Canadian Housing Market in May 2025: Sales Rebound and First Signs of Stabilization

Photo: WOWA.ca

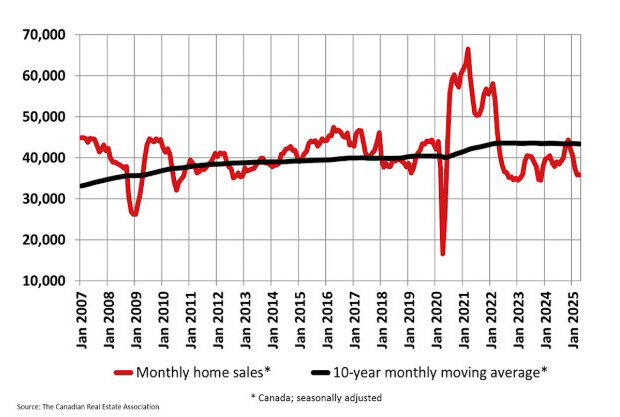

Home sales in Canada rose by 3.6% in May 2025 compared to April — the first increase in activity in six months. However, compared to the same period in 2024, the number of transactions is still down by 4.3%, reports the Canadian Real Estate Association (CREA).

"May marked the first monthly sales gain since November, and price declines have also paused," said CREA Senior Economist Shaun Cathcart. "One month doesn’t make a trend, but it feels like the expected rebound in activity has simply been delayed due to initial shocks related to tariffs and uncertainty."

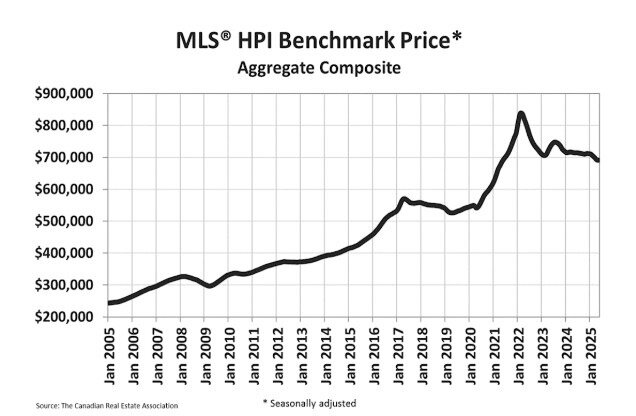

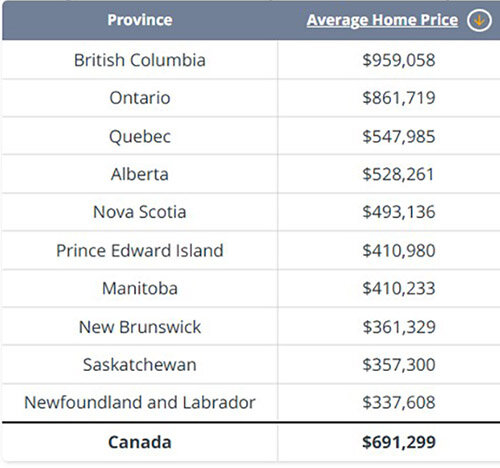

New property listings also increased, up 3.1% month-over-month. The MLS® Home Price Index remained nearly unchanged (-0.2% MoM) but declined 3.5% year-over-year. The average home price in Canada was CAD $691,299 (USD $505,850), 1.8% lower than in May 2024.

By the end of May, there were 201,880 active listings — up 13.2% from the same month last year, but still 5% below the long-term average for May (211,500). The national housing inventory stood at 4.9 months — close to the long-term norm of 5 months.

According to WOWA.ca, the average home price in Canada increased to CAD $691,299 (USD $505,850), up 1.7% from April but down 1.1% year-over-year. The MLS® benchmark price was CAD $701,800 (USD $513,530), remaining virtually unchanged for the month (-0.2%) and down 3.5% from May 2024.

