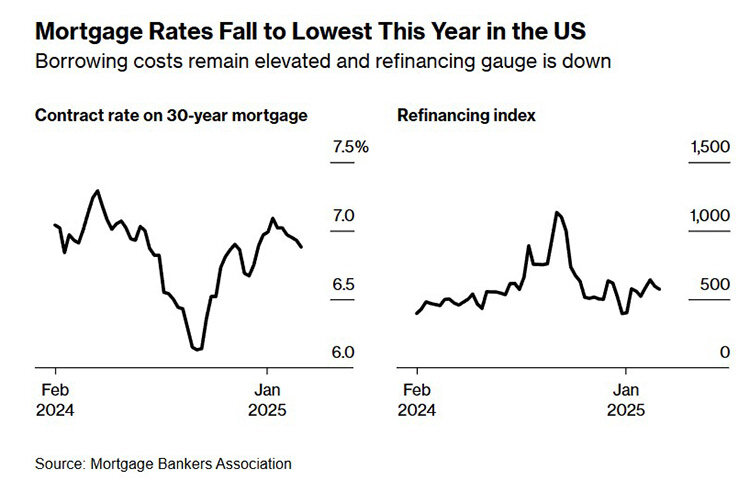

Mortgage rates remain near 7%, and home prices continue to rise. According to S&P CoreLogic Case-Shiller, prices increased 3.9% year-over-year in December. The median sale price for existing homes in January reached $396,900, up 49% from five years ago.

New Home Sales Drop Sharply

Sales of newly built single-family homes fell 10.5% year-over-year in January. The South saw a nearly 15% drop, with activity declining across most regions — except the West.

Homebuilders who were optimistic about deregulation under President Trump are now grappling with rising material costs due to new tariffs. Builders like PulteGroup and Toll Brothers reported an oversupply of unsold homes, and plan to cancel or delay upcoming construction.

“There are plenty of new homes, but high prices, mortgage rates, and cold weather slowed the market,”

said Robert Frick, economist at Navy Federal Credit Union.

“Rate cuts could help — but a spring rebound is not guaranteed.”

Builders Pull Back as Inventory Grows

As new home inventory rises and buyer activity weakens, developers are expected to pause or reduce new construction in the coming months. The average new home price increased 3.7% year-over-year to $446,300 in January.

In February, mortgage rates dropped 5 basis points to 6.88%, according to Bloomberg, but borrowing remains expensive.

The refinancing index fell 3.6%, and overall mortgage activity remained flat. Analysts expect sales to keep falling throughout 2025, with elevated inventory continuing to pressure the construction sector.

Подсказки: USA, housing, real estate, mortgages, home sales, Atlanta, Orlando, Jacksonville, Florida, Redfin, NAR, inflation, construction, home prices, contracts, spring market, 2025