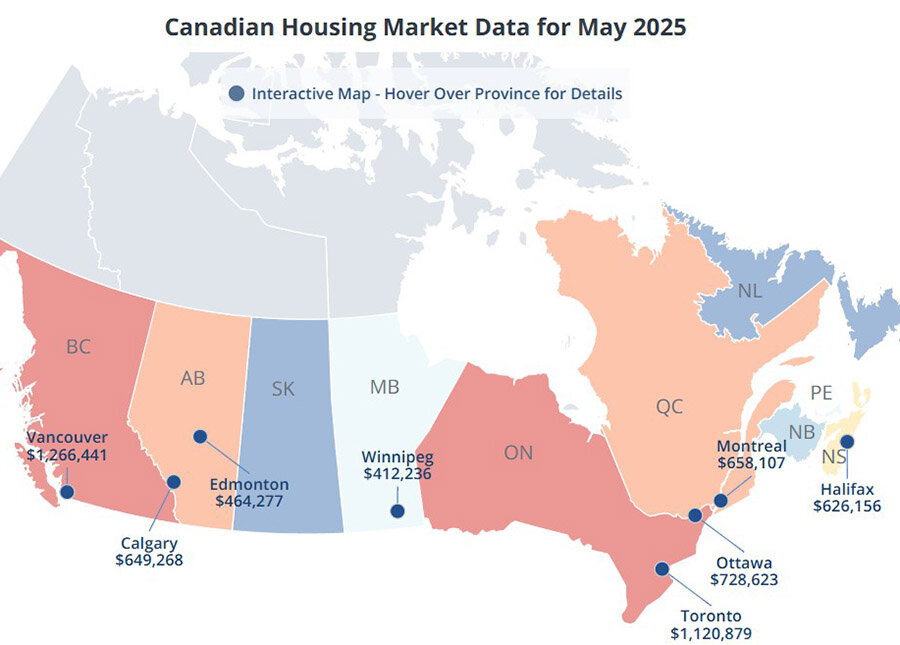

In Quebec, home prices rose by around 9% year-over-year in May 2025, reaching a record of CAD $547,985 (USD $400,900). The trend has been ongoing for several months and is especially visible in Quebec City, where prices surged by almost 14%.

A similar pattern is observed in Montreal, where prices increased by 8% to CAD $658,107 (USD $481,400). In Eastern Canada, Nova Scotia also posted solid growth, with an average home price of CAD $493,136 (USD $360,900), and Halifax reaching CAD $626,156 (USD $458,000), up about 5% annually.

In contrast, prices in Toronto declined by 3.8%, falling to CAD $1,120,879 (USD $820,500), with the benchmark price down 4.5% to CAD $1,012,800 (USD $741,300). The sales-to-new listings ratio stood at around 34%. In Vancouver, the average price was CAD $1,266,441 (USD $927,100), but annual prices dropped by 5.9%, cooling investor activity in British Columbia.

Meanwhile, in Saskatchewan, Manitoba, and Newfoundland and Labrador, prices hit record highs in May — in some cases growing more than 10% year-over-year. Saskatchewan reached CAD $357,300 (USD $261,300), Manitoba climbed to CAD $410,233 (USD $300,000), and Newfoundland and Labrador approached CAD $338,000 (USD $247,000). These gains reflect not just a rebound, but the formation of a new pricing range supported by internal migration and a relatively low base for growth.

As a reminder, in March 2025, the Canadian Real Estate Association (CREA) reported a sharp year-over-year decline in transactions (-9.3%). Activity dropped most significantly in Toronto (-24%), Calgary (-17%), and Vancouver (-13%). Experts cited the trade conflict with the U.S. as a key factor. Small business confidence hit a 25-year low, and job numbers declined.

At the time, analysts predicted stagnation, a 3.2% drop in prices, and a 0.9% decline in sales volume, with the greatest risks expected in British Columbia and Ontario. However, May brought a shift in momentum. This could be partially attributed to a change in political direction and a possible easing of U.S. trade tariffs. Bank of Canada Governor Tiff Macklem noted that negotiations may lead to lifting duties on steel, aluminum, and automobile imports, which would support the economy and reduce inflation pressure.

If current tariffs and countermeasures remain, about 75% of their cost would be absorbed over the next 18 months. So far, Canada has avoided mass layoffs. Annual inflation fell to 1.7% in April due to the end of temporary tax measures, though core indicators rose above the Bank of Canada’s 1–3% target. If conditions worsen, job losses may follow, putting more pressure on households and businesses.

See also:

Canada's Real Estate Market: Small Investors Struggle Amid Economic Headwinds

Canada Changes Work Permit Rules

Canada’s Economic and Political Challenges Require New Solutions

How Startup Support Fuels Economic Growth: Global Ranking

Global Real Estate Market: Price Trends and Forecast from Knight

Подсказки: Canada, housing market, real estate, home prices, Toronto, Vancouver, Quebec, Nova Scotia, CREA, tariffs, inflation, economy